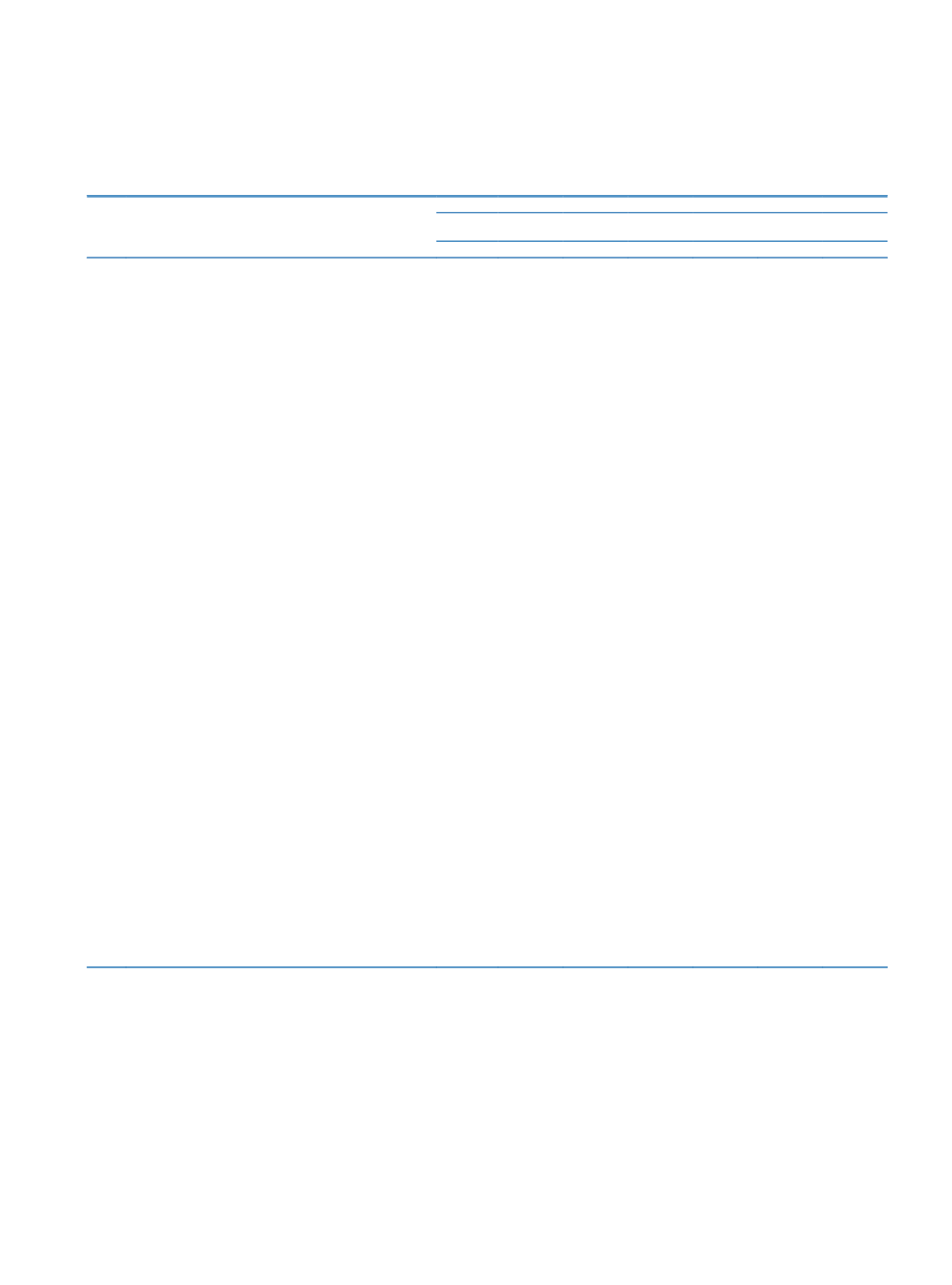

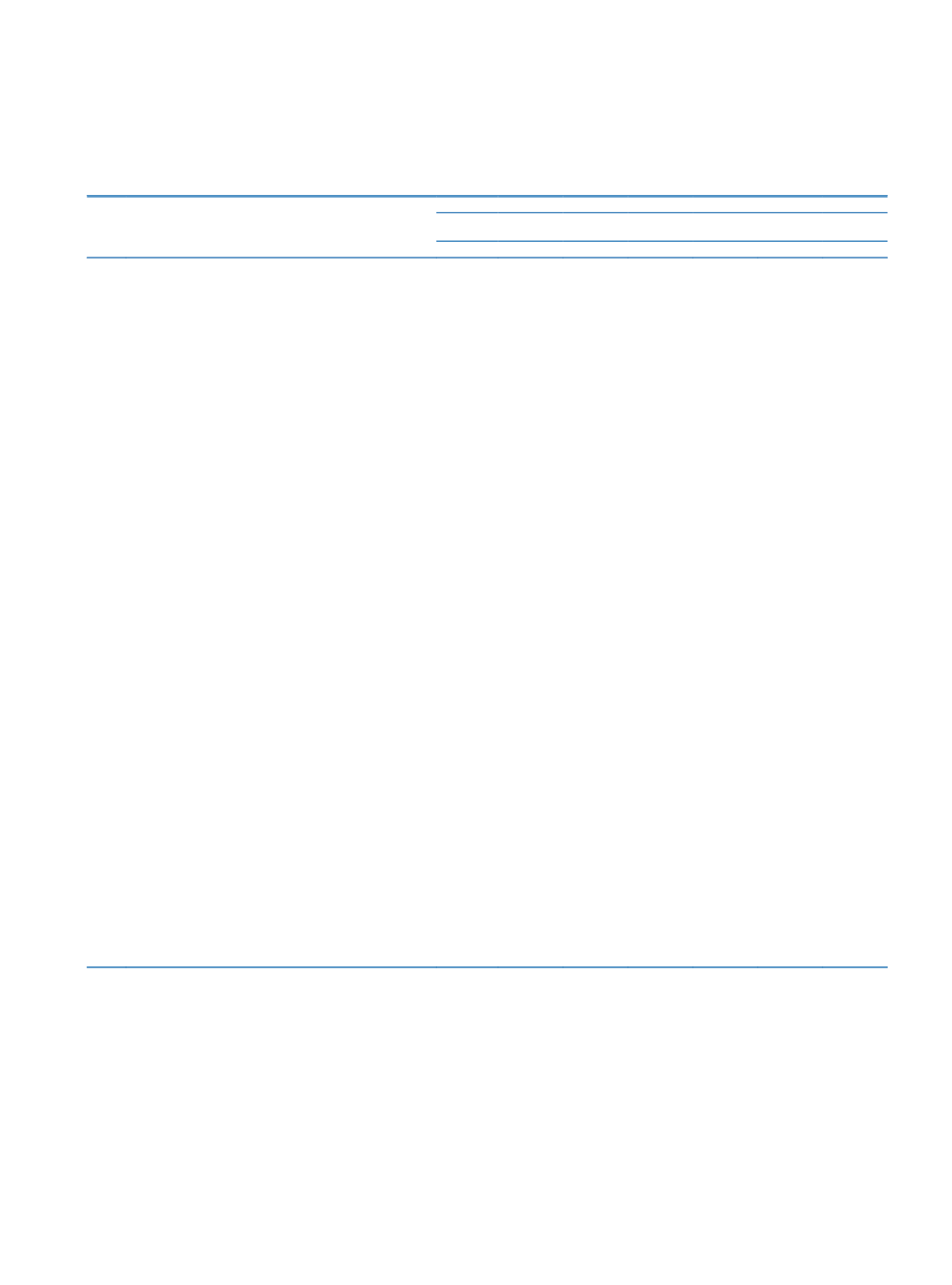

92 İşbank

Annual Report 2015

Türkiye İş Bankası A.Ş.

Unconsolidated Statement of Off-Balance Sheet Items

THOUSAND TL

Footnotes

CURRENT PERIOD

(31/12/2015)

PRIOR PERIOD

(31/12/2014)

TL

FC

Total

TL

FC

Total

A.

GUARANTEES AND SURETYSHIPS

V-III

91,672,574 127,335,881219,008,455 78,878,269 93,121,610 171,999,879

I.

Letters of Guarantee

20,181,325 30,459,541 50,640,866 17,664,161 25,151,012 42,815,173

1.1.

