225

Financial Information and Risk Management

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

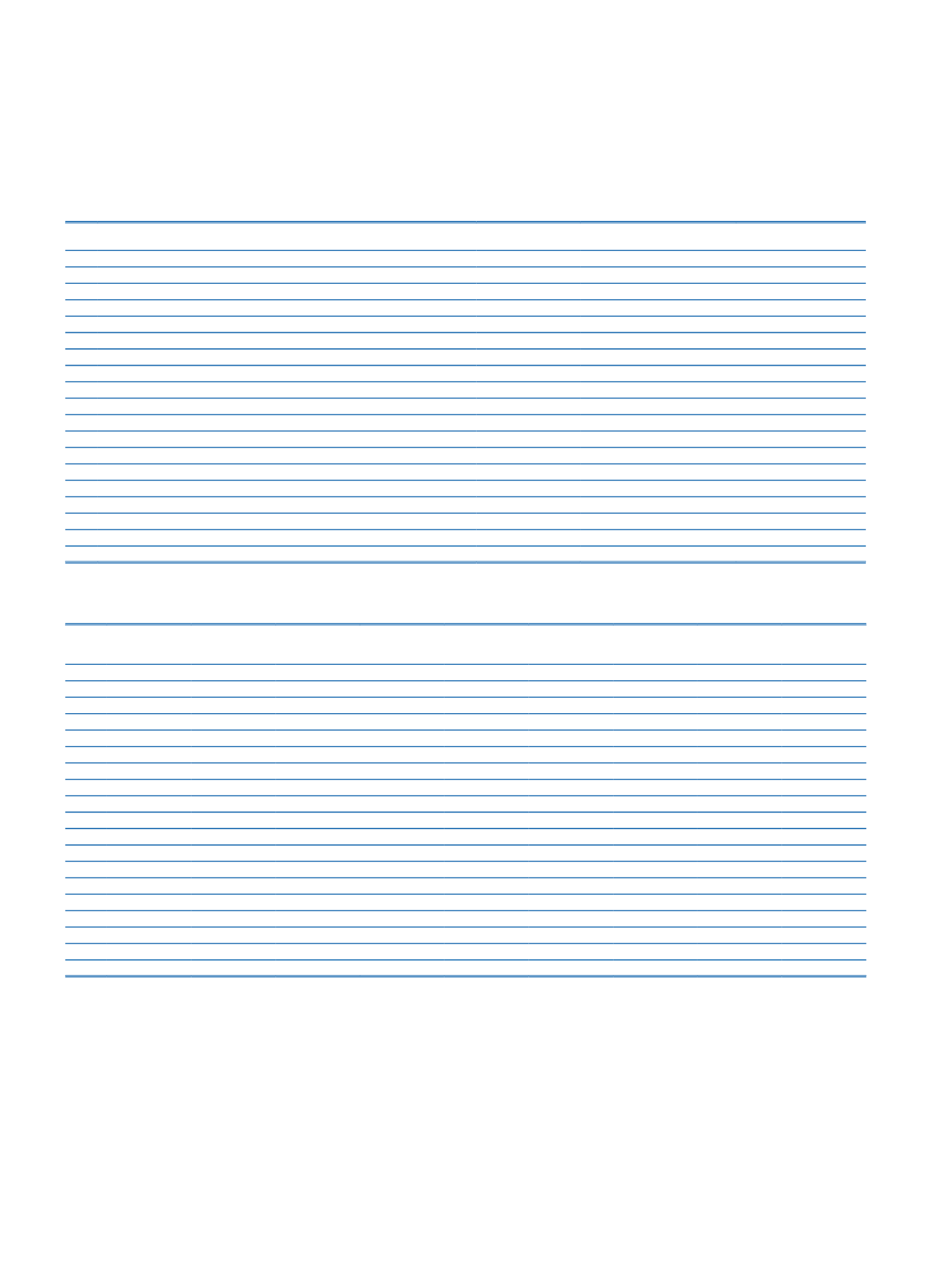

h.3. Information on consolidated subsidiaries:

Title

Address

(City/ Country)

Bank’s Share Percentage-If

Different, Voting Rights (%)

(1)

Bank’s Risk Group Share

Percentage (%)

1-

Anadolu Anonim Türk Sigorta Şirketi

İstanbul/Turkey

43.92

56.08

2-

Anadolu Hayat Emeklilik A.Ş.

