Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

147

Financial Information and Risk Management

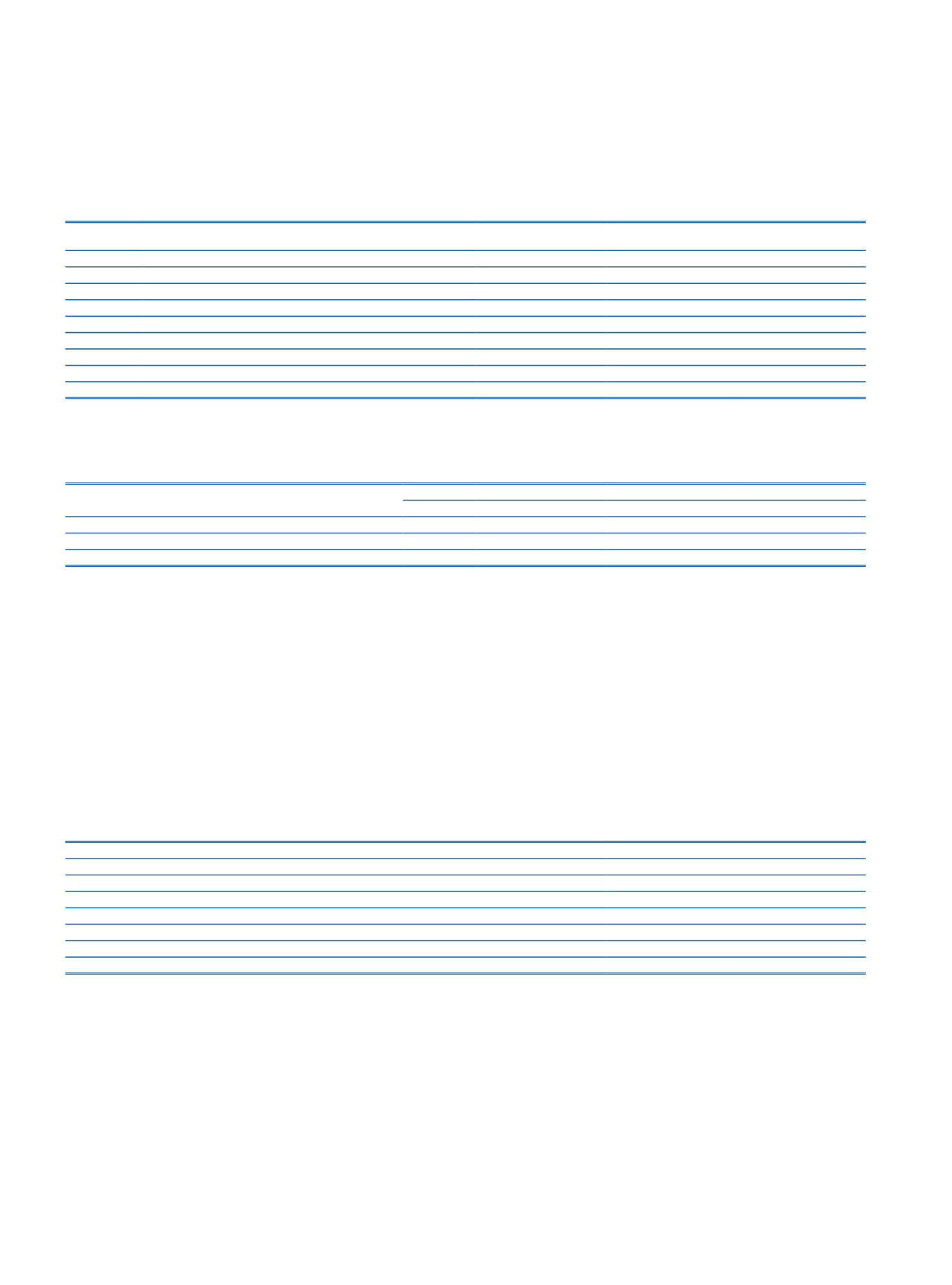

Information on funds received through securitization is given below.

