233

Financial Information and Risk Management

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

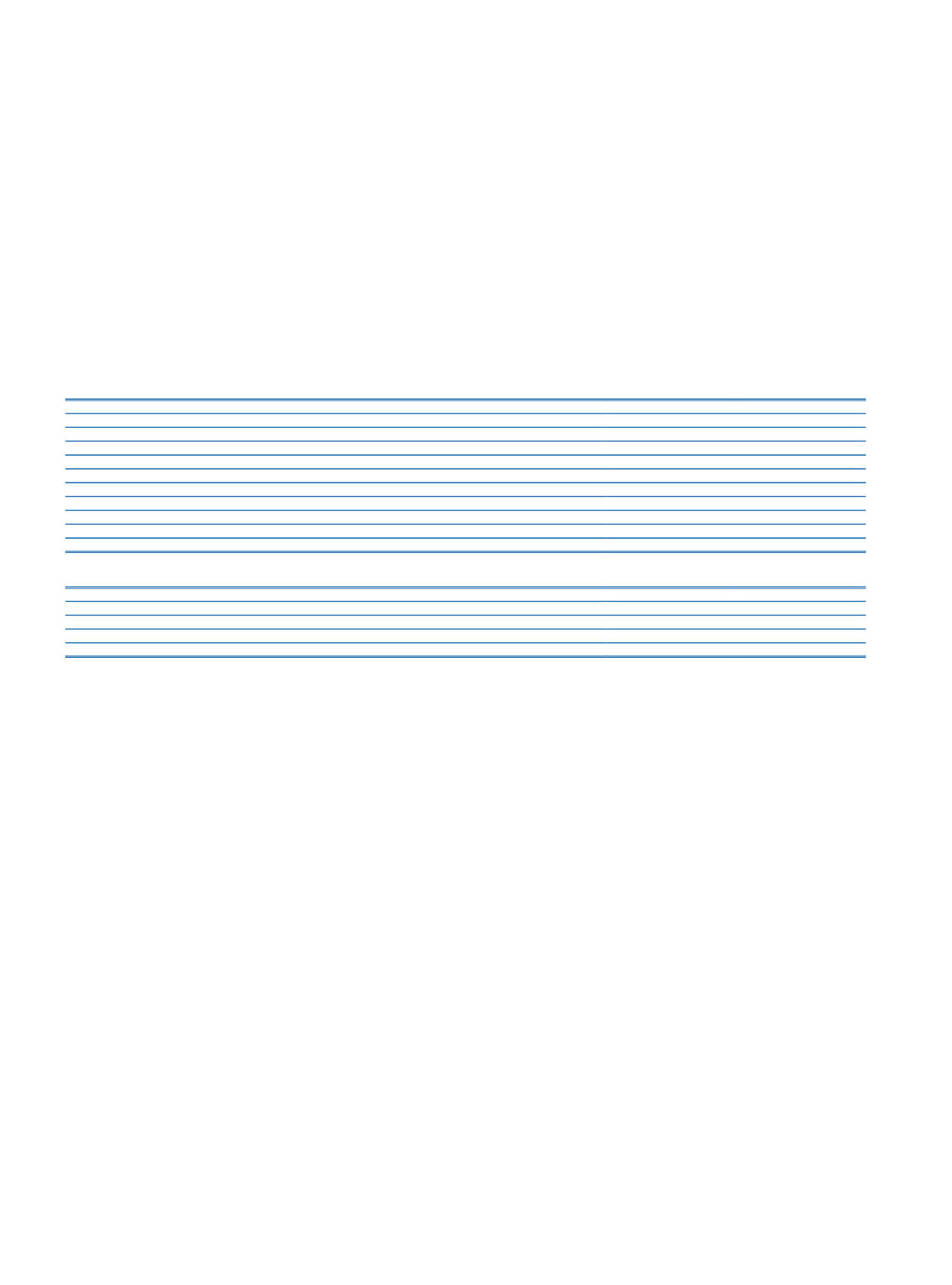

Liabilities of pension funds founded as per the Social Security Institution:

Within the scope of the explanations given in Section Three Note XX, in the actuarial report which was prepared as of 31 December 2015 for Türkiye İş Bankası A.Ş. Emekli Sandığı

Vakfı (İşbank Pension Fund), of which each Bank employee is a member, and which has been established according to the provisional Article 20 of the Social Security Act No. 506, the

amount of actuarial and technical deficit stands at TL 2,175,902 (31 December 2014: 1,898,407). In this context, the provision with that amount has been reflected in the financial

statements. According to the actuarial report as at 31 December 2015 of Milli Reasürans T.A.Ş., besides the Parent Bank, the amount of actuarial and technical deficit was determined

to be TL 28,359 (31 December 2014: 28,331). In this context, the additional provision with an amount of TL 28 has been reflected in the financial statement.

The above mentioned actuarial audit, which was made in accordance with the principles of the related law, measures the cash value of the liability as of 31 December 2015, in other

words, it measures the amount to be paid to the Social Security Institution by the Parent Bank. Actuarial assumptions used in the calculation are given below.

