196 İşbank

Annual Report 2015

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

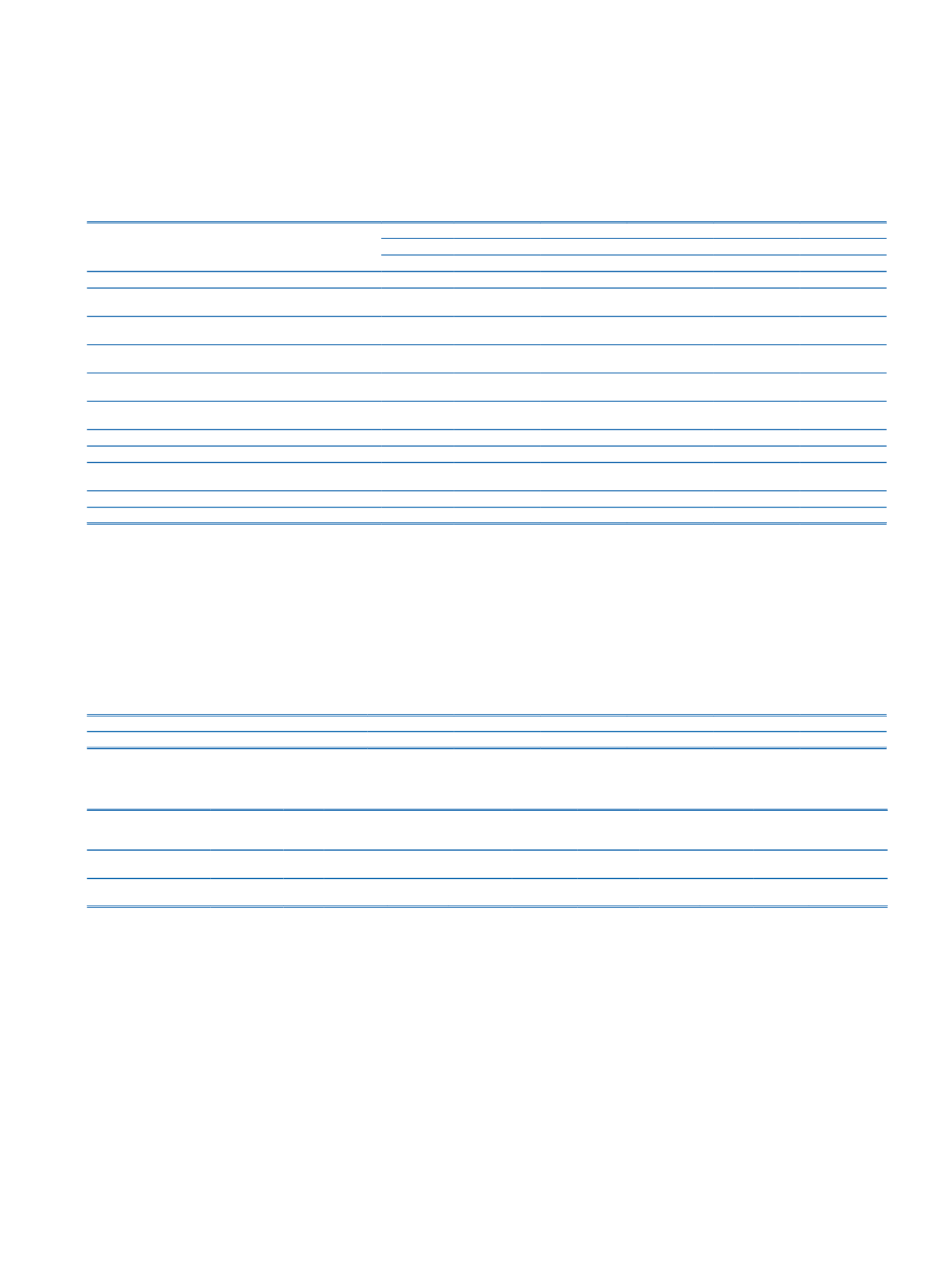

14. Analysis of Maturity-Bearing Exposures According to Remaining Maturities:

Current Period

Remaining Maturities

1 Month

1-3 Months

3-6 Months

6-12 Months

Over 1 Year

Total

Risk Groups (1)

Contingent and Non-Contingent Receivables from Central

Governments or Central Banks

1,702,681

235,340

111,593

1,687,139

46,562,456

50,299,209

Contingent and Non-Contingent Receivables from Regional

Governments or Domestic Governments

20

7,434

7,711

763

26,161

42,089

Contingent and Non-Contingent Receivables from Administrative

Units and Non-Commercial Enterprises

896

3,762

11,134

25,101

272,030

312,923

The multilateral development banks and non-contingent

receivables

156

215

152

523

Contingent and Non-Contingent Receivables from Banks and

Intermediaries

6,341,128

3,077,198

1,271,068

891,105

5,279,095

16,859,594

Contingent and Non-Contingent Corporate Receivables

6,840,714

7,702,305

9,376,986

16,521,158

90,978,308 131,419,471

Contingent and Non-Contingent Retail Receivables

7,019,872

2,149,652

2,098,681

3,181,482

13,849,575

28,299,262

Contingent and Non-Contingent Collateralized Receivables with

Real Estate Mortgages

587,909

661,931

1,020,125

2,082,753

24,203,534

28,556,252

Receivables are identified as High Risk by the Board

527,039

1,015,465

1,357,402

3,351,508

7,970,924

14,222,338

Total

23,020,259 14,853,243 15,254,700 27,741,224 189,142,235 270,011,661

(1)

Risk amounts before the effect of credit risk mitigation but after the credit conversions

