198 İşbank

Annual Report 2015

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

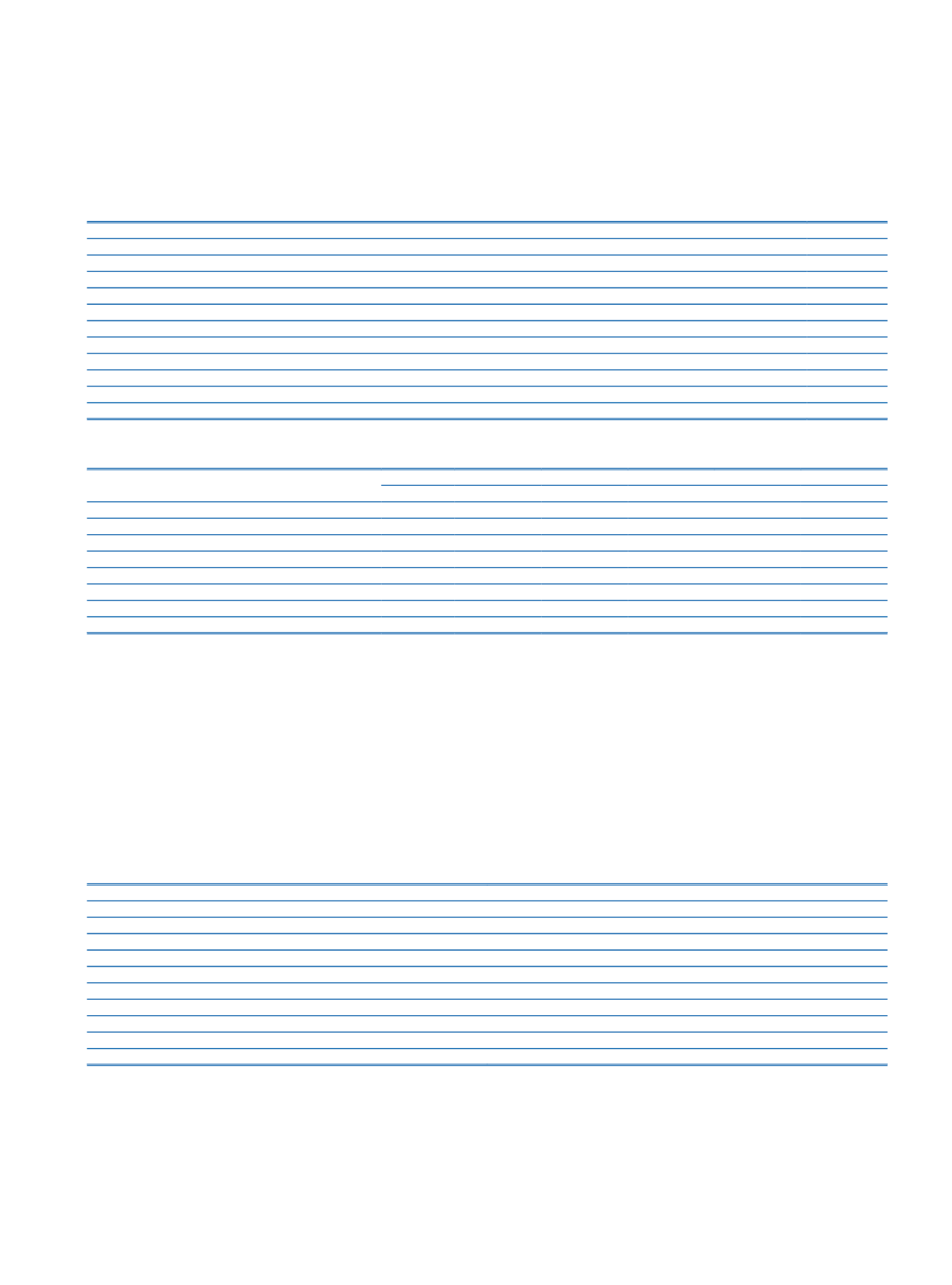

1.a. Information on the market risk:

