Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

132 İşbank

Annual Report 2015

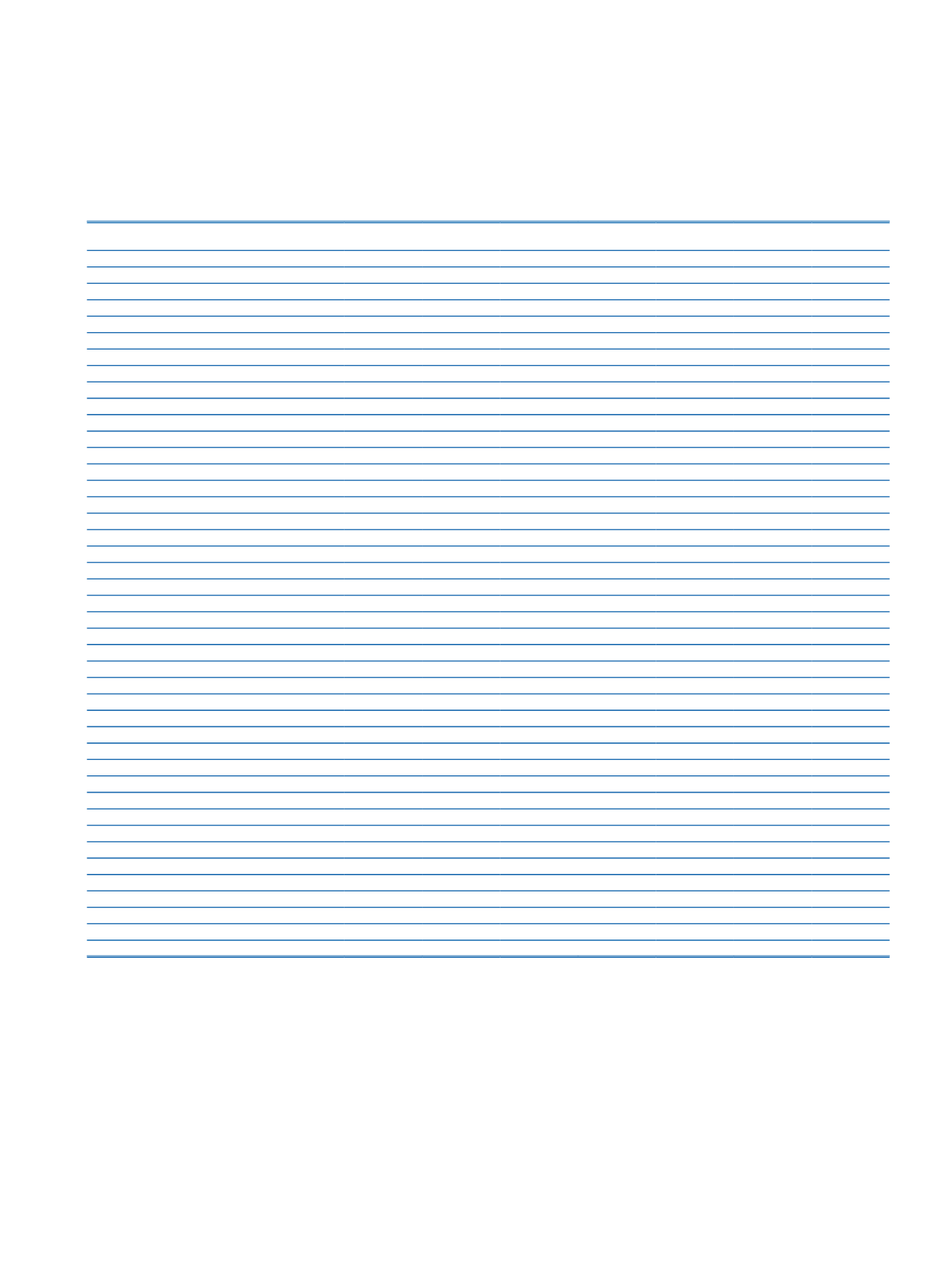

Statement of information related to business segmentation is given below.

Current Period

Corporate Commercial

Retail

Private

Treasury/

Investment Unallocated

Total

OPERATING INCOME/EXPENSE

Interest Income

19,200,361

Interest Income from Loans

3,522,483

7,455,665

4,558,782

17,330

133,846 15,688,106

Interest Income from Banks

17,230

17,230

Interest Income from Securities

3,410,608

3,410,608

Other Interest Income

64,768

19,649

84,417

Interest Expense

10,214,805

Interest Expense on Deposits

841,348 1,066,648 2,840,009

987,963

642,055

6,378,023

Interest Expense on Funds Borrowed

754,852

754,852

Interest Expense on Money Market Transactions

1,690,336

1,690,336

Interest Expense on Securities Issued

1,359,913

1,359,913

Other Interest Expense

31,681

31,681

Net Interest Income

8,985,556

Net Fees and Commissions Income

2,388,802

Fees and Commissions Received

409,050

1,351,787

926,811

10,606

105,903

2,804,157

Fees and Commissions Paid

415,355

415,355

Dividend Income

554,940

554,940

Trading Income/Loss (Net)

(868,620)

(868,620)

