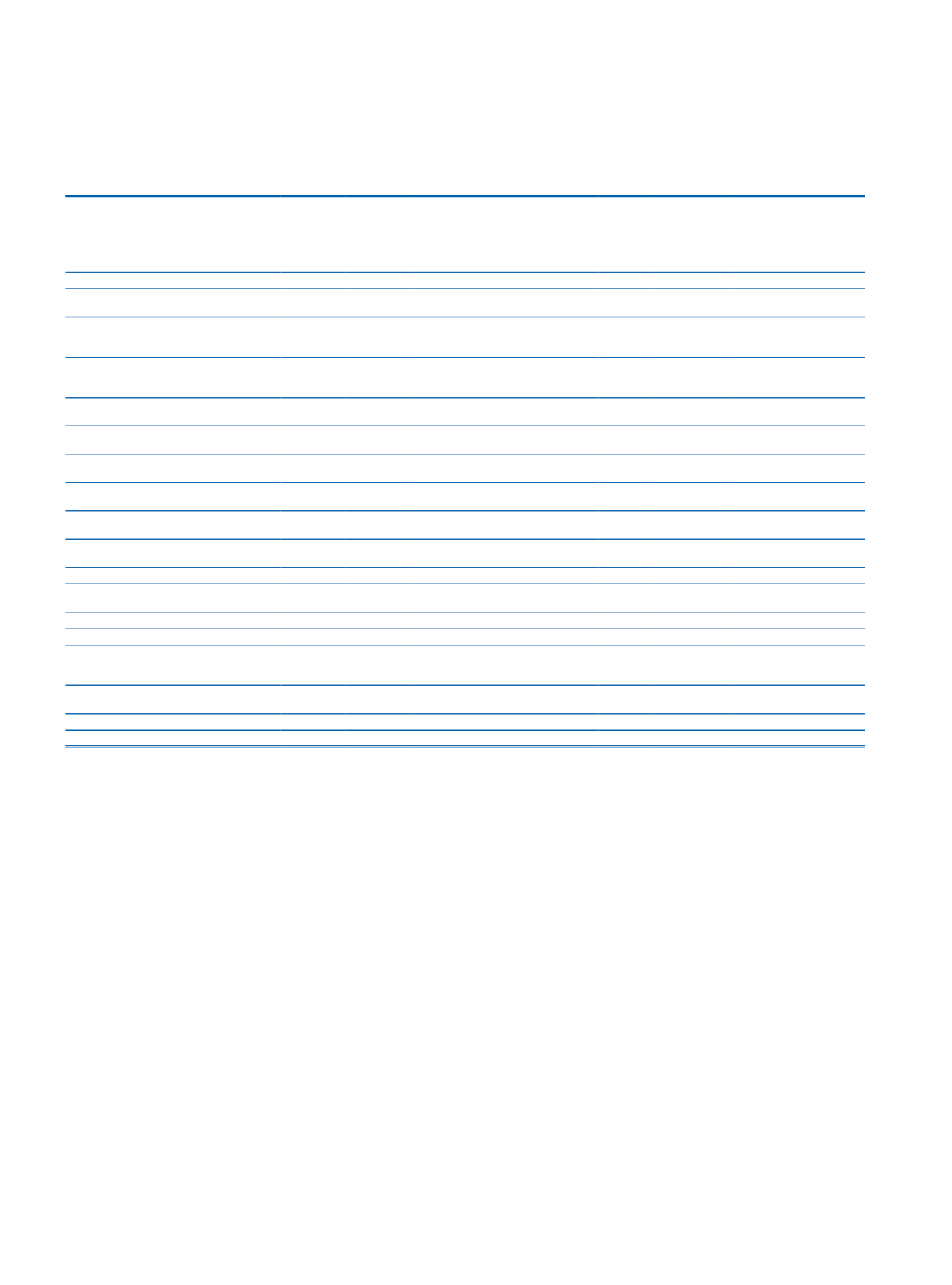

Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

113

Financial Information and Risk Management

Prior Period

Domestic

European

Union

OECD

Countries

(2)

Off-Shore

Banking

Regions

USA,

Canada

Other

Countries

Investments

in Associates,

Subsidiaries

and Jointly

Controlled

Entities

Undistributed

Assets/

Liabilities

(3)

Total

Risk Groups

(1)

Contingent and Non-Contingent Receivables

from Central Governments or Central Banks

64,744,865

10

55,168

64,800,043

Contingent and Non-Contingent Receivables

from Regional Government or Domestic

Government

39,787

6

39,793

Contingent and Non-Contingent Receivables

from Administrative Units and Non-Commercial

Enterprises

152,807

11

152,818

Contingent and Non-Contingent Receivables

fromMultilateral Development Banks

1,660

1,660

Contingent and Non-Contingent Receivables

from International Organizations

Contingent and Non-Contingent Receivables

from Banks and Intermediaries

2,521,085 4,453,561

374,318

27,900 380,216 530,807

8,287,887

Contingent and Non-Contingent Corporate

Receivables

104,523,268 578,329

1,384

23,657 10,388 1,990,500

107,127,526

Contingent and Non-Contingent Retail

Receivables

44,095,141

17,534

1,621

20

1,225 556,405

44,671,946

Contingent and Non-Contingent Receivables

Secured by Residential Property

12,880,577

40,521

3,986

2,488 110,641

13,038,213

Non-Performing Receivables

558,612

34

12

20

102

558,780

Receivables are identified as high risk by the

Board

17,529,407

13,323

2,517

1,185 203,011

17,749,443

Secured Marketable Securities

Securitization Positions

Short-term Receivables and Short-term

Corporate Receivables from Banks and

Intermediaries

Investments as Collective Investment

Institutions

410,934

410,934

Other Receivables

5,264,743

9,658,887

14,923,630

Total

252,310,292 5,104,972 383,838 51,577 395,522 3,446,651 10,069,821

271,762,673

(1)

Includes total risk amounts before the effect of credit risk mitigation but after credit conversions.

(2)

OECD countries other than EU countries, USA and Canada

(3)

Assets and liabilities that are not consistently allocated