Amount

(I) Capital Requirement against General Market Risk – Standard Method

84,577

(II) Capital Requirement against Specific Risk – Standard Method

103,609

Capital Requirement for Specific Risk Related to Securitization Positions-Standard Method

(III) Capital Requirement against Currency Risk – Standard Method

398,842

(IV) Capital Requirement against Commodity Risk – Standard Method

40,216

(V) Capital Requirement against Exchange Risk – Standard Method

1,119

(VI) Capital Requirement against Market Risk of Options – Standard Method

14,073

(VII) Capital Requirement against Counterparty Credit Risk-Standard Method

90,895

(VIII) Capital Requirement against Market Risks of Banks Applying Risk Measurement Models

(IX) Total Capital Requirement against Market Risk (I+II+III+IV+V+VI+VII)

733,331

(X) Value at Market Risk (12.5 x VIII) or (12.5 x IX)

9,166,638

1.b. Table of the average market risk related to the market risk calculated quarterly during the period:

Current Period

Prior Period

Average

Highest

(1)

Lowest

(1)

Average

Highest

(1)

Lowest

(1)

Interest Rate Risk

95,534

89,228

87,986

77,490

83,508

76,256

Share Certificate Risk

81,044

75,299

96,256

81,263

99,104

70,765

Currency Risk

437,728

480,358

403,235

325,962

439,237

192,937

Commodity Risk

38,095

35,330

25,029

27,013

39,306

22,933

Settlement Risk

760

2,643

445

310

Options Risk

8,703

13,559

4,981

4,441

7,363

2,961

Counterparty Credit Risk

93,389

102,022

78,273

71,062

63,490

108,691

Total Value at Risk

9,440,662

9,980,488

8,697,000

7,345,950

9,150,100

5,935,663

(1)

Market risk elements are presented for the monthly periods where total value at risk is minimum and maximum.

