96 İşbank

Annual Report 2015

Türkiye İş Bankası A.Ş.

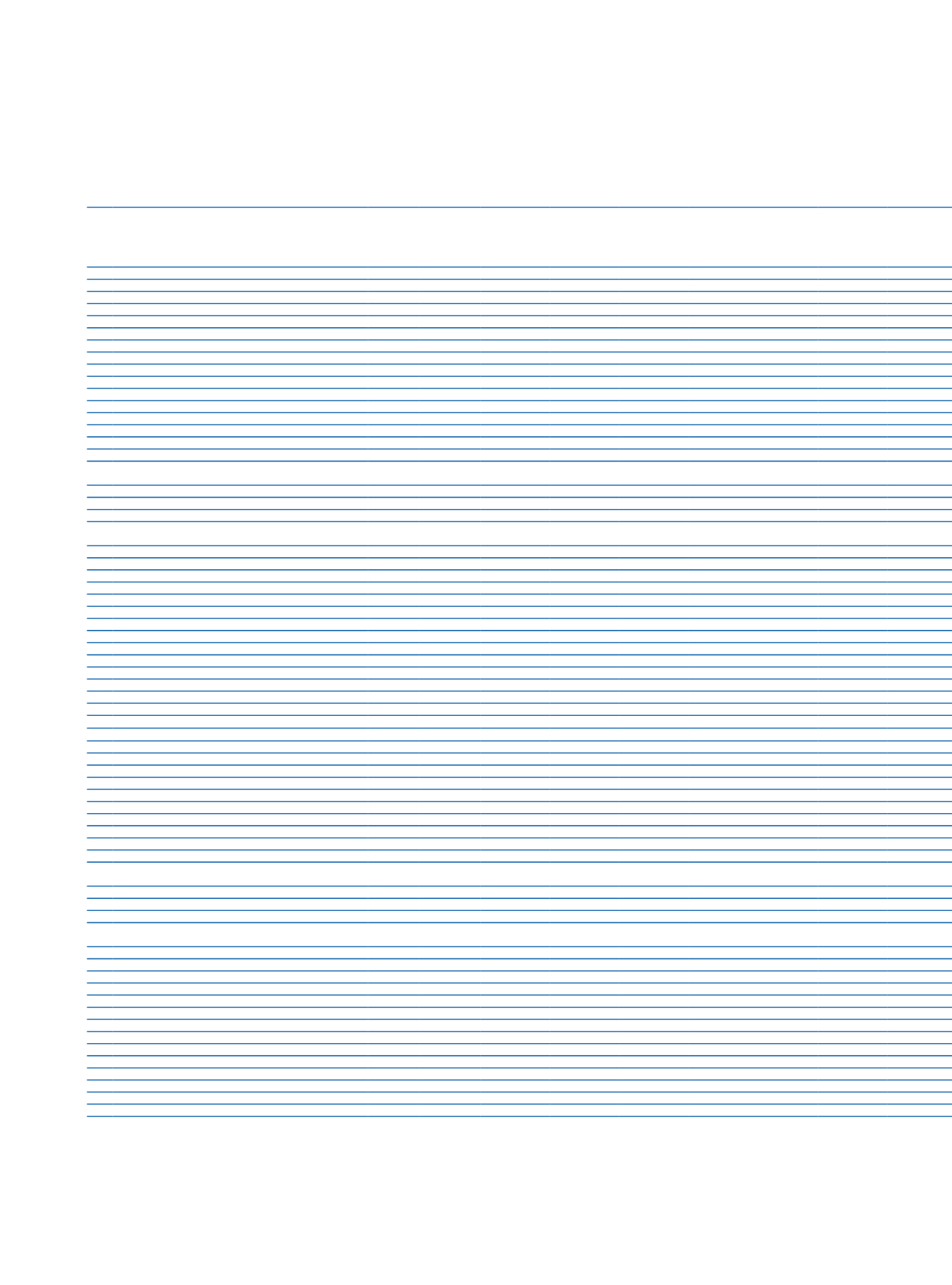

Unconsolidated Statement of Changes in Shareholders’ Equity

CHANGES IN SHAREHOLDERS’ EQUITY

Footnotes

“Paid-in

Capital

Paid-in Capital

Inflation

Adjustment

Share

Premium

Share

Cancellation

Profits

Legal

Reserves

Statutory

Reserves

Extraordinary

Reserves

V -V

PRIOR PERIOD

(31/12/2014)

I.

Beginning Balance

4,500,000 1,615,938

3,694

2,044,830

10,177,540

II.

Corrections Made According to TAS 8

2.1 The Effect of Corrections of Errors

2.2 The Effect of Changes in Accounting Policies

III.

Adjusted Beginning Balance (I+II)

4,500,000 1,615,938

3,694

2,044,830

10,177,540

Changes During the Period

IV.

Increase/Decrease Due to Mergers

V.

Marketable Securities Value Increase Fund

VI. Hedge Reserves (Effective Portion)

6.1 Cash Flow Hedges

6.2 Net Foreign Investment Hedges

VII. Revaluation Surplus on Tangible Assets

VIII. Revaluation Surplus on Intangible Assets

IX. Bonus Shares fromAssociates, Subsidiaries and

Jointly Controlled Entities (Joint Ventures)

X.