- 9.8% technical deficit interest rate is used.

- 34.5 % total premium rate is used.

- CSO 1980 woman/man mortality tables are used.

Below table shows the cash values of premium and salary payments of the Parent Bank as of 31 December 2015, taking the health expenses within the Social Security Institution

limits into account.

31 December 2015

31 December 2014

Net Present Value of Total Liabilities Other Than Health

(6,252,749)

(5,397,570)

Net Present Value of Long Term Insurance Line Premiums

2,799,494

2,433,204

Net Present Value of Total Liabilities Other Than Health

(3,453,255)

(2,964,366)

Net Present Value of Health Liabilities

(773,842)

(726,581)

Net Present Value of Health Premiums

1,590,621

1,382,502

Net Present Value of Health Liabilities

816,779

655,921

Pension Fund Assets

460,574

410,038

Amount of Actuarial and Technical Deficit

(2,175,902)

(1,898,407)

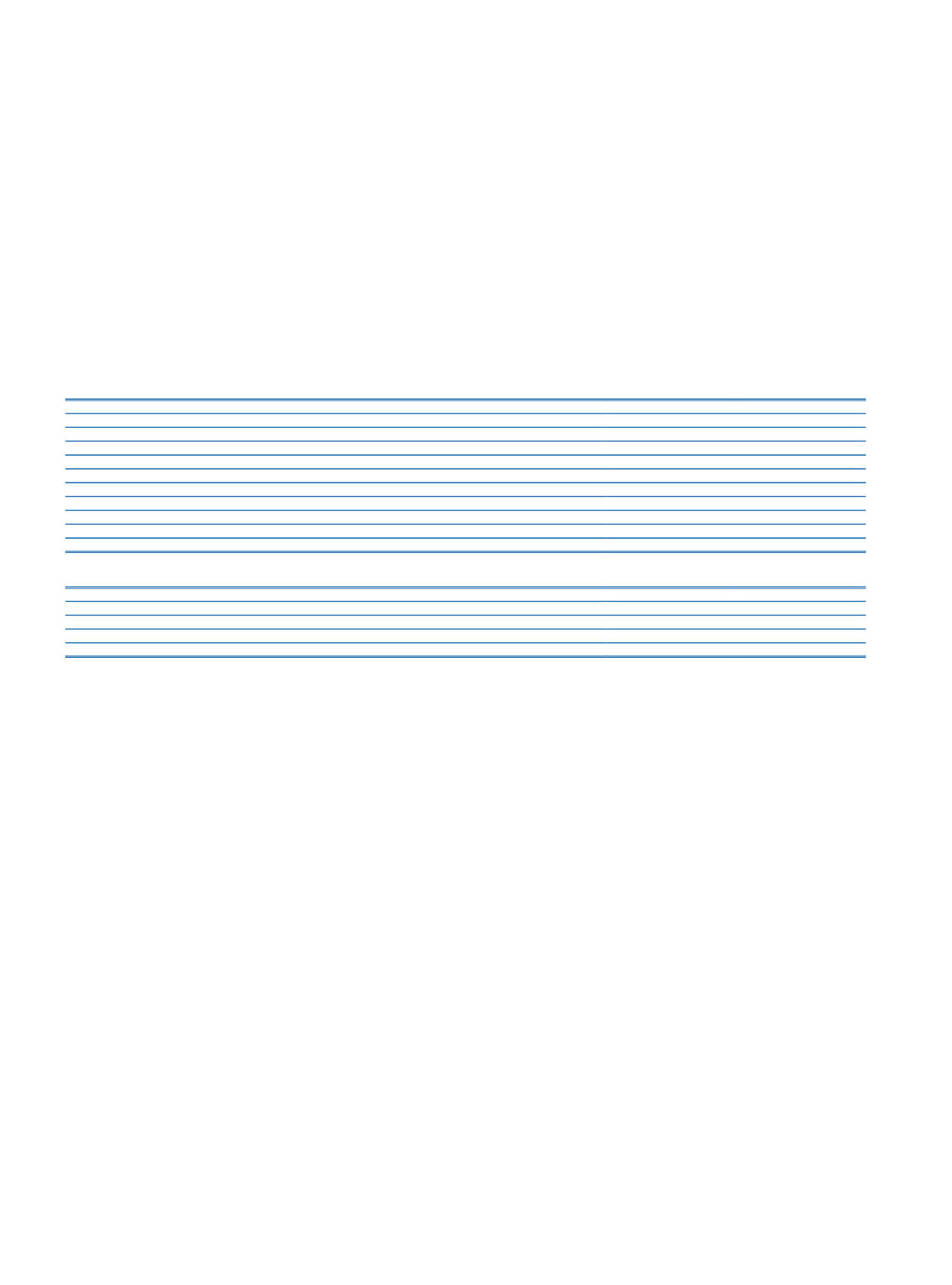

The assets of the pension fund are as follows.

