221

Financial Information and Risk Management

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

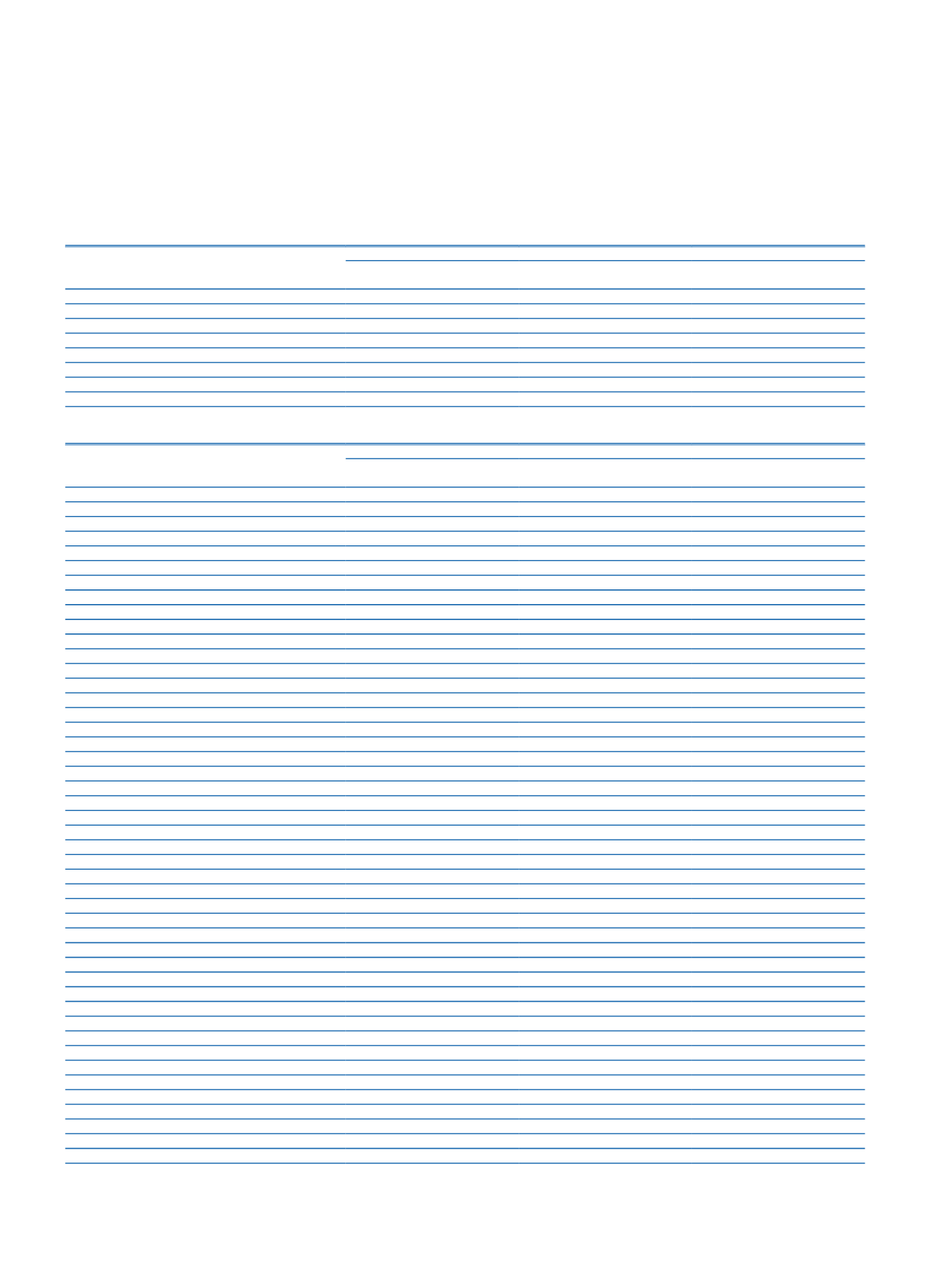

e.10. Information on non-performing loans (Net):

e.10.1.

Information on loans and other receivables included in non-performing loans, which are restructured or rescheduled by the Group:

Group III

Group IV

Group V

Loans and Receivables with

Limited Collectability

Loans and Receivables with

Doubtful Collectability

Uncollectible Loans and Other

Receivables

Current Period

(Gross amounts before the specific provisions)

42,762

59,132

71,274

Restructured Loans and Other Receivables

Rescheduled Loans and Other Receivables

42,762

59,132

71,274

Prior Period

(Gross amounts before the specific provisions)