Guarantees Subject to State Tender Law

20,167,536 18,372,484 38,540,020 17,646,415 15,968,529 33,614,944

1.1.1.

Guarantees Given for Foreign Trade Operations

804,216 2,524,859 3,329,075

741,815 2,975,340 3,717,155

1.1.2.

Other Letters of Guarantee

3,540,122 6,843,585 10,383,707 3,205,517 5,001,864 8,207,381

1.1.3.

Bank Acceptances

15,823,198 9,004,040 24,827,238 13,699,083 7,991,325 21,690,408

1.2.

Import Letters of Acceptance

4,821

931,732 936,553

9,813 1,219,918 1,229,731

1.2.1.

Other Bank Acceptances

0 116,817

116,817

0 413,697 413,697

1.2.2.

Letters of Credit

4,821

814,915 819,736

9,813 806,221

816,034

1.3.

Documentary Letters of Credit

5,655 10,249,180 10,254,835

0 7,206,401 7,206,401

1.3.1.

Other Letters of Credit

5,067 7,780,957 7,786,024

0 5,035,503 5,035,503

1.3.2.

Prefinancing Given as Guarantee

588 2,468,223 2,468,811

0 2,170,898 2,170,898

1.4.

Endorsements

0

0

0

0

0

0

1.5.

Endorsements to the Central Bank of Turkey

0

0

0

0

0

0

1.5.1.

Other Endorsements

0

0

0

0

0

0

1.5.2.

Purchase Guarantees for Securities Issued

0

0

0

0

0

0

1.6.

Factoring Guarantees

0

0

0

0

0

0

1.7.

Other Guarantees

0

0

0

0

0

0

1.8.

Other Suretyships

3,313 906,145 909,458

7,933 756,164 764,097

1.9.

COMMITMENTS

0

0

0

0

0

0

II.

Irrevocable Commitments

40,030,743 12,279,503 52,310,246 38,011,936 8,711,030 46,722,966

2.1.

Irrevocable Commitments

39,904,819 5,050,503 44,955,322 37,901,969 2,795,325 40,697,294

2.1.1.

Forward Asset Purchase Commitments

152,889 3,008,812 3,161,701

54,810 936,721

991,531

2.1.2.

Forward Deposit Purchase and Sale Commitments

-

-

-

-

-

-

2.1.3.

Capital Commitment for Associates and Subsidiaries

-

-

-

-

121,296 121,296

2.1.4.

Loan Granting Commitments

10,340,937 566,627 10,907,564 9,429,052 572,525 10,001,577

2.1.5.

Securities Underwriting Commitments

-

-

-

-

-

-

2.1.6.

Commitments for Reserve Deposit Requirements

-

-

-

-

-

-

2.1.7.

Commitments for Cheque Payments

5,654,056

- 5,654,056 5,875,007

- 5,875,007

2.1.8.

Tax and Fund Liabilities from Export Commitments

11,630

-

11,630

17,932

-

17,932

2.1.9.

Commitments for Credit Card Expenditure Limits

21,219,999

- 21,219,999 20,489,527

- 20,489,527

2.1.10.

Commitments for Credit Cards and Banking Services Promotions

100,470

-

100,470

93,072

-

93,072

2.1.11.

Receivables from Short Sale Commitments

-

-

-

-

-

-

2.1.12.

Payables for Short Sale Commitments

-

-

-

-

-

-

2.1.13.

Other Irrevocable Commitments

2,424,838 1,475,064 3,899,902 1,942,569 1,164,783 3,107,352

2.2.

Revocable Commitments

125,924 7,229,000 7,354,924 109,967 5,915,705 6,025,672

2.2.1.

Revocable Loan Granting Commitments

125,924 7,229,000 7,354,924 109,967 5,915,705 6,025,672

2.2.2.

Other Revocable Commitments

-

-

-

-

-

-

III.

DERIVATIVE FINANCIAL INSTRUMENTS

31,460,506 84,596,837 116,057,343 23,202,172 59,259,568 82,461,740

3.1

Derivative Financial Instruments Held for Risk Management

-

-

-

-

-

-

3.1.1 Fair Value Hedges

-

-

-

-

-

-

3.1.2 Cash Flow Hedges

-

-

-

-

-

-

3.1.3 Net Foreign Investment Hedges

-

-

-

-

-

-