204 İşbank

Annual Report 2015

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

c.

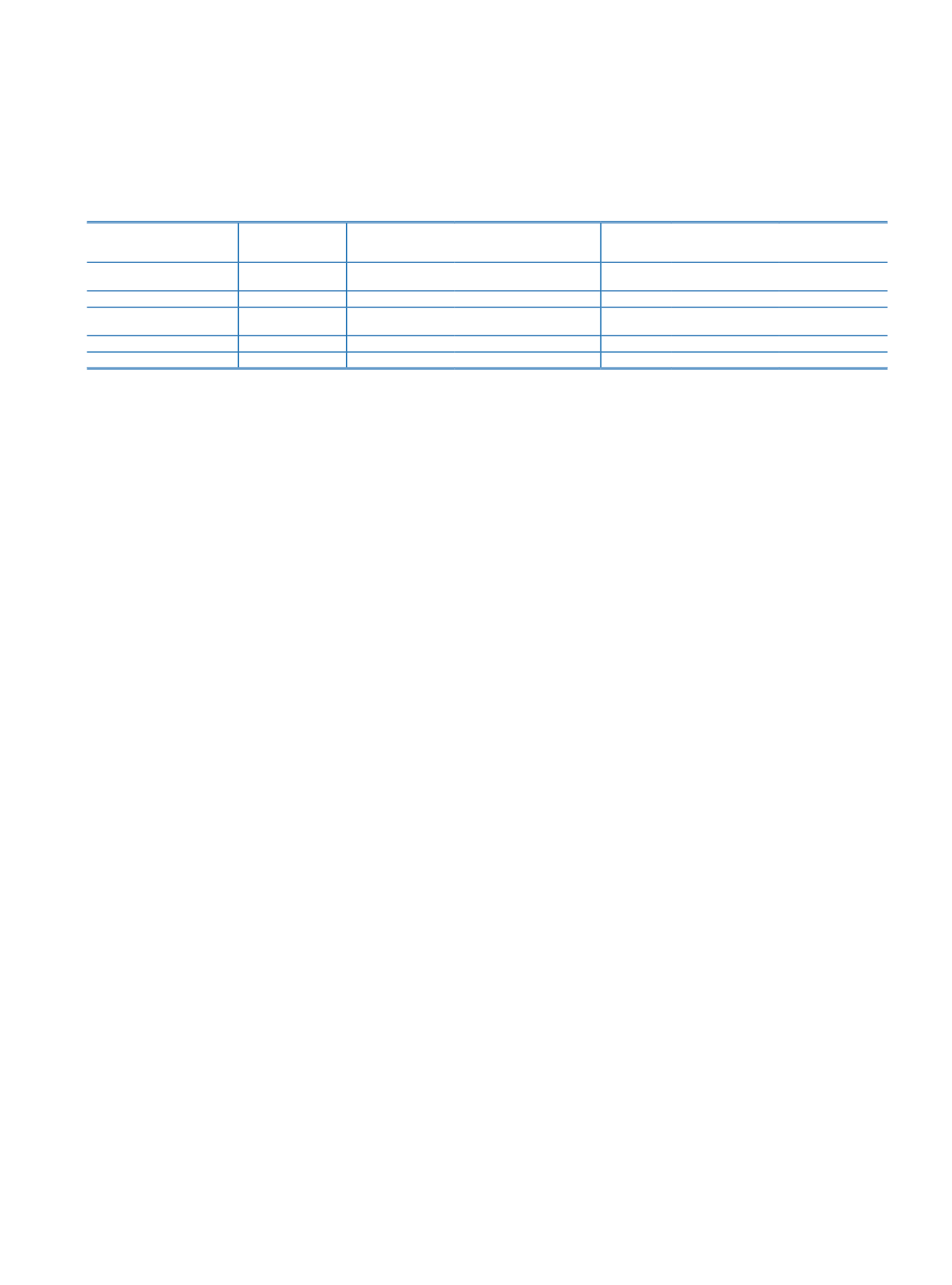

Unrealized gains and losses on investment in stocks, revaluation increases with the amounts of main and additive capital:

