Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

143

Financial Information and Risk Management

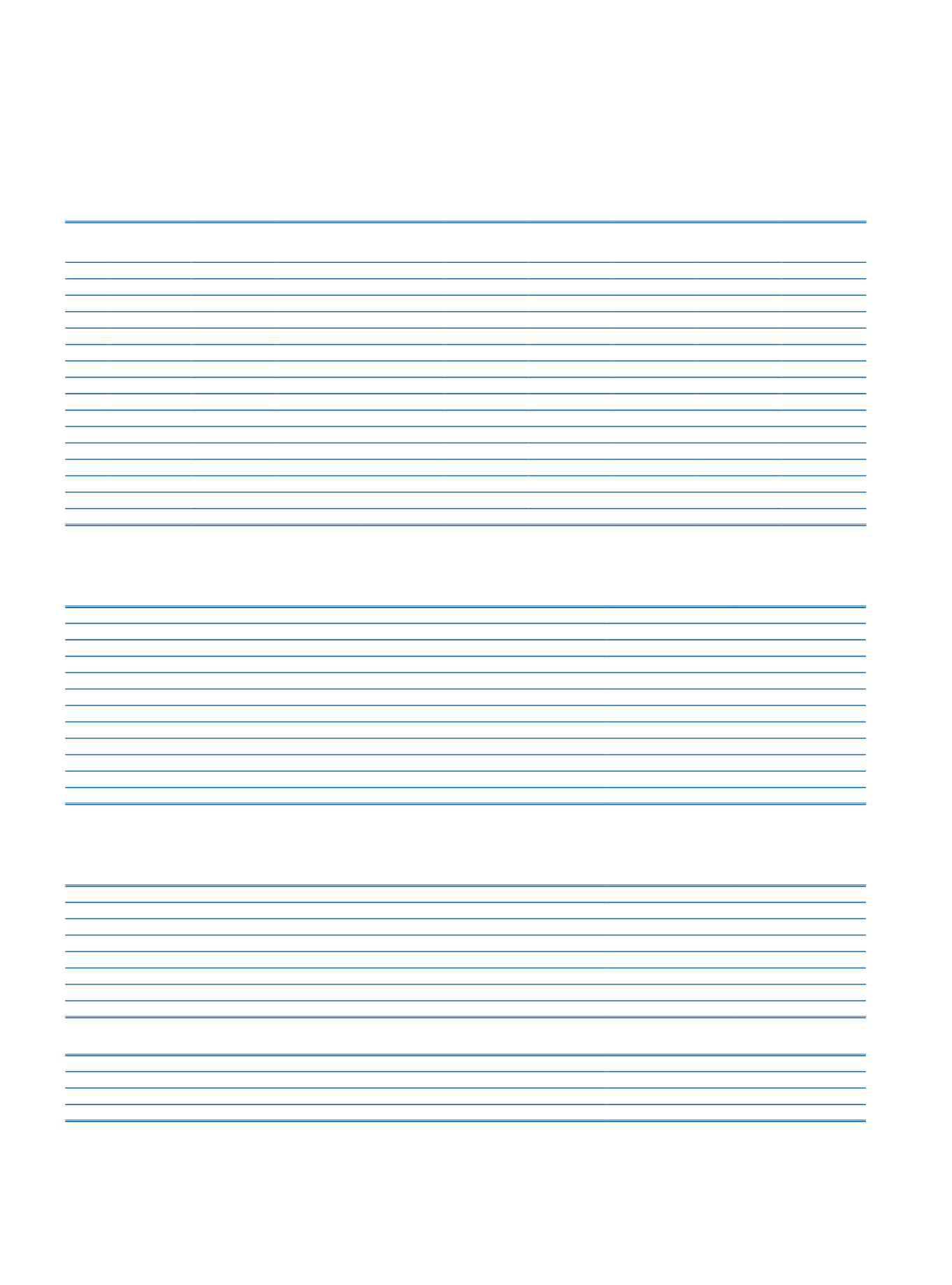

i.3. Financial statement information related to subsidiaries in the above order

(1)

:

No.

