194 İşbank

Annual Report 2015

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

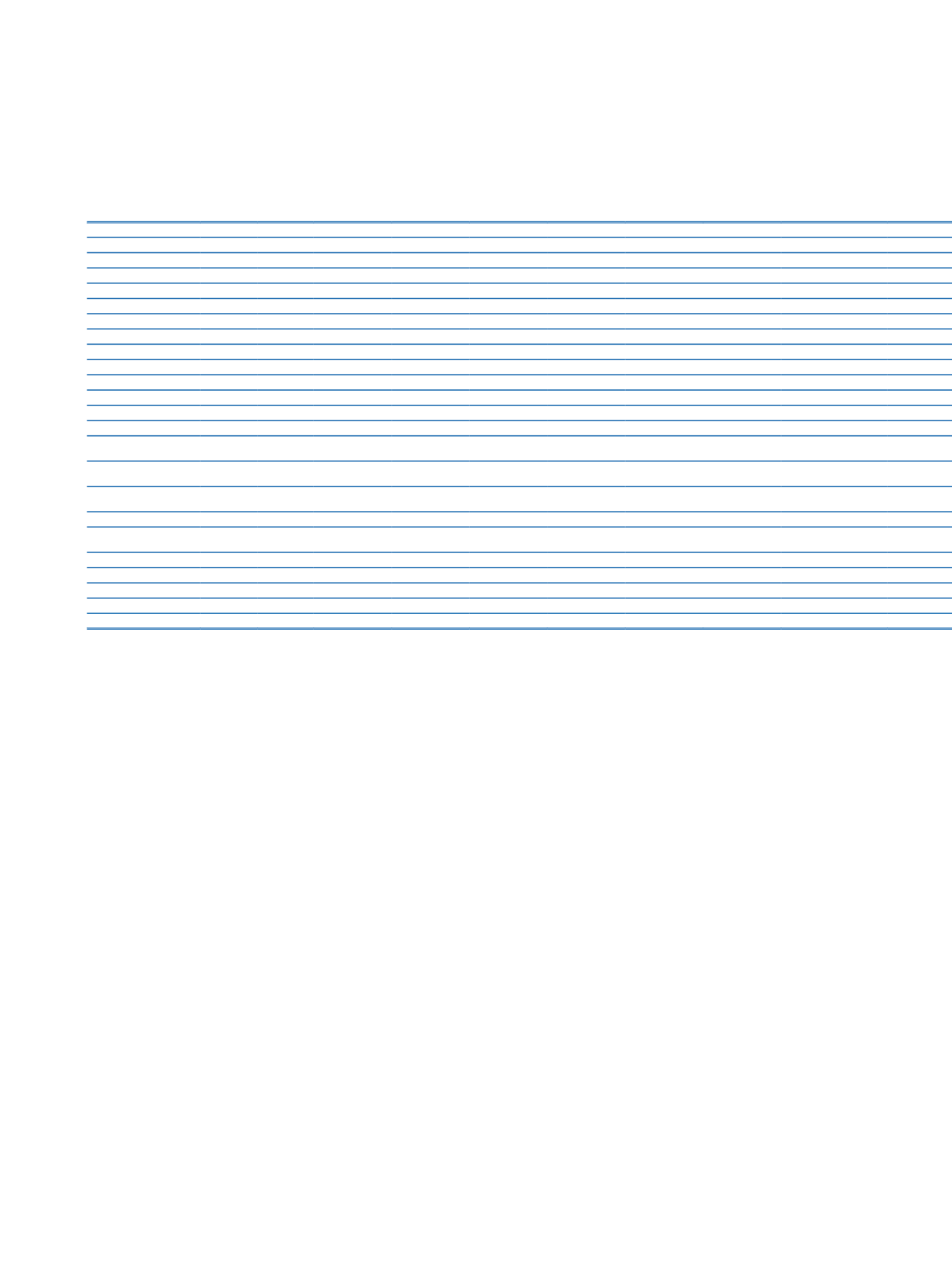

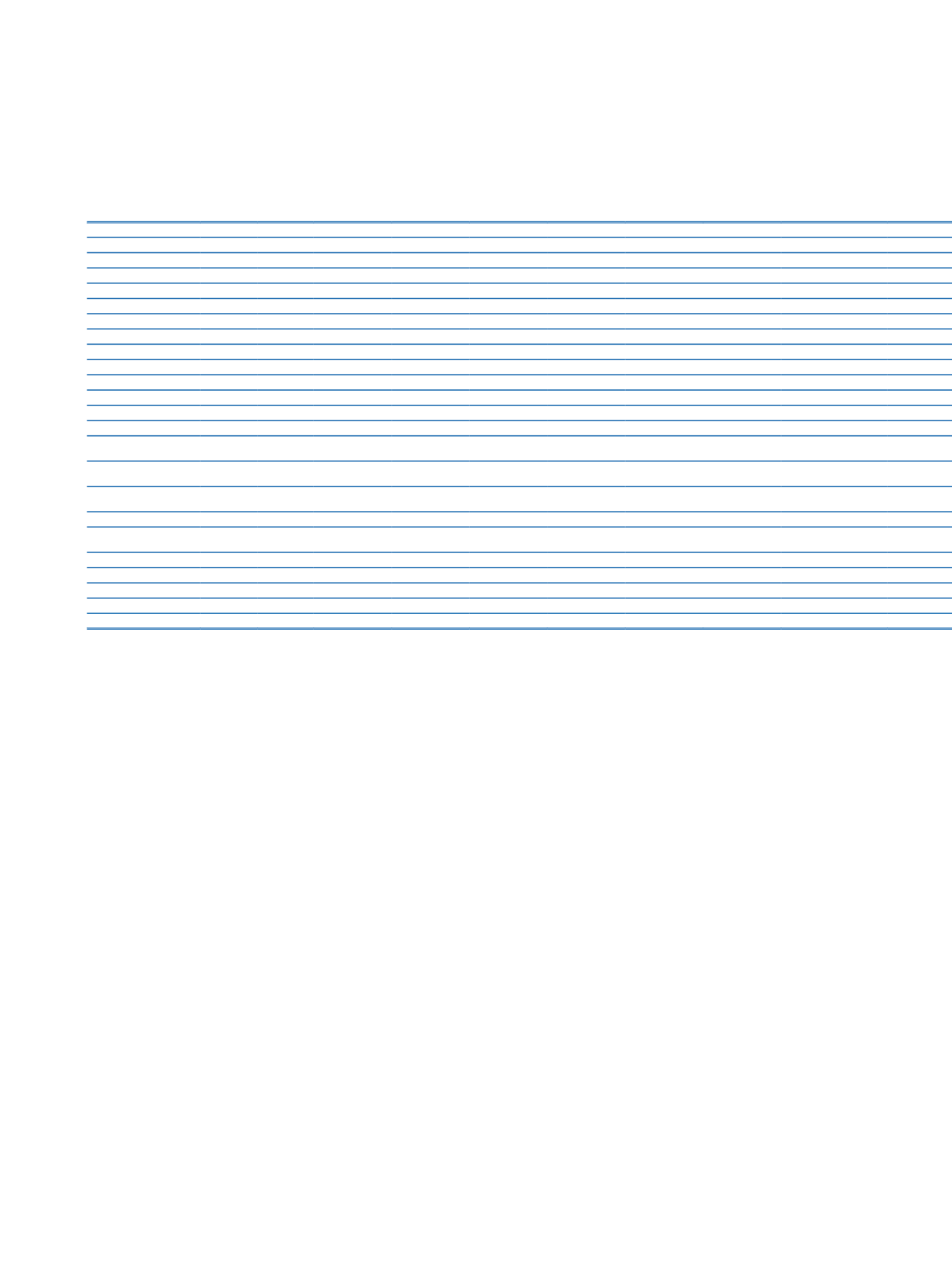

13. Risk Profile by Sectors or Counterparties:

Current Period

Consolidated

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

Sectors/Counterparty

(17)

Agriculture

1,412

1,733

1,410,377

692,878

384,142

Farming and Stockbreeding

1,412

1,633

1,179,380

615,879

320,938

Forestry

100

54,749

63,142

31,137

Fishing

176,248

13,857

32,067

Industry

2,767

64,498

67,223,219

3,412,153

4,858,999

Mining

7

2,734,184

134,459

112,027

Production

2,816

35,957,818

3,212,390

4,433,382

Electricity, gas, and water

2,767

61,675

28,531,217

65,304

313,590

Construction

18,101,705

1,996,508

4,031,147

Services

34,390,483

262,925

523

18,337,182

61,904,314

13,080,378

13,620,033

Wholesale and Retail

Trade

2,237

24,648,224

6,945,213

6,628,126

Hotel, Food and Beverage

Services

57

3,935,821

473,954

1,721,008

Transportation and

Telecommunication

793

11,080,286

2,717,708

1,121,489

Financial Institutions

34,390,321

6,072

523

18,337,182

8,722,106

134,385

94,337

Real Estate and Renting

Services

36,736

8,073,398

837,155

2,092,071

Self-Employment Services

113,347

3,048,254

1,539,925

1,414,090

Education Services

162

11,436

1,014,726

114,609

222,186

Health and Social Services

92,247

1,381,499

317,429

326,726

Other

48,529,742 44,860

51,863

12,395

2,091,375

27,966,688

11,176,119

Total

82,920,225

49,039

381,019

523

18,349,577 150,730,990

47,148,605

34,070,440

(1)

Contingent and non-contingent exposures to central governments or central banks

(2)

Contingent and non-contingent exposures to regional governments or local authorities

(3)

Contingent and non-contingent exposures to administrative bodies and non-commercial undertakings

(4)

Contingent and non-contingent exposures to multilateral development banks

(5)

Contingent and non-contingent exposures to international organizations

(6)

Contingent and non-contingent exposures to banks and brokerage houses

(7)

Contingent and non-contingent corporate receivables

(8)

Contingent and non-contingent retail receivables

(9)

Contingent and non-contingent exposures secured by real estate property

(10)

Past due items

(11)

Items in regulatory high-risk categories

(12)

Exposures in the form of bonds secured by mortgages

(13)

Securitization positions

(14)

Short term exposures to banks, brokerage houses and corporate

(15)

Exposures in the form of collective investment undertakings

(16)

Other items

(17)

Risk amounts before the effect of credit risk mitigation but after the credit conversions.