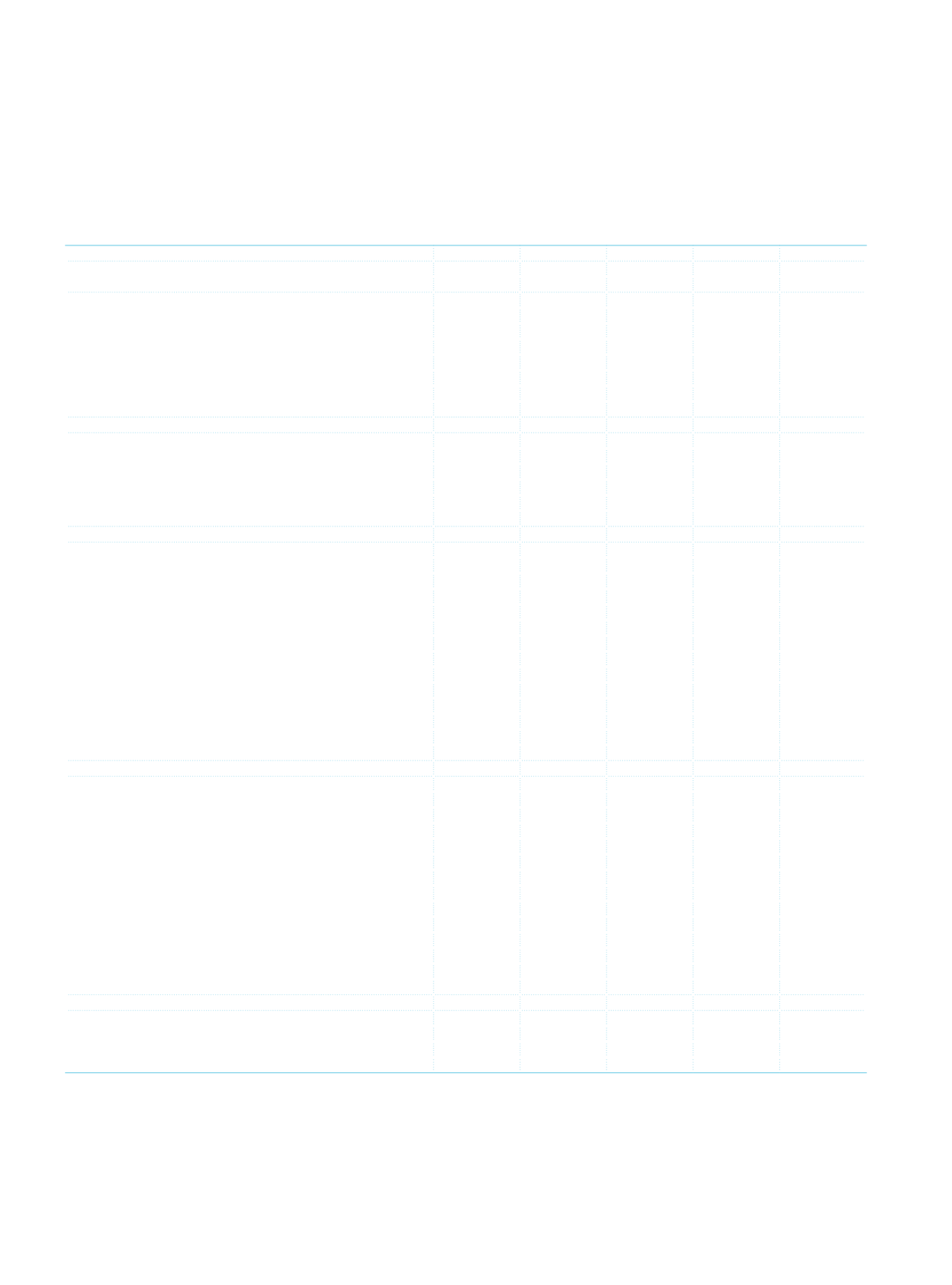

Financial Information and Risk Management

302

İş Bankası

Annual Report 2013

Financial Highlights and Key Ratios for the Five-Year Period

UNCONSOLIDATED

ASSETS (TL thousand)

2009/12

2010/12

2011/12

2012/12

2013/12

Cash and Equivalents

884,514 1,253,650 1,231,464 1,756,595 2,219,817

Banks and Receivables from Interbank Money Markets

(1)

16,308,023 10,454,093 14,802,918 15,634,097 22,335,328

Securities (Net)

39,289,717 45,436,557 42,778,027 38,054,734 36,866,263

Loans

(2)

