206 İşbank

Annual Report 2015

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

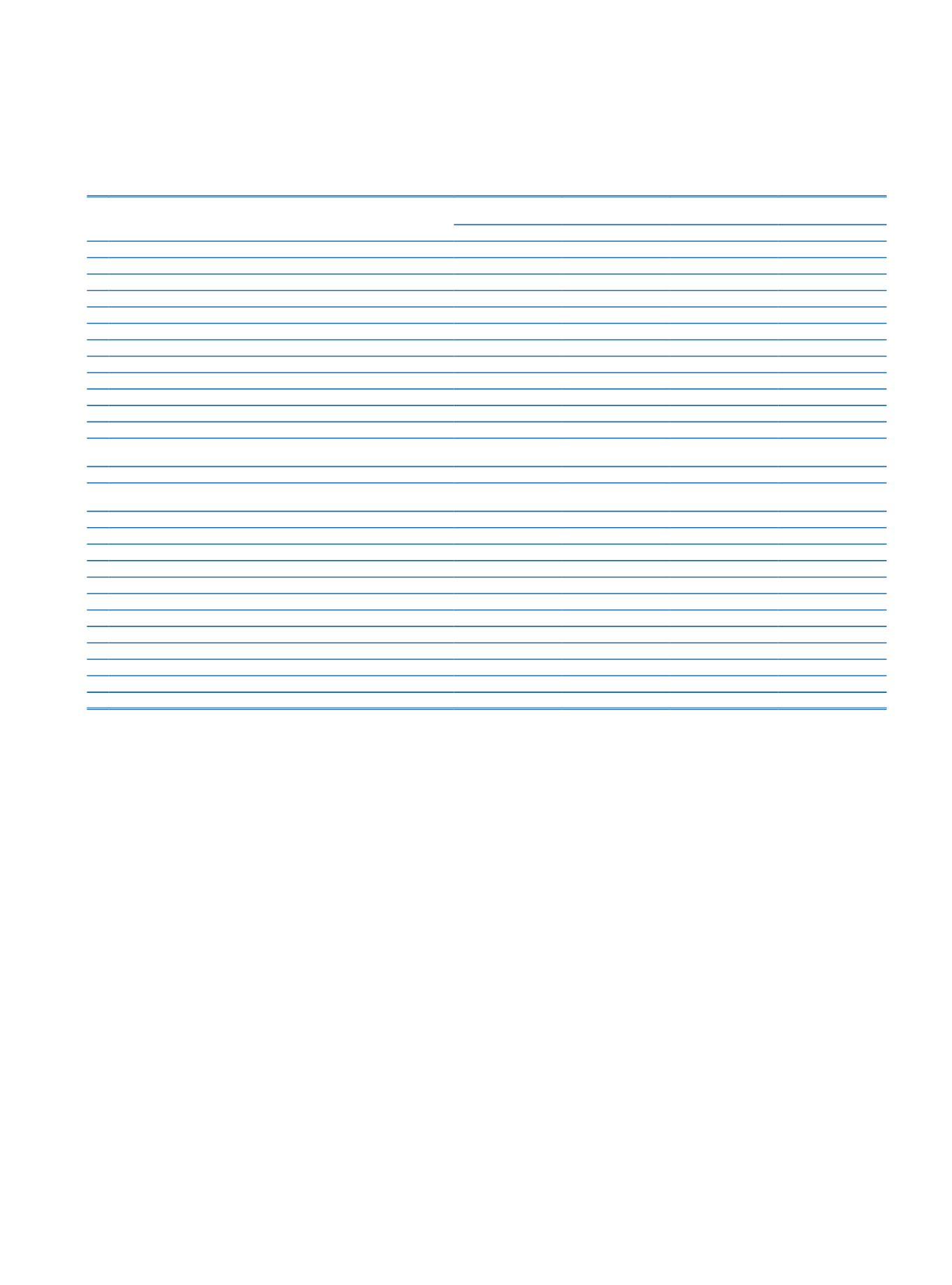

