Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

128 İşbank

Annual Report 2015

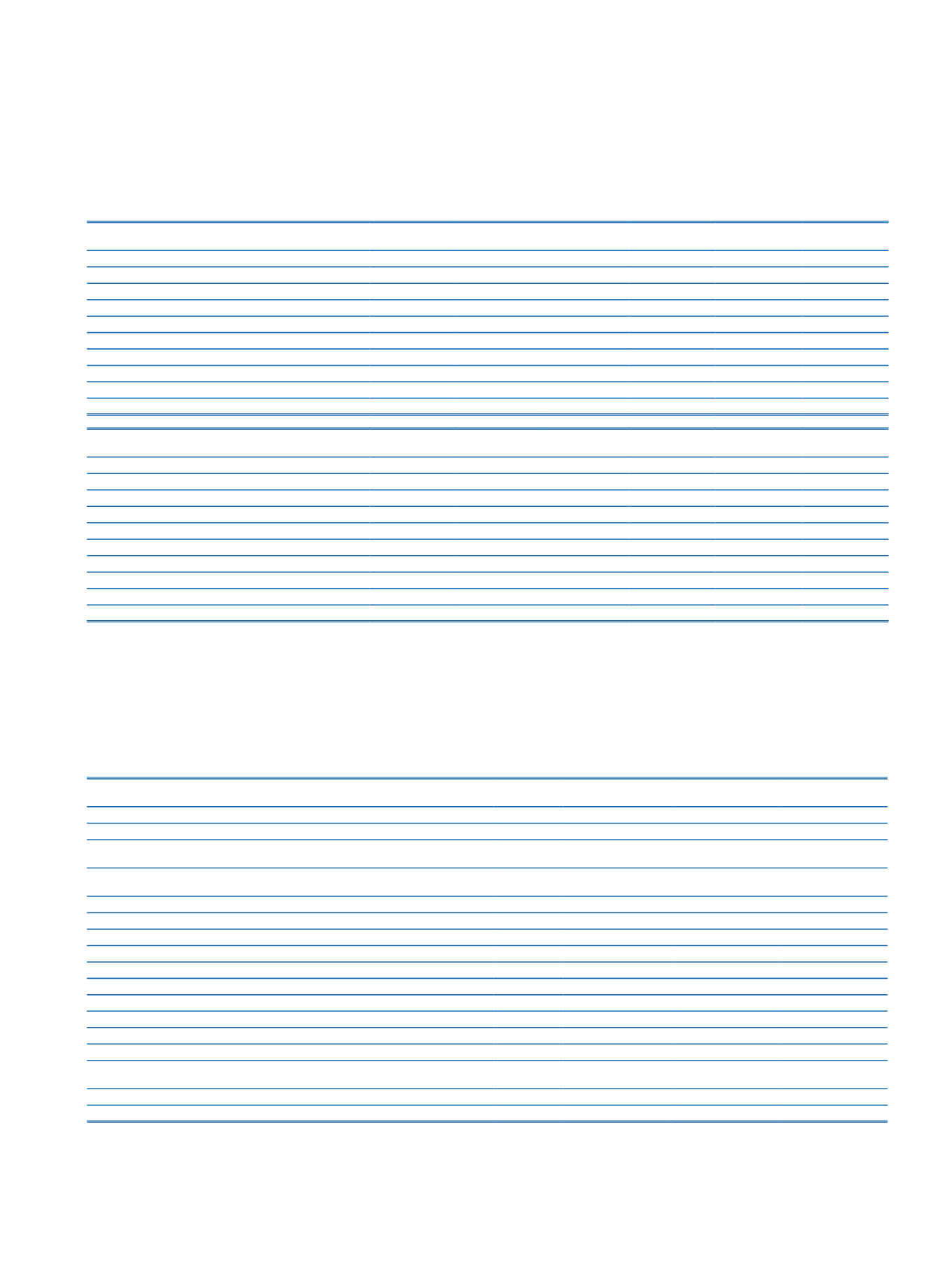

The following table shows the remaining maturities of derivative financial assets and liabilities of the Bank.

