Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

112 İşbank

Annual Report 2015

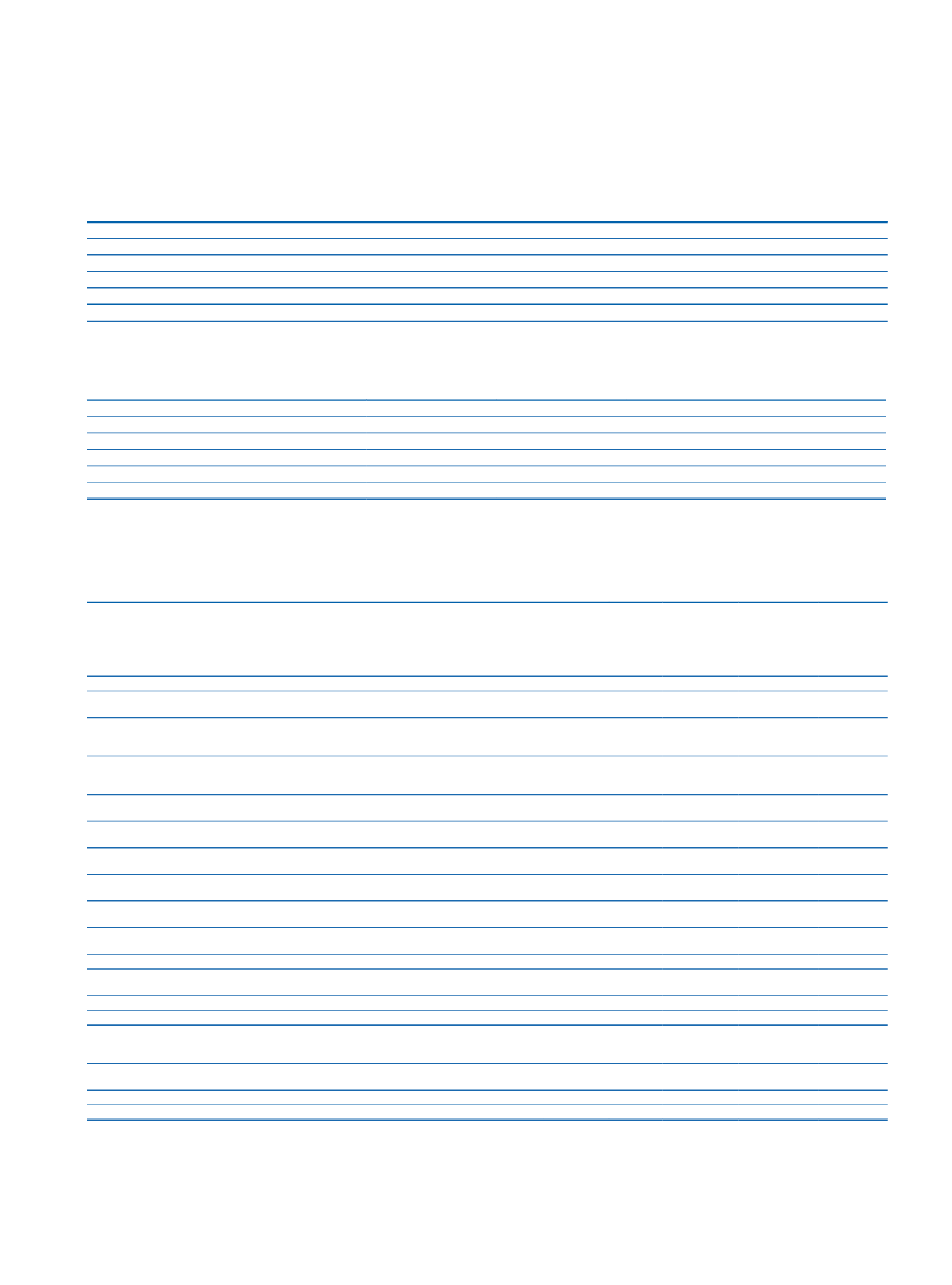

11. The aging analysis of the loans past due but not impaired is as follows:

Current Period

(1)

1-30 Days

(2)

31-60 Days

(3)

61-90 Days

(3)

Total

Loans

Corporate / Commercial Loans

318,591

55,111

39,198

412,900

Consumer Loans

150,609

55,067

23,975

229,651

Credit Cards

496,529

152,028

65,410

713,967

Total

965,729

262,206

128,583

1,356,518

(1)

The balance of the loans that are classified as closely monitored although they are not past due or past due for less than 31 days is TL 2,251,541.

