Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

120 İşbank

Annual Report 2015

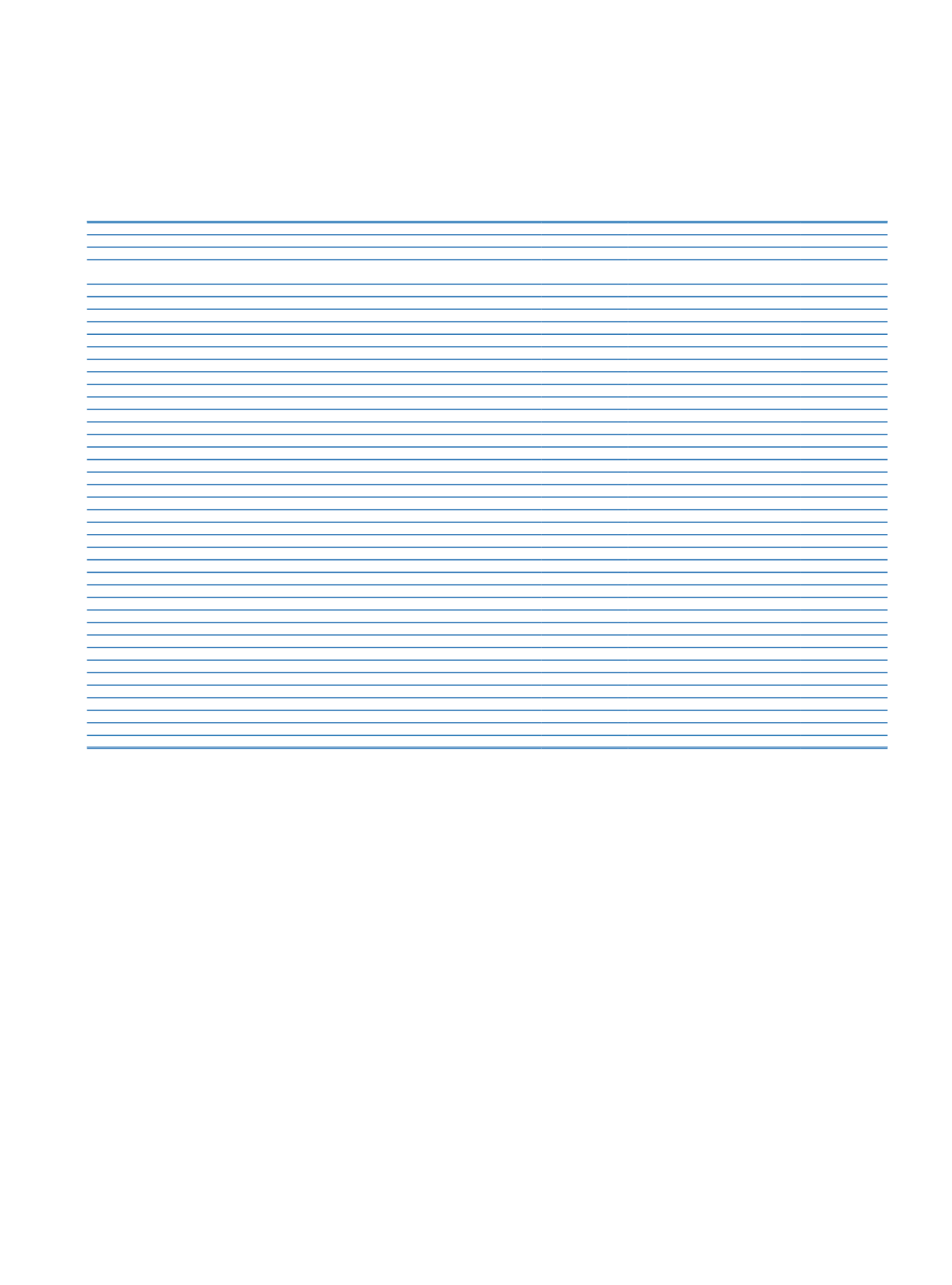

Information on currency risk:

Current Period

EUR

USD

Other FC

Total

Assets

Cash (Cash in Vault, Foreign Currency Cash, Money in Transit, Cheques Purchased) and Balances with

the Central Bank of Turkey

5,172,455

18,265,405

4,926,286

28,364,146

Banks

225,647

476,490

727,476

1,429,613

Financial Assets at Fair Value through Profit/Loss

(1)

131,451

765,630

897,081

Money Market Placements

Financial Assets Available for Sale

939,980

8,848,141

9,788,121

Loans

(2)

20,869,874

46,040,244

2,126,321

69,036,439

Investments in Associates, Subsidiaries and Jointly Controlled Entities (Joint Ventures)

