Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

117

Financial Information and Risk Management

There is no credit rating and credit export agency has been assigned for the items that are not included to trading accounts.

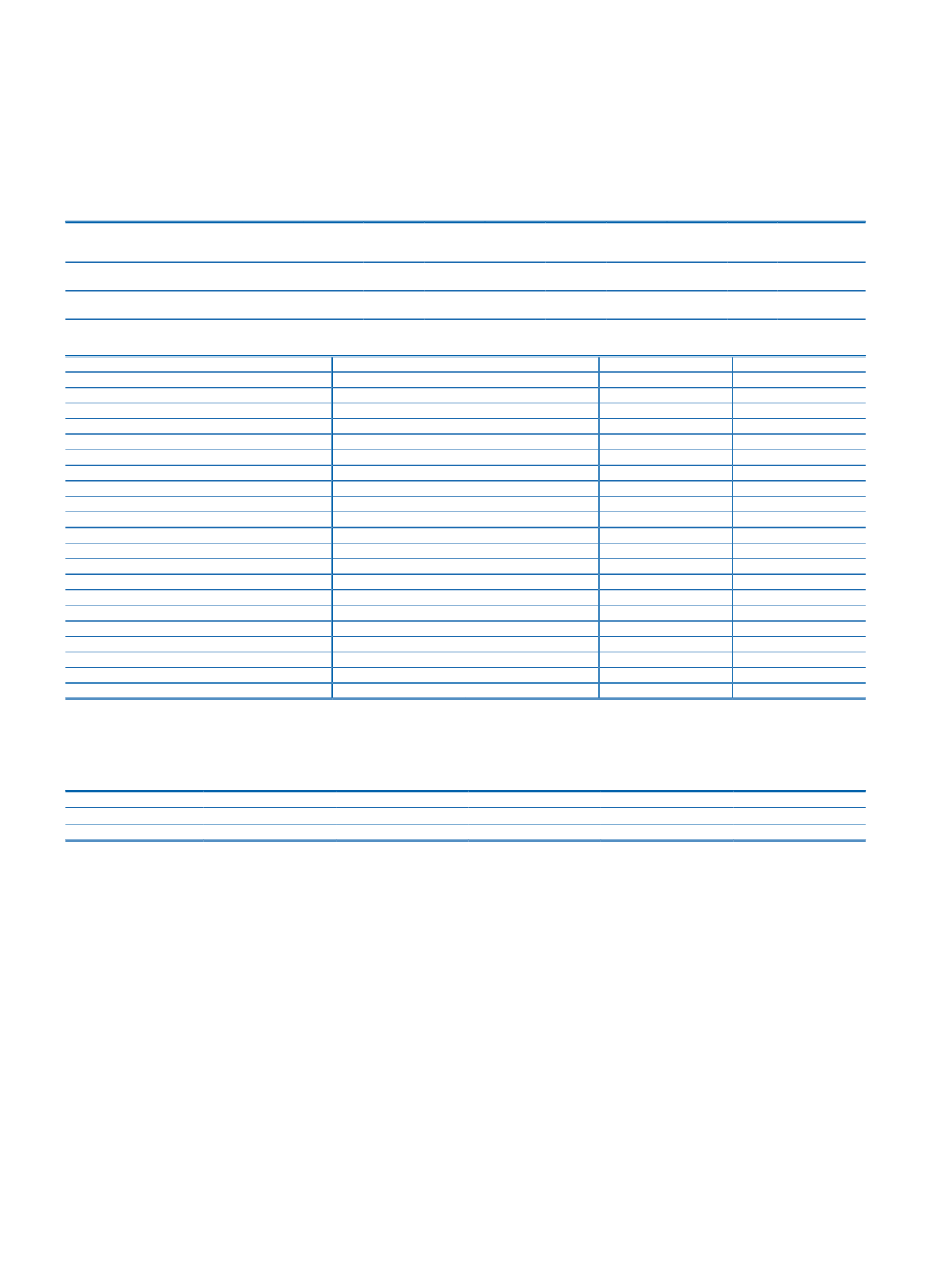

Risk Weight

0% 10% 20% 50% 75% 100% 150% 200% 250% 1250%

Mitigation in

Shareholders’

