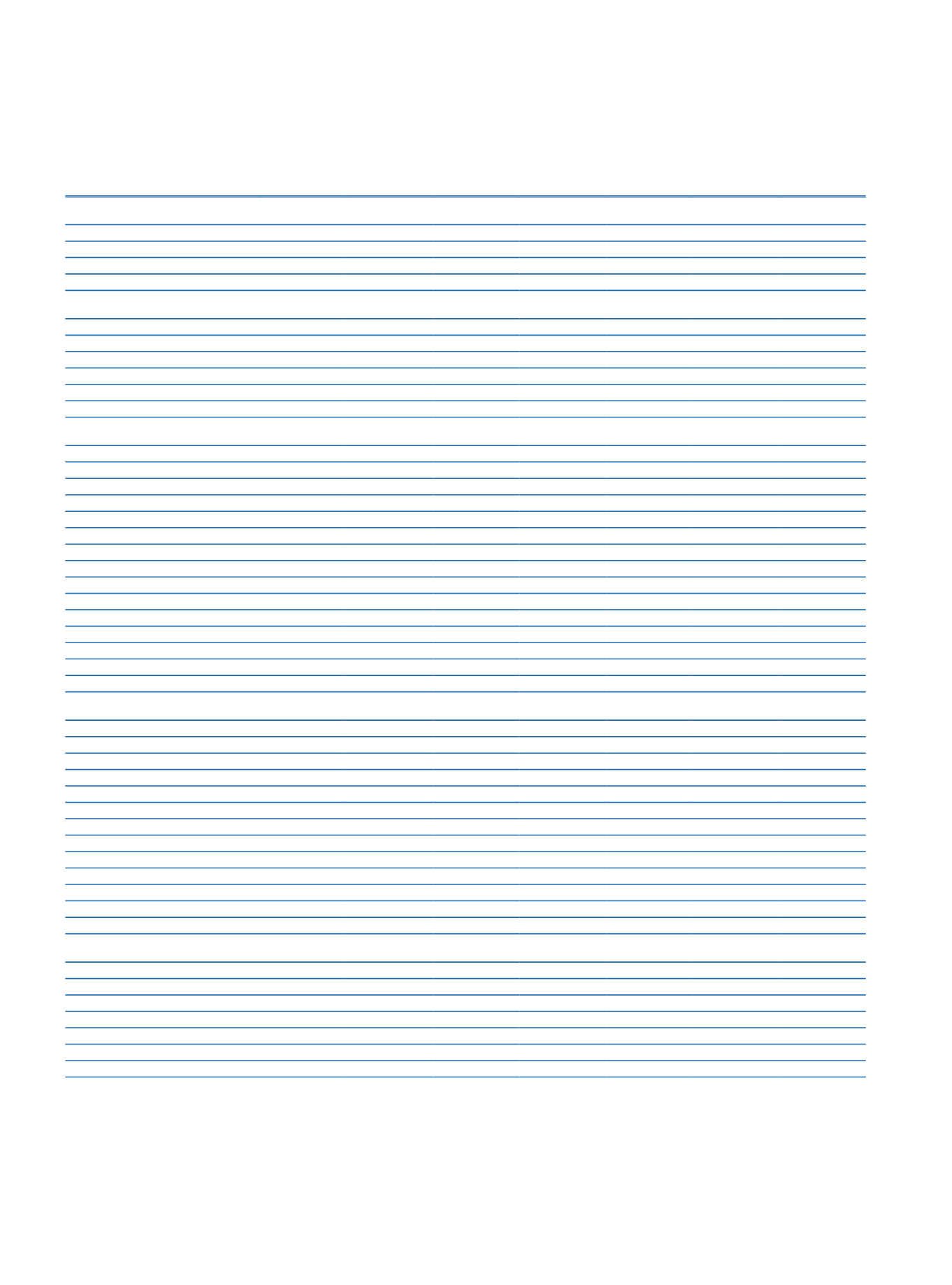

215

Financial Information and Risk Management

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

Prior Period

Corporate

Commercial

Retail

Private

Treasury/

Investment

Unallocated

Total

OPERATING INCOME/EXPENSE

Interest Income

17.752.690

Interest Income from Loans

3,164,256

5,938,353

3,931,362

23,248

254,447

13,311,666

Interest Income from Banks

194,568

194,568

Interest Income fromMoney Market

Transactions

15,067

15,067

Interest Income from Securities

3,931,245

3,931,245

Finance Lease Income

70,071

116,561

186,632

Other Interest Income

58,445

23,614

5,918

25,535

113,512

Interest Expense

9,282,281

Interest Expense on Deposits

698,808

931,037

2,434,589

1,034,964

503,638

5,603,036

Interest Expense on Funds Borrowed

298,055

482,494

780,549

Interest Expense on Money Market

Transactions

1,762,400

1,762,400

Interest Expense on Securities Issued

1,071,177

1,071,177

Other Interest Expense

65,119

65,119

Net Interest Income

8,470,409

Net Fees and Commissions Income

1,505,183

Fees and Commissions Received

240,218

1,167,392

898,592

11,742

91,388

25,245

2,434,577

Fees and Commissions Paid

340,518

233,374

70

24,534

330,898

929,394

Dividend Income

292,047

292,047

Trading Income/Loss (Net)