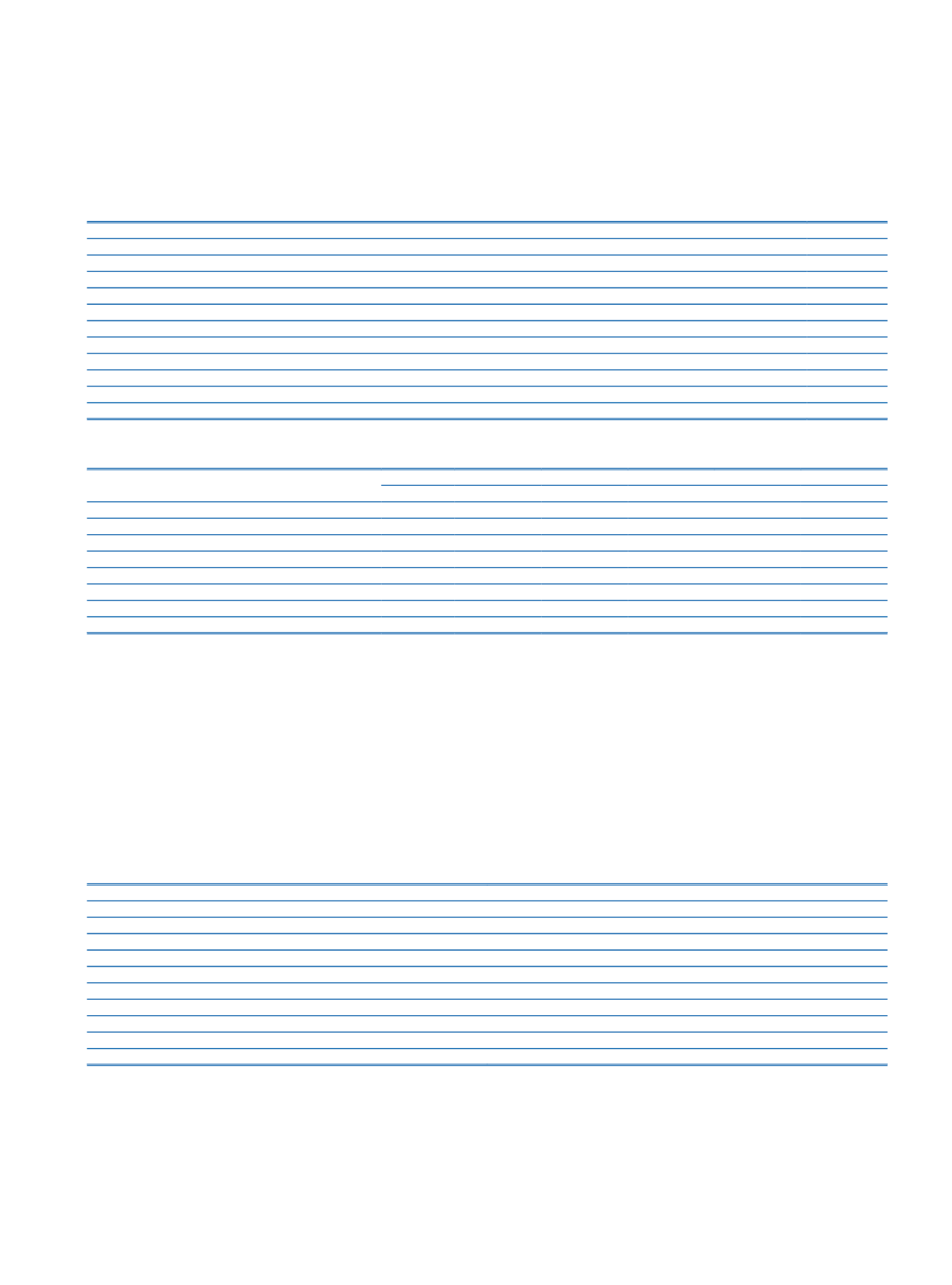

2. Information on counterparty credit risk:

A counterparty credit risk, which is accounts for trading derivatives and repo transactions tracked on both sides, such as the credit risk the liability arising from transactions, is

determined by the methodology which is used according to the Appendix-2 of the “Regulation on Measurement and Evaluation of Capital Adequacy of Banks” which is published on

the Official Gazette no.28337 dated 28 June 2012 and became effective starting from 1 July 2007. Counterparty credit risk valuation method based on the calculation of the fair value

of the derivative transactions is implemented. The calculation of the amount of risk on derivative transactions, the potential amount of credit risk is positively correlated with the

sum of the costs of renewal. The calculation of the amount of the potential credit risk of the contract amount is multiplied by the rates given in the regulation. Derivative instruments

valuation based on replacement costs and the fair value of the related contracts are obtained.

The Bank is exposed to counterparty credit risk is managed within the framework of general principles and guarantees the credit limit allocation. Exposure to credit risk of derivative

transactions with banks due to the majority of reciprocal agreements signed with related parties are subject to the daily exchange of collateral, counterparty credit risk exposure

is reduced in this way. On the other hand, the calculation of capital adequacy under the legislation of counterparty credit risk, the risk-reducing effect of such agreements is not

considered.

Within the scope of trading accounts with credit derivatives acquired or disposed of by the Bank does not have any protection.

Quantitative information on counterparty risk (31 December 2015)

Amount

Interest-Rate Contracts

150,069

Foreign-Exchange-Rate Contracts

536,388

Commodity Contracts

96,410

Equity-Shares Related Contracts

1,236

Other

Gross Positive Fair Values

966,246

Netting Benefits

Net Current Exposure Amount

Collaterals Received

Net Derivative Position

1,750,349

IV. Explanations on Consolidated Operational Risk

The operational risk capital requirement is calculated according to Regulation on Measurement and Evaluation of Capital Adequacy of Banks’ article number 24, is measured using the

Basic Indicator Approach once a year in parallel with domestic regulations. As of 31 December 2015 the consolidated operational risk amount is TL 19,117,210 information about the

calculation is given below.