(2)

Related figures show only overdue amounts of installment based commercial loans and installment based consumer loans; the principal amounts of the loans which are not due as of the balance sheet date are

equal to TL 640,792 and TL 1,399,842 respectively.

(3)

Related figures show only overdue amounts of installment based commercial loans and installment based consumer loans; the principal amounts of the loans which are not due as of the balance sheet date are

equal to TL 505,559 and TL 538,059 respectively.

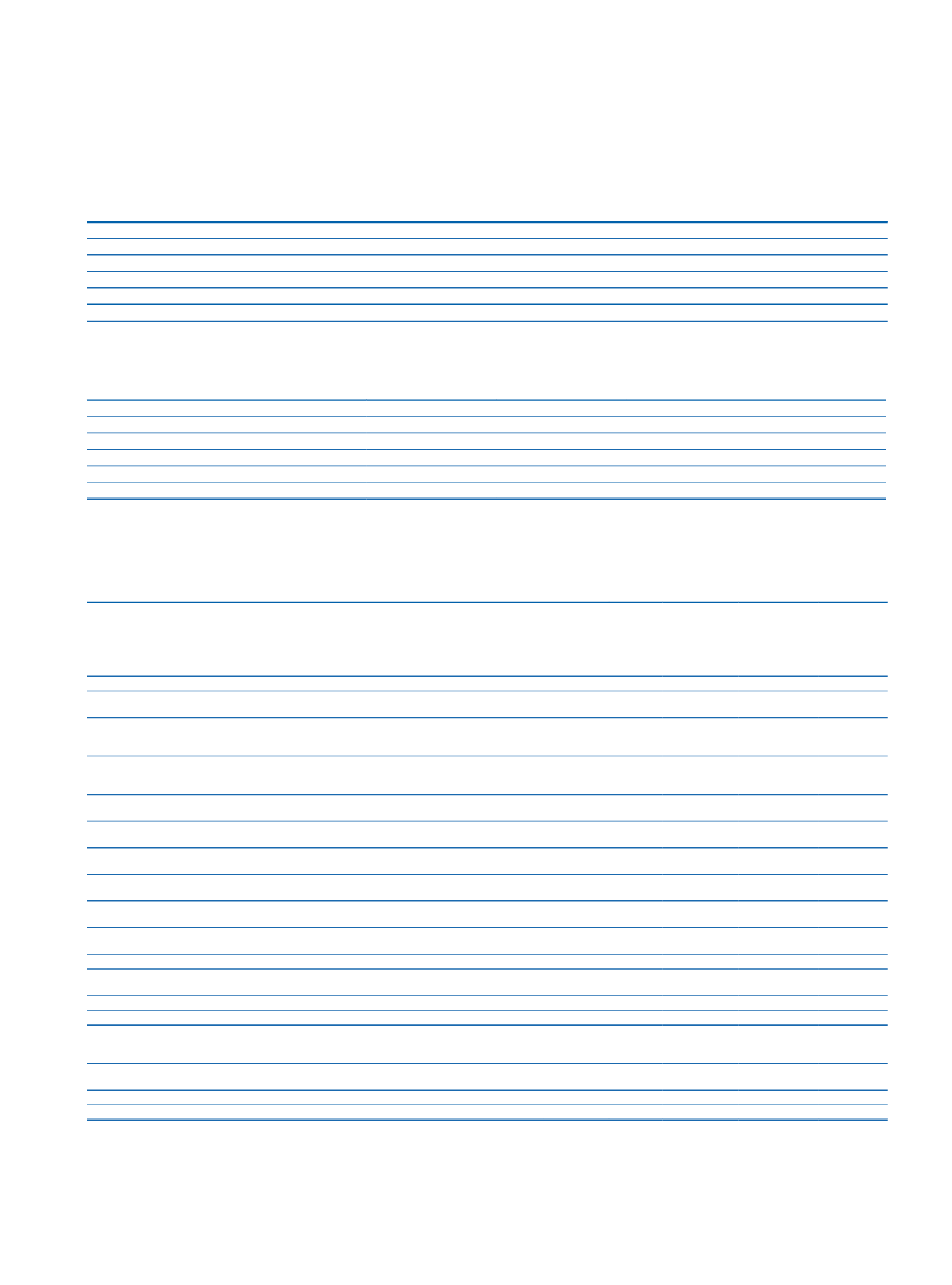

Prior Period

(1)

1-30 Days

(2)

31-60 Days

(3)

61-90 Days

(3)

Total

Loans

Corporate / Commercial Loans

255,992

46,517

29,711

332,220

Consumer Loans

111,010

38,005

14,614

163,629

Credit Cards

458,529

127,508

55,121

641,158

Total

825,531

212,030

99,446

1,137,007

(1)

The balance of the loans that are classified as closely monitored although they are not past due or past due for less than 31 days is TL 1,702,297.

(2)

Related figures show only overdue amounts of installment based commercial loans and installment based consumer loans; the principal amounts of the loans which are not due as of the balance sheet date are

equal to TL 414,283 and TL 1,025,345 respectively.

(3)

Related figures show only overdue amounts of installment based commercial loans and installment based consumer loans; the principal amounts of the loans which are not due as of the balance sheet date are

equal to TL 310,158 and TL 366,128 respectively.

12. Profile of significant exposures in major regions

Current Period

Domestic

European

Union

OECD

Countries

(2)

Off-Shore

Banking

Regions

USA,

Canada

Other

Countries

Investments

in Associates,

Subsidiaries

and Jointly

Controlled

Entities

Undistributed

Assets/

Liabilities

