Türkiye İş Bankası A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2015

130 İşbank

Annual Report 2015

XII. Explanations on Leverage Ratio

a. Explanations on Differences Between Current and Prior Years’ Leverage Ratios

The Bank’s unconsolidated leverage ratio is calculated in accordance with the principles of the “Regulation on Measurement and Evaluation of Banks’ Leverage Level”. As of 31

December 2015, the Bank’s leverage ratios is 8.50% (31 December 2014: 9.15%). Change of leverage ratio is mainly related to increase in the amount of risk on balance sheet items.

According to Regulation, the minimum leverage ratio is 3%.

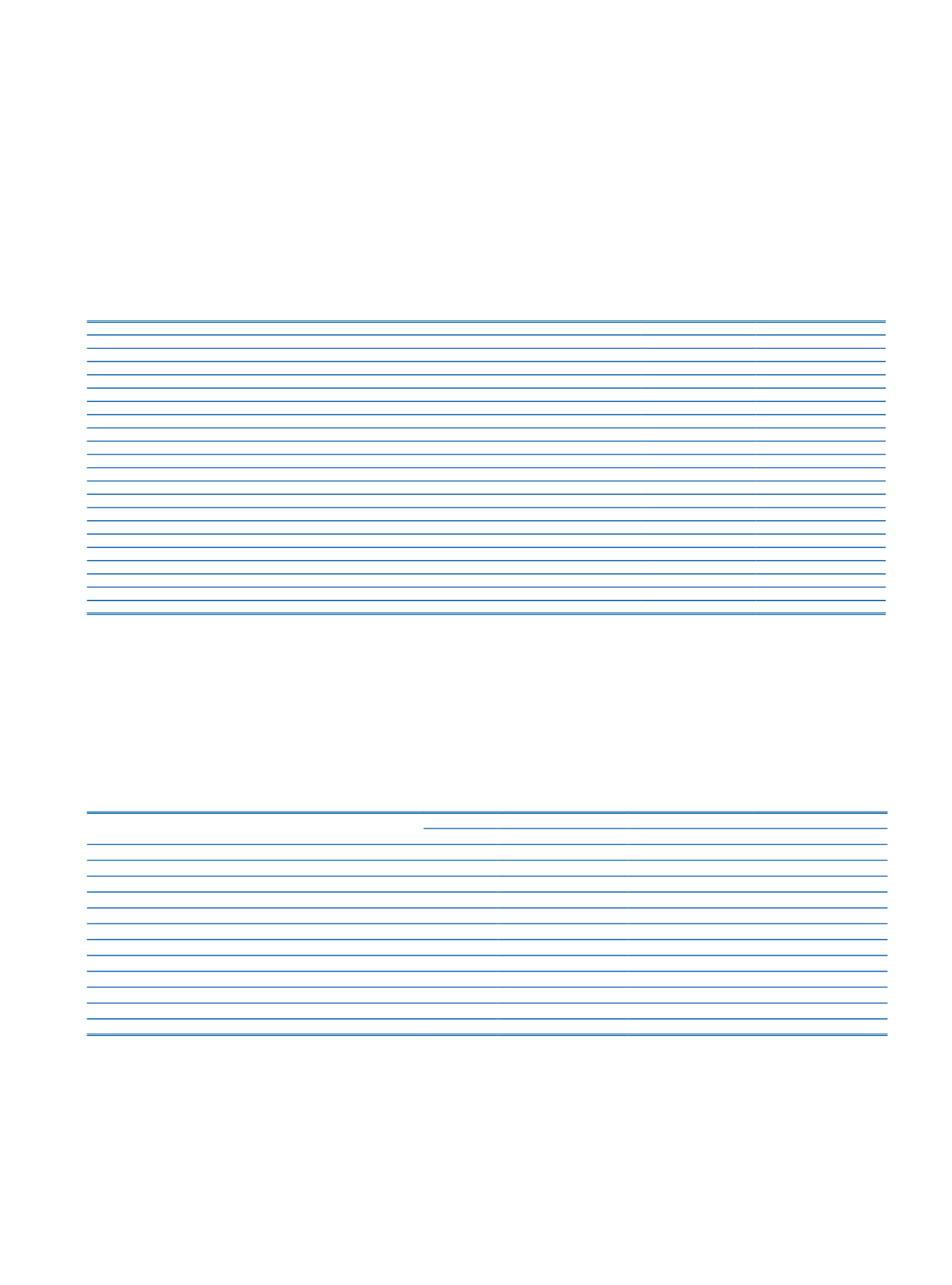

b. Explanation on leverage ratio

Current Period

(1)

