Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

140 İşbank

Annual Report 2015

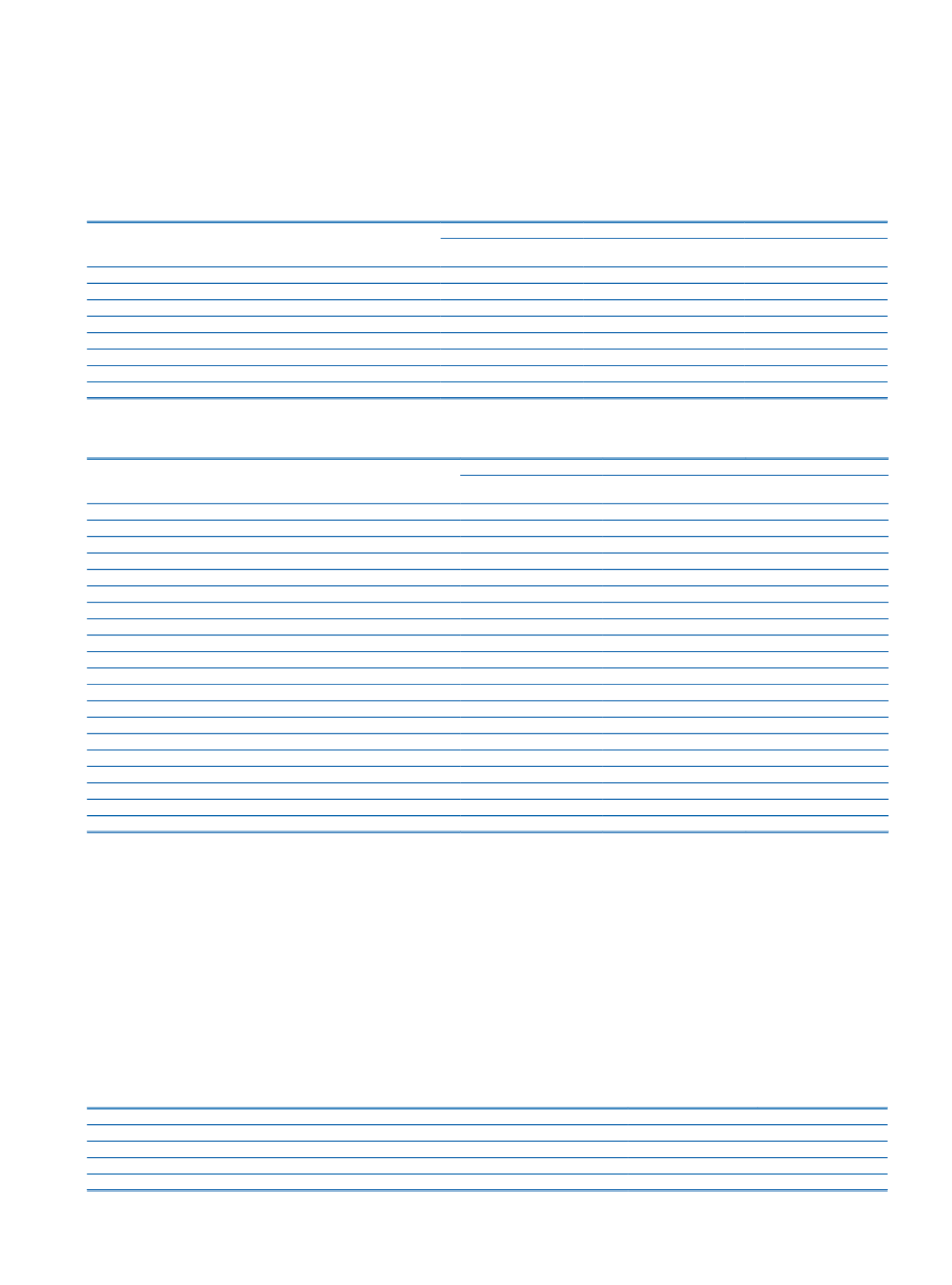

f.10.3.

Information on foreign currency non-performing loans and other receivables:

Group III

Group IV

Group V

Loans and Receivables with

Limited Collectability

Loans and Receivables with

Doubtful Collectability

Uncollectible Loans and

Other Receivables

Current Period:

Period Ending Balance

23,156

161,653

398,438

Specific Provisions (-)

5,114

81,562

398,438

Net Balance on Balance Sheet

(1)

18,042

80,091

Prior Period:

Period Ending Balance

7,560

25,072

314,816

Specific Provisions (-)

1,875

13,728

314,816

Net Balance on Balance Sheet

(1)

5,685

11,344

(1)

In addition to the loans extended in foreign currency, loans which are monitored in Turkish Lira are included.

