222 İşbank

Annual Report 2015

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

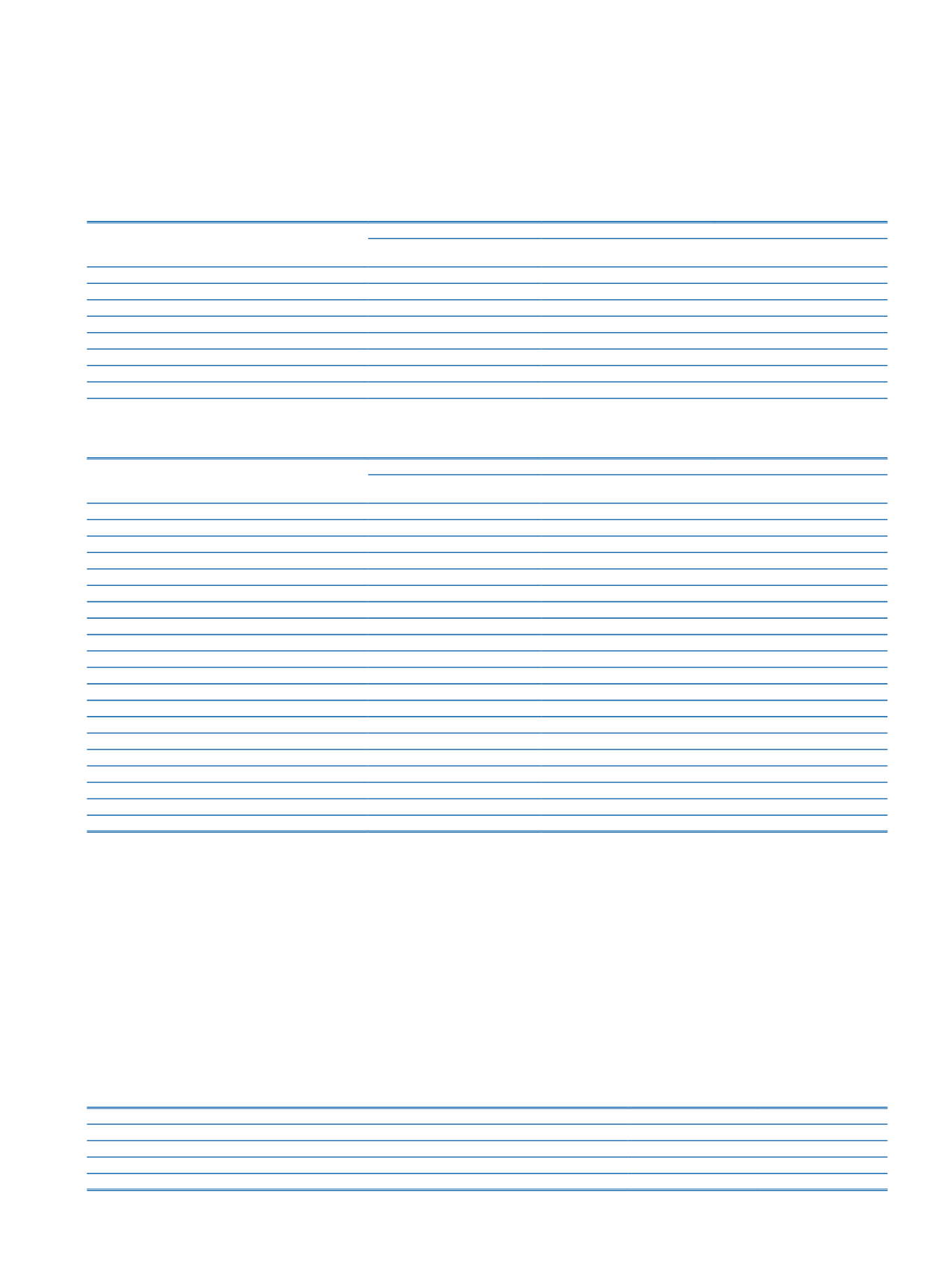

e.10.3.

Information on the Group’s foreign currency non-performing loans and other receivables:

Group III

Group IV

Group V

Loans and Receivables with

Limited Collectability

Loans and Receivables with

Doubtful Collectability

Uncollectible Loans and Other

Receivables

Current Period:

Period Ending Balance

36,505

164,767

504,720

Specific Provisions (-)

7,783

83,119

504,720

Net Balance on Balance Sheet

(1)

28,722

81,648

Prior Period:

Period Ending Balance

13,564

34,125

419,332

Specific Provisions (-)

3,076

18,254

419,332

Net Balance on Balance Sheet

(1)

10,488

15,871

(1)

In addition to the loans extended in foreign currency, loans which are monitored in Turkish Lira are included

e.10.4.

