Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

116 İşbank

Annual Report 2015

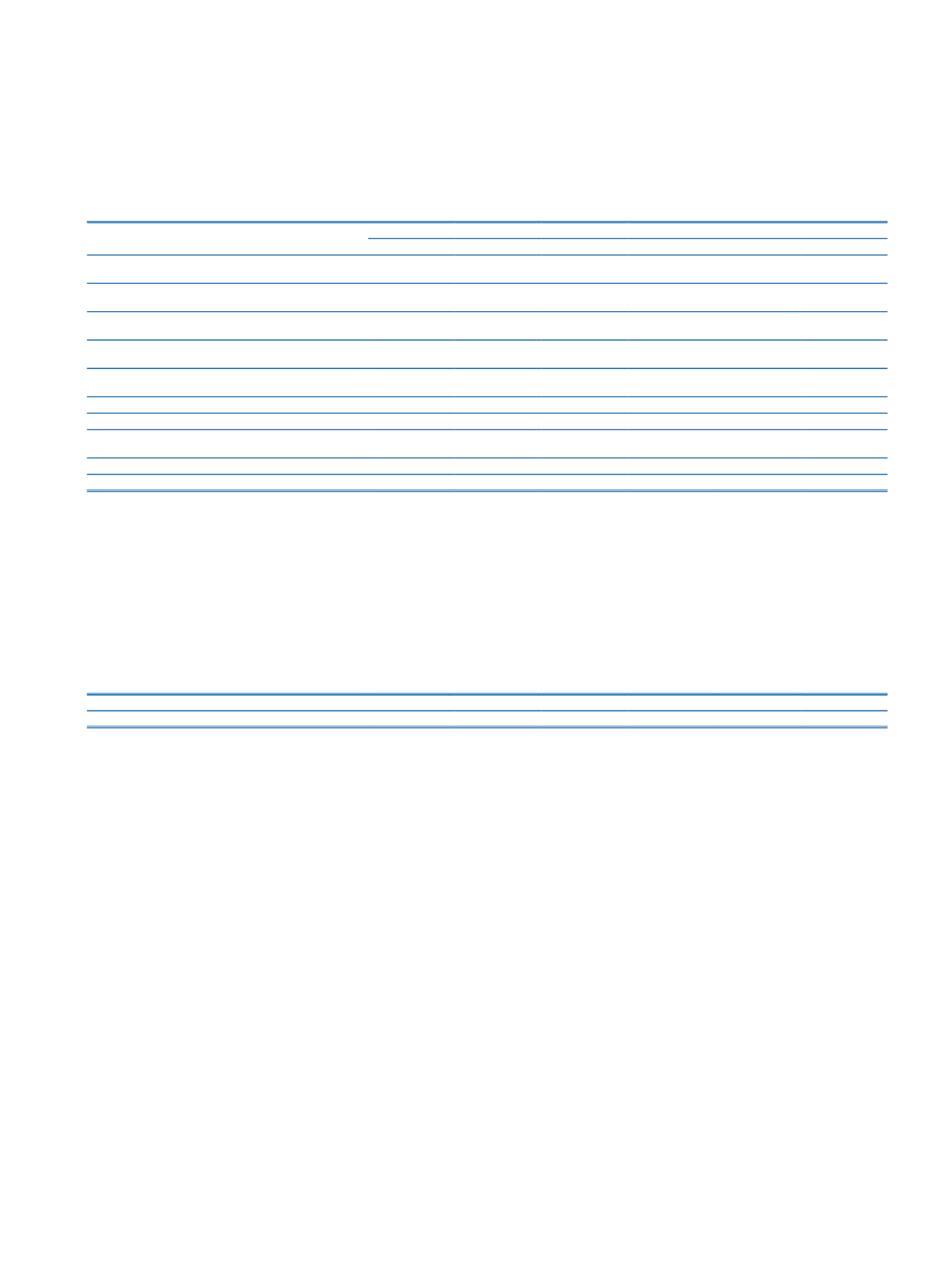

14. Analysis of maturity-bearing exposures according to remaining maturities:

Risk Groups

(1)

Time to Maturity

1 Month

1-3 Months

3-6 Months

6-12 Months

Over 1 Year

Total

Contingent and Non-Contingent Receivables from Central

Governments or Central Banks

1,669,728

168,691

88,220

1,217,201

42,618,228

45,762,068

Contingent and Non-Contingent Receivables from Regional

Governments or Domestic Governments

20

7,434

7,711

763

26,161

42,089

Contingent and Non-Contingent Receivables from

Administrative Units and Non-Commercial Enterprises

896

2,220

11,134

25,101

154,037

193,388

The multilateral development banks and non-contingent

receivables

156

215

152

523

Contingent and Non-Contingent Receivables from Banks and

Intermediaries

1,797,439

1,013,289

728,257

571,750

4,415,974

8,526,709

Contingent and Non-Contingent Corporate Receivables

4,813,254

6,634,098

8,142,019

14,830,265

75,241,740

109,661,376

Contingent and Non-Contingent Retail Receivables

6,990,609

2,124,602

2,077,019

3,144,828

13,427,541

27,764,599

Contingent and Non-Contingent Collateralized Receivables with

Real Estate Mortgages

587,909

661,931

1,020,125

2,082,753

24,407,351

28,760,069

Receivables are identified as High Risk by the Board

527,039

1,015,465

1,357,402

3,351,338

7,970,924

14,222,168

Total

16,386,894 11,627,886 13,431,887

25,224,214 168,262,108 234,932,989

(1)

Includes total risk amounts before the effect of credit risk mitigation but after credit conversions.