Total Assets

Shareholders’

Equity

Total Tangible

Assets

Interest

Income

(2)

Securities

Income

Current Period

Profit/ Loss

Prior Period

Profit/Loss

Fair Value

Additional

Shareholders’

Equity Required

1-

11,893,997

783,026

154,769

255,399

26,559

145,883

104,075

2,514,120

2-

206,069

194,611

197,876

503

90

39,833

1,558

3-

560,365

142,841

46,002

54,786

236

(26,582)

(11,985)

4-

263,063

37,000

3,548

7,261

462

5-

5,580,838

738,408

20,944

396,184

3,929

87,264

80,174

429,015

6-

4,125,201

2,790,635

3,319,084

4,328

4,519

555,933

328,433

1,339,070

7-

58,195

22,192

1,898

2,454

4

7,662

9,874

8-

89,667

61,017

26,174

702

453

11,205

7,908

9-

5,781,240

908,208

94,219

241,557

70,327

22,408

92,570

400,085

10-

3,767,688

421,572

49,706

94,528

10,206

5,234

11-

20,082

11,855

649

1,534

1,198

12-

2,647,784

1,183,899

426,968

98,141

66,402

130,243

30,426

13-

576,738

315,102

315,440

4,739

96

(33,557)

(89,150)

14-

222,711

222,458

47

182

(9,217)

(205,899)

15-

21,366,580

2,783,792

450,376

1,098,725

22,197

410,590

374,111

2,604,000

16-

14,582,588

7,856,158

6,369,824

57,967

1,611

638,558

424,703

6,017,300

(1)

Indicates financial data of Anadolu Hayat Emeklilik A.Ş., JSC İşbank. JSC İşbank Georgia. İş Finansal Kiralama A.Ş., İş Gayrimenkul Yatırım Ortaklığı A.Ş., İş YatırımMenkul Değerler A.Ş., İşbank AG. Milli Reasürans T.A.Ş.,

Türkiye Sınai Kalkınma Bankası A.Ş. are as at 31 December 2015. Türkiye Şişe ve Cam Fabrikaları A.Ş. as at 30 September 2015 and the financial data of other companies are as of 31 December 2014.

(2)

Includes interest income on securities.

