Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

125

Financial Information and Risk Management

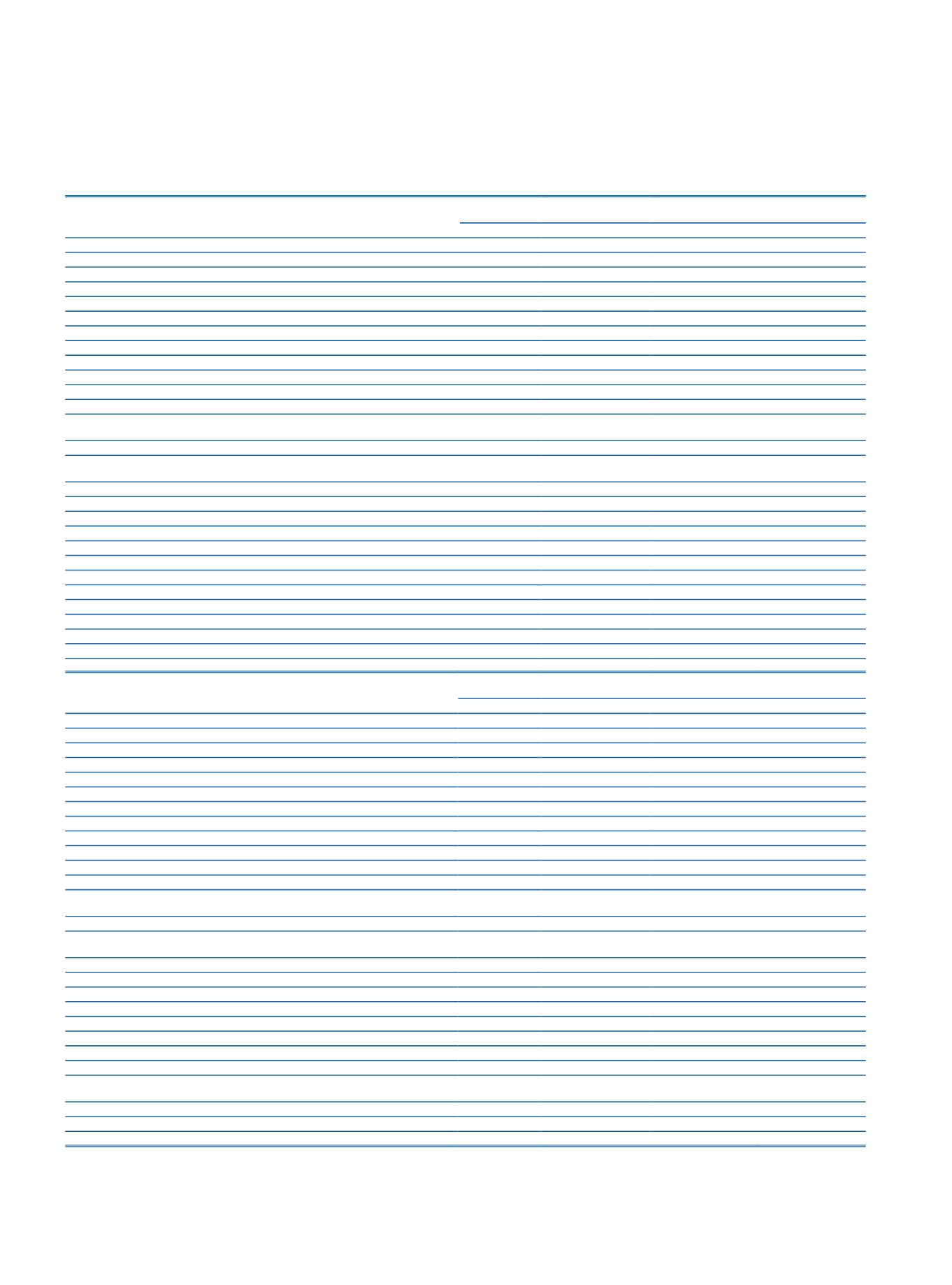

Current Period

Total Unweighted Value

(average)

Total Weighted Value

(average)