285,945

270,594

556,539

Held to Maturity Investments

52,773

23,250

39,082

115,105

Derivative Financial Assets Held for Risk Management

Tangible Assets

(1)

868

247

1,385

2,500

Intangible Assets

(1)

Other Assets

(1)

641,096

974,690

12,585

1,628,371

Total Assets

28,320,089 75,394,097

8,103,729 111,817,915

Liabilities

Banks Deposits

2,127,148

3,784,552

633,254

6,544,954

Foreign Currency Deposits

(3)

24,551,380

44,007,369

5,468,718

74,027,467

Money Market Funds

198,881

2,843,328

3,042,209

Funds Provided from Other Financial Institutions

7,237,101

18,509,415

10,040

25,756,556

Debt Securities Issued

(4)

1,114,707

16,344,986

22,884

17,482,577

Miscellaneous Payables

171,403

162,435

213,232

547,070

Derivative Financial Liabilities Held for Risk Management

Other Liabilities

(1)

221,644

637,310

31,340

890,294

Total Liabilities

35,622,264 86,289,395

6,379,468 128,291,127

Net Balance Sheet Position

(7,302,175)

(10,895,298)

1,724,261 (16,473,212)

Net Off Balance Sheet Position

3,025,376 13,256,177 (2,145,684)

14,135,869

Derivative Financial Assets

(5)

6,740,759

24,526,672

2,426,212

33,693,643

Derivative Financial Liabilities

(5)

3,715,383

11,270,495

4,571,896

19,557,774

Non-Cash Loans

8,515,440

20,770,670

1,173,431

30,459,541

Prior Period

Total Assets

21,419,488

61,330,004

6,408,087

89,157,579

Total Liabilities

29,302,051

63,165,621

5,938,857

98,406,529

Net Balance Sheet Position

(7,882,563)

(1,835,617)

469,230 (9,248,950)

Net Off Balance Sheet Position

4,449,669

2,647,966 (1,441,280)

5,656,355

Derivative Financial Assets

9,006,701

12,848,651

765,352

22,620,704

Derivative Financial Liabilities

4,557,032

10,200,685

2,206,632

16,964,349

Non-Cash Loans

7,782,686

16,465,152

903,174

25,151,012

(1)

In accordance with the principles of the “Regulation on Measurement and Practices of Banks’ Net Overall FC Position / Shareholders’ Equity Ratio on a Consolidated and Unconsolidated Basis”, Foreign Currency

Income Accruals of Derivative Financial Instruments (TL 250,816), Operating Lease Development Costs (TL 7,577), Intangible assets (TL 354), Deferred Tax Asset (TL 330), Prepaid Expenses (TL 35,749) in assets and

Foreign Currency Expense Accruals of Derivative Financial Instruments (TL 399,643), General Provision (TL 9,712) and Shareholders’ Equity (TL 55,523) in liabilities are not included.

(2)

Foreign currency indexed loans amounting TL 5.134.345 presented in TL loans in the balance sheet are included in the table above. TL 2,630,254 is USD indexed, TL 2,473,356 is EUR indexed, TL 7,940 is CHF

indexed, TL 5,306 is GBP indexed, TL 17,481 is JPY indexed and TL 8 is CAD indexed.

(3)

Precious metals deposit accounts amounting TL 1,906,169 are included.

(4)

Includes Tier 2 subordinated bonds which are classified on the balance sheet as subordinated loans.

(5)

Located in the Regulation mentioned above and forward foreign exchange purchase and sale commitments are taken into account derivative instruments within the scope of the definition.