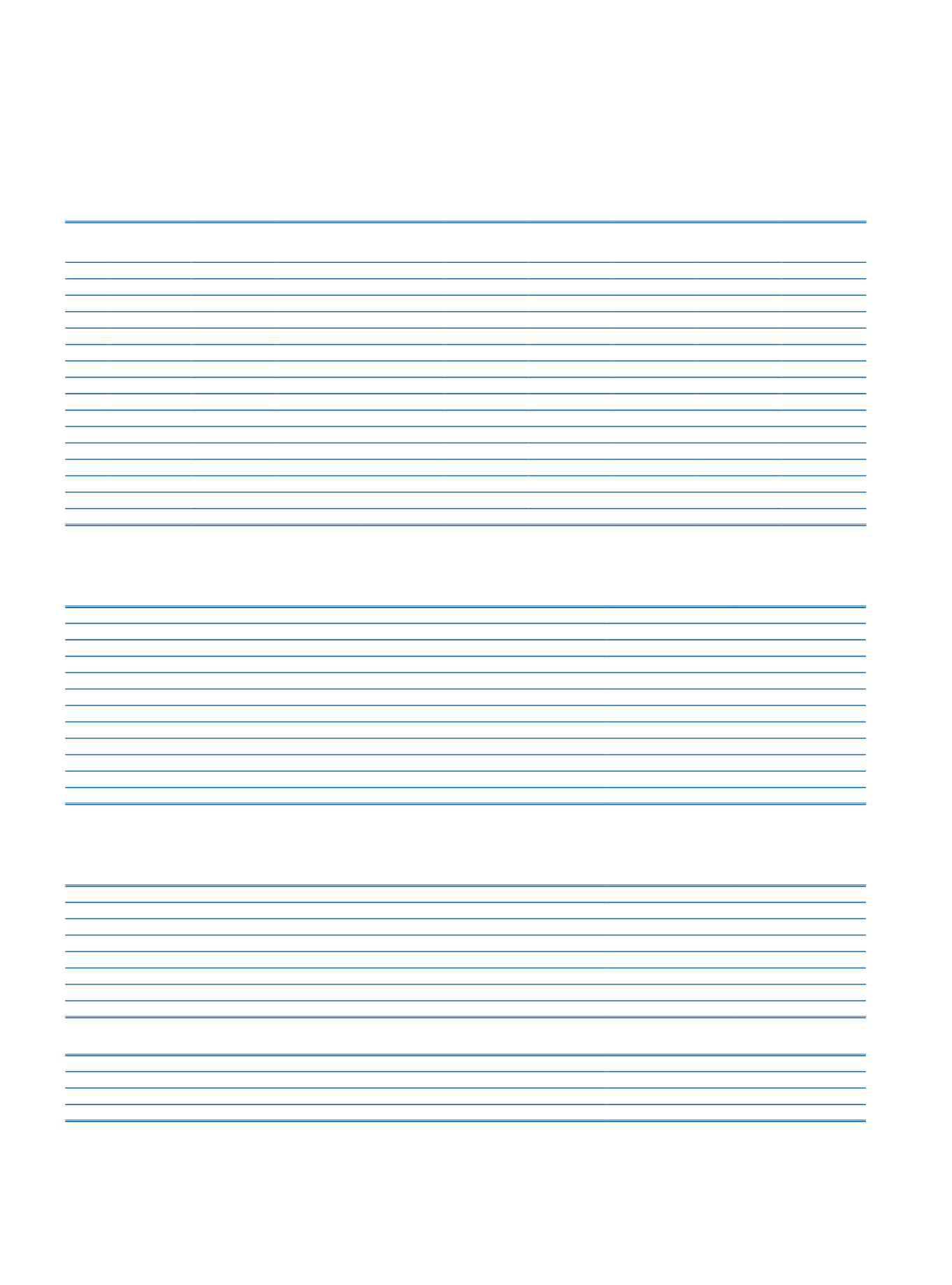

i.4. Movement of investments in subsidiaries:

Current Period

Prior Period

Balance at the Beginning of the Period

8,841,777

7,016,856

Movements in the Period

Purchases

(1)

486,663

399,106

Bonus Shares Acquired

Dividends Received from Current Year Profit

Sales

(142,196)

Revaluation Surplus

(2)

(63,089)

1,435,733

Impairment

132,278

Balance at the End of the Period

9,265,351

8,841,777

Capital Commitments

Contribution in equity at the end of the period (%)

(1)

TL 103,450 of related amount is comprised of the participation in the cash capital increase of Joint Stock Company İşbank, TL 36,777 of the acquisition of JSC İşbank Georgia while the rest is due other subsidiaries’

capital increase -from profits- through issuance of bonus shares in the current period.

(2)

The relevant amounts represent the increases and decreases in the market value of participations traded on the stock exchange.

i.5. Sectoral information on financial subsidiaries and the related carrying amounts:

Subsidiaries

Current Period

Prior Period

Banks

1,611,609

1,643,985

Insurance Companies

2,042,486

1,694,716

Factoring Companies

Leasing Companies

119,241

121,857

Finance Companies

Other Financial Subsidiaries

828,223

661,597

Total

4,601,559

4,122,155

i.6.

Subsidiaries quoted on stock exchange:

Current Period

Prior Period

Traded on domestic stock exchanges

7,500,929

7,251,253

Traded on foreign stock exchanges

Total

7,500,929

7,251,253

i.7. Subsidiaries disposed of in the current period:

None.

i.8.

Subsidiaries acquired in the current period:

Beginning from the 3 August 2015, the Bank has started to proceed its banking operations in Georgia under the JSC Isbank Georgia which is a fully owned subsidiary having a banking

license in Georgia and has an initial capital of TL 36,777 (Lari 30,000,000).