192 İşbank

Annual Report 2015

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

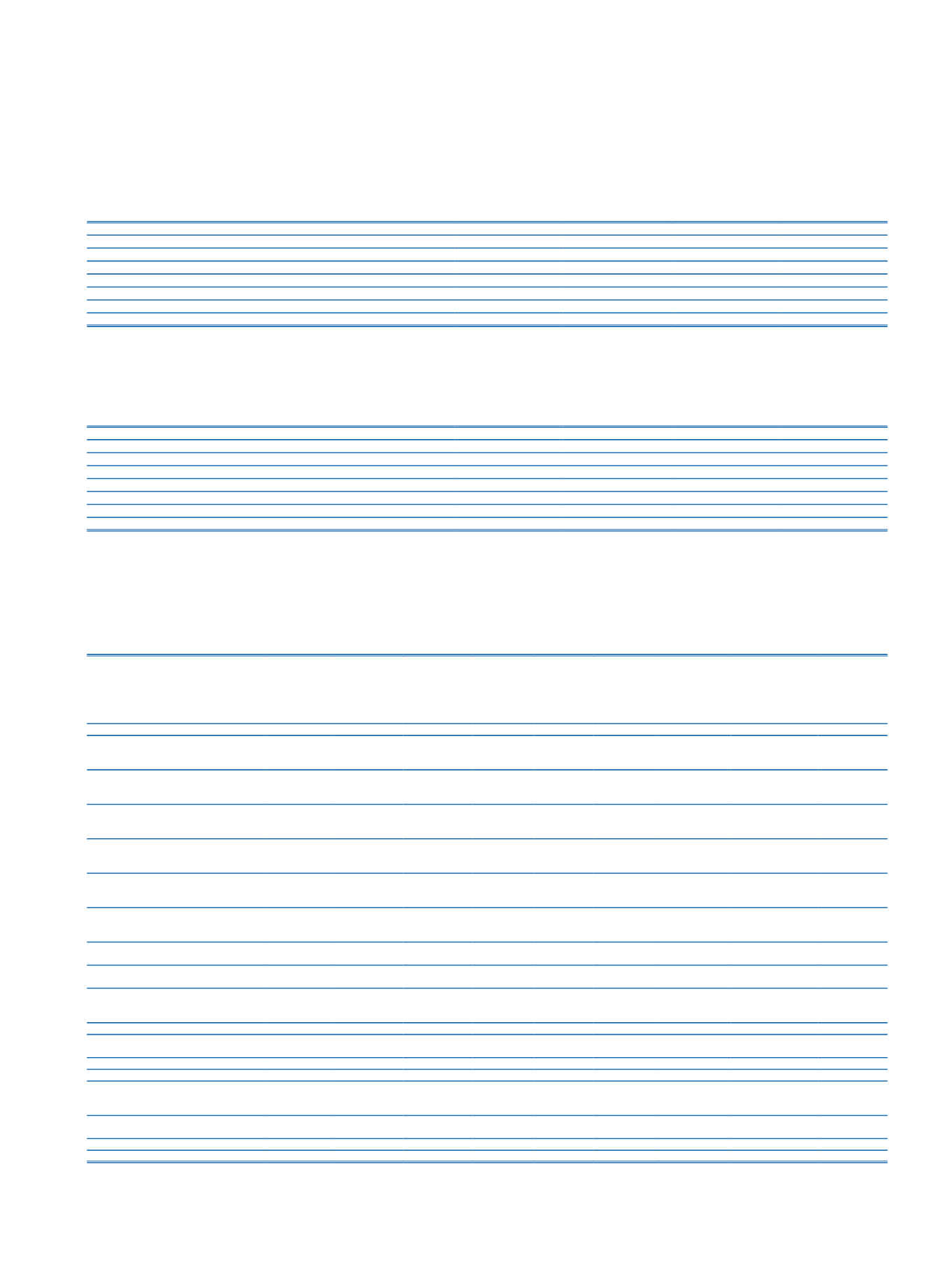

11. The aging analysis of the loans past due but not impaired in terms of financial asset classes, is as follows:

Current Period

(1)

1-30 Days

(2)

31-60 Days

(3)

61-90 Days

(3)

Total

Loans:

978,416

276,479

132,854

1,387,749

Corporate / Commercial Loans

(4)