Portfolio

Realized Gains/

losses During the

period

Revaluation Increases

Unrealized Gains

Total

Including to the Capital

Contribution

Total

Including in to the

main capital

Including to the

Capital Contribution

Private Equity Investments

Shares Traded on a Stock

Exchange

2,219,941

2,219,941

Other Stocks

Total

2,219,941

2,219,941

VIII. Explanations on Liquidity Risk Management and Liquidity Coverage Ratio

Liquidity risk may occur as a result of funding long-term assets with short-term liabilities. The Bank’s liquidity is managed by the Asset-Liability Management Committee in accordance

with the business strategies, legal requirements, current market conditions and expectations regarding the economic and financial conjuncture.

The Bank’s principal source of funding is deposits. Although the average maturity of deposits is shorter than that of assets as a result of the market conditions, the Bank’s wide

network of branches and stable core deposit base are its most important safeguards of funding. Additionally, the Bank borrows medium and long-term funds from institutions abroad.

Concentration limits are generally used in deposit and non-deposit borrowings in order to prevent adverse effects of concentrations in the liquidity risk profile of the Bank.

In order to meet the liquidity requirements that may arise frommarket fluctuations, considerable attention is paid to the need to preserve liquidity and efforts in this respect are

supported by projections of Turkish Lira and Foreign Currency (FC) cash flows. The term structure of TL and FC deposits, their costs and amounts are monitored on a daily basis.

During these studies historical events and future expectations are taken into account as well. Based upon cash flow projections, prices are differentiated for different maturities and

measures are taken accordingly to meet liquidity requirements. Moreover, potential alternative sources of liquidity are determined to be used in case of extraordinary circumstances.

The liquidity risk exposure of the Bank has to be within the risk capacity limits which are prescribed by the legislation and the Bank’s risk appetite defined in its business strategy. It is

essential for the Bank to have an adequate level of unencumbered liquid asset stock which can be sold or pledged, in case a large amount of reduction in liquidity sources occurs. The

level of liquid asset bufferis determined in accordance with the liquidity risk tolerance which is set by the Board of Directors. Asset-Liability Management Committee is responsible for

monitoring the liquidity position, determining appropriate sources of funds and deciding the maturity structure in accordance with the limits which are set by the Board of Directors.

The Treasury Division is responsible for monitoring the liquidity risk, in accordance with the Asset and Liability Risk Policy limits, objectives set out in the business plan and the

decisions taken at the meetings of Asset-Liability Management Committee. The Treasury Division is also responsible for making liquidity projections and taking necessary precautions

to reduce liquidity risk, by using the results of stress testing and scenario analysis. Within this scope, Treasury Division is monitoring the Turkish Lira (TL) and foreign currency (FC)

liquidity position instantly and prospectively based on the information provided from the branches, business units and IT infrastructure of the Bank. The assessment of long-term

borrowing opportunities is carried out regularly in order to balance the cash inflows and outflows and to mitigate the liquidity risk. The Bank creates liquidity through repurchase

agreements and secured borrowings based on the high quality liquid asset portfolio, through securitization and other structured finance products which are created from the asset

pools like credit card receivables and retail loans.

The Bank applies liquidity stress tests to measure liquidity risk. These liquidity stress tests reveal the Bank’s liquid assets’ ability to cover cash outflows within one-month-horizon.

Liquidity adequacy limits for TL and FC are determined by Board of Directors, based on the liquidity requirements and risk tolerance of the Bank. The liquidity risk is measured by the

Risk Management Division and results are reported to the related executive functions, senior management and Board of Directors.

It is essential for the Bank to monitor the liquidity position and funding strategy continuously. In case of a liquidity crisis that may arise from unfavorable market conditions,

extraordinary macroeconomic situations and other reasons which are beyond the control of the Bank, “Emergency Action and Funding Plan” is expected to be commissioned. In that

case, aforementioned committees have to report the precautions taken and their results to the Board of Directors through Audit Committee.