Date

Special Purpose Vehicle (SPV)

Amount

Final Maturity

Remaining Debt Amount

as at 31 December 2015

October 2011 TIB Diversified Payment Rights Finance Company

USD 75,000,000

5 years

USD 25,000,000

October 2011 TIB Diversified Payment Rights Finance Company

EUR 160,000,000

5-7 years

EUR 69,333,333

June 2012

TIB Diversified Payment Rights Finance Company

USD 225,000,000

5 years

USD 131,250,000

June 2012

TIB Diversified Payment Rights Finance Company

EUR 125,000,000

12 years

EUR 109,375,000

December 2013 TIB Diversified Payment Rights Finance Company

USD 50,000,000

5 years

USD 50,000,000

December 2013 TIB Diversified Payment Rights Finance Company

EUR 185,000,000

5-12 years

EUR 185,000,000

December 2014 TIB Diversified Payment Rights Finance Company

USD 250,000,000

5-14 years

USD 250,000,000

March 2015 TIB Diversified Payment Rights Finance Company

USD 555,000,000

5-15 years

USD 555,000,000

October 2015 TIB Diversified Payment Rights Finance Company

USD 221,200,000

10 years

USD 221,200,000

Other:

The Bank has obtained funds with an amount of USD 500 million and 10 years maturity, through securitization of future flow transactions.