330,159

67,925

42,587

440,671

Consumer Loans

151,728

56,526

24,857

233,111

Credit Cards

496,529

152,028

65,410

713,967

Lease Receivables

(5)

12,994

4,760

17,342

35,096

Insurance Receivables

119,128

23,594

11,863

154,585

Total

1,110,538

304,833

162,059

1,577,430

(1)

Loans, which are neither past due nor are classified under closely monitored although being past due for less than 31 days, are amounting to TL 2,411,542

(2)

Related figures show only overdue amounts of installment based commercial loans and installment based consumer loans; the principal amounts of the loans which are not due as of the balance sheet date are

equal to TL 649,346 and TL 1,410,514 respectively.

(3)

Related figures show only overdue amounts of installment based commercial loans and installment based consumer loans; the principal amounts of the loans which are not due as of the balance sheet date are

equal to TL 512,447 and TL 551,673 respectively.

(4)

The balance includes factoring receivables.

(5)

Includes only overdue installments, total principal amounts which are not due as of the balance sheet date is TL 210,022. Loans overdue between 91-150 days are amounting to TL 1,098.

Prior Period

(1)

1-30 Days

(2)

31-60 Days

(3)

61-90 Days

(3)

Total

Loans

830,321

267,176

116,087

1,213,584

Corporate / Commercial Loans

(4)

260,773

101,251

45,441

407,465

Consumer Loans

111,019

38,417

15,525

164,961

Credit Cards

458,529

127,508

55,121

641,158

Lease Receivables

(5)

7,357

3,470

1,992

12,819

Insurance Receivables

89,760

13,191

3,148

106,099

Total

927,438

283,837

121,227

1,332,502

(1)

Loans, which are neither past due nor are classified under closely monitored although being past due for less than 31 days, are amounting to TL 1,813,300.

(2)

Related figures show only overdue amounts of installment based commercial loans and installment based consumer loans; the principal amounts of the loans which are not due as of the balance sheet date are

equal to TL 415,407 and TL 1,025,345 respectively.

(3)

Related figures show only overdue amounts of installment based commercial loans and installment based consumer loans; the principal amounts of the loans which are not due as of the balance sheet date are

equal to TL 323,633 and TL 367,895 respectively.

(4)

The balance includes factoring receivables

(5)

Includes only overdue installments, the principal amounts which are not due as of the balance sheet date is TL 285,819. Loans overdue between 91-150 days are amounting to TL 1,018.

