197

Financial Information and Risk Management

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

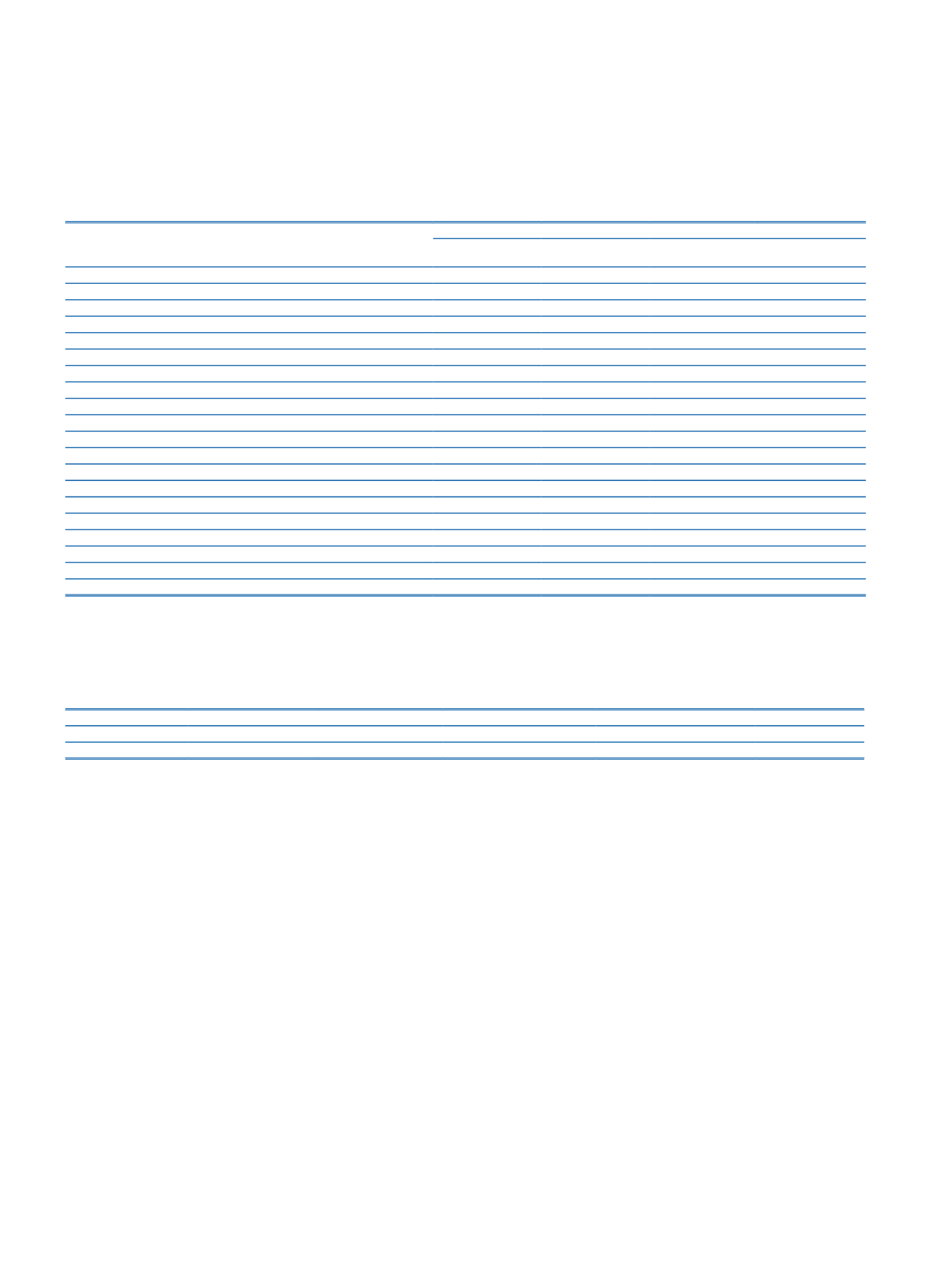

16. Miscellaneous Information According to Type of Counterparty of Major Sectors

Loans

Significant Sectors/Counterparty

(1)