İstanbul/Turkey

71.70

28.30

3-

Efes Varlık Yönetim A.Ş.

İstanbul/Turkey

65.14

34.86

4-

Is Investments Gulf Ltd.

Dubai/UAE

68.79

31.21

5-

İş Faktoring A.Ş.

İstanbul/Turkey

42.34

57.66

6-

İş Finansal Kiralama A.Ş.

İstanbul/Turkey

42.08

57.92

7-

İş Gayrimenkul Yatırım Ortaklığı A.Ş.

İstanbul/Turkey

51.65

48.35

8-

İş Girişim Sermayesi Yatırım Ortaklığı A.Ş.

İstanbul/Turkey

33.89

66.11

9-

İş Portföy Yönetimi A.Ş.

İstanbul/Turkey

66.72

33.28

10- İş YatırımMenkul Değerler A.Ş.

İstanbul/Turkey

68.79

31.21

11- İş Yatırım Ortaklığı A.Ş.

İstanbul/Turkey

24.51

75.49

12- İşbank AG

Frankfurt/Germany

100.00

0.00

13- JSC İşbank

Moscow/Russia

100.00

0.00

14- JSC İşbank Georgia

Tbilisi/Georgia

100.00

0.00

15- Maxis Investments Ltd.

London/England

68.79

31.21

16- Milli Reasürans T.A.Ş.

İstanbul/Turkey

76.64

23.36

17- TSKB Gayrimenkul Yatırım Ortaklığı A.Ş.

İstanbul/Turkey

31.26

68.74

18- Türkiye Sınai Kalkınma Bankası A.Ş.

İstanbul/Turkey

43.33

56.67

19- Yatırım Finansman Menkul Değerler A.Ş.

İstanbul/Turkey

42.05

57.95

(1)

Indirect share of the Group is considered as the Parent Bank’s share percentage.

