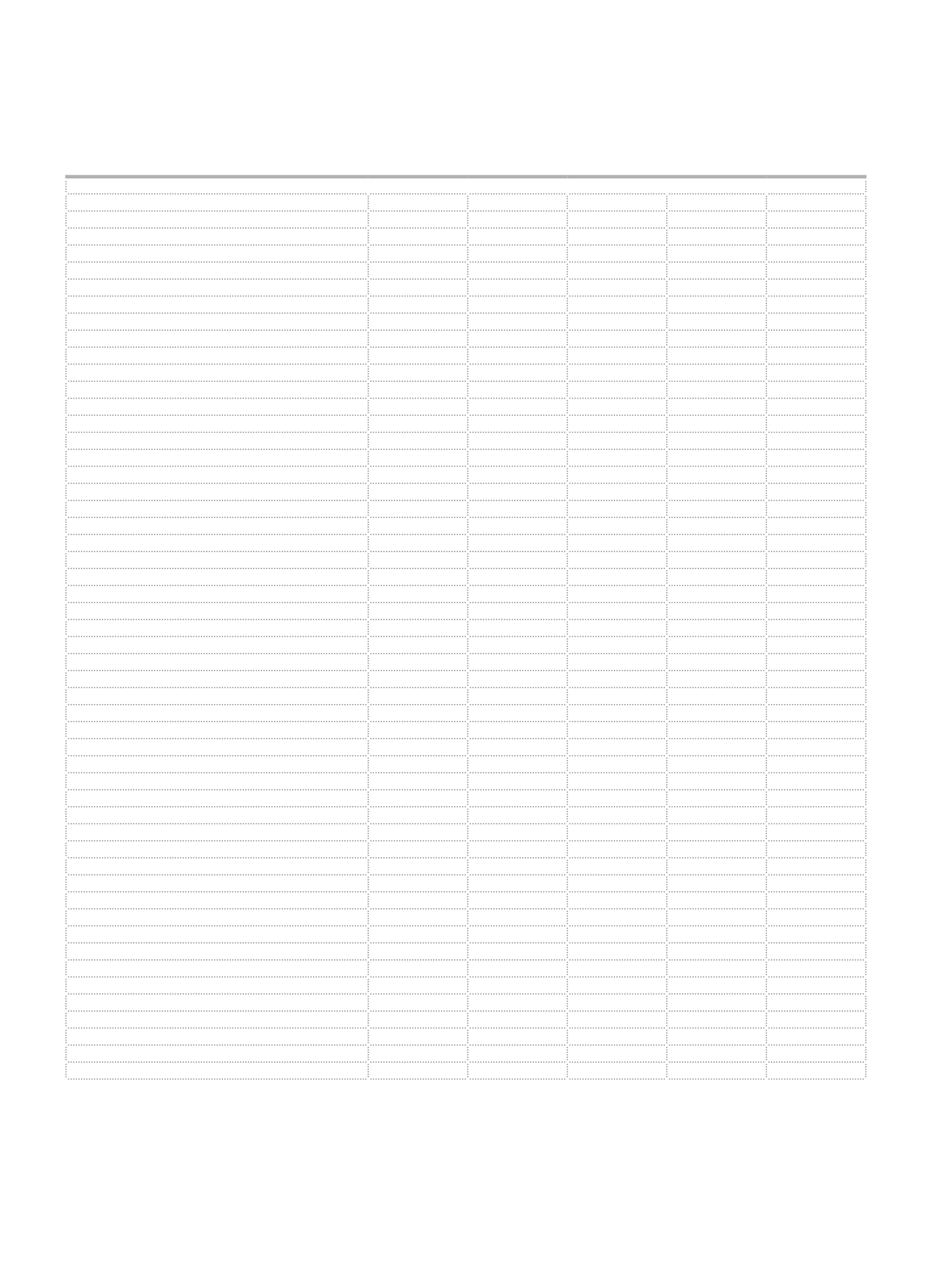

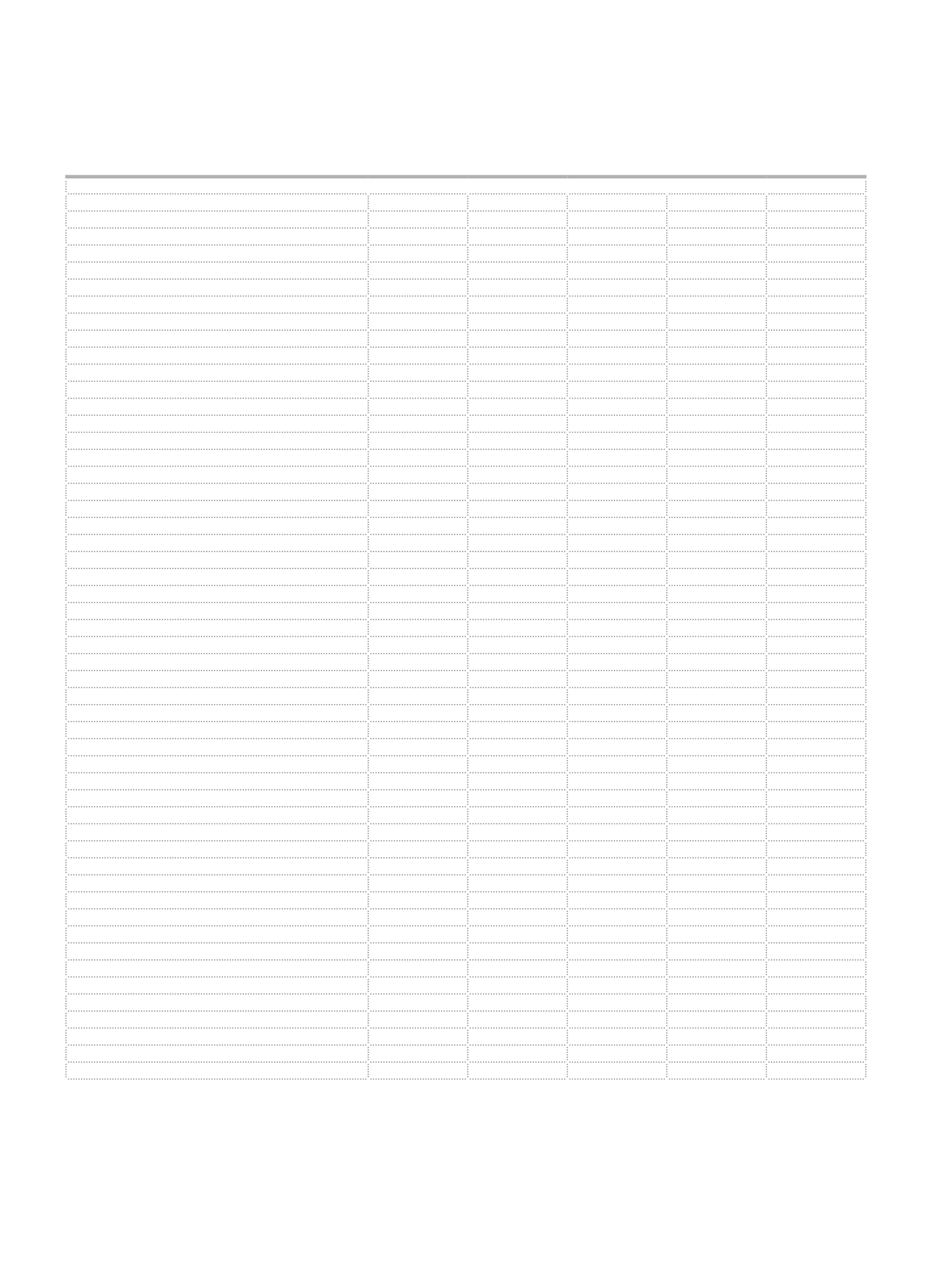

249

Financial Information and Risk Management

Consolidated - Financial Highlights and Key Ratios for the Five-Year Period

ASSETS (TL thousand)

2011/12

2012/12

2013/12

2014/12

*

2015/12

Cash and Equivalents

1,260,374

1,779,460

2,257,090

2,586,183

2,870,757

Banks and Receivables from Interbank Money Markets

(1)

17,545,722

18,965,235

26,479,037

28,827,380

37,303,516

Securities (Net)

48,720,930

44,782,722

43,651,041

48,248,088

52,558,209

Loans

(2)

99,432,775

115,733,719

146,136,030

169,066,501

194,860,737

Associates and Subsidiaries (Net)

3,979,038

4,398,434

4,174,551

5,611,155

4,948,894

Receivables from Finance Lease (Net)

1,376,390

1,384,455

2,034,122

2,746,199

3,199,311

Fixed Assets (Net)

3,384,754

3,511,410

3,938,176

5,529,490

9,405,417

Other Assets

8,235,847

10,519,304

12,949,093

14,458,236

20,352,131

Total Assets

183,935,830

201,074,739

241,619,140

277,073,232

325,498,972

LIABILITIES (TL thousand)

2011/12

2012/12

2013/12

2014/12

*

2015/12

Deposits

98,831,996

106,010,860

121,837,798

134,501,226

154,201,290

Funds Borrowed and Interbank Money Market Placements

(3)

