216 İşbank

Annual Report 2015

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

SECTION FIVE: DISCLOSURES AND FOOTNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

I. DISCLOSURES AND FOOTNOTES ON CONSOLIDATED ASSETS

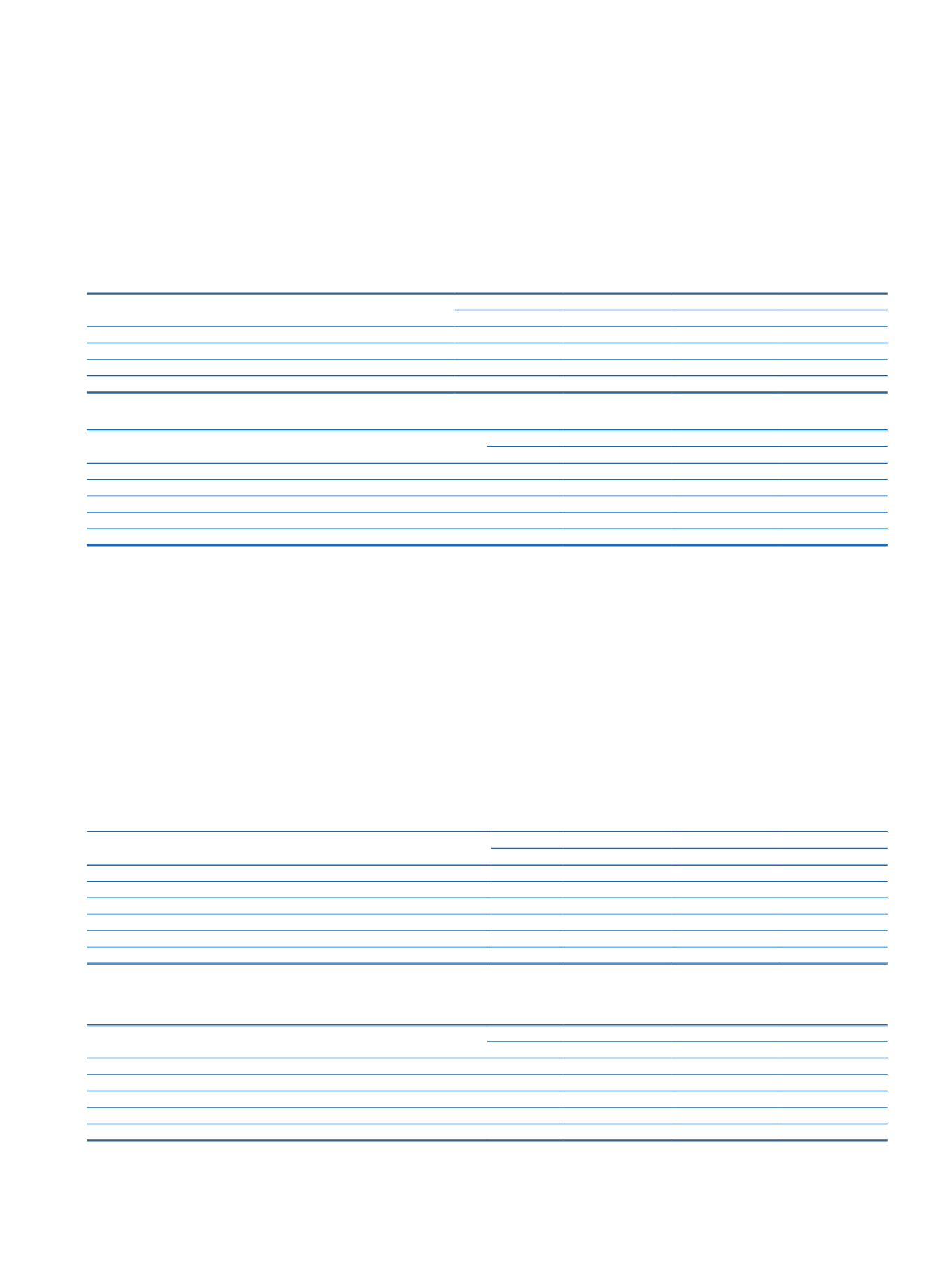

a. Cash and CBRT:

a.1. Information on Cash and Balances with the Central Bank of the Republic of Turkey:

Current Period

Prior Period

TL

FC

TL

FC

Cash in TL / Foreign Currency

1,875,394

792,774

1,623,885

906,882

Central Bank of the Republic of Turkey

1,453,639

28,165,580

3,138,527

19,418,837

Other

202,589

55,416

Total

3,329,033

29,160,943

4,762,412

20,381,135

a.2. Information on Balances with the CBRT:

Current Period

Prior Period

TL

FC

TL

FC

Unrestricted Demand Deposit

1,453,639

3,538,655

3,138,527

2.627.004

Unrestricted Time Deposit

Restricted Time Deposit

Other

(1)

24,626,925

16.791.833

Total

1,453,639

28,165,580

3,138,527

19.418.837

(1)

The amount of reserve deposits held at the Central Bank of the Republic of Turkey regarding the foreign currency liabilities

a.3. Information on reserve requirements:

As per the Communiqué no. 2013/15 “Reserve Deposits” of the Central Bank of the Republic of Turkey (“CBRT”), banks keep reserve deposits at the CBRT for their TL and FC liabilities

mentioned in the communiqué. The reserve deposit rates vary according to their maturity compositions; the reserve deposit rates are realized between 5% - 11.5% for TL deposits

and other liabilities, between 9% - 13% for FC deposits and between 5% - 25% for other FC liabilities. Reserves are calculated and set aside every two weeks on Friday for 14-day

periods. In accordance with the related communiqué, CBRT pays interests TL and USD reserves.

