Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

111

Financial Information and Risk Management

2.

There are certain control limits on forward transactions in terms of counter parties, and the risks taken for derivative instruments are evaluated along with other potential risks

resulting from the market fluctuations.

3.

As a result of the current level of customers’ needs and the progress in the domestic market in this particular area, the Bank uses derivative transactions either for hedging or for

commercial purposes.

Derivative instruments with a remarkable volume are monitored with consideration that they can always be liquidated in case of need.

4.

Indemnified non-cash loans are considered as having the same risk weights as unpaid cash loans.

The rating and scoring systems applied by the Bank, includes detailed company analysis and enables rating of all companies and loans without any restrictions regarding credibility.

Loans and companies, which have been renewed, restructured or rescheduled, are rated within the scope of this system. Specialized loans are evaluated by a special rating system,

which is based on the credibility of the counterparty as well as the feasibility and risk analysis of the cash flows created mainly by the projects undertaken or the asset financed.

5.

Lending transactions abroad are conducted by determining the country risks of related countries within the context of the current rating system and by taking the market

conditions, country risks, and the relevant legal limitations into account. Furthermore, the credibility of banks and other financial institutions established abroad is examined within

the framework of the rating system that has been developed and credit limits are assigned accordingly.

6.

i)

The share of the Bank’s receivables from the top 100 and 200 cash loan customers in the overall cash loan portfolio stands at 22%, 29%, respectively (31 December 2014: 22%, 28%).

ii)

The share of the Bank’s receivables from the top 100 and 200 non-cash loan customers in the overall non-cash portfolio stands at 51%, 61% respectively (31 December 2014:

46%, 56%).

iii)

The share of the Bank’s cash and non-cash receivables from the top 100 and 200 loan customers in the overall cash and non-cash loans stands at 16%, 22%, respectively (31

December 2014: 16%, 21%).

Companies that are among the top loan customers ranked according to cash, non-cash and total risks are leaders in their own sectors, the loans advanced to them are in line with

their volume of industrial and commercial activity. A significant part of such loans is extended on a project basis, with their repayment sources being analyzed in accordance with the

banking principles to be considered as satisfactory and associated risks are determined and duly covered by obtaining appropriate guarantees when deemed necessary.

7.

The total value of the general provisions allocated for credit risk stands at TL 2,851,829.

8.