Other Income

3,529

275,692

157,116

168

19,897

652,186

1,108,588

Provision For Loans and Other Receivables

154,475

766,285

530,867

5

2,308

604,240

2,058,180

Other Operating Expense

43,866

763,701

1,565,086

9,639

154,266

3,790,831

6,327,389

Income Before Tax

3,783,697

Tax Provision

701,006

Net Period Profit

3,082,691

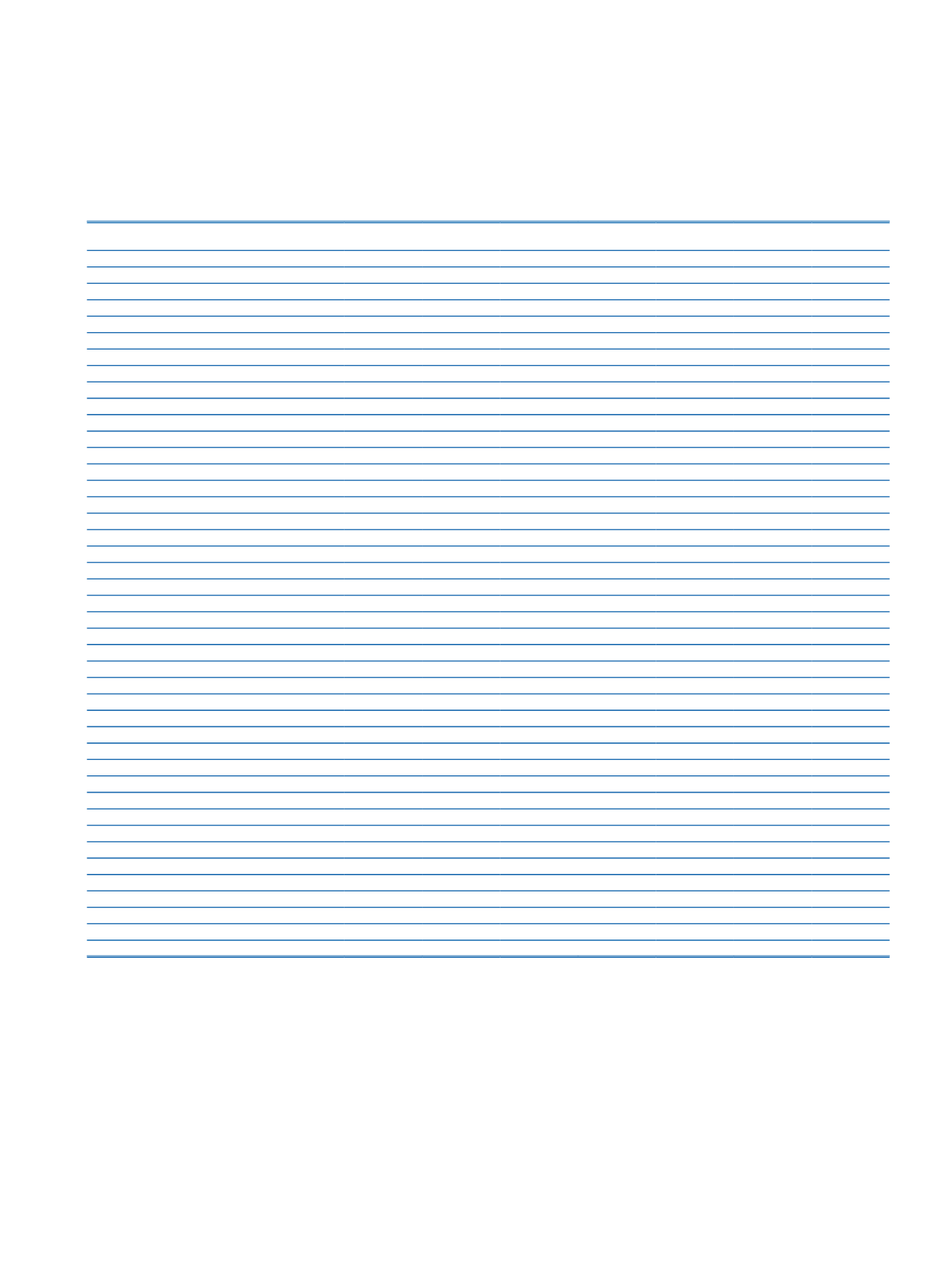

SEGMENT ASSETS

Financial Assets at FV Through P/L

1,592,298

1,592,298

Banks and Other Financial Institutions

1,517,501

1,517,501

Financial Assets Available for Sale

40,860,360

40,860,360

Loans

56,611,813 77,481,838 40,792,717

196,007

2,851,381 177,933,756

Held to Maturity Investments

3,591,631

3,591,631

Associates and Subsidiaries

9,393,597

9,393,597

Other

40,828,441 40,828,441

275,717,584

SEGMENT LIABILITIES

Deposits

22,957,793 31,156,975 70,152,778 16,194,848

13,340,032 153,802,426

Derivative Financial Liabilities Held for Trading

927,974

927,974

Funds Borrowed

28,408,499

28,408,499

Money Market Funds

20,089,147

20,089,147

Marketable Securities Issued

(1)

23,808,262

23,808,262

Other Liabilities

9,552,540

9,552,540

Provisions

7,093,746

7,093,746

Shareholders’ Equity

32,034,990 32,034,990

275,717,584

(1)

Includes Tier 2 subordinated bonds which are classified on the balance sheet as subordinated loans.