48,334,786 64,231,678 91,620,638 106,715,770 134,843,374

Associates and Subsidiaries (Net)

5,031,079 6,264,039 6,275,017 7,699,954 7,760,771

Fixed Assets (Net)

1,922,019 1,918,459 1,983,314 1,998,785 2,090,204

Other Assets

1,453,166 2,238,018 2,977,126 3,584,515 4,384,280

Total Assets

113,223,304 131,796,494 161,668,504 175,444,450 210,500,037

LIABILITIES (TL thousand)

2009/12

2010/12

2011/12

2012/12

2013/12

Deposits

72,177,063 88,260,157 98,313,134 105,383,434 120,974,765

Funds Borrowed and Interbank Money Market Placements

(3)

20,727,737 18,201,332 34,390,699 30,630,769 46,933,598

Provisions

3,493,802 3,631,589 4,204,926 5,380,105 5,862,456

Other Liabilities

3,341,174 4,689,612 6,838,381 11,331,097 13,170,101

Shareholders’ Equity

13,493,528 17,013,804 17,921,364 22,719,045 23,563,117

Total Liabilities

113,233,304 131,796,494 161,668,504 175,444,450 210,504,037

INCOME STATEMENT

(4)

(TL thousand)

2009/12

2010/12

2011/12

2012/12

2013/12

Interest Income

10,200,437 9,797,839 10,898,384 13,390,415 13,460,682

Interest Expenses

5,332,949 5,215,964 6,336,584 7,462,498 6,805,252

Net Interest Income

4,867,488 4,581,875 4,561,800 5,927,917 6,655,430

Net Trading Income

408,373

134,630

306,073

590,390

223,266

Net Fees and Commissions Income

1,252,604 1,236,425 1,428,583 1,706,227 1,919,086

Dividend Income

325,037

369,210

555,702

417,703

450,312

Other Operating Income

1,073,275 1,569,284 1,311,114 1,172,144 1,038,142

Total Operating Income

7,926,777 7,891,424 8,163,272 9,814,381 10,286,236

Operating Expenses

2,694,687 3,203,123 3,481,199 4,484,306 4,962,519

NET OPERATING PROFIT/LOSS

5,232,090 4,688,301 4,682,073 5,330,075 5,323,717

Provision for Losses on Loans and Other Receivables

2,286,474 1,135,449 1,383,793 1,209,122 1,467,018

PROFIT/(LOSS) BEFORE TAXES

2,945,616 3,552,852 3,298,280 4,120,953 3,856,699

Provision for Taxes

573,209

570,642

630,793

810,646

693,334

NET PERIOD PROFIT /(LOSS)