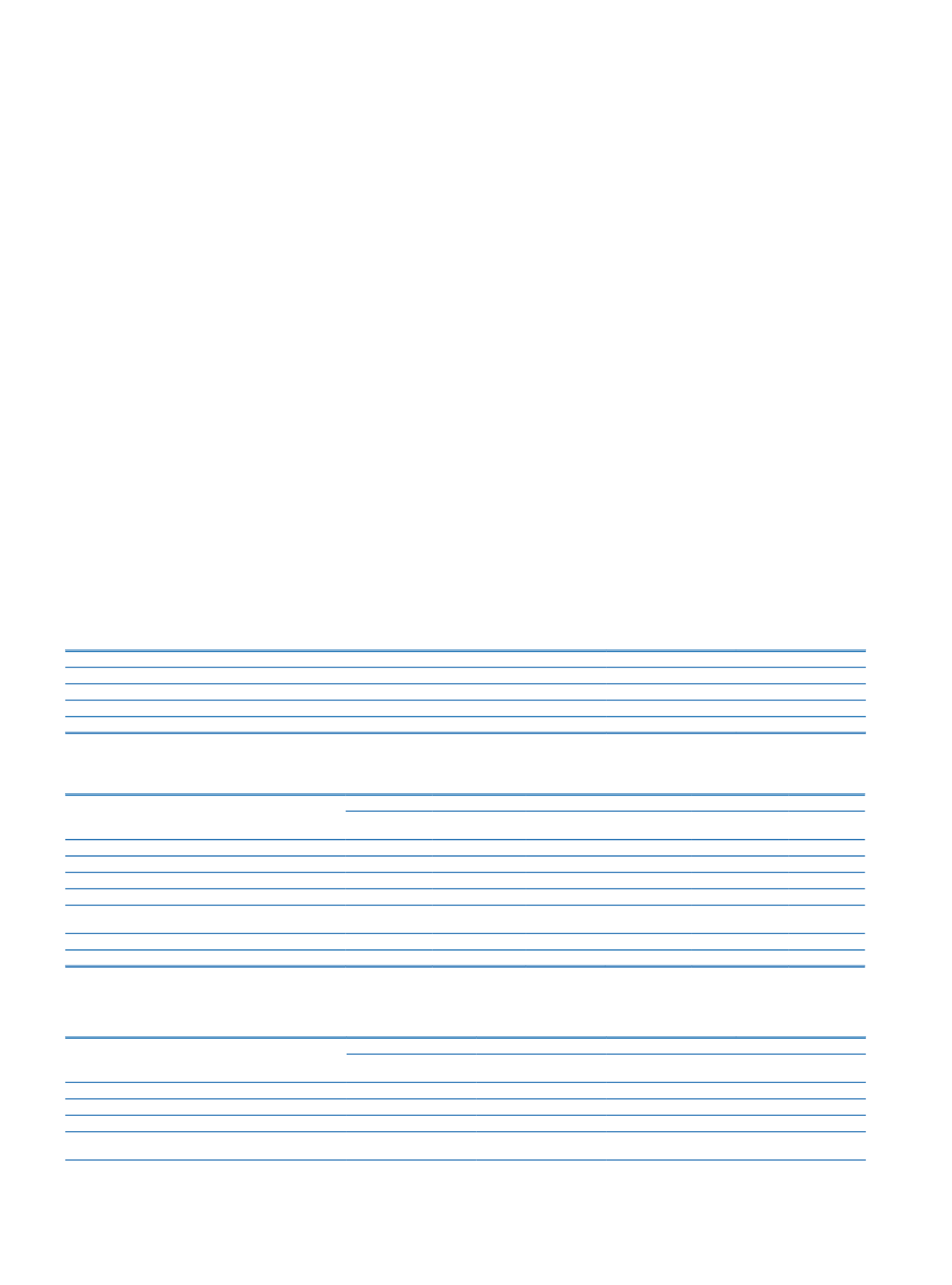

The Bank measures the quality of its loan portfolio by applying different rating/scoring models on cash commercial/corporate loans, retail loans and credit cards. The breakdown of

the rating/scoring results, which are classified as “Strong”, “Standard” and “Below Standard” by considering their default features, is shown below.

The loans whose borrowers’ capacity to fulfill their obligations is very good, are defined as “Strong”, whose borrowers’ capacity to fulfill its obligations in due time is reasonable, are

defined as “Standard” and whose borrowers’ capacity to fulfill their obligations is poor, are defined as “Below Standard”.

Current Period

Prior Period

Strong

48.86%

52.37 %

Standard

43.16%

37.28%

Below Standard

5.55%

6.72 %

Not Rated/Scored

2.43%

3.63 %

The table data comprises behavior rating/scoring results

9.

