Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

114 İşbank

Annual Report 2015

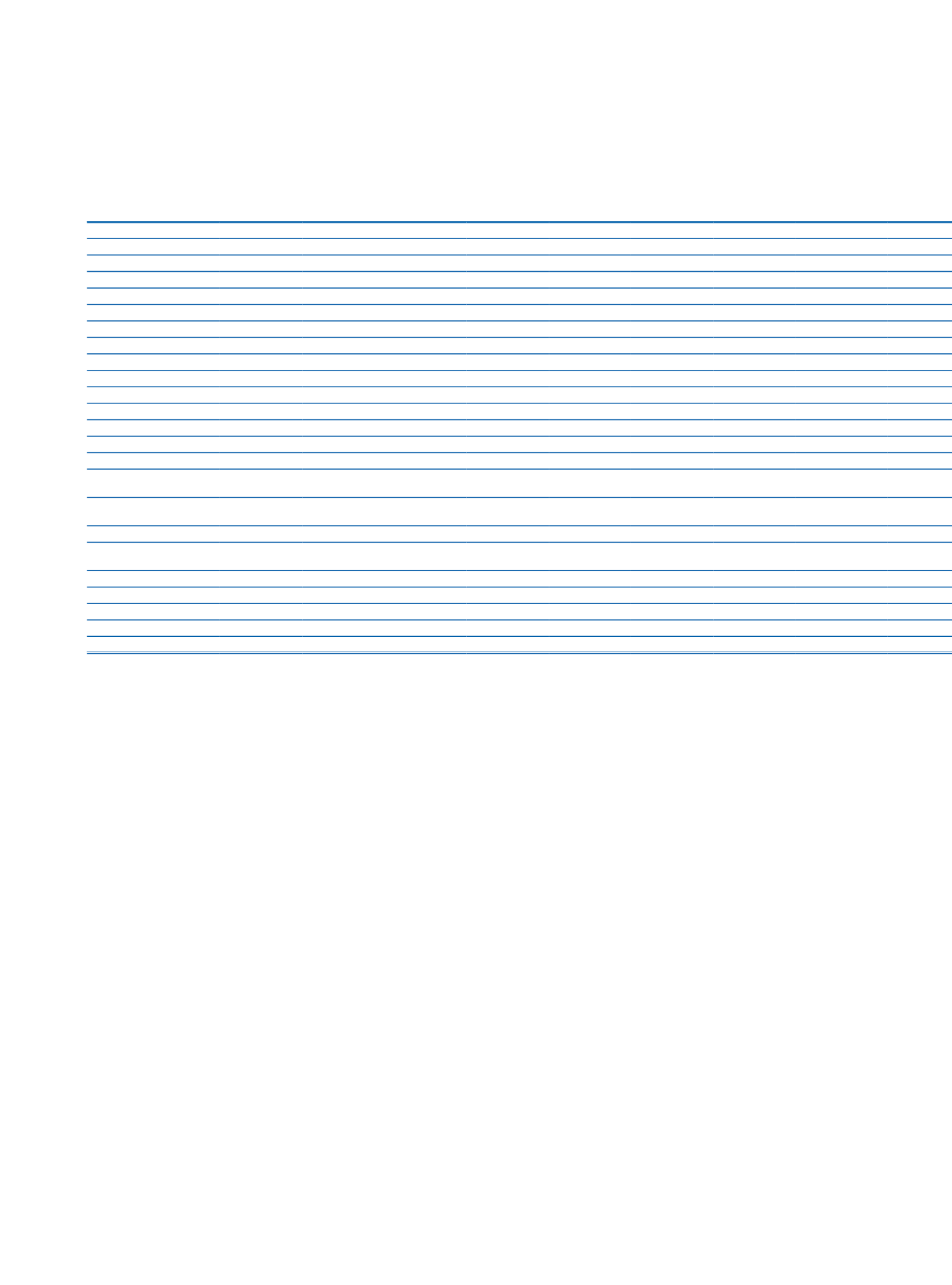

13. Risk profile by sectors or counterparties:

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

Sectors/Counterparty

(17)

Agricultural

1,412

1,733

1,287,368

682,149

Farming and Raising Livestock

1,412

1,633

1,057,843

605,319

Forestry

100

54,604

63,142

Fishing

174,921

13,688

Industry

127

64,498

54,353,362

3,295,036

Mining

7

2,525,433

122,959

Production

2,816

30,067,203

3,109,444

Electricity, gas, and water

127

61,675

21,760,726

62,633

Construction

16,852,712

1,935,724

Services

31,190,234

165,815

523

9,016,630 54,533,117

12,979,630

Wholesale and Retail Trade

2,237

23,068,010

6,923,243

Hotel, Food and Beverage

Services

57

3,260,862

467,928

Transportation and

Telecommunication

793

9,823,099

2,689,986

Financial Institutions

31,190,072

21

523

9,016,630

6,381,173

119,467

Real Estate and Renting

Services

36,735

7,688,297

833,116

Self-Employment Services

113,347

2,401,538

1,519,467

Education Services

162

11,436

852,250

114,042

Health and Social Services

1,189

1,057,888

312,381

Other

44,471,483

44,860

11,298

10,888

353,775

18,712,038

Total

75,661,717

46,399

243,344

523

9,027,518 127,380,334

37,604,577

(1) Contingent and non-contingent exposures to central governments or central banks (2) Contingent and non-contingent exposures to regional governments or local authorities

(3) Contingent and non-contingent exposures to administrative bodies and non-commercial undertakings

(4) Contingent and non-contingent exposures to multilateral development banks (5) Contingent and non-contingent exposures to international organizations (6) Contingent and non-contingent exposures to banks

and brokerage houses

(7) Contingent and non-contingent corporate receivables (8) Contingent and non-contingent retail receivables (9) Contingent and non-contingent exposures secured by real estate property (10) Past due items (11)

Items in regulatory high-risk categories

(12) Exposures in the form of bonds secured by mortgages (13) Securitization positions (14) Short term exposures to banks, brokerage houses and corporates (15) Exposures in the form of collective investment

undertakings (16) Other items

(17) Risk amounts before the effect of credit risk mitigation but after the credit conversions.