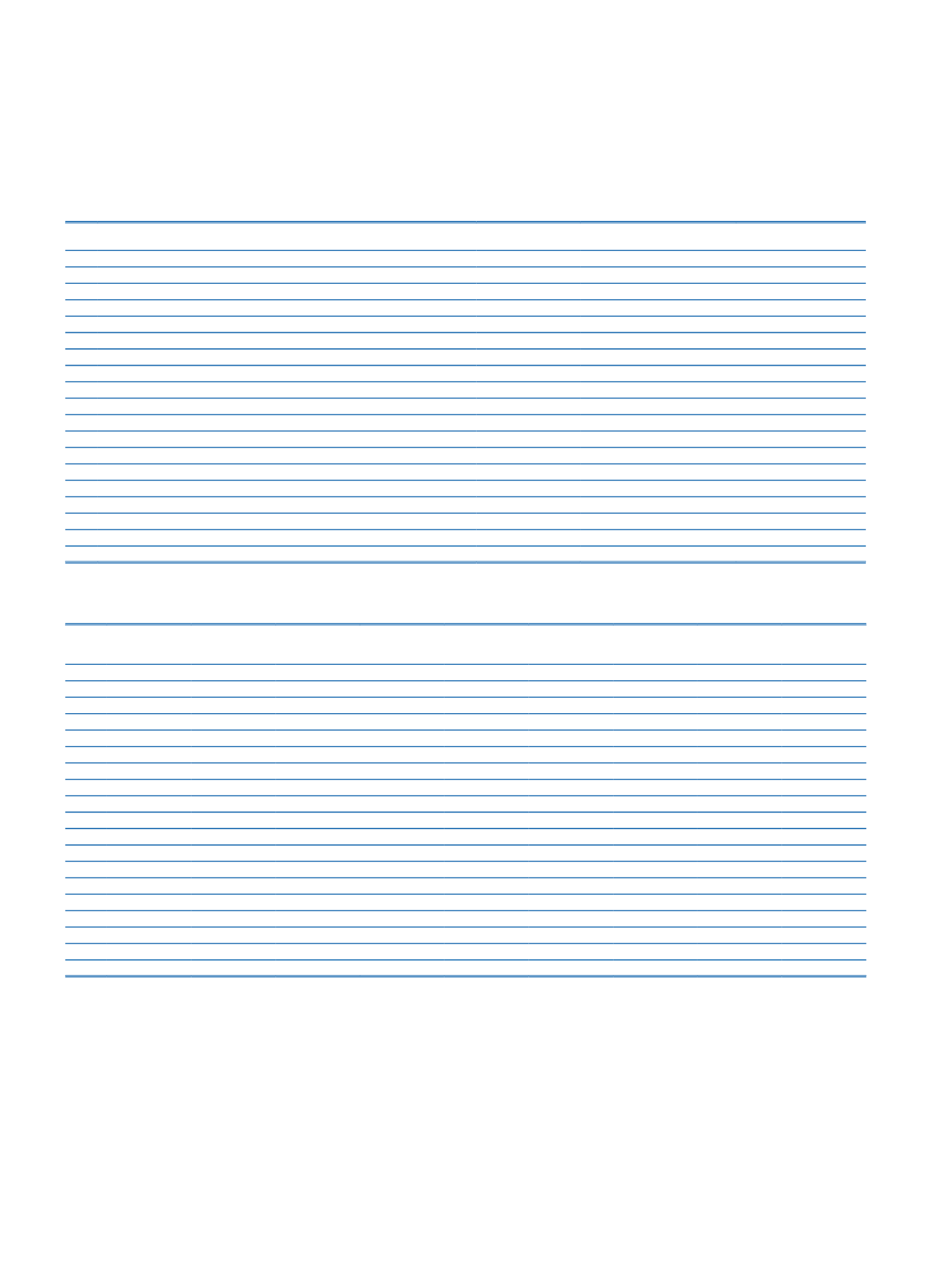

Financial statement information related to consolidated subsidiaries in the above order:

Total Assets

Shareholders’

Equity

Total

Tangible Assets

Interest

Income

(1)

Securities

Income

Current Period

Profit/Loss

Prior Period

Profit/Loss

Fair Value

Additional

Shareholders’

Equity Required

1-

4,548,870

863,218

142,871

203,119

52,995

74,983

76,515

796,000

2-

11,893,997

783,026

154,769

255,399

26,559

145,883

104,075

2,514,120

3-

215,724

47,094

942

53,757

15,314

17,813

4-

522

522

95

(1,220)

(367)

5-

1,978,756

99,832

1,012

125,257

2,072

24,167

7,938

6-

5,580,838

738,408

20,944

396,184

3,929

87,264

80,174

429,015

7-

4,125,201

2,790,635

3,319,084

4,328

4,519

555,933

328,433

1,339,070

8-

258,934

255,106

266

12,120

3,480

773

14,598

120,265

9-

92,448

87,914

1,581

7,892

1,530

13,079

10,094

10-

5,781,240

908,208

94,219

241,557

70,327

22,408

92,570

400,085

11-

238,169

235,530

101

19,472

1,311

5,912

28,994

146,467

12-

3,767,688

421,572

49,706

94,528

10,206

5,234

13-

560,365

142,841

46,002

54,786

236

(26,582)

(11,985)

14-

263,063

37,000

3,548

7,261

462

15-

88,251

14,686

1,549

9,451

(4,112)

(301)

16-

2,647,784

1,183,899

426,968

98,141

66,402

130,243

30,426

17-

421,685

219,547

403,778

483

9,036

1,543

88,500

18-

21,366,580

2,783,792

450,376

1,098,725

22,197

410,590

374,111

2,604,000

19-

555,153

73,728

3,595

23,233

2,010

(1,951)

(645)

(1)

Includes interest income on securities.