Equity

Amount Before Credit Risk

Mitigation

66,704,748

3,918,797 50,657,559 35,044,178 145,387,202 5,608,370 8,514,662 725,439

693,352

Amount After Credit Risk

Mitigation

73,632,349

3,918,763 50,655,369 34,765,756 138,835,742 5,568,918 8,458,619 725,439

693,352

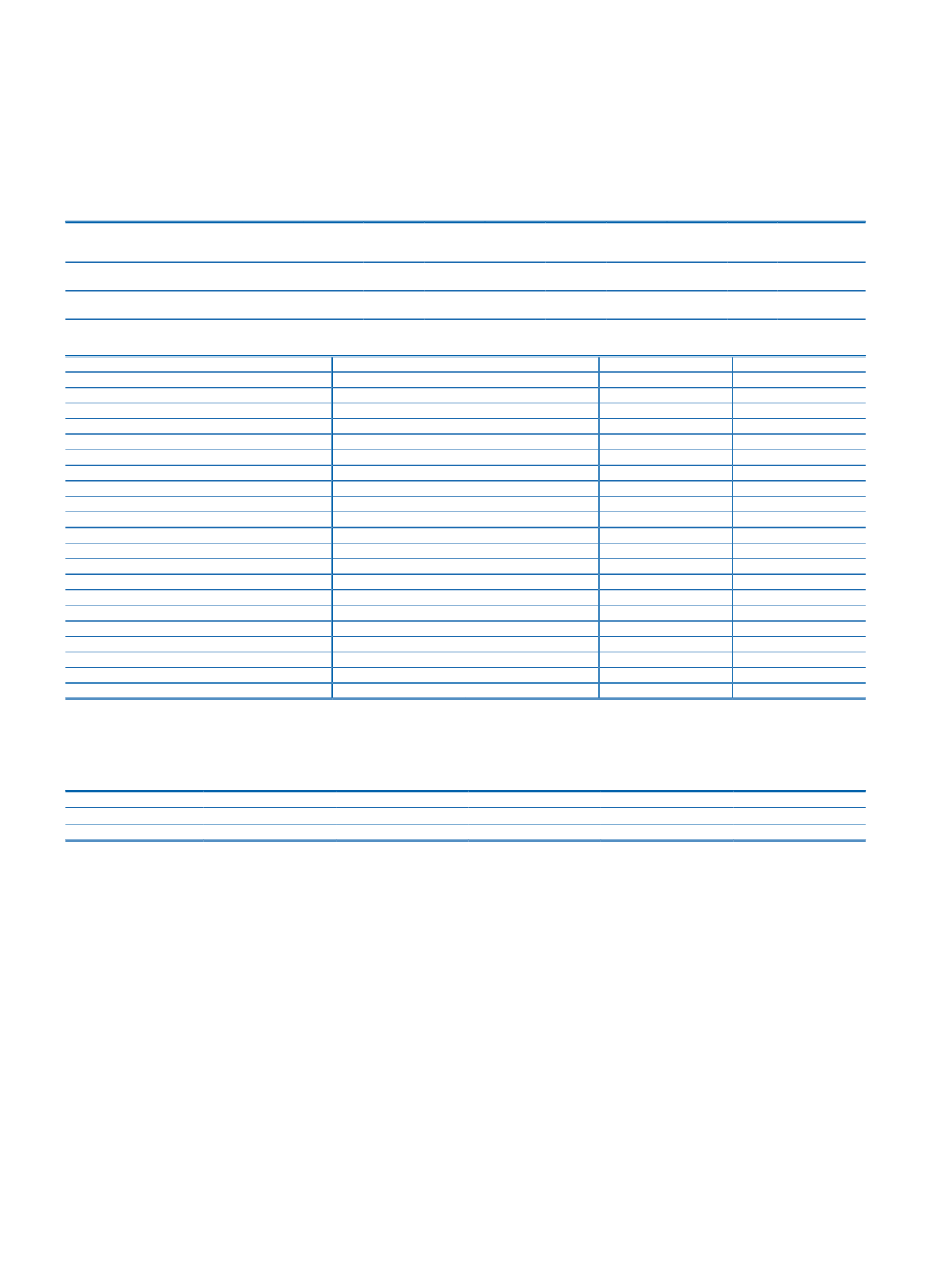

16. Miscellaneous Information According to Type of Counterparty or Major Sectors

Significant Sectors/Counterparty

Loans

Impaired

Non-Performing

(1)

Value Adjustment

(2)

Provisions

(3)

Agricultural

50,427

12,608

598

36,112

Farming and Raising Livestock

45,346

10,934

469

31,658

Forestry

3,765

1,418

63

3,278

Fishing

1,316

256

66

1,176

Industry

581,575

79,359

3,921

464,195

Mining

72,883

3,872

208

70,572

Production

493,418

73,653

3,648

379,873

Electricity, gas, and water

15,274

1,834

65

13,750

Construction

455,617

98,060

4,634

375,593

Services

1,113,112

251,998

15,523

814,186

Wholesale and Retail Trade

717,250

140,850

7,820

531,987

Hotel, Food and Beverage Services

137,159

26,470

1,268

76,423

Transportation and Telecommunication

79,949

41,664

4,414

60,817

Financial Institutions

8,671

1,151

60

8,235

Real Estate and Renting Services

109,180

29,458

924

91,273

Self-Employment Services

45,709

9,108

528

33,946

Education Services

4,783

752

325

4,079

Health and Social Services

10,411

2,545

184

7,426

Other

1,402,958

914,493

101,807

1,016,467

Total

3,603,689

1,356,518

126,483

2,706,553

(1)

Refers to loans overdue up to 90 days. Related Items included in the commercial installment loans and installment consumer loans are given only in the overdue amounts, the payment of these loans outstanding

principal amounts of TL 1,146,351 and TL 1,937,901 respectively.

(2)

Refers to the general provisions for non-performing loans.

(3)

Refers to specific provision for impaired loans.

17. Information on Value Adjustments and Change in Credit Provisions:

Beginning Balance

Provisions

Reversal of Provisions Other Value Adjustment

Ending Balance

Specific Provisions