664,128

664,128

Other Income

2,426,119

1,534,369

224,677

241

254,964

684,388

5,124,758

Prov. for Loans and Other Receivables

22,415

431,642

495,132

190

3

580,731

1,530,113

Other Operating Expense

2,104,486

1,999,594

1,413,959

11,930

323,470

3,645,939

9,499,378

Income Before Tax

5,027,034

Tax Provision

1,006,617

Net Period Profit

4,020,417

Group Profit/Loss

3,523,719

Non-controlling Interest’s Shares’ Profit/

Loss

496,698

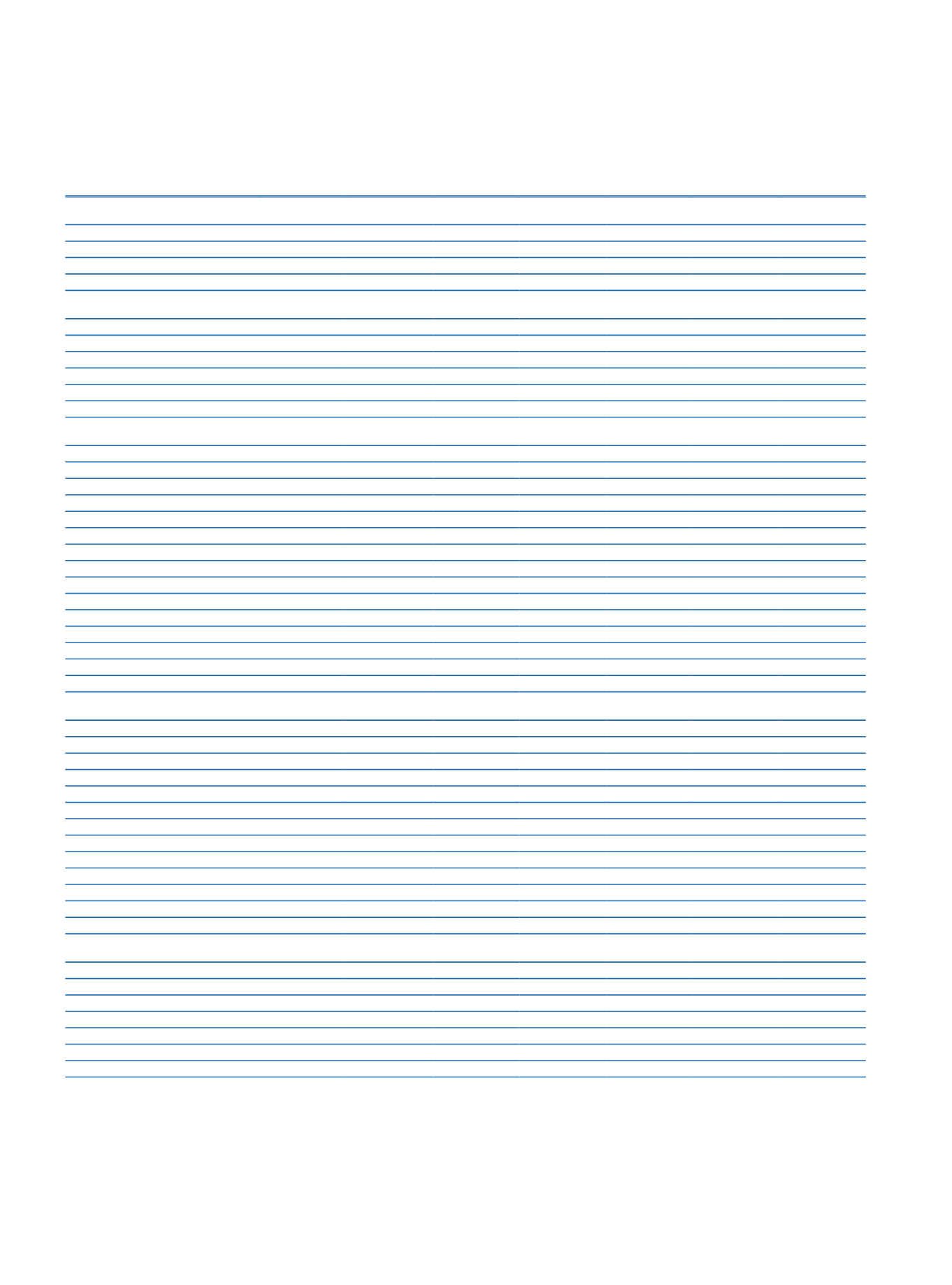

SEGMENT ASSETS

Fin. Assets At Fair Value Through P/L

2,260,170

2,260,170

Banks and Other Financial Institutions

6,006,457

6,006,457

Money Market Placements

263,559

263,559

Financial Assets Available for Sale

45,677,129

45,677,129

Loans and Receivables

61,584,680

64,176,931

36,942,468

250,548

26,639

5,346,822 168,328,088

Investments Held to Maturity

1,391,860

1,391,860

Associates and Subsidiaries

5,611,155

5,611,155

Lease Receivables

1,220,196

1,523,651

2,352

2,746,199

Other

1,489,261

233,629

1,387,651

41,678,074

44,788,615

277,073,232

SEGMENT LIABILITIES

Deposits

17,823,229

27,546,652

59,404,916

17,447,516

12,278,913

134,501,226

Derivative Financial Liabilities Held for

Trading

749,841

749,841

Funds Borrowed

13,507,931

20,668,141

34,176,072

Money Market Funds

22,304,769

22,304,769

Marketable Securities Issued

(1)

21,865,876

21,865,876

Other Liabilities

(2)

50,960

166,890

18,169,517

18,387,367

Provisions

12,083,515

12,083,515

Shareholders’ Equity

33,004,566

33,004,566

277,073,232

(1)

The amount of TL 3,268,784 of Includes Tier 2 subordinated bonds which are classified on the balance sheet as subordinated loans.

(2)

The borrower funds are presented in “Other Liabilities”.