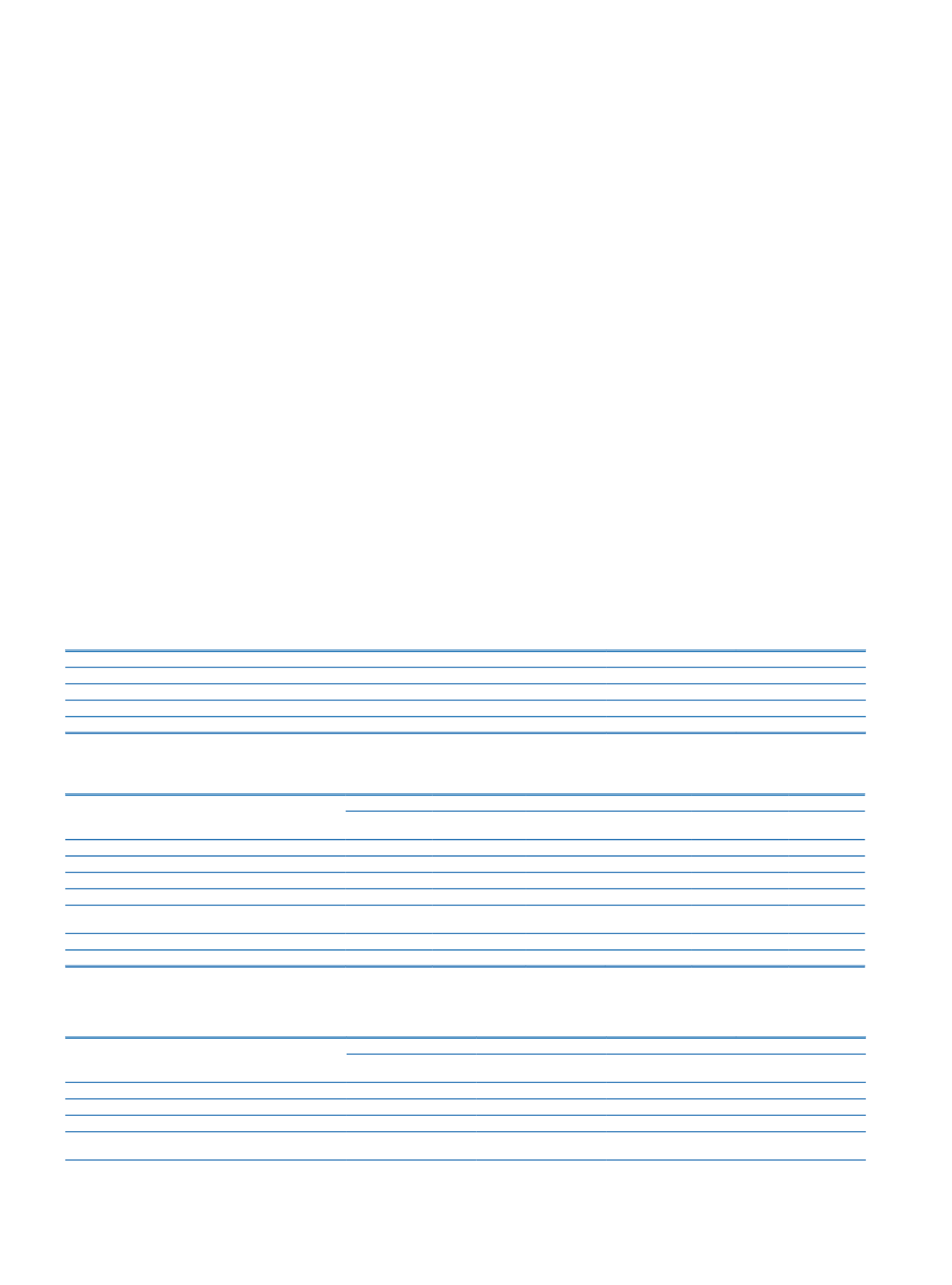

The net values of the collaterals of the closely monitored loans are given below in terms of collateral types and risk matches.

Current Period

Prior Period

Type of Collateral

Personal

Commercial and

Corporate Credit Cards

Personal

Commercial and

Corporate Credit Cards

Real Estate Mortgage

(1)

393,980

611,286

283,998

549,334

Cash Collateral (Cash, securities pledge, etc.)

2,299

15,103

4,686

11,159

Pledge on Wages and Vehicles

383,725

115,505

284,491

68,611

Cheques & Notes

94,843

43,378

Other (Suretyship, commercial enterprise under pledge,

commercial papers, etc.)

105,728

867,935

84,626

530,086

Non-collateralized

382,950

172,283

540,311

243,783

147,764

438,143

Total

1,268,682

1,876,955

540,311

901,584

1,350,332

438,143

(1)

The mortgage and/or pledge amounts on which third parties have priorities are deducted from the fair values of collaterals in expertise reports; and after comparing the results to the mortgage/pledge amounts and

loan balances, the smallest figures are considered to be the net value of collaterals.

10.

The net values of the collaterals of non-performing loans are given below in terms of collateral types and risk matches.

Current Period

Prior Period

Type of Collateral

Net Value of

the Collateral

Loan Balance

Net Value of

the Collateral

Loan Balance

Real Estate Mortgage

(1)

485,365

485,365

278,642

278,642

Cash Collateral

Vehicle Pledge

74,667

74,667

49,746

49,746

Other (Suretyship, commercial enterprise under pledge,

commercial papers, etc.)

53,661

53,661

50,947

50,947

(1)

The mortgage and/or pledge amounts on which third parties have priorities are deducted from the fair values of collaterals in expertise reports, and after comparing the results to the mortgage/pledge amounts and

loan balances the smallest figures are considered to be the net value of collaterals.