Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

118 İşbank

Annual Report 2015

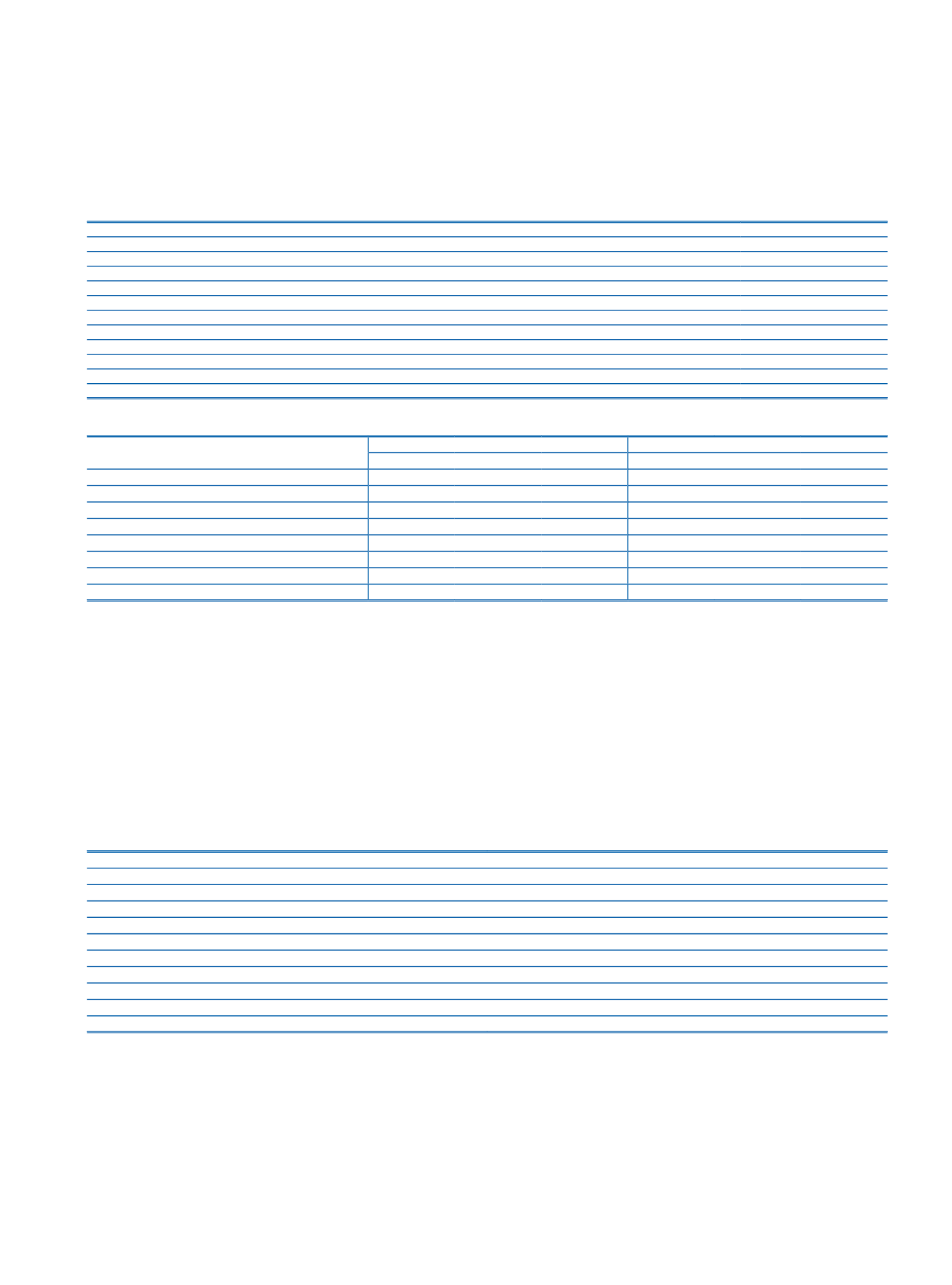

1.a. Information on the market risk:

Amount

(I) Capital Requirement against General Market Risk – Standard Method

77,524

(II) Capital Requirement against Specific Risk – Standard Method

7,760

Capital Requirement for Specific Risk Related to Securitization Positions – Standard Method

(III) Capital Requirement against Currency Risk – Standard Method

375,941

(IV) Capital Requirement against Commodity Risk – Standard Method

37,152

(V) Capital Requirement against Exchange Risk – Standard Method

1,119

(VI) Capital Requirement against Market Risk of Options – Standard Method

5,511

(VII) Capital Requirement against Counterparty Credit Risk – Standard Method

72,856

(VIII) Capital Requirement against Market Risks of Banks Applying Risk Measurement Models

(IX) Total Capital Requirement against Market Risk (I+II+III+IV+V+VI+VII)

577,863

(X) Value at Market Risk (12.5 x VIII) or (12.5 x IX)

7,223,288

1.b. Table of the average market risk related to the market risk calculated quarterly during the period:

Current Period

Prior Period

Average

Highest

(1)

Lowest

(1)

Average

Highest

(1)

Lowest

(1)

Interest Rate Risk

46,714

62,740

25,266

36,392

35,323

48,179

Share Certificate Risk

6,851

6,036

6,750

5,514

6,274

5,848

Currency Risk

407,681

457,812

358,032

313,934

392,592

289,407

Commodity Risk

37,775

34,923

25,029

24,721

25,567

1,329

Settlement Risk

760

2,643

445

1,921

Options Risk

4,351

10,582

181

1,942

1,092

952

Counterparty Credit Risk

77,732

80,844

67,551

63,835

50,832

48,576

Total Value at Risk

7,273,300

8,194,750 6,035,113

5,584,788

6,396,000

4,952,650

(1)

Market risk elements are presented for the monthly periods where total value at risk is minimum and maximum.