45,121,027

44,483,302

65,397,271

78,385,798

98,396,171

Provisions

8,713,868

10,260,057

10,918,968

12,083,515

13,562,294

Other Liabilities

10,958,370

15,461,765

17,570,477

19,098,127

22,655,691

Shareholders’ Equity

20,310,569

24,858,755

25,894,626

33,004,566

36,683,526

Total Liabilities

183,935,830

201,074,739

241,619,140

277,073,232

325,498,972

INCOME STATEMENT

(4)

(TL thousand)

2011/12

2012/12

2013/12

2014/12

*

2015/12

Interest Income

12,081,352

14,676,856

14,853,908

17,752,690

21,406,966

Interest Expenses

6,664,356

7,834,591

7,172,014

9,282,281

11,211,101

Net Interest Income

5,416,996

6,842,265

7,681,894

8,470,409

10,195,865

Net Trading Income

446,913

871,070

378,591

664,128

(325,160)

Net Fees and Commissions Income

1,102,726

1,258,319

1,468,946

1,505,183

1,807,881

Dividend Income

171,477

205,032

238,057

292,047

256,696

Other Operating Income

4,070,527

4,571,878

4,625,333

5,124,758

5,884,632

Total Operating Income

11,208,639

13,748,564

14,392,821

16,056,525

17,819,914

Operating Expenses

6,615,795

7,783,373

8,308,239

9,499,378

10,940,293

NET OPERATING PROFIT/LOSS

4,592,844

5,965,191

6,084,582

6,557,147

6,879,621

Provision for Losses on Loans and Other Receivables

1,494,935

1,291,545

1,654,701

1,530,113

2,289,722

PROFIT/(LOSS) BEFORE TAXES

3,097,909

4,673,646

4,429,881

5,027,034

4,589,899

Provision for Taxes

708,541

958,912

823,022

1,006,617

850,228

NET PERIOD PROFIT/(LOSS)

2,389,368

3,714,734

3,606,859

4,020,417

3,739,671

KEY RATIOS (%)

2011/12

2012/12

2013/12

2014/12

*

2015/12

Interest Earning Assets

(5)

/ Total Assets

90.7

89.8

90.3

89.8

88.3

Interest Earning Assets

(5)

/ Interest Bearing Liabilities

115.9

120.0

116.5

116.9

113.8

Securities / Total Assets

26.5

22.3

18.1

17.4

16.1

Loans / Total Assets

53.8

57.1

60.1

60.5

59.3

Loans / Deposits

100.2

108.2

119.2

124.6

125.1

Retail Loans / Total Loans

25.9

26.8

26.7

25.5

24.4

NPL Ratio

2.1

1.8

1.7

1.6

2.0

Coverage Ratio

100.0

76.8

77.9

74.3

73.8

Demand Deposits / Total Deposits

19.3

20.1

21.5

22.4

22.9

Shareholders’ Equity / Total Liabilities

11.0

12.4

10.7

11.9

11.3

Capital Adequacy Standard Ratio

14.1

16.3

14.3

15.7

15.1

Return on Average Assets

(6)

1.4

1.9

1.6

1.5

1.2

Return on Average Equity

(6)

12.1

16.7

14.3

13.4

10.7

Cost / Income

(7)

48.4

47.1

49.1

50.1

51.6

OTHER INFORMATION (TL thousand)

2011/12

2012/12

2013/12

2014/12

*

2015/12

Regulatory Capital

21,187,094

27,325,571

30,567,360

38,653,387

41,654,637

Core Capital

19,841,319

22,715,413

25,607,957

32,704,560

35,428,502

Free Capital

(8)

13,021,182

16,535,929

17,332,191

21,280,547

21,427,087

Demand Deposits

19,054,431

21,346,638

26,161,926

30,101,859

35,239,348

(*)

Accounting policy change which was made in 2015 was applied retrospectively, and 2014 financial tables are corrected in accordance with the restatement.

(1)

Includes Deposits at the Central Bank and Reserve Requirements

(2)

Excludes Receivables under Follow-up

(3)

Includes TRY, FC bond issuances and subordinated debts

(4)

Fees and Commissions Received from Cash Loans are shown under Interest Income; Fees and Commissions Paid to Cash Loans are shown under Interest Expense.

(5)

Interest Earning Assets include TRY and FC reserves at Central Bank, which are currently paid 0% interest.

(6)

Averages are calculated over quarter figures. For 2015/12 and 2014/12 periods, average figures were calculated corrected over the year-end balances.

(7)

Insurance Technical Income and Expense remainders were clarified.

(8)

Free Equity = Shareholders’ Equity - (Fixed Assets+Non-Financial Associates and Subsidiaries+Receivables Under Follow-Up-Specific Provisions)