26,499

34,403

60,245

Restructured Loans and Other Receivables

Rescheduled Loans and Other Receivables

26,499

34,403

60,245

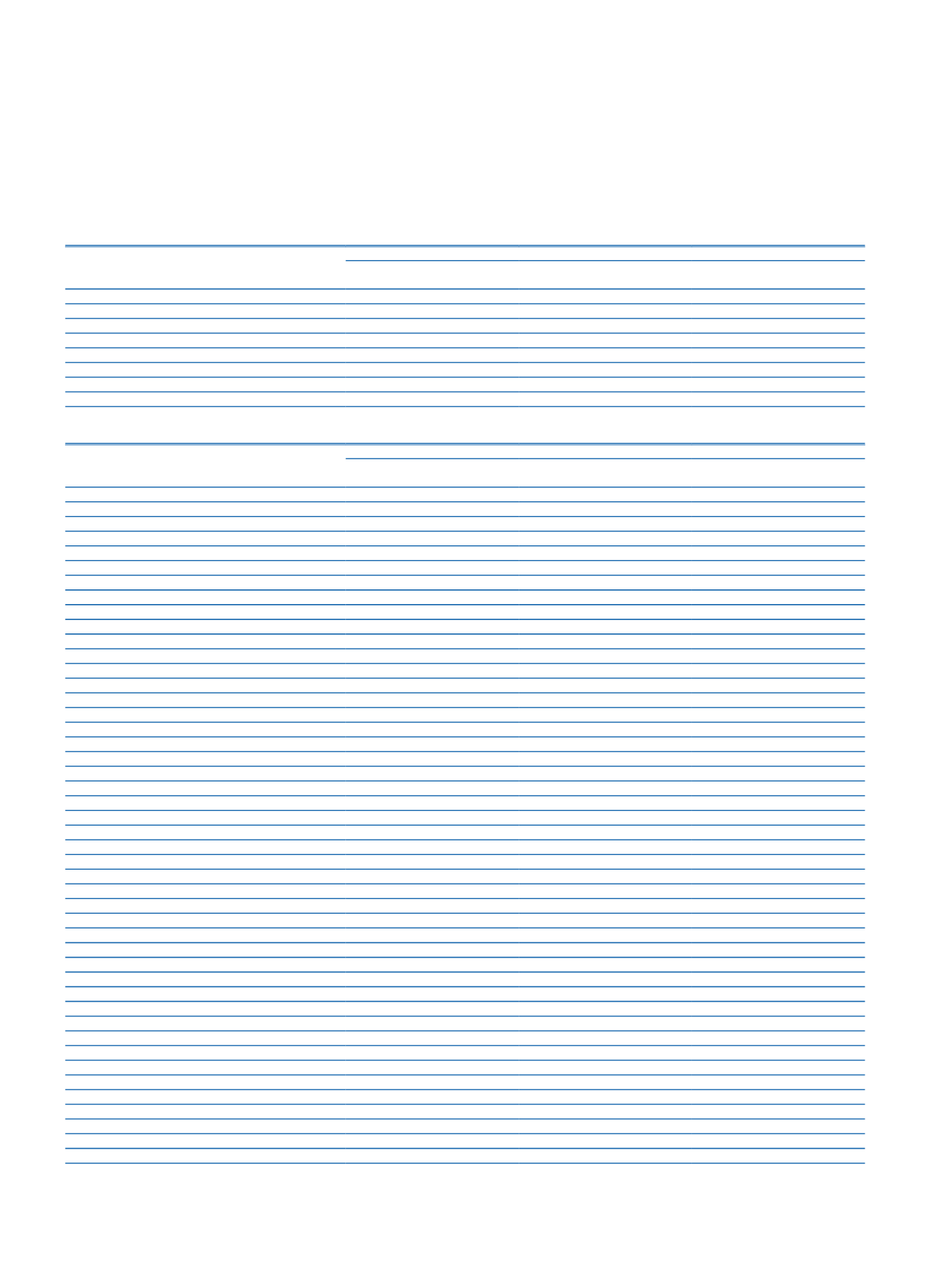

e.10.2.

Movement of total non-performing loans:

Group III

Group IV

Group V

Loans and Receivables with

Limited Collectability

Loans and Receivables with

Doubtful Collectability

Uncollectible Loans and Other

Receivables

Prior Period Ending Balance

384,519

533,476

1,781,506

Corporate and Commercial Loans

195,338

240,973

1,216,861

Retail Loans

110,853

155,389

328,113

Credit Cards

78,328

137,114

181,693

Other

54,839

Additions (+)

2,445,285

27,044

128,333

Corporate and Commercial Loans

1,355,233

18,609

73,645

Retail Loans

657,906

2,814

41,082

Credit Cards

432,146

5,621

1,046

Other

12,560

Transfers fromOther NPL categories (+)

1,883,203

1,220,366

Corporate and Commercial Loans

1,077,372

677,491

Retail Loans

478,495

298,710

Credit Cards

327,336

244,165

Other

Transfers to Other NPL categories (-)

1,883,203

1,220,366

Corporate and Commercial Loans

1,077,372

677,491

Retail Loans

478,495

298,710

Credit Cards

327,336

244,165

Other

Collections (-) (1)

378,063

299,474

530,361

Corporate and Commercial Loans

148,473

127,114

272,950

Retail Loans

136,675

101,225

196,902

Credit Cards

92,915

71,135

57,153

Other

3,356

Write-Offs (-) (1)

49

606

181,707

Corporate and Commercial Loans

42

389

79,753

Retail Loans

2

201

69,173

Credit Cards

5

16

31,530

Other

1,251

Foreign Currency Effect

1,074

876

8,378

Corporate and Commercial Loans

942

655

6,842

Retail Loans

132

221

1,536

Credit Cards

Other

Current Period Ending Balance

569,563

924,153

2,426,515

Corporate and Commercial Loans

325,626

532,615

1,622,136

Retail Loans

153,719

236,783

403,366

Credit Cards

90,218

154,755

338,221

Other

62,792

Specific Provisions (-)

116,801

465,980

2,309,082

Corporate and Commercial Loans

66,336

268,395

1,514,875

Retail Loans

32,336

120,031

393,194

Credit Cards

18,129

77,554

338,221

Other

62,792

Net Balance on Balance Sheet

452,762

458,173

117,433

(1)

In the current period, a portfolio of non-performing loans amounting to TL 189,224, of which TL 10 was written-off in prior periods, is sold to Final Varlık Yönetimi A.Ş with a value of TL 29,091.