TL+FC

FC

TL+FC

FC

High Quality Liquid Assets

High Quality Liquid Assets

39,351,442

25,961,320

Cash Outflows

Retail and Small Business Customers, of which;

105,758,034

49,945,637

8,217,339

4,030,814

Stable deposits

47,169,288

19,274,987

2,358,464

963,749

Less stable deposits

58,588,746

30,670,650

5,858,875

3,067,065

Unsecured wholesale funding , of which;

42,121,545

21,752,902

23,574,414

12,459,606

Operational deposits

609,644

4,138

152,411

1,035

Non-operational deposits

34,277,136

20,934,986

19,103,010

11,704,402

Other unsecured funding

7,234,765

813,778

4,318,993

754,169

Secured funding

Other cash outflows, of which;

26,314,697

17,452,211

26,314,697

17,452,211

Derivatives cash outflow and liquidity needs related to market valuation changes on

derivatives or other transactions

26,314,697

17,452,211

26,314,697

17,452,211

Obligations related to structured financial products

Commitments related to debts to financial markets and other off-balance sheet

obligations

Other revocable off-balance sheet commitments and contractual obligations

8,155,741

7,948,635

407,787

397,432

Other irrevocable or conditionally revocable off-balance sheet obligations

95,046,083

34,485,819

8,257,064

3,043,643

Total Cash Outflows

66,771,301

37,383,706

Cash Inflows

Secured lending

Unsecured lending

11,799,218

4,407,163

7,329,582

3,533,106

Other cash inflows

23,236,412

20,910,744

23,236,412

20,910,744

Total Cash Inflows

35,035,630

25,317,907

30,565,994

24,443,850

Total Adjusted Value

Total HQLA Stock

39,351,442

25,961,320

Total Net Cash Outflows

36,205,307

12,943,790

Liquidity Coverage Ratio (%)