31 December 2015

31 December 2014

Cash and Cash Equivalents

357,448

243,003

Securities Portfolio

59,390

116,934

Other

43,736

50,101

Total

460,574

410,038

On the other hand, after the transfer, the currently paid health benefits will be revised within the framework of the Social Security Institution legislation and related regulations.

i.5.3. Provision of credit cards and promotion of banking services applications:

The Bank has recognized provisions amounting to TL 79,159 for the amount which is recognized within

the framework of credit card expenses of credit card customers or promotions for banking services. (31 December 2014: TL 67,203)

i.5.4.

As mentioned public disclosures of the Bank on 31 December 2012 and 19 December 2013; an inspection has been made by the inspectors of Tax Inspection Board to “Türkiye

İş Bankası A.Ş. Mensupları Munzam Sosyal Güvenlik ve Yardımlaşma Sandığı Vakfı” (“İşbank Supplementary Pension Fund”), which was founded as per the provisions of the Turkish

Commercial and Civil Codes, regarding the payments that fulfill İşbank’s liabilities within the framework of the Articles of Foundation of the Pension Fund and the relevant legislation.

As a result of this investigation, tax audit reports were prepared for the years 2007, 2008, 2009, 2010, 2011 claiming that the aforementioned liabilities should be taxed in terms of

wage base, thus, they should be subject to withholding tax and stamp duty. According to this report, the total amount of tax and penalties notified to Bank was TL 74,353 for 2007

and 2008; and as of reporting date TL 151,899 for 2009, 2010 and 2011 and it was stated that the Bank applied to tax courts to cancel these tax notifications and some of the court

decisions were determined in favor of the Bank and some others were determined against the Bank.

In this context, for the finalized decisions of Regional Administrative Courts related to the years 2007 and 2008 against the Bank, the Bank applied to the Constitutional Court. As

considering one of the Bank’s applications, the Constitutional Court made its decision court file numbered 2014/6192 amounting to TL 39,378.20 (full amount). The court decision

dated 12 November 2014 appeared in the official gazette dated 21 February 2015 and numbered 29274. According to this decision, there is no predictability in legal conformity for

taxing the Bank’s contributions to the Pension Fund in terms of wage base and for this reason it was accepted that property right of the Bank has been violated according to the 35th

article of Constitution. Finally the Court decided that the amount of tax, penalties and default interest which was paid by the Bank should be paid back to the Bank as for compensation

with its legal interest.

Besides of the Bank, an inspection was conducted by Tax Audit Committee Inspectors regarding to the contribution obligations mentioned above for the period 2007-2011 on Munzam

Sosyal Güvenlik ve Yardımlaşma Sandığı Vakfı Mensupları which is founded according to Turkish Commercial Law and Civil Law, owned by “Türkiye Sınai Kalkınma Bankası A.Ş”, “Milli

Reasürans T.A.Ş”, and Anadolu Anonim Türk Sigorta Şirketi. As a result of the issued report that companies a total of TL 33 million (exact amount) tax penalty notices were notified.

Assessments made on the subject by the company’s application in accordance with the legislation, which was suspended for Tax Administration concluded that the lack of legal basis

of assessment and said assessment were filed in court against the various tax. A number of cases concluded in favor of the Bank, another part of lawsuits concluded against the Bank

but portion of the case has not been concluded yet.

According to the decision of the Constitutional Court, it is expected that the cases related to the periods 2007, 2008, 2009, 2010 and 2011 will conclude in favor of the Bank. In this

context, the provisions amounting to TL 217,265 which had been allocated for the mentioned periods, reversed. The path to be followed for other provisions, allocated for the same

reason within the scope of accounting standards for the year 2012 and subsequent periods, will be determined depending on the process. Within the scope of these developments,

the Bank recognized provisions amounting to TL 42,271 as at 31 December 2015 (31 December 2014: TL 42,016).

i.5.5.

The Ministry of Customs and Trade initiated an investigation under Law No: 6502 and now-abolished Law No: 4077 and has imposed an administrative fine of TL 110,110 to the

Bank pursuant to this investigation. The Bank paid TL 82,583, which is the amount calculated by benefiting from the discount within the framework of Article 17 of Misdemeanor Law

No: 5326, provided that the Bank reserves its right to litigate against the related decision and to claim for refund. The Bank has filed a lawsuit in İstanbul 11th Administrative Court for

the cancellation of administrative fine imposed against the Bank in due time. The court proceedings are not finalized as of reporting date.

i.5.6.

Except the provisions which are stated above, other provisions contain provision for expenses, provisions for ongoing lawsuit and other provisions set aside for miscellaneous

reasons.

j. Information on Tax Liability:

j.1. Information on current tax liability:

j.1.1.

Information on tax provision:

Explanations in relation to taxation and tax calculations were stated in Note XXI of Section 3. The remaining corporate tax liability of the Parent Bank and the consolidated companies

after the deduction of the temporary tax amount stands at TL 359,959 as of 31 December 2015.