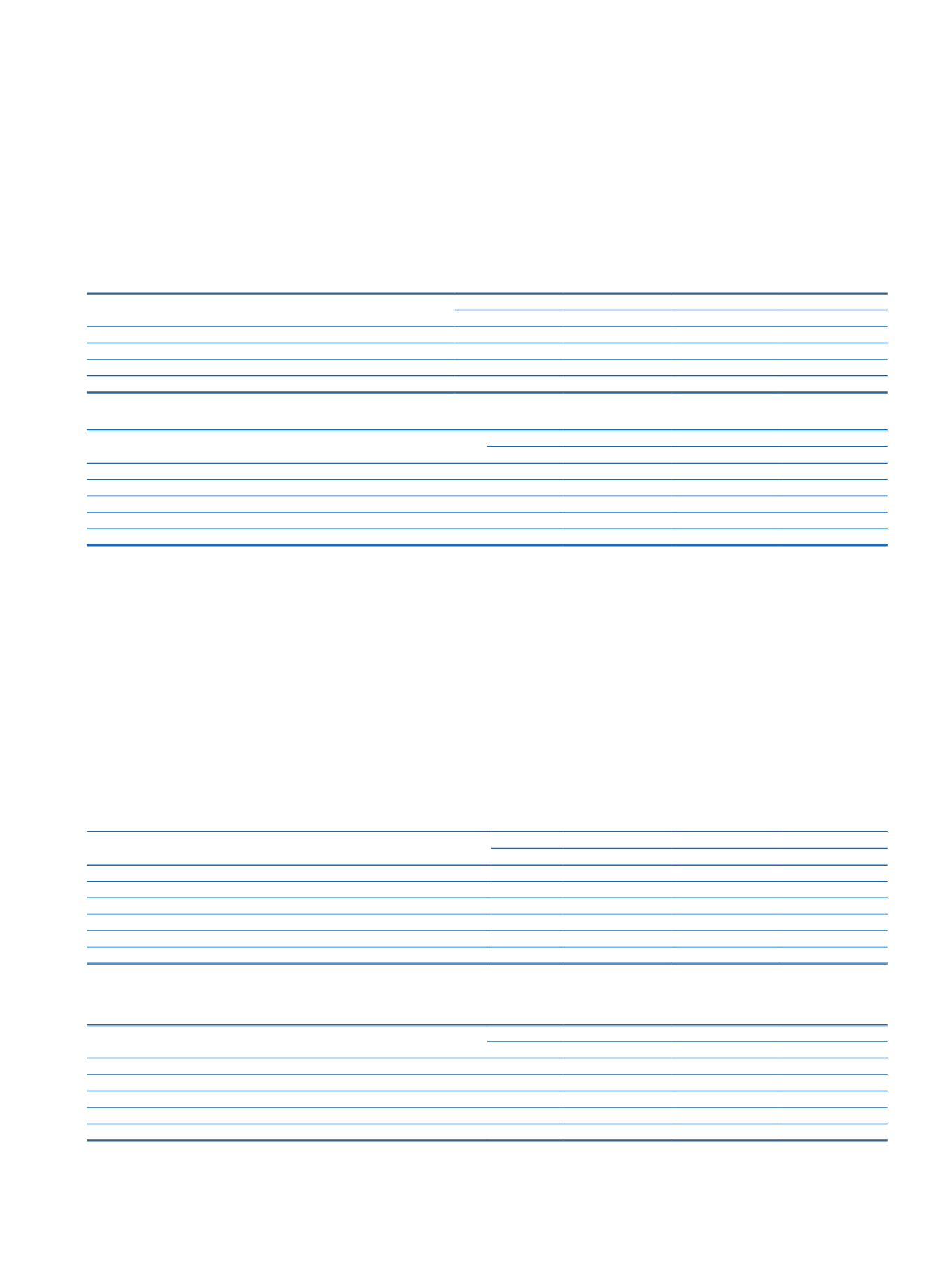

b. Information on Financial Assets at Fair Value through Profit and Loss:

b.1. Financial assets at fair value through profit and loss, which are given as collateral or blocked:

Financial assets at fair value through profit and loss, which are given as collateral or blocked as of 31 December 2015 are amounting to TL 67,766

(31 December 2014: TL 85,724).

b.2. Financial assets at fair value through profit and loss, which are subject to repurchase agreements:

Financial assets at fair value through profit and loss, which are subject to repurchase agreements as of 31 December 2015 are amounting to TL 364,261

(31 December 2014: TL 318,315).

b.3. Positive differences on derivative financial assets held for trading:

Current Period

Prior Period

TL

FC

TL

FC

Forward Transactions

27,489

49,423

26,197

31,501

Swap Transactions

120,036

1,120,515

202,935

737,716

Futures

36

8

Options

1,708

97,169

2,352

67,078

Other

13

35,610

7

13,277

Total

149,282

1,302,717

231,499

849,572

c. Information on Banks:

c.1. Information on banks:

Current Period

Prior Period

TL

FC

TL

FC

Banks

Domestic Banks

1,574,532

2,951,273

3,123,784

1,293,062

Foreign Banks

83,847

1,766,442

286,035

1,303,576

Foreign Head Office and Branches

Total

1,658,379

4,717,715

3,409,819

2,596,638