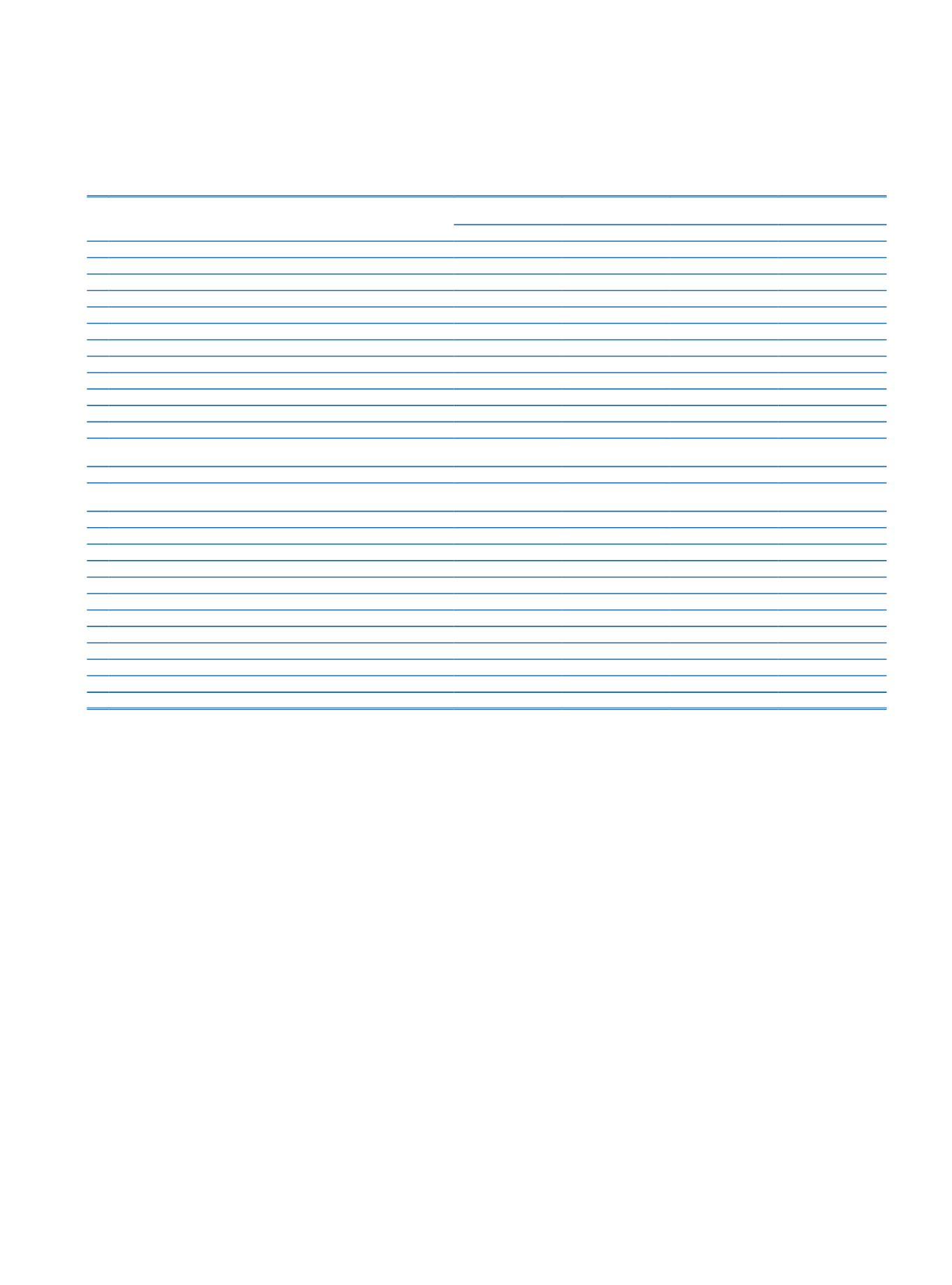

Prior Period

Total Unweighted Value

(average)

Total Weighted Value

(average)