Prior Period

(1)

On-Balance Sheet Items

On-balance sheet items (excluding derivatives and SFTs, but including collateral)

276,020,449

232,624,506

Assets amounts deducted in determining Basel III Tier 1 capital

(453,159)

(368,656)

Total on balance sheet exposures

275,567,290

232,255,850

Derivative exposures and credit derivatives

Replacement cost associated with derivative financial instruments and credit derivatives

1,390,575

932,645

The potential amount of credit risk with derivative financial instruments and credit derivatives

747,653

520,975

The total amount of risk on derivative financial instruments and credit derivatives

2,138,228

1,453,620

Investment securities or commodity collateral financing transactions

The amount of risk investment securities or commodity collateral financing transactions (Excluding on balance sheet items)

3,653,168

3,939,599

Risk amount of exchange brokerage operations

Total risks related with securities or commodity financing transactions

3,653,168

3,939,599

Off -Balance Sheet Items

Gross notional amount of off-balance sheet items

105.599.526

89.082.925

Adjustments for conversion to credit equivalent amounts

(7,016,044)

(5,472,772)

The total risk of off-balance sheet items

98,583,482

83,610,153

Capital and Total Exposures

Tier 1 Capital

32,278,853

29,397,221

Total Exposures

379,942,168

321,259,222

Leverage Ratio

Leverage Ratio

8.50

9.15

(1)

Three-month average of the amounts in Leverage Ratio table.

XIII. Explanations on Other Price Risks

The Bank has investments in companies traded on the Borsa İstanbul A.Ş. is exposed to equity securities price risk. Shares are being acquired for investment purposes rather than.

The Bank’s sensitivity to equity price risk at the reporting date an analysis was conducted to measure. In the analysis, with the assumption of all other variables were held constant

(stock prices) are 10% higher or lower and is assumed that. According to this assumption in equity securities revaluation reserve account TL 750,093 (31 December 2014: TL 725,125)

increase/decrease is expected to be. This, in fact, the fair value of publicly traded subsidiaries and associates the increase/decrease is due. On the other hand, according to the

analysis carried out similar assumptions, held for trading securities that are traded in an active market (stock exchange) may have an impact on profit (+/-) TL 5,625.