2. Information on counterparty credit risk

A counterparty credit risk, which is accounts for trading derivatives and repo transactions tracked on both sides, such as the credit risk the liability arising from transactions, is

determined by the methodology which is used according to the Appendix-2 of the “Regulation on Measurement and Evaluation of Capital Adequacy of Banks” which is published on

the Official Gazette no. 28337 dated 28 June 2012 and became effective starting from 1 July 2007. Counterparty credit risk valuation method based on the calculation of the fair value

of the derivative transactions is implemented. The calculation of the amount of risk on derivative transactions, the potential amount of credit risk is positively correlated with the

sum of the costs of renewal. The calculation of the amount of the potential credit risk of the contract amount is multiplied by the rates given in the regulation. Derivative instruments

valuation based on replacement costs and the fair value of the related contracts are obtained.

The Bank is exposed to counterparty credit risk is managed within the framework of general principles and guarantees the credit limit allocation. Exposure to credit risk of derivative

transactions with banks due to the majority of reciprocal agreements signed with related parties are subject to the daily exchange of collateral, counterparty credit risk exposure

is reduced in this way. On the other hand, the calculation of capital adequacy under the legislation of counterparty credit risk, the risk-reducing effect of such agreements is not

considered.

Within the scope of trading accounts with credit derivatives acquired or disposed of by the Bank does not have any protection.

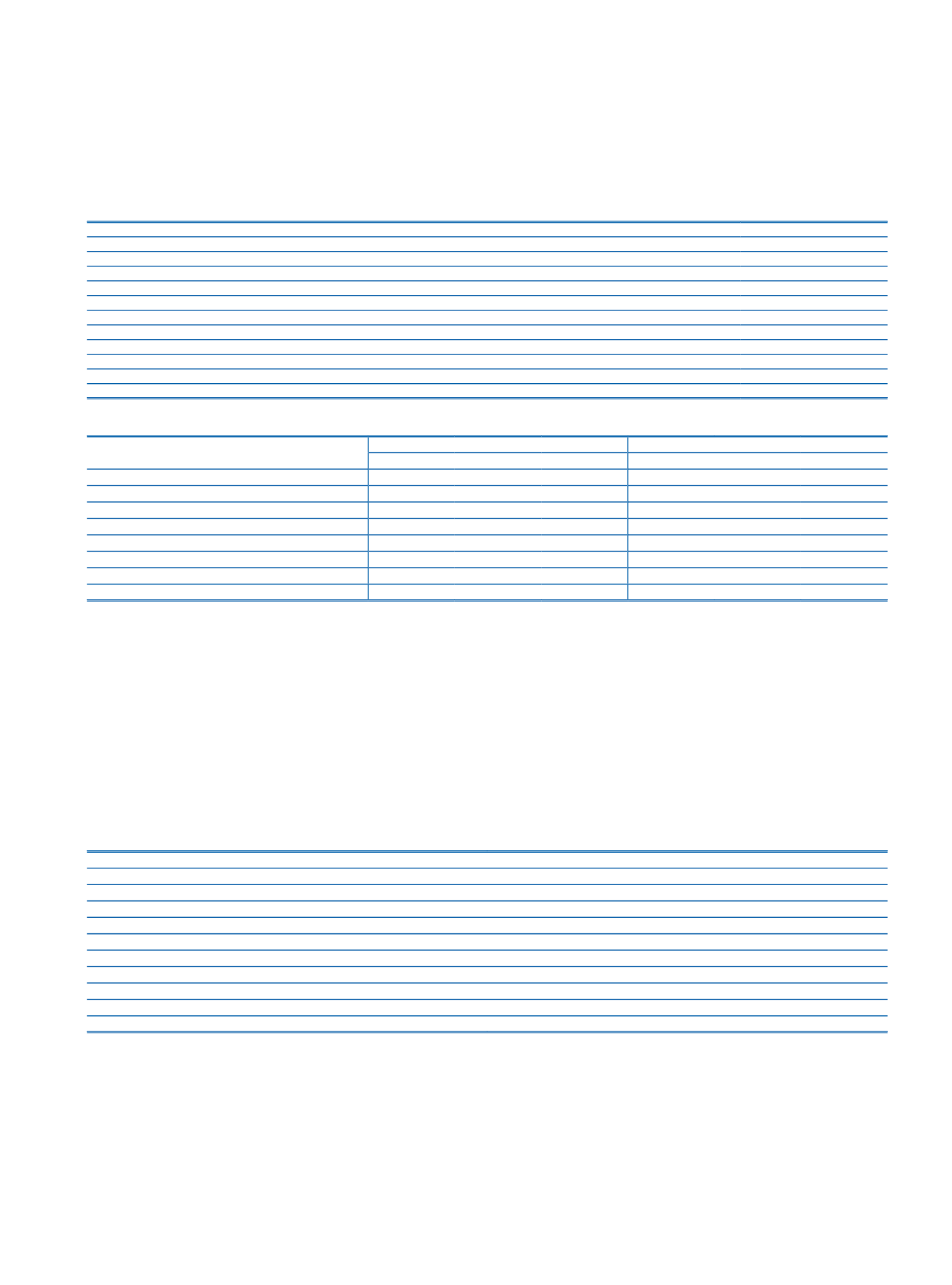

Quantitative Information on Counterparty Risk (31 December 2015)

Amount

Interest-Rate Contracts

108,256

Foreign-Exchange-Rate Contracts

398,197

Commodity Contracts

95,884

Equity-Shares Related Contracts

Other

Gross Positive Fair Values

777,658

Netting Benefits

Net Current Exposure Amount

Collaterals Received

Net Derivative Position

1,379,995