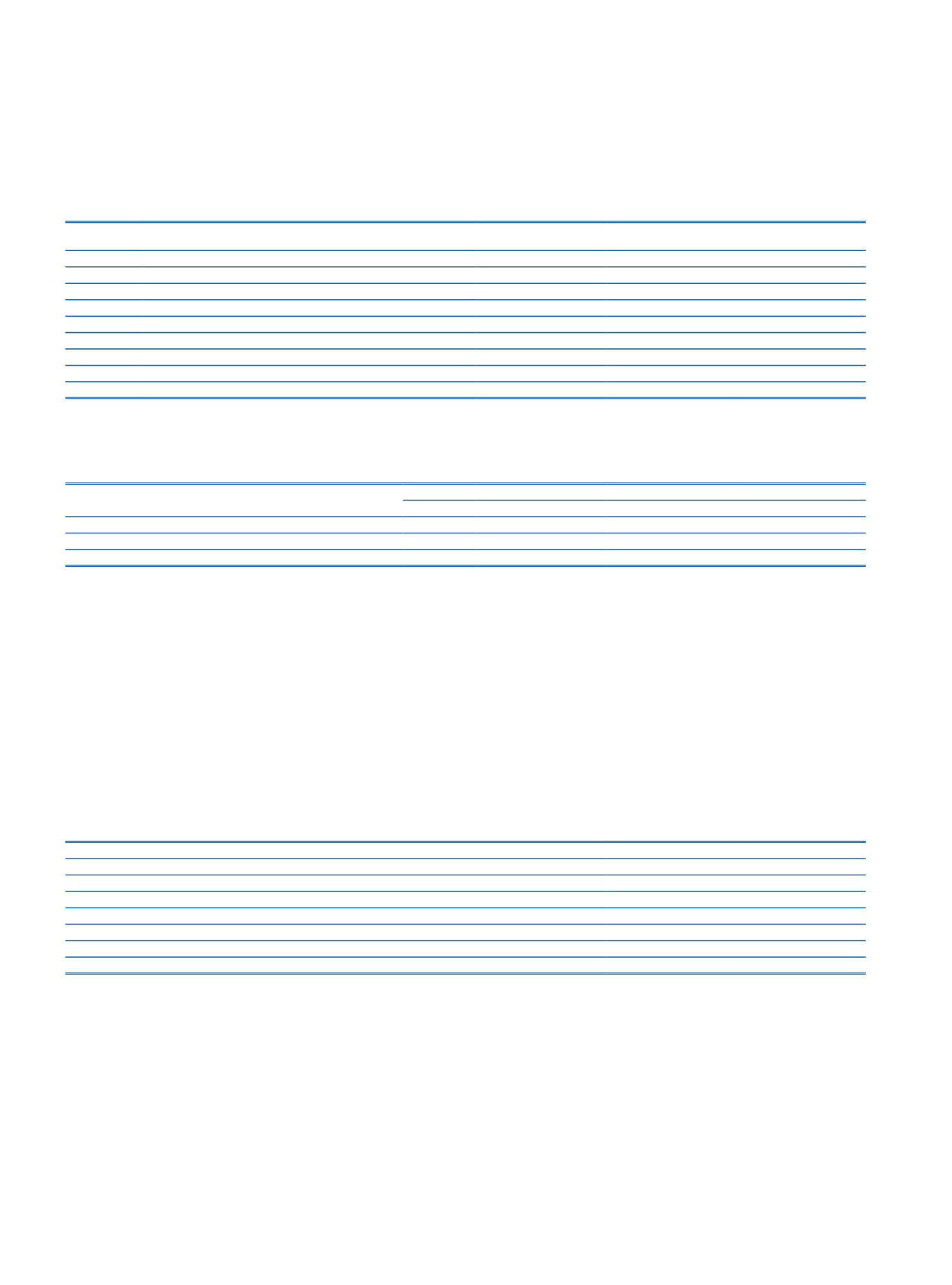

d. Information on Debt Securities Issued (Net):

Current Period

Prior Period

TL

FC

TL

FC

Bills

5,551,796

1,927,381

4,305,319

2,339,748

Bonds

773,889

11,508,063

1,209,113

9,299,577

Total

6,325,685

13,435,444

5,514,432

11,639,325

e. Concentration of the liabilities of the Bank:

Bank’s liabilities come from 56% of deposits, 10% of funds borrowed, 9% of the secondary subordinated securities loans and 7% of the funds provided under repurchase

agreements. Deposits, having different properties are spread across a large customer base. The borrowings, on the other hand, are comprised of various funds obtained from financial

institutions through syndication, securitization, post-financing and money market operations. No risk concentration exists related to the Bank’s liabilities

f. Information on Other Liabilities:

Other liabilities do not exceed 10% of the balance sheet total.

g. Information on Lease Payables (net):

The Bank does not have any lease payables.

h. Information on Derivative Financial Liabilities Held for Risk Management:

The Bank does not have any derivative financial liabilities held for risk management purposes.

i. Information on Provisions:

i.1. Information on general loan loss provisions:

Current Period

Prior Period

General Loan Loss Provisions(1)

2,851,829

2,328,896

Provision for Group I Loans and Receivables

2,406,126

1,981,728

-Additional Provision for Loans and Receivables with Extended Maturities

124,210

108,338

Provision for Group II Loans and Receivables

175,504

123,405

- Additional Provision for Loans and Receivables with Extended Maturities

17,785

14,596

Provision for Non-cash Loans

166,016

150,873

Other

104,183

72,890

i.2. Reserves for employee benefits:

According to the related regulation and the collective bargaining agreements, the Bank is obliged to pay employee termination benefits to employees who retire, die, quit for their

military service obligations, who have been dismissed as defined in the related regulation or to the female employees who have voluntarily quit within one year after the date of their

marriage. In accordance with the related regulations, the amount of employee termination benefits is TL 3,828.37 (full TL amount as of 31 December 2015), which is one month salary

for each service year and cannot exceed the base wage ceiling for employee termination benefits. A provision for severance pay to allocate that employees need to be paid upon

retirement is calculated by estimating the present value of probable amount. In this context, as of 31 December 2015 TL 517,074 provision was set aside and reflected to the financial

statements (31 December 2014: TL 440,195).

The main actuarial assumptions used in the calculation of the employee termination benefits are as follows:

- Discount and inflation rates, which vary by years, were used for the calculation and the real rate of increase in wage was taken as 2%.

- TL 3,828.37 (full TL amount) wage ceiling, which was effective as at 31 December 2015 was taken into account for the calculations.

- The age of retirement is considered as the earliest age possible that an individual can retire.

- CSO 1980 table is used for the mortality rate for female and male employees