Current Period

Up to 1

Month

1-3

Months

3-12

Months

1-5

Years

5 Years

and Over

Total

Forwards Contracts-Buy

1,115,548

935,351

1,847,165

320,577

4,218,641

Forwards Contracts-Sell

1,117,192

934,872

1,858,497

351,493

4,262,054

Swaps Contracts-Buy

16,154,450

7,112,794

7,735,785

10,036,924

6,309,308

47,349,261

Swaps Contracts-Sell

13,164,481

7,350,396

7,720,001

9,804,457

6,309,308

44,348,643

Futures Transactions-Buy

Futures Transactions-Sell

Options-Call

910,133

1,592,671

1,925,801

382,651

552,240

5,363,496

Options-Put

867,248

1,481,078

1,737,951

382,650

552,240

5,021,167

Other

3,532,169

377,574

1,207,206

377,132

5,494,081

Total

36,861,221

19,784,736 24,032,406 21,655,884 13,723,096 116,057,343

Prior Period

Up to 1

Month

1-3

Months

3-12

Months

1-5

Years

5 Years

and Over

Total

Forwards Contracts- Buy

1,701,540

621,552

823,023

495,025

3,641,140

Forwards Contracts- Sell

1,690,151

621,270

823,809

505,445

3,640,675

Swaps Contracts-Buy

12,030,882

2,227,273

4,451,807

11,006,407

2,866,138

32,582,507

Swaps Contracts-Sell

10,671,538

2,178,118

4,271,913

10,875,880

2,866,138

30,863,587

Futures Transactions-Buy

Futures Transactions-Sell

Options-Call

1,319,368

1,541,247

990,593

396,894

574,458

4,822,560

Options-Put

1,314,392

1,566,608

980,431

396,890

574,458

4,832,779

Other

1,457,576

445,229

175,687

2,078,492

Total

30,185,447

9,201,297

12,517,263 23,676,541

6,881,192 82,461,740

IX. Explanations on securitization positions

None.