TL+FC

FC

TL+FC

FC

HIGH QUALITY LIQUID ASSETS

1 High Quality Liquid Assets

33,641,192

18,658,920

CASH OUTFLOW

2 Retail and Small Business Customers

94,335,266

40,951,503

7,483,178

3,339,813

3 Stable deposit

39,006,968

15,106,728

1,950,348

755,336

4 Less stable deposits

55,328,298

25,844,775

5,532,830

2,584,477

5 Unsecured wholesale funding

40,389,063

18,439,410

24,753,057

10,581,500

6 Operational deposits

1,069,278

6,223

267,319

1,556

7 Non-operational deposits

27,166,929

17,377,577

14,984,256

9,640,147

8 Other unsecured funding

12,152,856

1,055,610

9,501,482

939,797

9 Secured funding

56,324

8,632

10 Other cash outflow

23,099,753

16,834,039

23,099,753

16,834,039

11

Derivatives cash outflow and liquidity needs related to market valuation

changes on derivatives or other transactions

23,099,753

16,834,039

23,099,753

16,834,039

12 Obligations related to structured financial products

13

Commitments related to debts to financial markets and other off-balance

sheet obligations

14 Other revocable off-balance sheet commitments and contractual obligations

54,660,719

30,583,815

2,733,036

1,529,191

15 Other irrevocable or conditionally revocable off-balance sheet obligations

37,591,070

2,136,448

3,852,698

277,690

16 TOTAL CASH OUTFLOW

61,978,046

32,570,865

CASH INFLOW

17 Secured lending

25,950

13,359

19,271

6,679

18 Unsecured lending

16,541,559

5,535,009

11,537,887

4,738,661

19 Other cash inflows

21,269,323

17,378,646

21,269,323

17,378,646

20 TOTAL CASH INFLOW

37,836,832

22,927,014

32,826,481

22,123,986

Total Adjusted Value

21 TOTAL HQLA Stock

33,641,192

18,658,920

22 TOTAL NET CASH OUTFLOWS

29,151,565

11,159,173

23 LIQUIDTY COVERAGE RATIO (%)

115.66

170.59

Between 30 September 2015 and 31 December 2015, while FC liquidity coverage ratio decreased from 206.46% to 165.75% due to decline in high quality liquid assets and the

negative impact of the derivative transactions, total liquidity coverage ratio increased from 102.52% to 103.59% due to the decrease in monthly cash outflows.

The Liquidity Coverage Ratio which has been introduced to ensure banks to preserve sufficient stock of high quality assets to meet their net cash outflows that may occur in the short

term is calculated as per the Communiqué on “Measurement and Assessment of the Liquidity Coverage Ratio of Banks’. The ratio is directly affected by the level of unencumbered high

quality assets which can be liquidated at any time and net cash inflows and outflows arising from the Bank’s assets, liabilities and off-balance sheet transactions.

The Bank’s high quality liquid asset stock primarily consists of cash, the accounts held at CBRT and unencumbered government bonds which are issued by Turkish Treasury.

The Bank’s principal source of funding is deposits. In terms of non-deposit borrowing, funds received from repurchase agreements, marketable securities issued and funds borrowed

from financial institutions are among the most significant funding sources of the Bank.

In order to manage liquidity effectively, concentration of liquidity sources and usages should be avoided. Due to the strong and stable core deposit base of the Bank, deposits are

received from a diversified customer portfolio. In addition, in order to provide diversification in liquidity sources and usages, liquidity concentration limits are used effectively. Total

amount of funds borrowed from a single counterparty or a risk group is closely and instantaneously monitored, taking liquidity concentration limits into account. Cash flows of

derivatives that will take place within 30 days are taken into account in calculation of liquidity coverage ratio. Cash outflows of derivatives that arise frommargin obligations, are

reflected to the results in accordance with the methodology articulated in the related legislation.

Liquidity risk of the Bank, its foreign branches and subsidiaries that are to be consolidated are managed within the regulatory limits and in accordance with the group strategies.

For the purposes of effectiveness and sustainability of liquidity management, funding sources of group companies and funding diversification opportunities in terms of markets,

instruments and tenor are evaluated and liquidity position of the group companies are monitored continuously by the Bank.