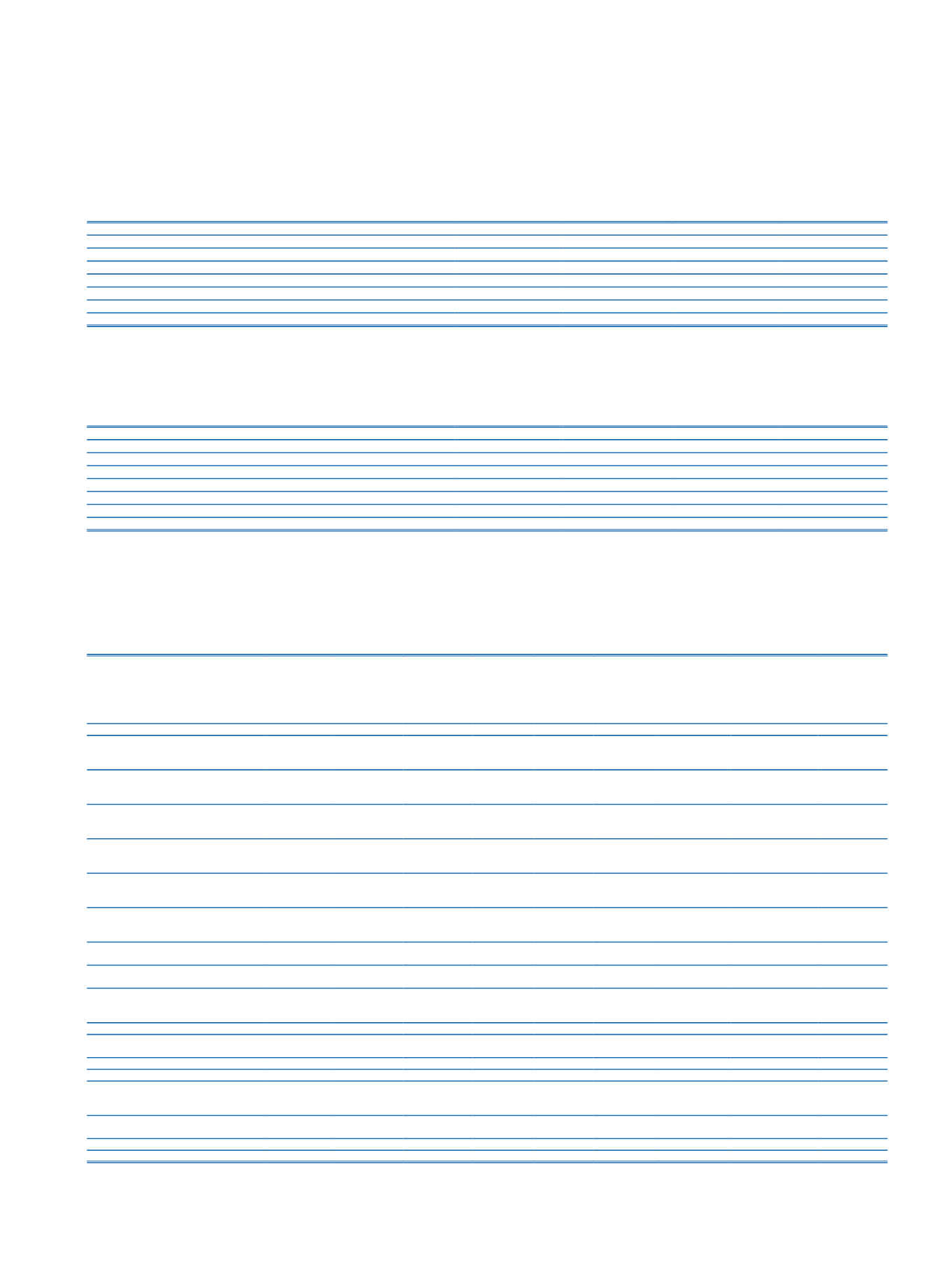

12. Profile of Significant Risk Exposures in Major Regions:

Current Period

Domestic

European

Union

OECD

Countries

(2)

Off-Shore

Banking

Regions USA, Canada

Other

Countries

Investments

in Associates,

Subsidiaries

and Jointly

Controlled

Entities

Unallocated

Assets/

Liabilities

(3)

Total

Risk Groups

(1)

Contingent and Non-Contingent

Receivables from Central Governments or

Central Banks

82,238,735

3,738

677,752

82,920,225

Contingent and Non-Contingent

Receivables from Regional Government or

Domestic Government

47,548

1,491

49,039

Contingent and Non-Contingent

Receivables from Administrative Units and

Non-Commercial Enterprises

362,929

17,842

248

381,019

Contingent and Non-Contingent

Receivables fromMultilateral

Development Banks

308

215

523

Contingent and Non-Contingent

Receivables from International

Organizations

Contingent and Non-Contingent

Receivables from Banks and

Intermediaries

10,717,860 5,686,656

454,373

51,746 554,002 884,940

18,349,577

Contingent and Non-Contingent

Corporate Receivables

140,321,601

4,350,641

78,695

1,218 2,640,651 3,338,184

150,730,990

Contingent and Non-Contingent Retail

Receivables

46,502,664

432,390

21,549

227

8,297

183,478

47,148,605

Contingent and Non-Contingent

Receivables Secured by Residential

Property

33,595,233

134,461

25,749

6

9,660

305,331

34,070,440

Non-Performing Receivables

1,026,625

995

30

46

672

1,028,368

Receivables are identified as high risk by

the Board

14,002,913

41,881

5,683

141

3,814 286,817

14,341,249

Secured Marketable Securities

Securitization Positions

Short-term Receivables and Short-term

Corporate Receivables from Banks and

Intermediaries

Investments as Collective Investment

Institutions

224,741

4,510

229,251

Other Receivables

14,172,639

4,948,894

19,121,533

Total

343,213,488 10,673,422

586,079 53,338 3,216,685 5,678,913 4,948,894

368,370,819

(1)

Risk amounts before the effect of credit risk mitigation but after the credit conversions.

(2)

OECD Countries other than EU countries, USA and Canada.

(3)

Assets and liabilities that are not consistently allocated.