Impaired

Non-

performing

(2)

Value

Adjustments

(3)

Provisions

(4)

Agricultural

58,259

15,648

694

42,860

Farming and Raising Livestock

53,178

13,974

565

38,406

Forestry

3,765

1,418

63

3,278

Fishing

1,316

256

66

1,176

Industry

760,308

96,589

4,368

608,963

Mining

74,757

4,168

208

72,043

Production

630,294

79,294

4,095

483,187

Electricity, gas, and water

55,257

13,127

65

53,733

Construction

495,894

107,108

4,997

407,222

Services

1,031,918

285,214

15,722

794,244

Wholesale and Retail Trade

588,281

144,031

8,003

485,251

Hotel, Food and Beverage Services

142,996

27,653

1,271

81,297

Transportation and Telecommunication

100,345

62,456

4,425

71,741

Financial Institutions

9,502

1,730

60

9,032

Real Estate and Renting Services

109,592

36,441

924

91,620

Self-Employment Services

61,355

9,418

528

40,161

Education Services

4,783

758

325

4,079

Health and Social Services

15,064

2,727

186

11,063

Other

1,573,852

919,384

101,816

1,038,574

Total

3,920,231

1,423,943

127,597

2,891,863

(1)

Amount includes finance lease and factoring receivables.

(2)

Refers to loans overdue up to 90 days and financial leasing receivables overdue up to 150 days. Related items included in the invoiced leasing receivables, commercial installment loans and installment consumer

loans are given only in the overdue amounts, the payment of these loans outstanding principal amounts of TL 1,161,793 and TL 1,962,187 respectively. Invoiced but not matured leasing receivables is amounting to TL

210,022.

(3)

Refers to the general provisions for non-performing loans.

(4)