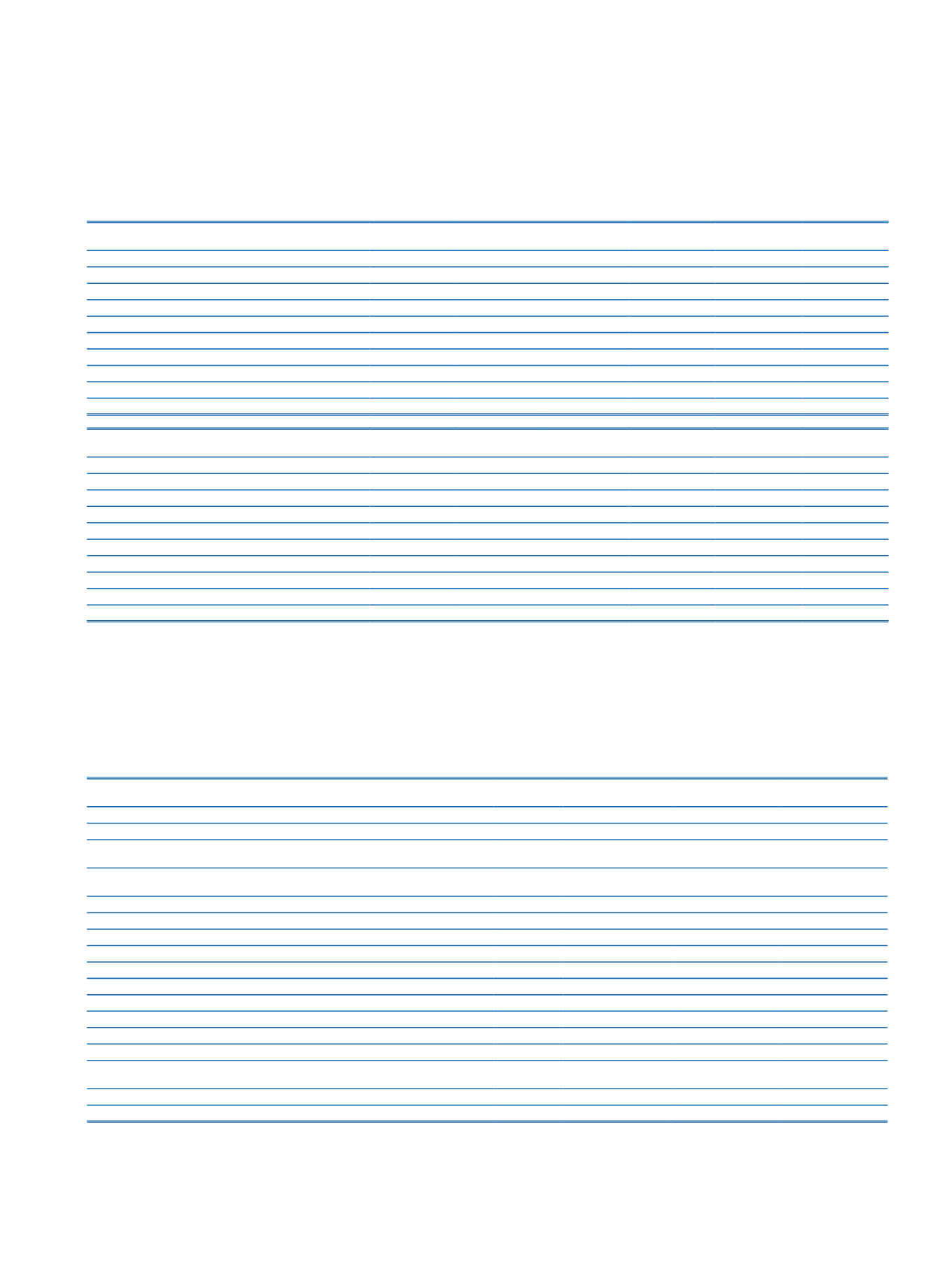

X. Explanations on credit risk mitigation techniques:

In the calculation of the Bank’s Credit Risk Mitigation in accordance with the “Communiqué on Credit Risk Mitigation Techniques” published in the Official Gazette numbered 29111 on 6

September 2014, the financial collaterals are taken into consideration. The Bank takes local currency and foreign currency deposit pledges into consideration as financial collaterals in

calculating regulatory capital adequacy.

Collaterals on the Basis of Risk Classes

Amount

(1)

Financial

Collateral

Other/Physical

Collateral

Guaranties and

Credit Derivatives

Risk Groups

Contingent and Non-Contingent Receivables from Central Governments or Central Banks

75,661,717

Contingent and Non-Contingent Receivables from Regional Government or Domestic

Government

46,399

34

Contingent and Non-Contingent Receivables from Administrative Units and Non-Commercial

Enterprises

243,344

3,036

Contingent and Non-Contingent Receivables fromMultilateral Development Banks

523

Contingent and Non-Contingent Receivables from International Organizations

Contingent and Non-Contingent Receivables from Banks and Intermediaries

9,027,518

2,721

Contingent and Non-Contingent Corporate Receivables

127,380,334

6,546,849

Contingent and Non-Contingent Retail Receivables

37,604,577

279,467

Contingent and Non-Contingent Receivables Secured by Residential Property

33,481,268

Non-Performing Receivables

897,136

Receivables are identified as high risk by the Board

14,222,168

95,495

Secured Marketable Securities

Securitization Positions

Short-term Receivables and Short-term Corporate Receivables from Banks and

Intermediaries

Investments as Collective Investment Institutions

Other Receivables

17,995,971

(1)

Includes total risk amounts before the effect of credit risk mitigation but after credit conversions.