217

Financial Information and Risk Management

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

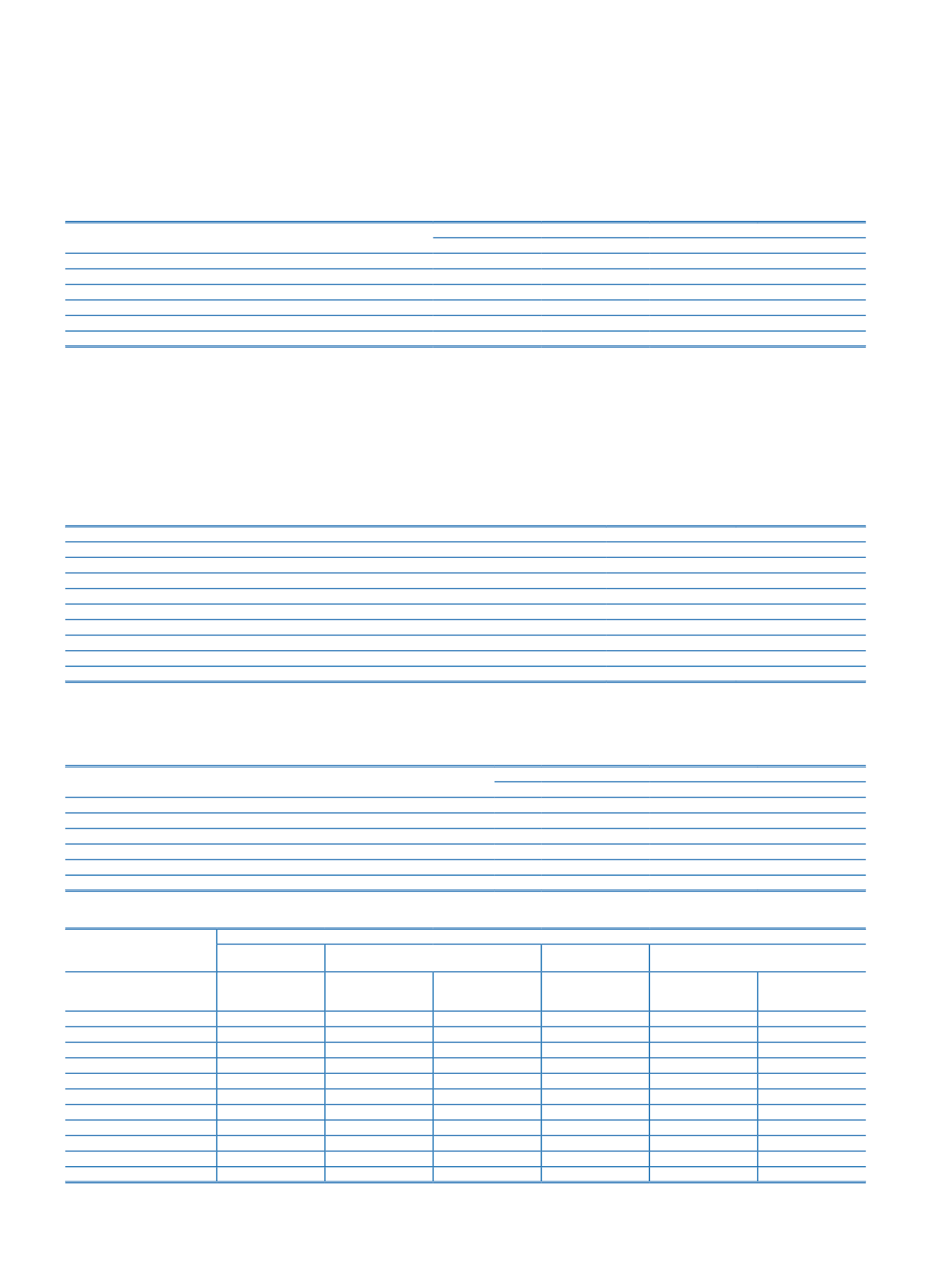

c.2. Information on foreign banks:

Unrestricted Amount

Restricted Amount

Current Period

Prior Period

Current Period

Prior Period

EU Countries

737,571

852,441

USA, Canada

190,332

146,051

116

OECD Countries

(1)

236,209

220,364

Off-shore Banking Regions

1,506

Other

483,876

251,442

200,795

119,197

Total

1,649,494

1,470,298

200,795

119,313

(1)

OECD countries other than the EU countries, USA and Canada.

d. Information on Financial Assets Available for Sale:

d.1. Information on financial assets available for sale, which are given as collateral or blocked:

Financial assets available for sale, which are given as collateral or blocked amount to TL 10,917,233 as of 31 December 2015 (31 December 2014: TL 10,083,896).

d.2. Information on financial assets available for sale, which are subject to repurchase agreements:

Financial assets available for sale which are subject to repurchase agreements amount to TL 21,594,391 as of 31 December 2015 (31 December 2014: TL 20,785,043).

d.3. Information on financial assets available for sale:

Current Period

Prior Period

Debt Securities

47,191,240

45,237,578

Quoted on a Stock Exchange

33,893,694

37,708,258

Not-Quoted

(1)

13,297,546

7,529,320

Share Certificates

361,877

110,846

Quoted on a Stock Exchange

33,272

38,687

Not-Quoted

328,605

72,159

Value Increases / Impairment Losses (-)

983,643

115,565

Other

439,868

444,270

Total

47,009,342

45,677,129

(1)

Refers to the debt securities, which are not quoted on the Stock Exchange or which are not traded, although quoted, on the Stock Exchange at the end of the related period.