Refers to specific provision for impaired loans

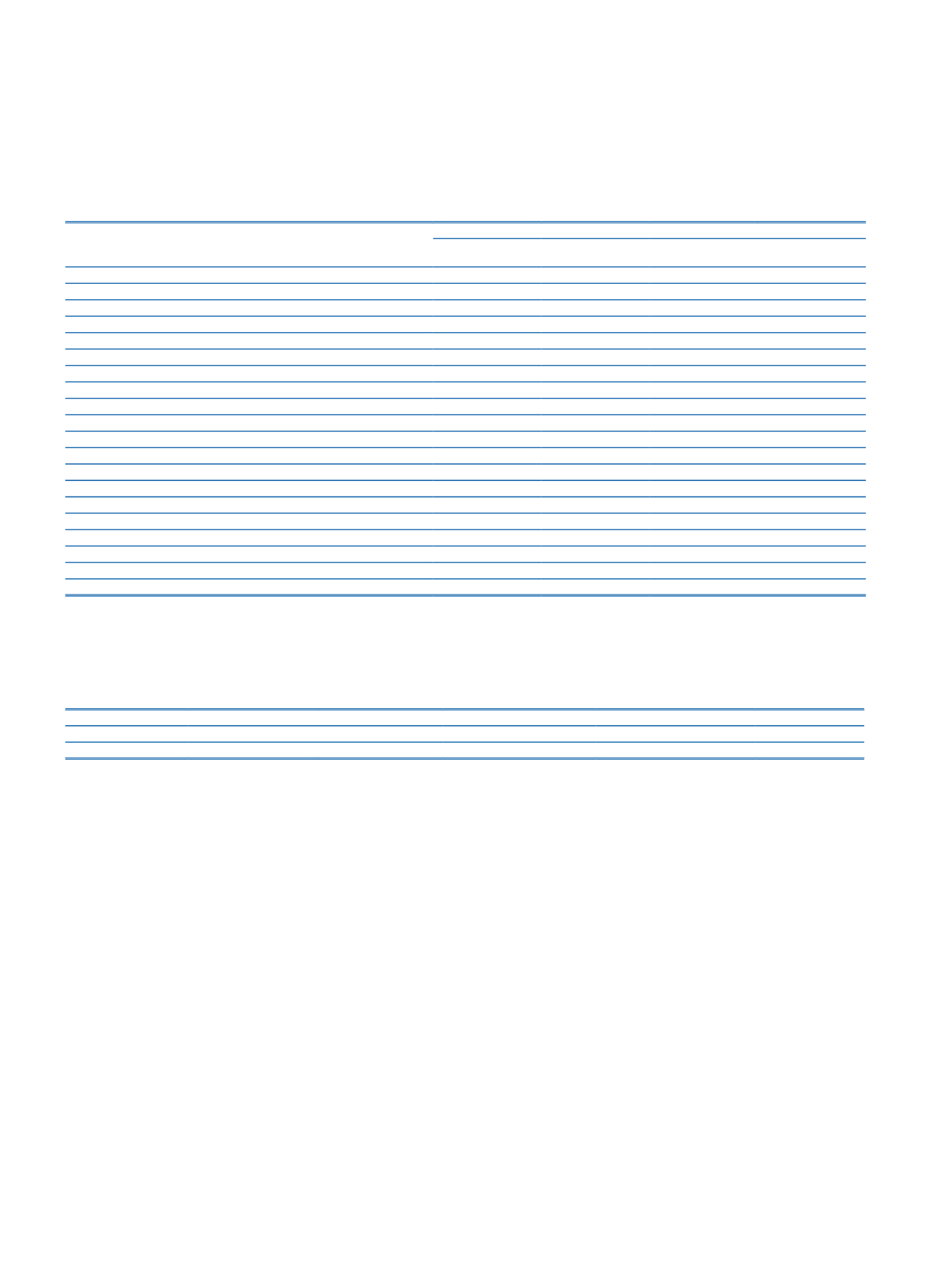

17. Information on Value Adjustments and Change in Credit Provisions

Beginning Balance

Provisions

Reversal of Provisions

Other Value Adjustments

(1)

Ending Balance

Specific Provisions

2,004,705

1,474,489

(597,825)

10,494

2,891,863

General Provisions

2,479,770

569,074

(35,760)

2,308

3,015,392

(1)

Stating foreign exchange gains and losses.

III. Explanations on Consolidated Market Risk:

1. Explanations on Consolidated Market Risk:

The market risk carried by the Group is measured by two separate methods known respectively as the Standard Method and the Value at Risk (VAR) Method in accordance with the

local regulations adopted from internationally accepted practices. In this context, currency risk emerges as the most important component of the market risk. The consolidated market

risk measurements are carried out on a quarterly basis, using the Standard Method. The results are accounted in the legal reporting and evaluated with the top management.

The VAR Method is another alternative for the Standard Method in measuring and monitoring market risk carried by the Parent Bank. This model is used to measure the market risk on

a daily basis in terms of interest rate risk, currency risk and equity share risk and is a part of the Parent Bank’s daily internal reporting. Further retrospective testing (back-testing) is

carried out on a daily basis to determine the reliability of the daily risk calculation by the VAR model, which is used to estimate the maximum possible loss for the following day.

Scenario analyses which support the VAR method used to measure the losses that may occur in the ordinary market conditions are practiced, and the possible impacts of scenarios

that are developed based on the future predictions and the past crises, on the value of the Parent Bank’s portfolio are determined and the results are reported to the Top Executive

Management. Financial participations also make VAR calculations within the frame determined by the Parent Bank, and the results are reported to the Parent Bank’s top management.

The limits set for the market risk management within the framework of the Parent Bank’s asset liability management risk policy, are monitored by the Risk Committee and reviewed in

accordance with the market conditions.

The following table shows details of the consolidated market risk calculations carried out within the context of “Standard Method for Market Risk Measurement” and in compliance

with “Regulation on Measurement and Evaluation of Capital Adequacy of Banks” as at 31 December 2015.