2,372,407 2,982,210 2,667,487 3,310,307 3,163,365

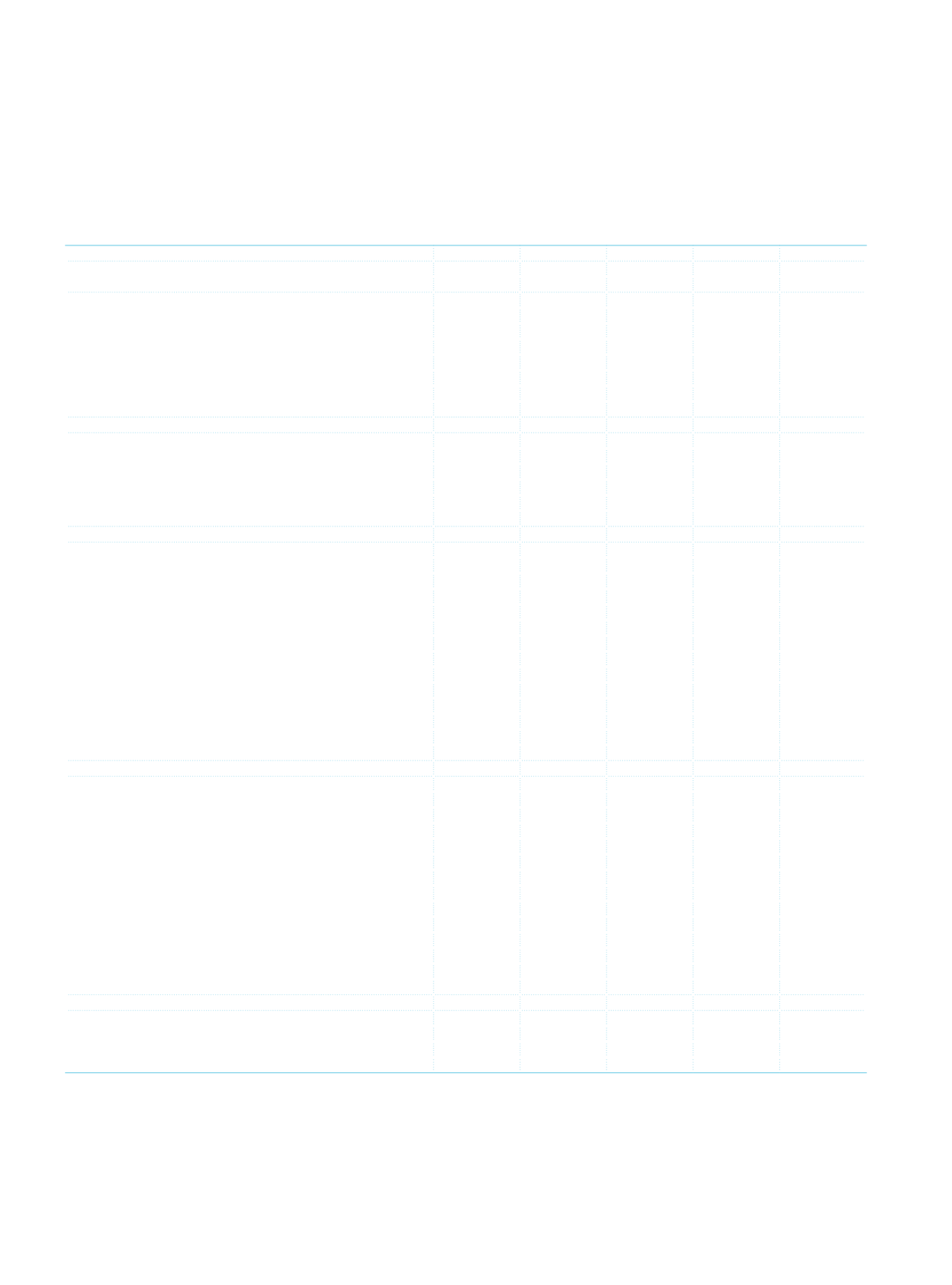

KEY RATIOS (%)

2009/12

2010/12

2011/12

2012/12

2013/12

Interest Earning Assets

(5)

/ Total Assets

91.7

91.1

92.2

91.4

92.1

Interest Earning Assets

(5)

/ Interest Bearing Liabilities

111.8

112.8

112.4

116.4

113.5

Securities / Total Assets

34.7

34.5

26.5

21.7

17.5

Loans / Total Assets

42.7

48.7

56.7

60.8

64.1

Loans / Deposits

67.0

72.8

93.2

101.3

111.5

Retail Loans / Total Loans

31.2

30.6

27.8

28.6

28.5

NPL Ratio

5.4

3.6

2.1

1.9

1.6

Coverage Ratio

100.0

100.0

100.0

78.9

80.4

Demand Deposits / Total Deposits

15.6

16.4

18.9

19.9

21.2

Shareholders’ Equity / Total Liabilities

11.9

12.9

11.1

12.9

11.2

Capital Adequacy Standard Ratio

18.3

17.5

14.1

16.3

14.4

Return on Average Assets

(6)

2.3

2.4

1.8

2.0

1.6

Return on Average Equity

(6)

21.0

19.9

15.2

16.5

13.7

Cost / Income

34.0

40.6

42.6

45.7

48.2

OTHER INFORMATION (TL thousand)

2009/12

2010/12

2011/12

2012/12

2013/12

Regulatory Capital

13,963,036 16,995,505 18,631,132 24,739,690 27,689,806

Core Capital

12,932,571 15,178,349 17,182,647 19,765,885 22,264,891

Free Capital

(7)

8,972,745 11,711,967 12,117,791 16,099,351 17,070,498

Demand Deposits

11,258,761 14,468,760 18,626,781 20,946,735 25,623,095

(1)

Includes Deposits at the Central Bank and Reserve Requirements

(2)

Excludes Receivables under Follow-up

(3)

Includes TRY, FC bond issuances and subordinated debts

(4)

Fees and Commissions Received from Cash Loans are shown under Interest Income; Fees and Commissions Paid to Cash Loans are shown under Interest Expense.

(5)

Interest Earning Assets include TRY and FC reserves at Central Bank, which are currently paid 0% interest.

(6)

Averages are calculated over quarter figures.

(7)

Free Equity = Shareholders’ Equity - (Fixed Assets+Non-Financial Associates and Subsidiaries+Receivables Under Follow-Up-Specific Provisions)