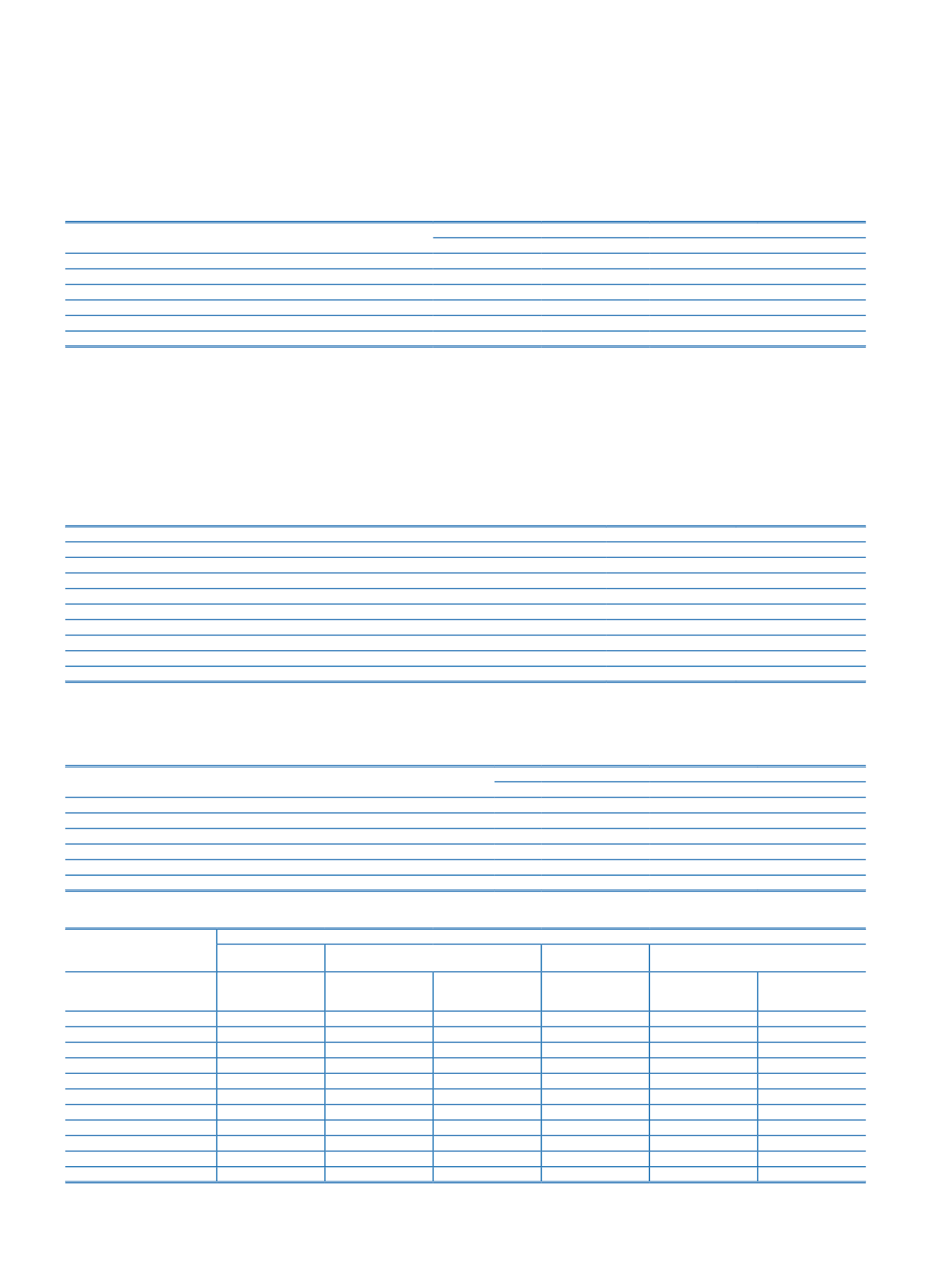

e. Information related to loans:

e.1. Information on all types of loans and advances given to shareholders and employees of the group:

Current Period

Prior Period

Cash

Non-Cash

Cash

Non-Cash

Direct Lending to Shareholders

Corporate Shareholders

Individual Shareholders

Indirect Lending to Shareholders

Loans to Employees

248,137

250

225,850

261

Total

248,137

250

225,850

261

e.2. Information about the first and second group loans and other receivables including loans that have been restructured or rescheduled:

Standard Loans and Other Receivables

Loans and Other Receivables Under Close Monitoring

Cash Loans

Loans and Other

Receivables Amendments on Conditions of Contract

Loans and Other

receivables Amendments on Conditions of Contract

Amendments related

to the extension of

the payment plan

Other

Amendments related

to the extension of

the payment plan

Other

Non-specialized loans

189,024,464

3,462,422

1,294,283

3,884,995

791,757

132,787

Corporation loans

92,200,586

2,171,340

1,443,543

300,953(1)

34,242

Export loans

8,103,037

3,914

83,823

8,306

Import loans

Loans Given to Financial Sector

3,537,971

Consumer loans

35,407,900

1,028,260

1,281,894

1,287,930

73,533

34,254

Credit Cards

11,347,034

540,311

312,033

Other

38,427,936

258,908

12,389

529,388

96,932

64,291

Specialized Loans

Other Receivables

Total

189,024,464

3,462,422

1,294,283

3,884,995

791,757

132,787

(1)

The amount of TL 30,407 loans provided to maritime sector which have extended payment plans within the scope of Temporary 6. Substance of the “Regulation on Procedures and Principles for Determination of

Qualifications of Loans and Other Receivables by Banks and Provisions to be Set Aside.