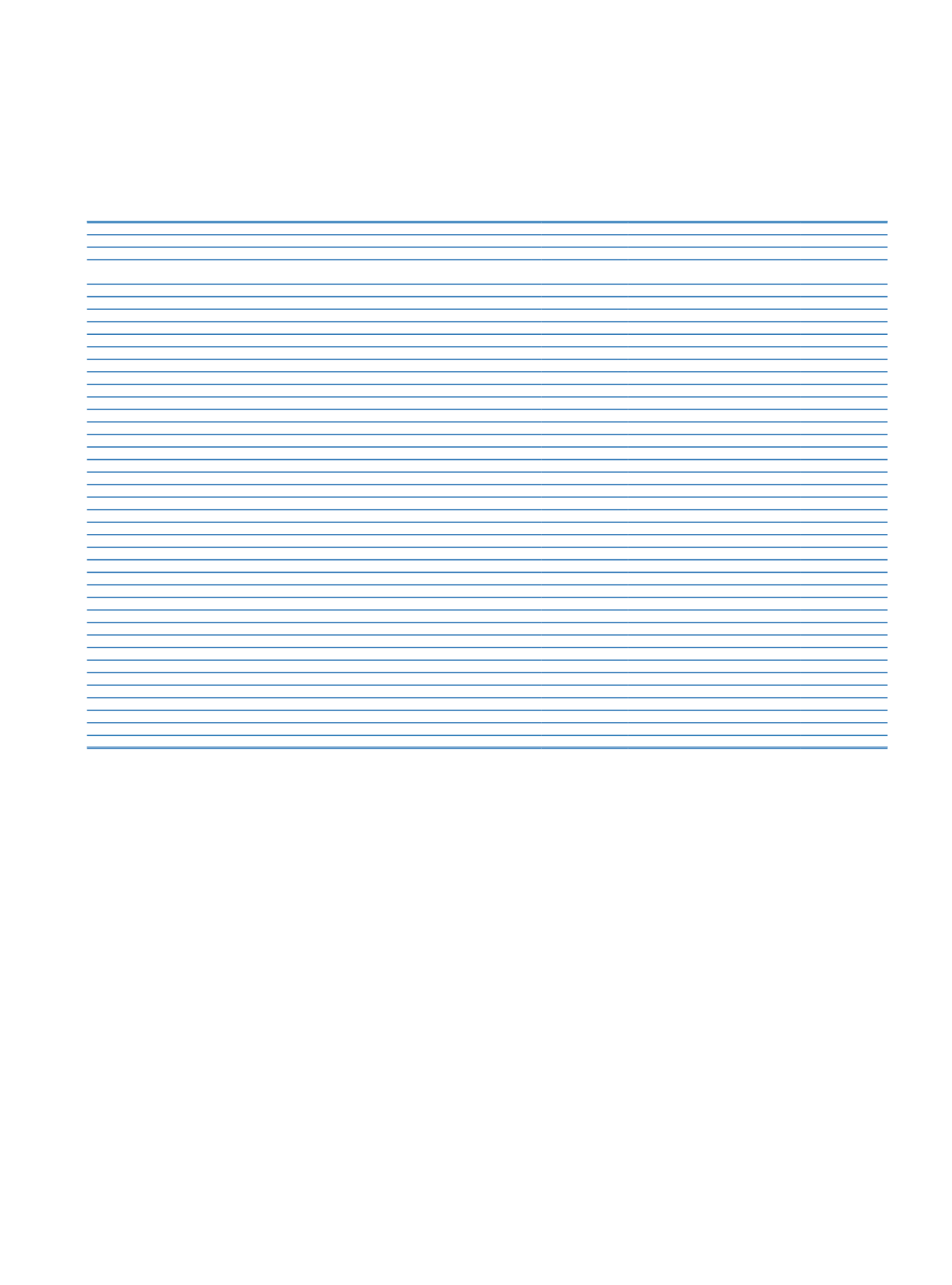

VI. Explanations on Interest Rate Risk

Interest rate risk is the risk that the value of the Bank’s interest sensitive assets, liabilities and off-balance sheet operations will decrease because of change in market interest rates.

The method of average maturity gap according to the repricing dates is used for measuring the interest rate risk arising from the banking accounts, whereas the interest rate risk

related to interest sensitive financial instruments followed under trading accounts is assessed within the scope of market risk.

Potential effects of interest rate risk on the Bank’s assets and liabilities, market developments, the general economic environment and expectations are regularly followed in meetings

of the Asset-Liability Committee, where further measures to reduce risk are taken when necessary.

The Bank’s on and off-balance sheet interest sensitive accounts other than the assets and liabilities exposed to market risk are monitored and controlled by the limits above the

average maturity gaps according to the repricing periods determined by the Board within the scope of asset-liability management risk policy. Moreover, scenario analyses formed in

line with the historical data and expectations are also used in the management of the related risk.

Interest rate sensitivity:

In this part, the sensitivity of the Bank’s assets and liabilities to the interest rates has been analyzed assuming that the year end balance figures were the same throughout the year.

Mentioned analysis shows how the FC and TL changes in interest rates by one point during the one-year period affect the Bank’s income accounts and shareholders’ equity under the

assumption maturity structure and balances are remain the same all year round at the end of the year.

During the measurement of the Bank’s interest rate sensitivity, the profit/loss on the asset and liability items that are evaluated with market value are determined by adding to/

deducting from the difference between the expectancy value of the portfolio after one year in case there is no change in interest rates and the value of the portfolio one year later,

which is measured after the interest shock, the interest income to be additionally earned/to be deprived of during the one year period due to the renewal or repricing of the related

portfolio at the interest rates formed after the interest shock.

On the other hand, in the profit/loss calculation of assets and liabilities that are not evaluated by the current market prices, it is assumed that assets and liabilities with fixed interest

rates will be renewed at maturity date and the assets and liabilities having variable interest rates will be renewed at the end of repricing period with the market interest rates

generated after the interest shock.