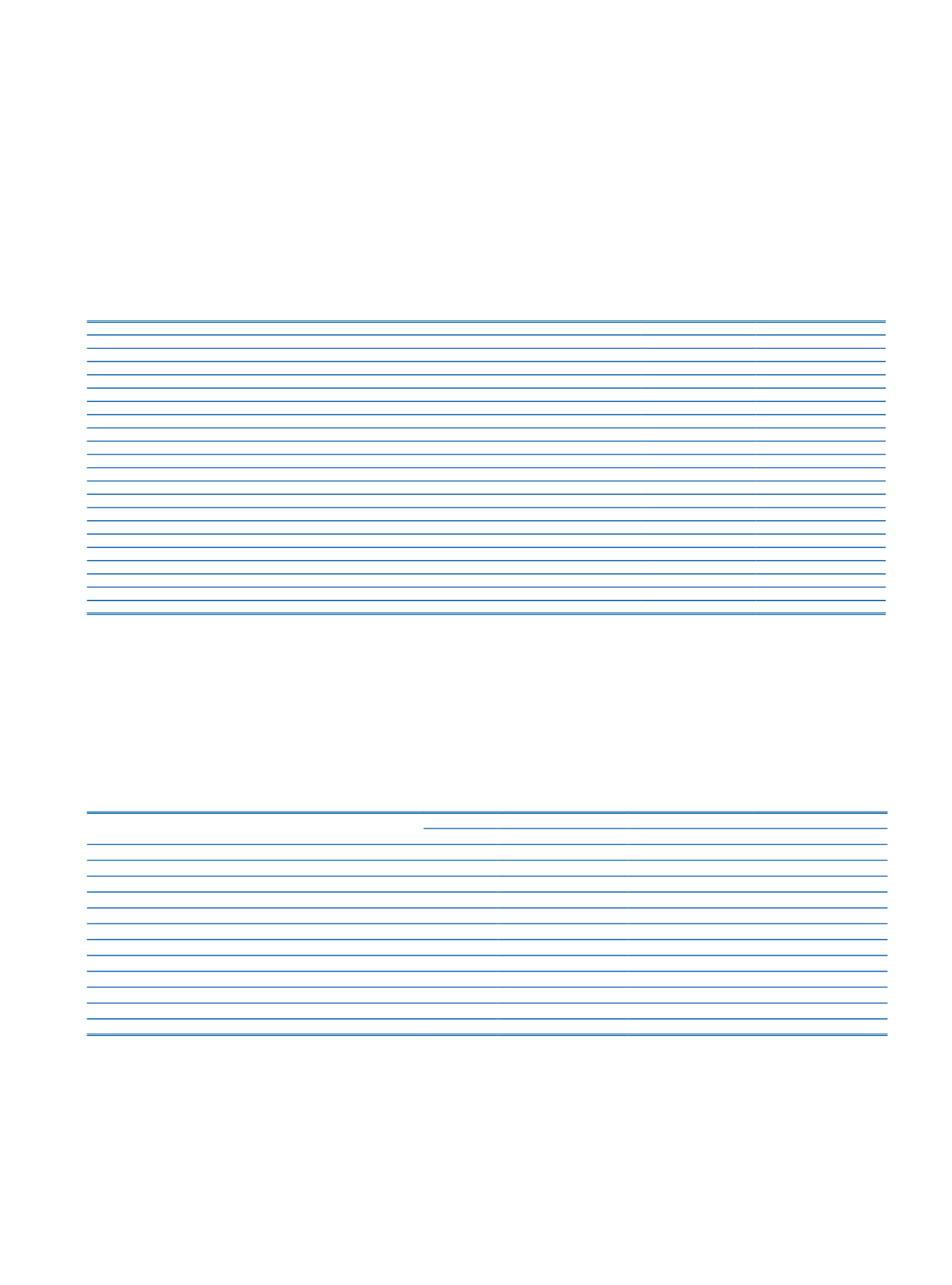

XIV. Explanations on Presentation of Assets and Liabilities at Fair Value

1. Information on fair values of financial assets and liabilities

Book Value

Fair Value

Current Period

Prior Period

Current Period

Prior Period

Financial Assets

Money Market Placements

Banks

1,517,501

1,393,221

1,528,903

1,395,713

Financial Assets Available for Sale

40,860,360

39,289,961

40,860,360

39,289,961

Investments Held to Maturity

3,591,631

1,301,104

3,508,664

1,304,277

Loans

177,933,756

155,874,278

176,241,705

156,953,561

Financial Liabilities

Banks Deposits

7,714,181

6,397,382

7,706,168

6,398,642

Other Deposits

146,088,245

127,153,809

146,201,394

127,204,047

Funds Provided from Other Financial Institutions

28,408,499

20,669,163

28,306,644

20,599,089

Marketable Securities Issued

(1)

23,808,262

20,422,541

23,827,075

20,762,846

Miscellaneous Payables

6,850,381

5,508,091

6,850,381

5,508,091

(1)

Includes subordinated bonds which are classified on the balance sheet as subordinated loans.

Fair values of investments held to maturity securities issued is determined by using the market prices; in cases where market prices cannot be measured, quoted market prices of

other securities that are subject to amortization having similar interest, maturity and other conditions are taken as the basis for the fair value determination.

Market prices are taken into account in determining the fair values of the securities available for sale. When the prices cannot be measured in an active market, fair values are not

deemed to be reliably determined and amortized cost, calculated by the internal rate of return method, are taken into account as the fair values.

Fair values of banks, loans granted, deposits and funds borrowed from other financial institutions and marketable securities are calculated by discounting the amounts in each

maturity bracket formed according to repricing periods, using the rate corresponding to relevant maturity bracket in the discount curves based on current market conditions.