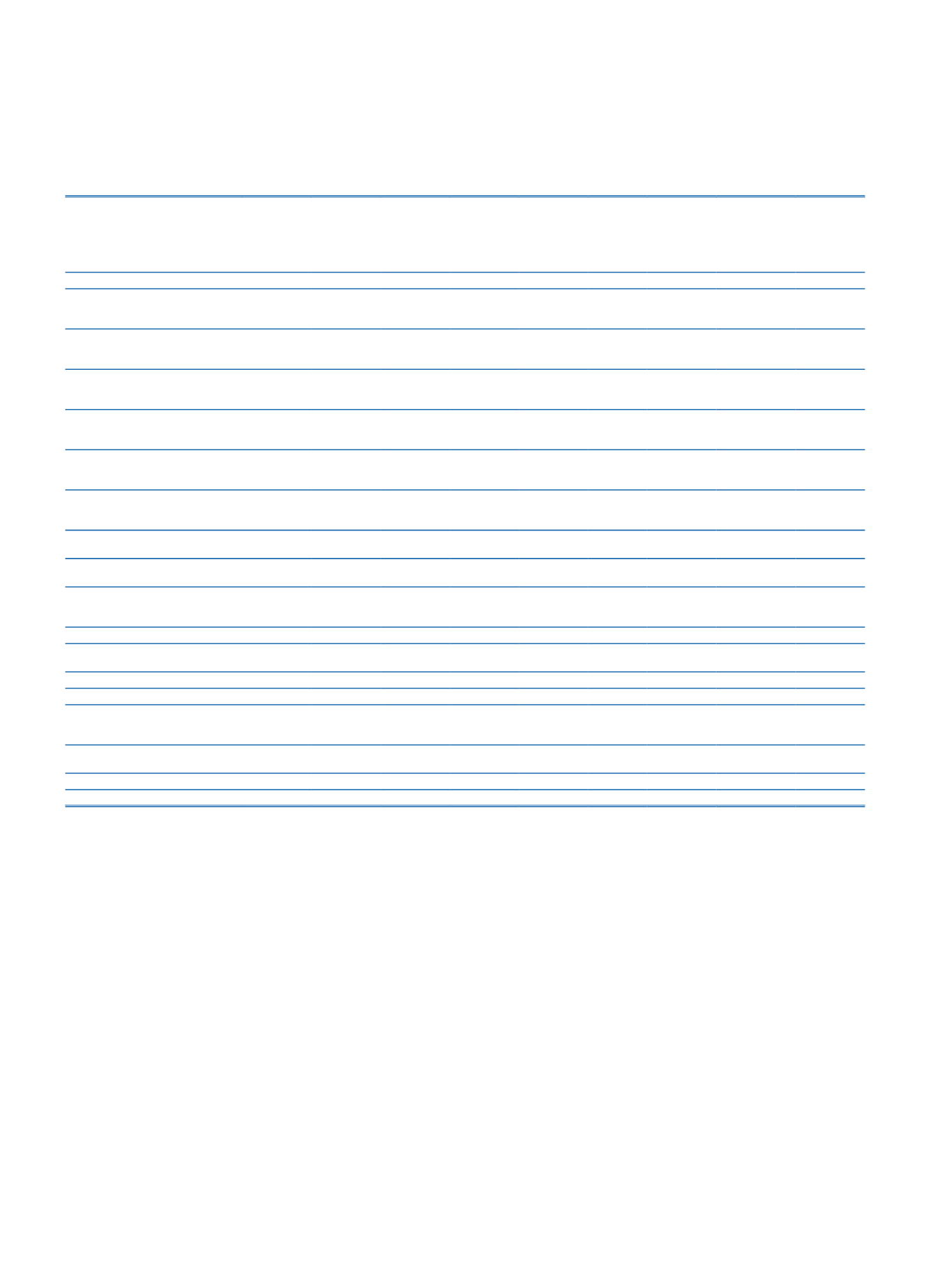

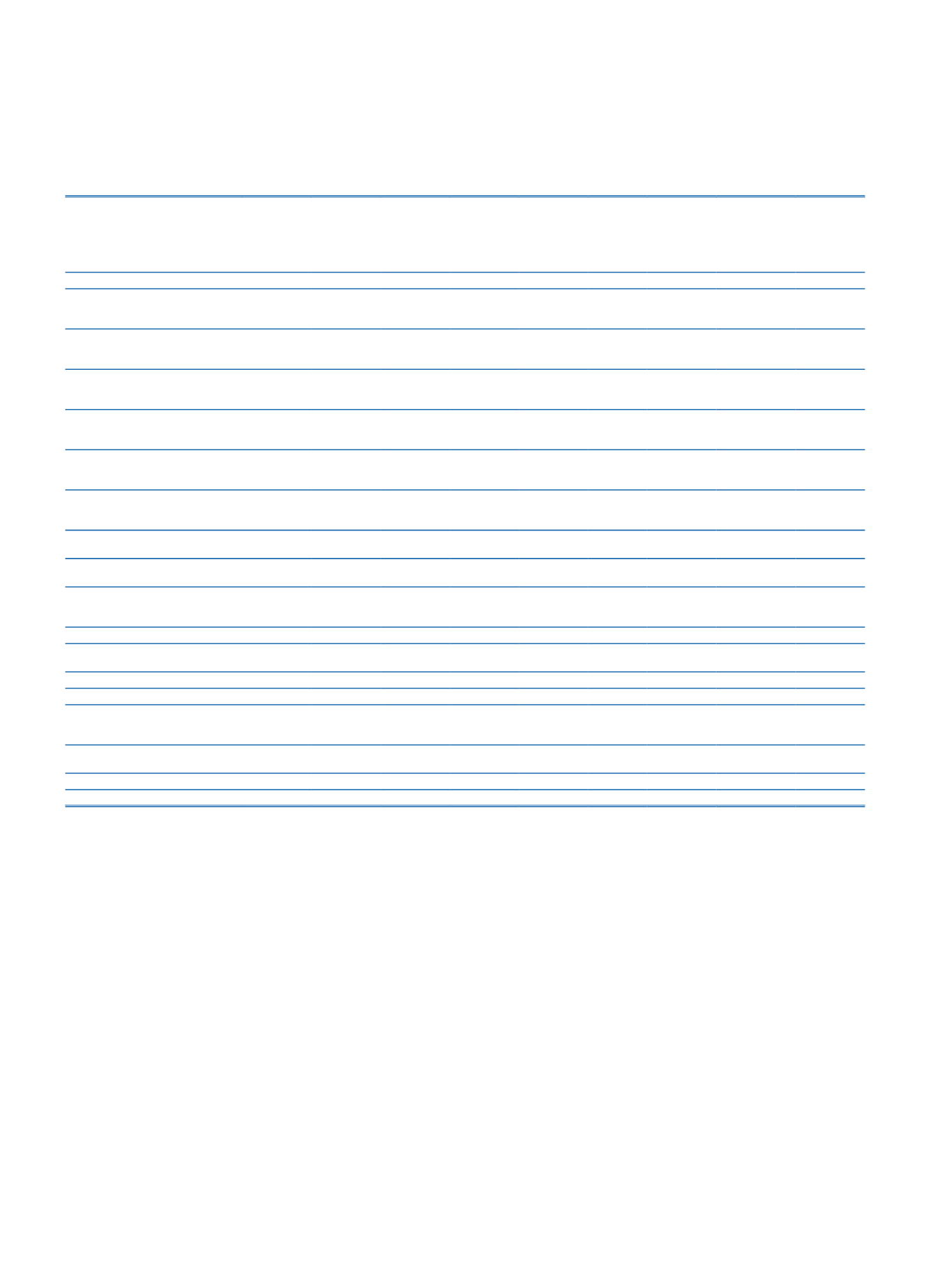

193

Financial Information and Risk Management

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

Prior Period

Domestic

European

Union

OECD

Countries

(2)

Off-Shore

Banking

Regions USA, Canada

Other

Countries

Investments

in Associates,

Subsidiaries

and Jointly

Controlled

Entities

Unallocated

Assets/

Liabilities

(3)

Total

Risk Groups

(1)

Contingent and Non-Contingent

Receivables from Central Governments

or Central Banks

71,239,685

10

109,638

71,349,333

Contingent and Non-Contingent

Receivables from Regional Government

or Domestic Government

39,787

6

39,793

Contingent and Non-Contingent

Receivables from Administrative Units

and Non-Commercial Enterprises

181,807

11

181,818

Contingent and Non-Contingent

Receivables fromMultilateral

Development Banks

1,660

1,660

Contingent and Non-Contingent

Receivables from International

Organizations

Contingent and Non-Contingent

Receivables from Banks and

Intermediaries

8,878,285 5,197,645

457,879

38,160 492,953 499,587

15,564,509

Contingent and Non-Contingent

Corporate Receivables

122,124,610 1,519,102

33,316

25,287

38,326 2,363,659

126,104,300

Contingent and Non-Contingent Retail

Receivables

51,714,332

17,534

1,621

20

1,225 556,405

52,291,137

Contingent and Non-Contingent

Receivables Secured by Residential

Property

12,880,577

40,521

3,986

2,488 110,641

13,038,213

Non-Performing Receivables

694,628

34

12

20

102

694,796

Receivables are identified as high risk

by the Board

17,597,356

13,323

2,517

1,185 203,011

17,817,392

Secured Marketable Securities

Securitization Positions

Short-term Receivables and Short-term

Corporate Receivables from Banks and

Intermediaries

Investments as Collective Investment

Institutions

182,765

5,066

187,831

Other Receivables

9,475,948

5,643,817

15,119,765

Total

295,009,780 6,794,895 499,331

63,467 536,197 3,843,060 5,643,817

312,390,547

(1)

Risk amounts before the effect of credit risk mitigation but after the credit conversions.

(2)

OECD Countries other than EU countries, USA and Canada.

(3)

Assets and liabilities that are not consistently allocated.