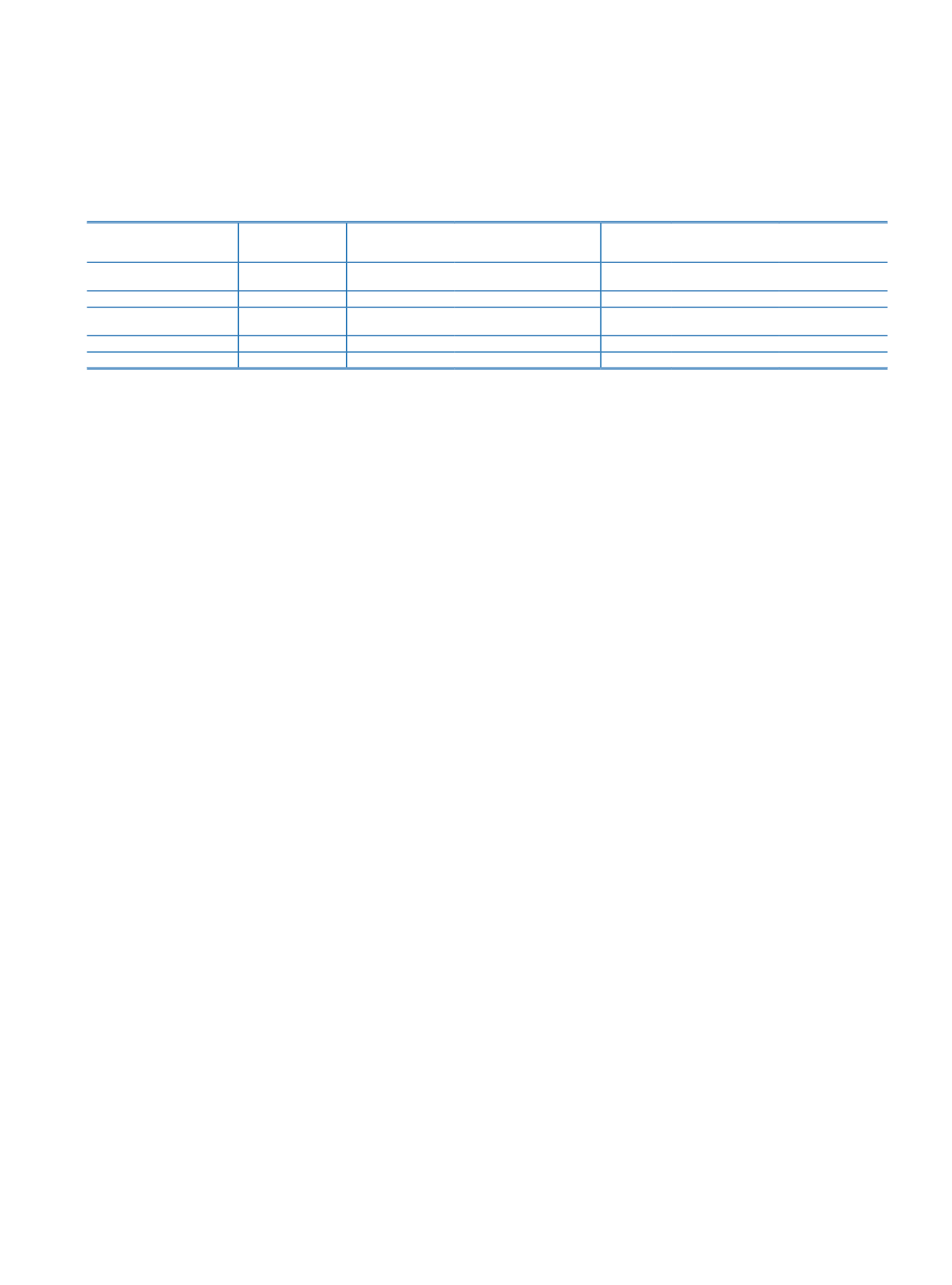

The Bank’s Foreign Currency (FC) and total (TL+FC) liquidity coverage ratio (LCR) averaged for the last three months are given below