Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

155

Financial Information and Risk Management

l. Explanation on other items on the income statement:

Other items do not exceed 10% of the total amount of the income statement.

V. DISCLOSURES AND FOOTNOTES ON STATEMENT OF CHANGES IN SHAREHOLDERS’ EQUITY

The paid-in capital is TL 4,500,000 in legal records. As of balance sheet date, the balance of legal reserves is TL 2,483,718 and the balance of extraordinary reserves is TL 15,018,038.

In the current period, the change in other reserves itemmainly is a result of the conversion profit of foreign branches and the actuarial loss related to employee termination benefit.

The details of revaluation surplus of securities are shared in the Note Section Five II-k.9. TL 229,495 of this amount is the deferred tax effect on available for sale securities (31

December 2014: TL (142,440)).

TL 2,279,090 amount of tangible and intangible revaluation surplus amount is detailed in the Section Five I-k.

Change in retained earnings amounting to TL 9,547 is comprised of reclassification of revaluation surplus of sold real estates to retained earnings in accordance with the TAS 16-

Property, Plant and Equipment.

VI. DISCLOSURES AND FOOTNOTES ON STATEMENTS OF CASH FLOWS

The operating profit of TL 10,417,838 before the changes in operating assets and liabilities mostly comprised of TL 18,615,121 of interest received from loans and securities, and

TL 10,034,161 of interest paid on deposits, money market operations and funds borrowed by the Bank. The account “Other” classified under operating profit other than fees and

commissions paid, cash payments to personnel and service suppliers and taxes paid consists of other operating expenses and foreign exchange gains/losses accounts is TL 1,952,434

(31 December 2014: TL (1,177,489)).

Net Increase (Decrease) in Other Liabilities account classified in changes of assets and liabilities resulting from the changes in Funds Provided Under Repurchase Agreements,

miscellaneous payables, other liabilities and taxes, duties, charges, and premiums is TL 2,183,101 (31 December 2014: 4,124,206 ).

Net Cash Provided from Other Investing Activities account includes net cash flows from sale of intangible assets and declined by TL 257,368 (31 December 2014: TL 195,704).

The effect of changes in foreign exchange rates on cash and cash equivalents is approximately TL (24,402) as of 31 December 2015. Due to the high rate of turnover of related foreign

currency assets, the difference between the last 30 days’ arithmetic average of currency exchange rates and the year end currency exchange rate is used to calculate the effect of

change in foreign exchange rate. Under the same assumption, the effect of change in foreign exchange rate on cash and cash equivalents as of 31 December 2014 was TL 54,386.

Cash, cash in foreign currency, unrestricted deposits in Central Bank of Turkey, money in transit, cheques purchased, precious metals, money market operations as well as demand and

timed up to 3 months are defined as cash and cash equivalents.