Information on gross and net non-performing loans and receivables as per customer categories:

Group III

Group IV

Group V

Loans and Receivables with

Limited Collectability

Loans and Receivables with

Doubtful Collectability

Uncollectible Loans and Other

Receivables

Current Period (Net)

452,762

458,173

117,433

Loans to Individuals and Corporate (Gross)

569,563

924,153

2,363,723

Specific Provisions (-)

116,801

465,980

2,246,290

Loans to Individuals and Corporate (Net)

452,762

458,173

117,433

Banks (Gross)

Specific Provisions (-)

Banks (Net)

Other Loans and Receivables (Gross)

62,792

Specific Provisions (-)

62,792

Other Loans and Receivables (Net)

Prior Period (Net)

305,900

264,183

124,713

Loans to Individuals and Corporate (Gross)

384,519

533,476

1,726,580

Specific Provisions (-)

78,619

269,293

1,601,867

Loans to Individuals and Corporate (Net)

305,900

264,183

124,713

Banks (Gross)

87

Specific Provisions (-)

87

Banks (Net)

Other Loans and Receivables (Gross)

54,839

Specific Provisions (-)

54,839

Other Loans and Receivables (Net)

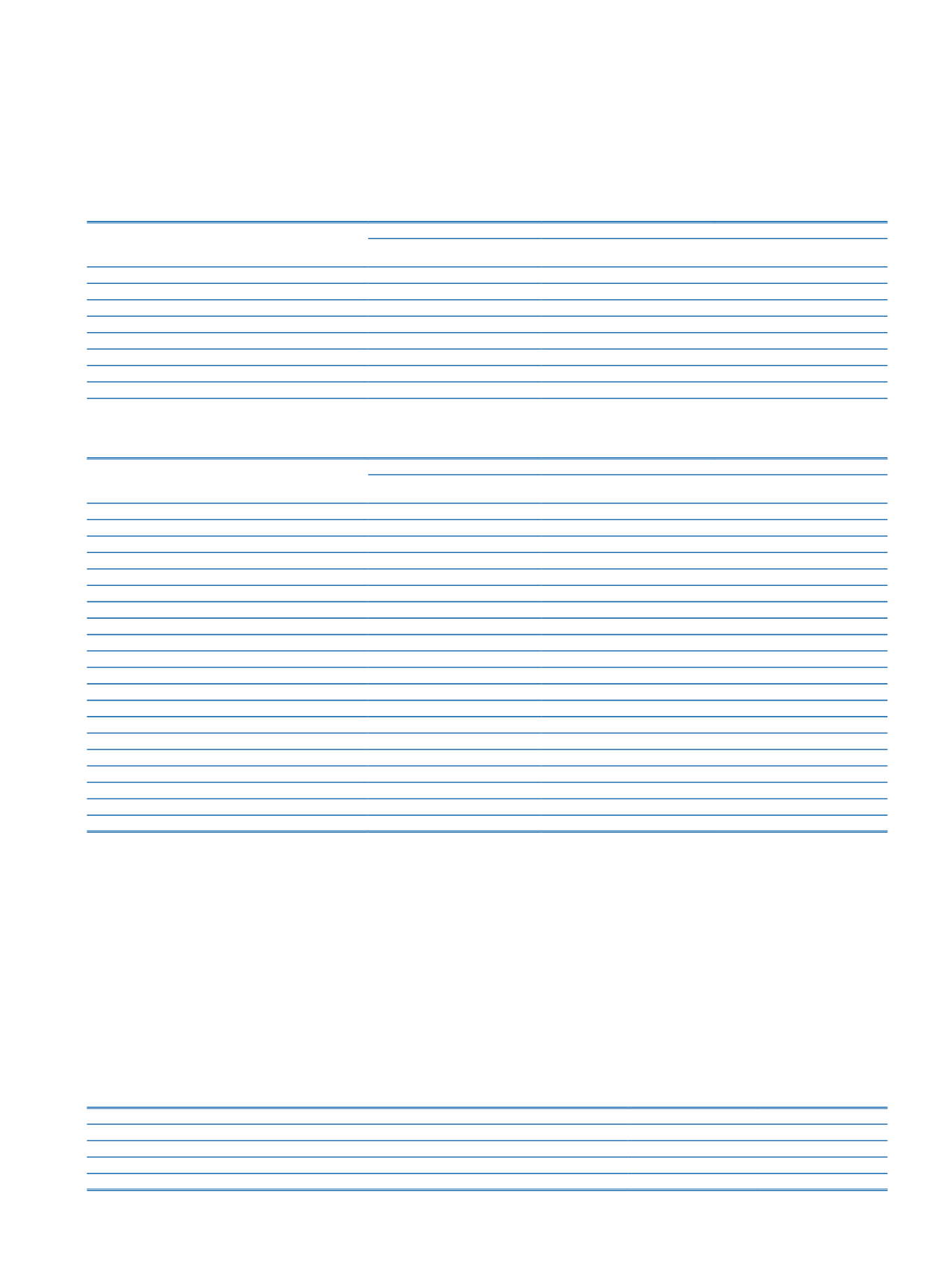

e.11. Main principles of liquidating for uncollectible loans and other receivables:

In order to ensure the liquidation of non-performing loans, all possibilities evaluated to ensure maximum collection according to the legislation. First of all, administrative initiatives are

taken to deal with the borrower. Collection through legal proceedings used if there is no possibility of collection and configuration with the interviews for other receivables.

e.12. Explanations on write-off policy:

The Bank’s general policy for write-offs of loans and receivables under follow-up is to write of such loans and receivables that are proven to be uncollectible in legal follow-up process

within the instructions of Tax Procedure Law.

f. Held to Maturity Investments:

f.1. Information on held to maturity investments, which are given as collateral or blocked:

As of 31 December 2015, held to maturity investments, which are given as collateral or blocked amount to TL 161,812 (31 December 2014: TL 447,605).

f.2. Information on held to maturity investments, which are subject to repurchase agreements:

As of 31 December 2015, assets held to maturity, which are subject to repurchase agreements amount to TL 2,723,082 (31 December 2014: TL 348,913).

f.3. Information on government securities held to maturity:

Current Period

Prior Period

Government Bonds

4,310,652

1,307,192

Treasury Bills

Other Public Debt Securities

Total

4,310,652

1,307,192