1,861,791

1,415,417

(570,655)

2,706,553

General Provisions

2,328,896

530,657

(7,724)

2,851,829

III. Explanations on Market Risk:

1. Explanations on Market Risk

The market risk carried by the Bank is measured by two separate methods known respectively as the Standard Method and the Value at Risk Model (VAR) in accordance with the local

regulations adopted from internationally accepted practices. In this context, currency risk emerges as the most important component of the market risk.

The market risk measurements are carried out by applying the Standard Method at the end of each month and the results are included in the statutory reports as well as being

reported to the Bank’s top management.

The Value at Risk Model is another alternative for the Standard Method used for measuring and monitoring market risk. This model is used to measure the market risk on a daily basis

in terms of interest rate risk, currency risk and equity share risk and is a part of the Bank’s daily internal reporting. Further retrospective testing (back-testing) is carried out on a daily

basis to determine the reliability of the daily risk calculation by the VAR model, which is used to estimate the maximum possible loss for the following day.

Scenario analyses which support the VAR model used to measure the losses that may occur in the ordinary market conditions are practiced, and the possible impacts of scenarios that

are developed based on the future predictions and the past crises, on the value of the Bank’s portfolio are determined and the results are reported to the Bank’s top management.

The limits set for the market risk management within the framework of the Bank’s asset liability management risk policy, are monitored by the Risk Committee and reviewed in

accordance with the market conditions.

The following table shows details of the market risk calculations carried out within the context of “Standard Method for Market Risk Measurement” and in compliance with “Regulation

on Measurement and Assessment Evaluation of Capital Adequacy of Banks ” as at 31 December 2015.