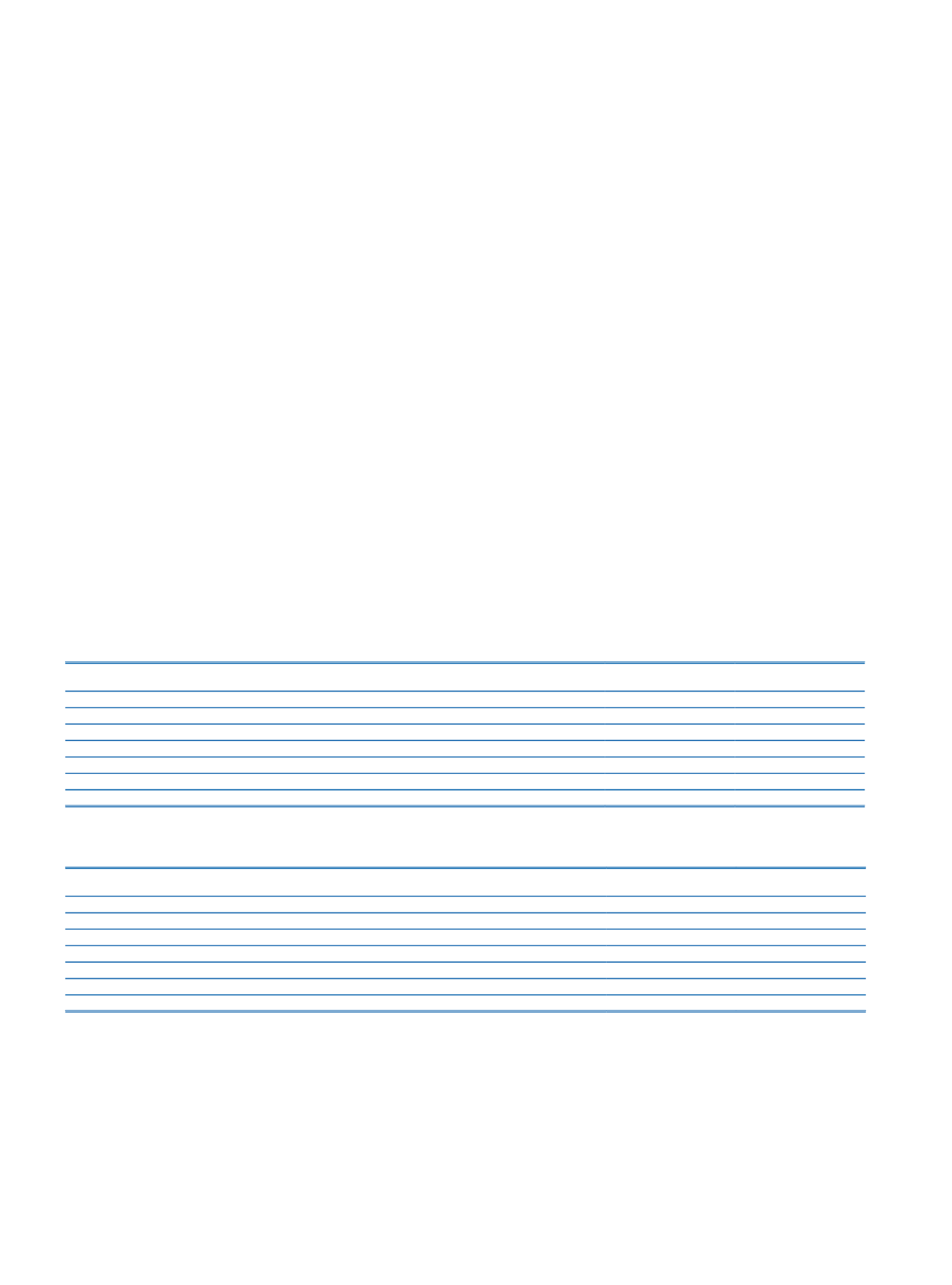

Cash and cash equivalents at beginning of the period:

Current Period

31 December 2014

Prior Period

31 December 2013

Cash

8,284,384

8,221,154

Cash in TL and Foreign Currency

2,501,742

2,152,329

Central Bank of Turkey and Other

5,782,642

6,068,825

Cash Equivalents

1,037,403

1,386,845

Banks’ Demand Deposits and Time Deposits Up to 3 Months

1,037,403

1,386,845

Money Market Receivables

Total Cash and Cash Equivalents

9,321,787

9,607,999

The total amount resulting from the transactions made in the previous period shows the total cash and cash equivalents as of the beginning of the current period.