108.85

204.45

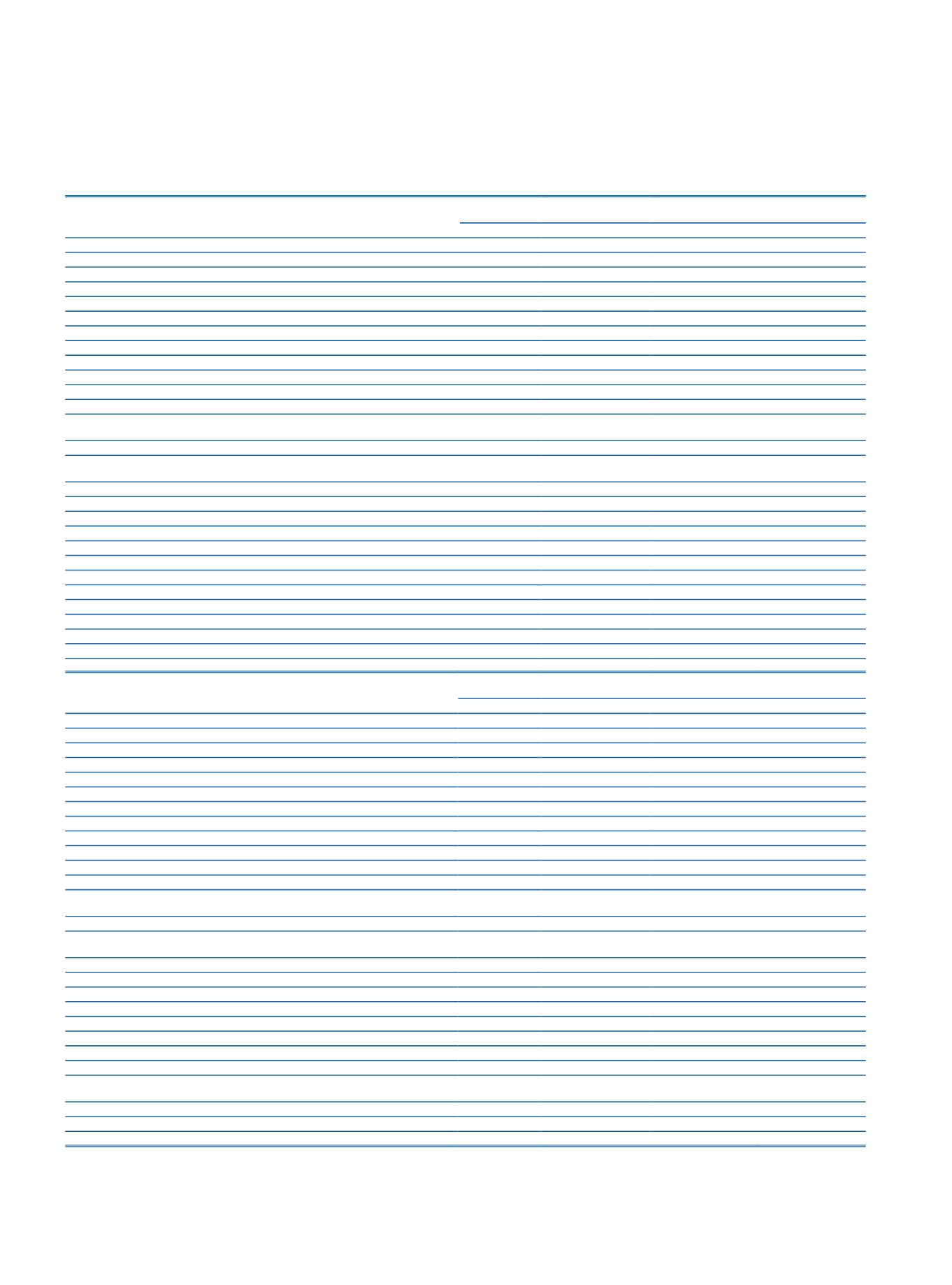

Prior Period

Total Unweighted Value

(average)

Total Weighted Value

(average)

TL+FC

FC

TL+FC

FC

High Quality Liquid Assets

High Quality Liquid Assets

30,667,369

18,701,129

Cash Outflows

Retail and Small Business Customers, of which;

92,284,845

39,463,800

7,280,959

3,194,679

Stable deposits

38,950,515

15,034,006

1,947,526

751,700

Less stable deposits

53,334,330

24,429,794

5,333,433

2,442,979

Unsecured funding, of which;

35,283,620

17,864,653

20,411,729

9,973,251

Operational deposits

493,292

5,155

123,323

1,289

Non-operational deposits

28,659,980

17,122,813

16,351,085

9,287,313

Other unsecured funding

6,130,348

736,685

3,937,321

684,649

Secured funding

Other cash outflows, of which;

19,134,159

13,603,200

19,134,159

13,603,200

Derivatives cash outflow and liquidity needs related to market valuation changes on

derivative or other transactions

19,134,159

13,603,200

19,134,159

13,603,200

Obligations related to structured financial products

Commitments related to debts to financial markets and other off-balance sheet

obligations

Other revocable off-balance sheet commitments and contractual obligations

50,476,997

27,015,414

2,523,850

1,350,771

Other irrevocable or conditionally revocable off-balance sheet obligations

33,796,722

1,812,174

2,444,016

181,217

Other cash outflows

51,794,713

28,303,118

Cash Inflows

Secured lending

Unsecured lending

10,205,714

3,134,105

6,234,262

2,493,795

Other cash inflows

17,204,394

14,993,539

17,204,394

14,993,539

Total Cash Inflows

27,410,108

18,127,644

23,438,656

17,487,334

Total Adjusted Value

Total HQLA Stock

30,667,369

18,701,129

Total Net Cash Outflows

28,356,057

10,867,391

Liquidity Coverage Ratio (%)

108.29

177.78

Between the weeks 5 October 2015 –9 October 2015 and 28 December 2015 –1 January 2016, FC liquidity coverage ratio decreased from 235.69% to 162.29% due to decline in high

quality liquid assets and the negative impact of the derivative transactions. Although the stock of high quality liquid assets increased over the same period, total liquidity coverage

ratio decreased from 109.50% to 103.48% due to the increase in monthly cash outflows.