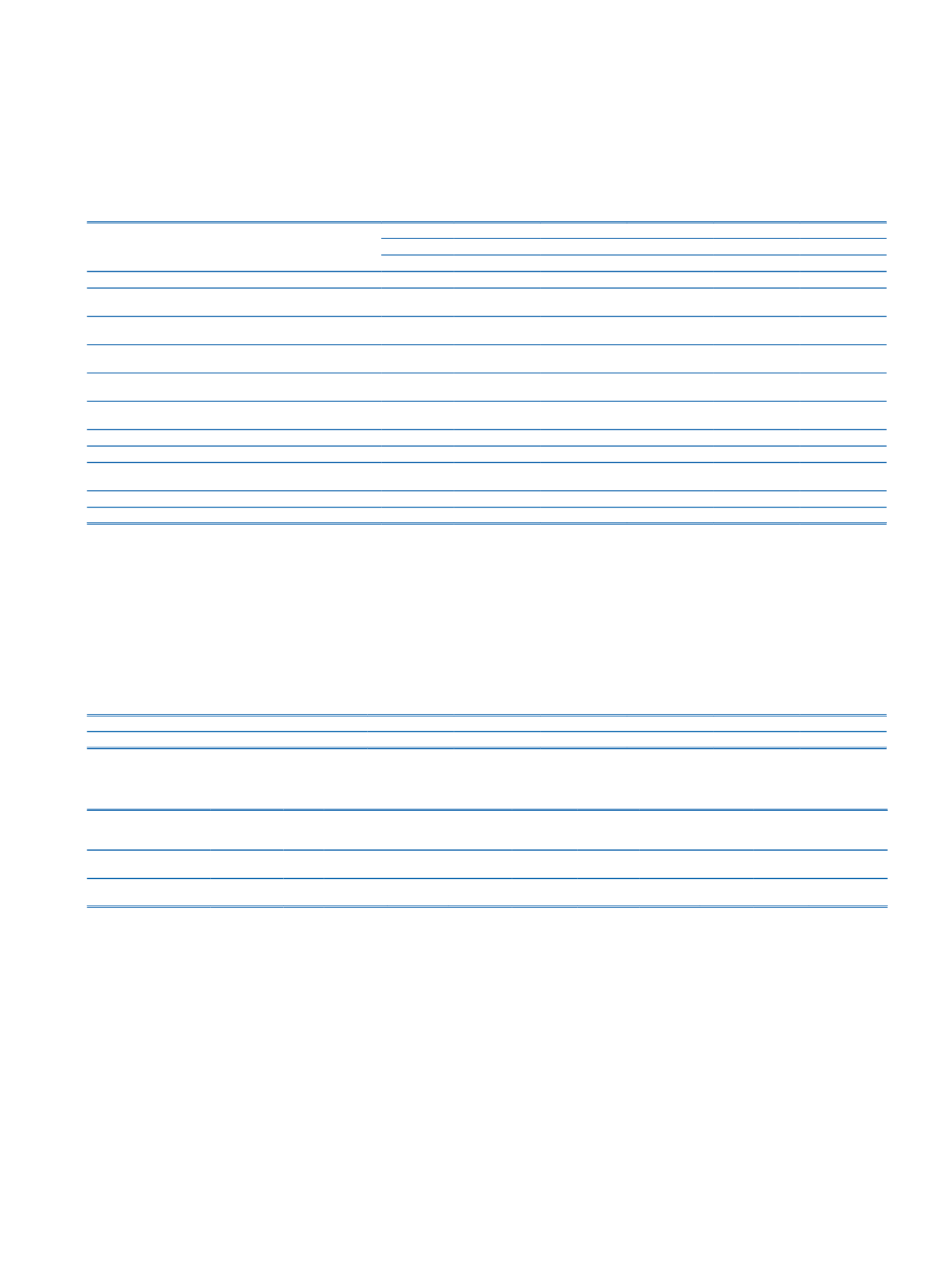

15. Information on Risk Classes:

In the calculation of the amount subject to credit risk, determining the risk weights related to risk classes stated on the sixth article of “Regulation on Measurement and Evaluation of

Capital Adequacy of Banks”, is based on the Fitch Ratings’ international rating. While receivables from resident banks in abroad which is assessed in the risk class of “Contingent and

Non-Contingent Receivables from Banks and Brokerage Agencies” and receivables from central governments which is assessed in the risk class of “Contingent and Non-Contingent

Receivables from Central Governments or Central Banks” will be subjected to risk weights with the scope of ratings; therefore domestic resident banks accepted as unrated, the risk

weight is applied according to receivables from relevant banks , type of exchange and remaining maturity.

If a receivable-specific rating is performed, risk weights to be applied on the receivable are determined by the relevant credit rating.

The table related to mapping the ratings used in the calculations and credit quality grades, which is stated in the Annex of Regulation on Measurement and Evaluation of Capital

Adequacy of Banks, is given below:

Credit Quality Grades

1

2

3

4

5

6

Risk Rating

AAA via AA-

A+ via A-

BBB+ via BBB-

BB+ via BB-

B+ via B- CCC+ and lower

There is no credit rating and credit export agency has been assigned for the items that are not included to trading accounts.

Risk Amounts according to Risk Weights

Risk Weight

0% 10% 20% 50% 75% 100% 150% 200% 250% 1250%

Mitigation in

Shareholders’

Equity

Amount Before Credit Risk

Mitigation

81,829,834

8,577,427 57,716,793 35,628,654 169,531,743 5,727,345 8,514,768 844,255

660,262

Amount After Credit Risk

Mitigation

88,826,432

8,577,393 57,714,604 35,350,280 162,911,237 5,687,893 8,458,725 844,255

660,262