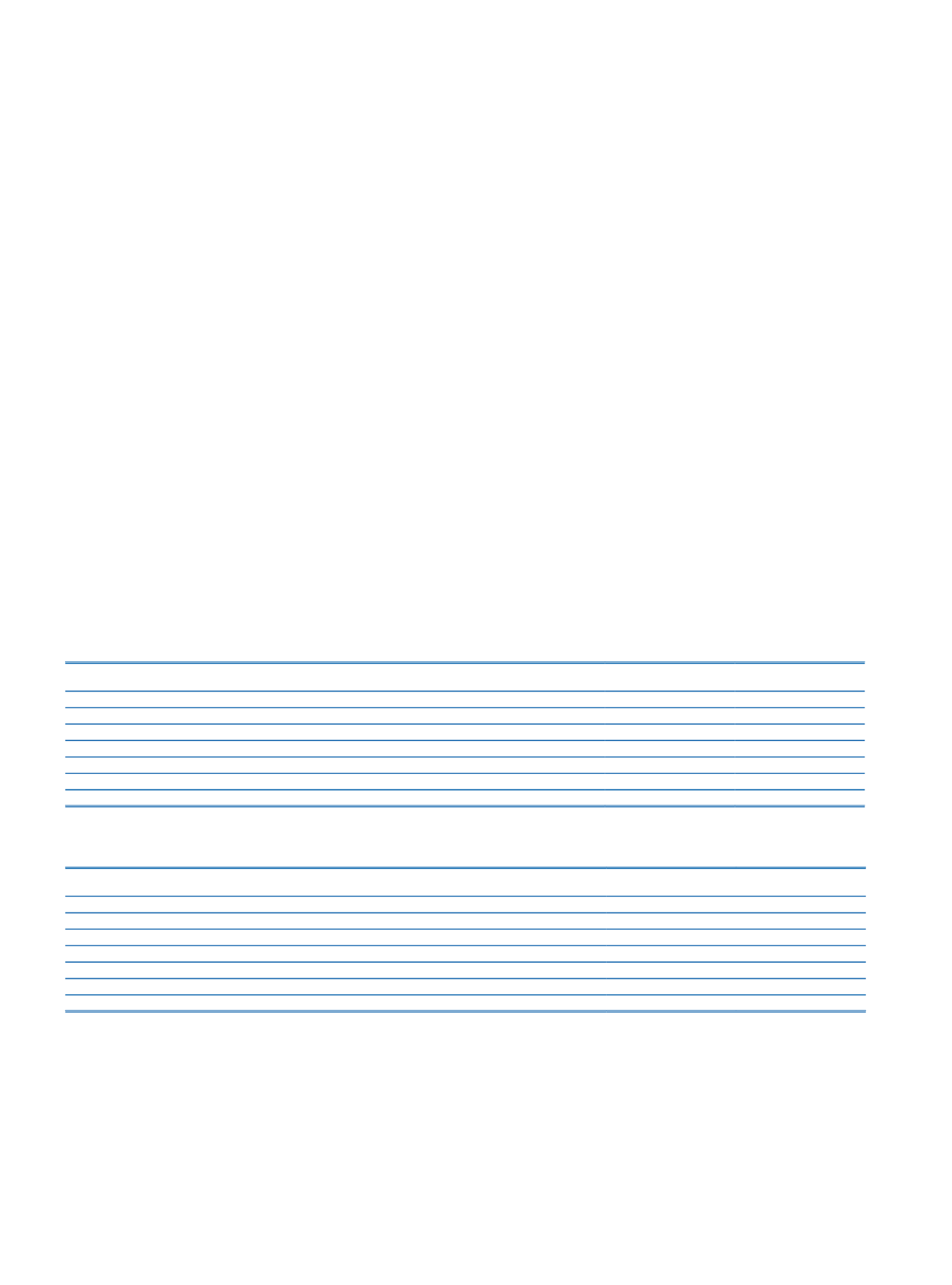

Cash and cash equivalents at end of the period:

Current Period

31 December 2015

Prior Period

31 December 2014

Cash

7,780,546

8,284,384

Cash in TL and Foreign Currency

2,641,819

2,501,742

Central Bank of Turkey and Other

5,138,727

5,782,642

Cash Equivalents

1,155,775

1,037,403

Banks’ Demand Deposits and Time Deposits Up to 3 Months

1,155,775

1,037,403

Money Market Receivables

Total Cash and Cash Equivalents

8,936,321

9,321,787