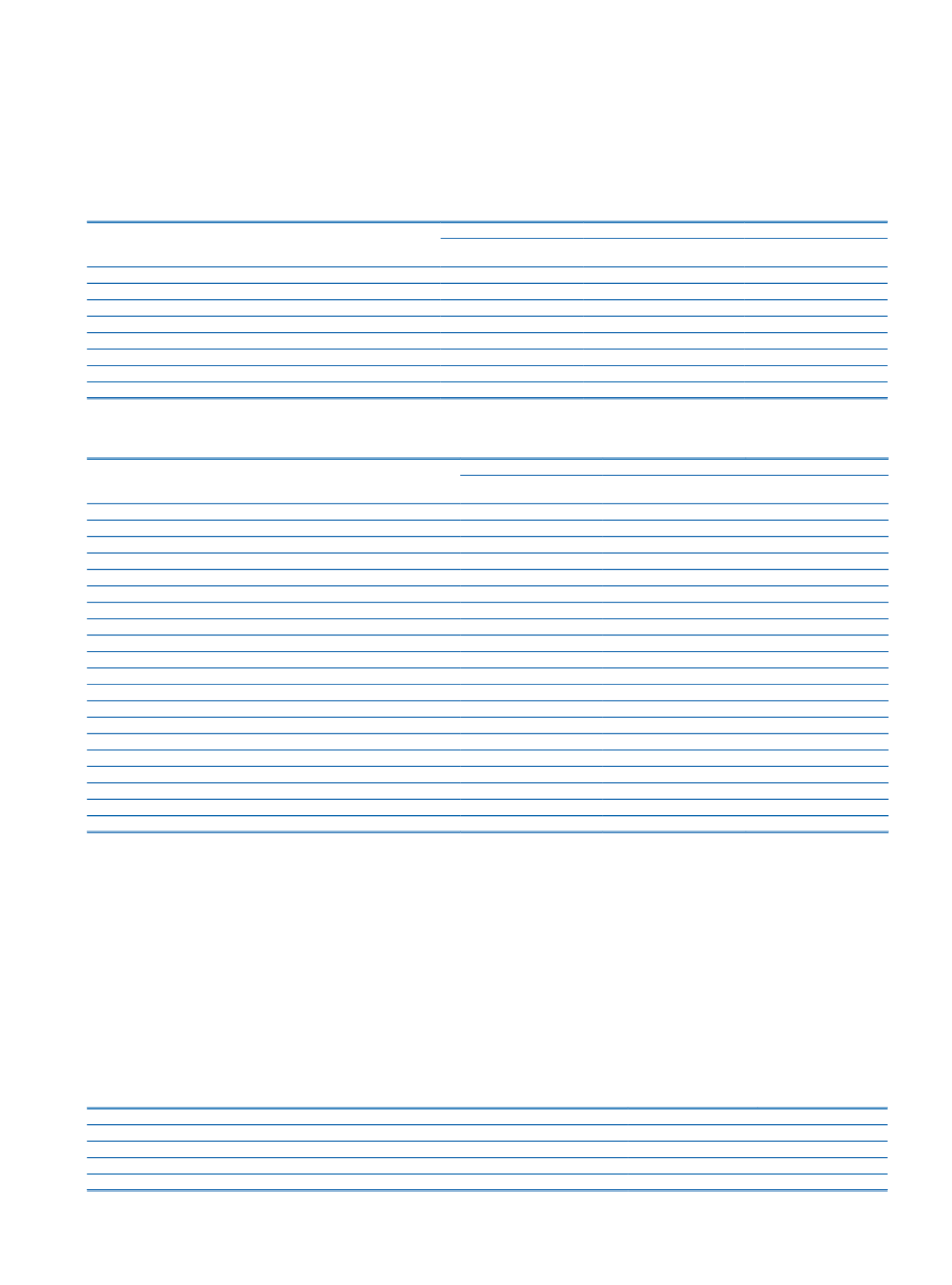

f.10.4.

Information on gross and net non-performing loans and receivables as per customer categories:

Group III

Group IV

Group V

Loans and Receivables with

Limited Collectability

Loans and Receivables with

Doubtful Collectability

Uncollectible Loans and

Other Receivables

Current Period (Net)

440,520

456,616

Loans to Individuals and Corporate (Gross)

554,262

921,039

2,065,596

Specific Provisions (-)

113,742

464,423

2,065,596

Loans to Individuals and Corporate (Net)

440,520

456,616

Banks (Gross)

Specific Provisions (-)

Banks (Net)

Other Loans and Receivables (Gross)

62,792

Specific Provisions (-)

62,792

Other Loans and Receivables (Net)

Prior Period (Net)

299,124

259,656

Loans to Individuals and Corporate (Gross)

376,049

524,423

1,465,260

Specific Provisions (-)

76,925

264,767

1,465,260

Loans to Individuals and Corporate (Net)

299,124

259,656

Banks (Gross)

Specific Provisions (-)

Banks (Net)

Other Loans and Receivables (Gross)

54,839

Specific Provisions (-)

54,839

Other Loans and Receivables (Net)

f.10.5.

Main principles of liquidating for uncollectible loans and other receivables:

In order to ensure the liquidation of non-performing loans, all possibilities evaluated to ensure maximum collection according to the legislation. First of all, administrative initiatives are

taken to deal with the borrower. Collection through legal proceedings used if there is no possibility of collection and configuration with the interviews for other receivables.

f.10.6.

Information on write-off policy:

The Bank’s general policy for write-offs of loans and receivables under follow-up is to write of such loans and receivables that are proven to be uncollectible in legal follow-up process

within the instructions of Tax Procedure Law.

g. Held to Maturity Investments:

g.1. Held to maturity investments given as collateral or blocked:

Held to maturity investments given as collateral or blocked amount to TL 146,257 as at 31 December 2015 (31 December 2014: TL 373,935).

g.2. Held to maturity investments subject to repurchase agreements:

Held to maturity investments, which are subject to repurchase agreements amount to TL 2,008,853 as at 31 December 2015 (31 December 2014: TL 348,913).

g.3. Information on government securities held to maturity:

Current Period

Prior Period

Government Bonds

3,414,877

1,226,442

Treasury Bills

Other Public Debt Securities

Total

3,414,877

1,226,442