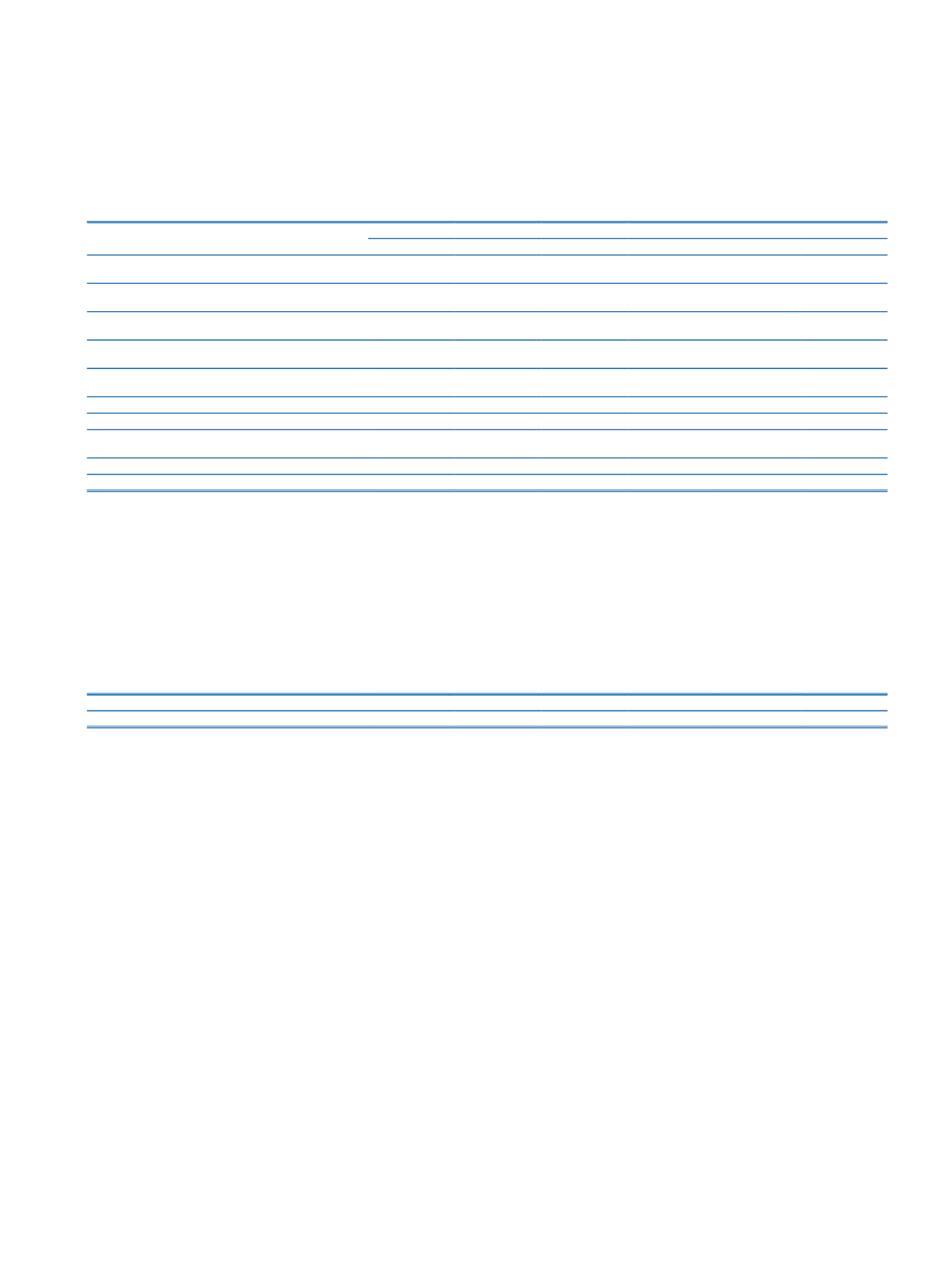

15. Information on Risk Classes

In the calculation of the amount subject to credit risk, determining the risk weights related to risk classes stated on the sixth article of “Regulation on Measurement and Evaluation

of Capital Adequacy of Banks”, is based on the Fitch Ratings’ international rating with the Banking Regulation and Supervision Board’s decision numbered 4577 dated 10 February

2012. While receivables from resident banks in abroad which is assessed in the risk class of “Contingent and Non-Contingent Receivables from Banks and Brokerage Agencies” and

receivables from central governments which is assessed in the risk class of “Contingent and Non-Contingent Receivables from Central Governments or Central Banks” will be subjected

to risk weights with the scope of ratings; therefore domestic resident banks accepted as unrated, the risk weight is applied according to receivables from relevant banks , type of

exchange and remaining maturity.

If a receivable-specific rating is performed, risk weights to be applied on the receivable are determined by the relevant credit rating.

The table related to mapping the ratings used in the calculations and credit quality grades, which is stated in the Annex of Regulation on Measurement and Evaluation of Capital

Adequacy of Banks, is given below

Credit Quality Grades

1

2

3

4

5

6

Risk Rating

AAA via AA-

A+ via A-

BBB+ via BBB-

BB+ via BB-

B+ via B- CCC+ and lower