(3)

Total

Risk Groups

(1)

Contingent and Non-Contingent Receivables

from Central Governments or Central Banks

74,983,459

506

677,752

75,661,717

Contingent and Non-Contingent Receivables

from Regional Government or Domestic

Government

44,908

1,491

46,399

Contingent and Non-Contingent Receivables

from Administrative Units and Non-

Commercial Enterprises

243,096

248

243,344

Contingent and Non-Contingent Receivables

fromMultilateral Development Banks

308

215

523

Contingent and Non-Contingent Receivables

from International Organizations

Contingent and Non-Contingent Receivables

from Banks and Intermediaries

2,374,263 5,263,225 367,826

43,286 341,384 637,534

9,027,518

Contingent and Non-Contingent Corporate

Receivables

118,980,912 3,035,295

6,790

555 2,617,841 2,738,941

127,380,334

Contingent and Non-Contingent Retail

Receivables

37,285,672

116,124

14,432

227

8,297 179,825

37,604,577

Contingent and Non-Contingent Receivables

Secured by Residential Property

33,006,061

134,461

25,749

6

9,660 305,331

33,481,268

Non-Performing Receivables

895,393

995

30

46

672

897,136

Receivables are identified as high risk by

the Board

13,883,832

41,881

5,683

141

3,814 286,817

14,222,168

Secured Marketable Securities

Securitization Positions

Short-term Receivables and Short-term

Corporate Receivables from Banks and

Intermediaries

Investments as Collective Investment

Institutions

Other Receivables

8,602,373

9,393,598

17,995,971

Total

290,299,969 8,592,795 420,510 44,215 2,981,257 4,828,611 9,393,598

316,560,955

(1)

Risk amounts before the effect of credit risk mitigation but after the credit conversions.

(2)

OECD countries other than EU countries, USA and Canada

(3)

Assets and liabilities that are not consistently allocated