Translation Differences

XI. The Effect of Disposal of Assets

XII. The Effect of Reclassification of Assets

XIII. The Effect of Changes in the Equity of Subsidiaries

on the Equity of the Bank

XIV. Capital Increase

14.1 Cash

14.2 Internal Sources

XV. Share Issue

XVI. Share Cancellation Profits

XVII. Paid-in-Capital Inflation Adjustment

XVIII.Other

XIX. Net Profit / Loss for the Period

XX. Profit Distribution

201,836

2,407,119

20.1 Dividend Paid

20.2 Transfer to Reserves

201,836

2,312,119

20.3 Other

(*)

95,000

Ending Balance (III+IV+V...+XVIII+XIX+XX)

4,500,000 1,615,938

3,694

2,246,666

12,584,659

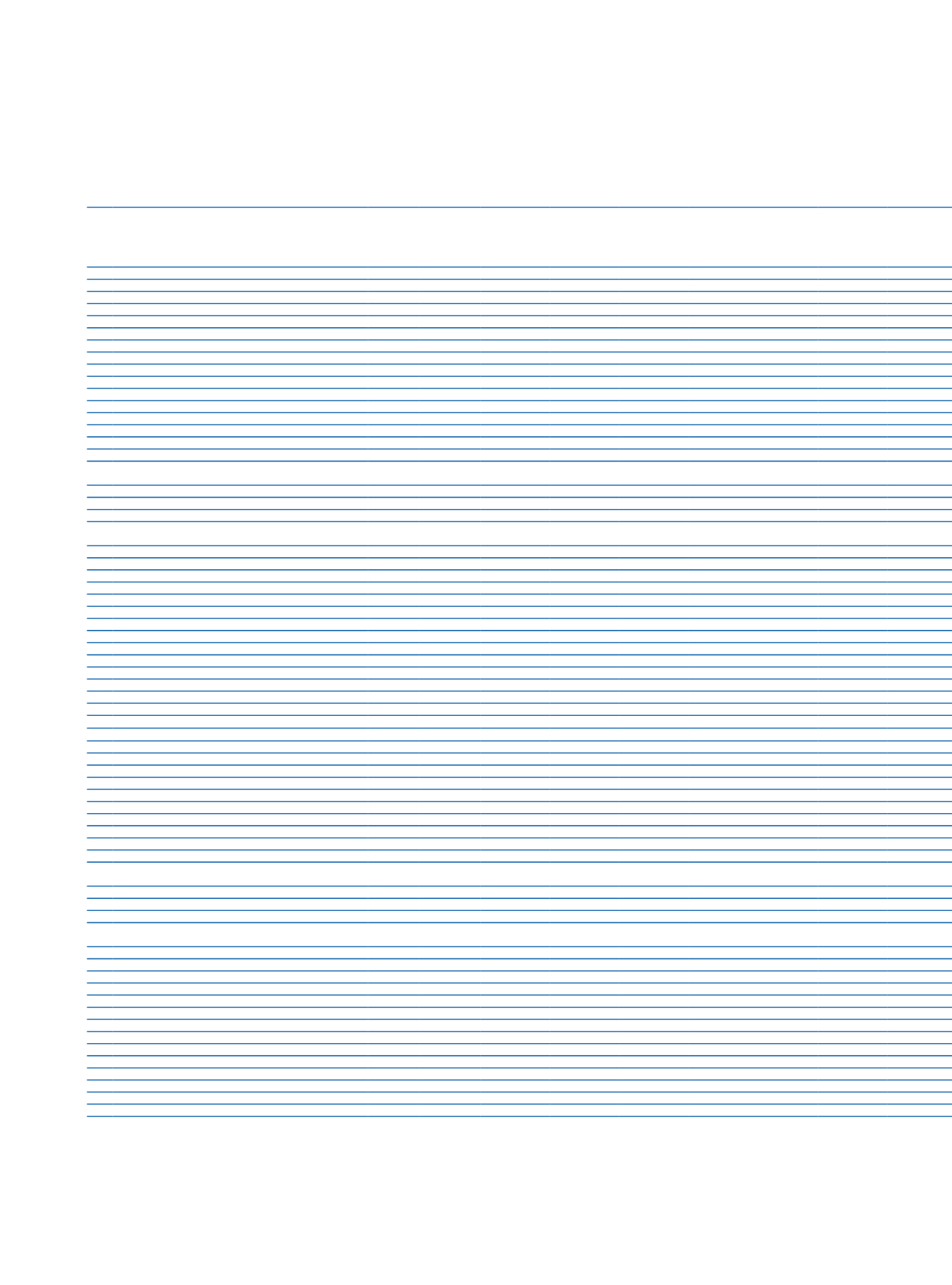

CURRENT PERIOD

(31/12/2015 )

I.

Beginning Balance

4,500,000 1,615,938

3,694

2,246,666

12,584,659

Changes During the Period

II.

Increase/Decrease Due to Mergers

III.

Marketable Securities Value Increase Fund

IV.

Hedge Reserves (Effective Portion)

4.1 Cash Flow Hedges

4.2 Net Foreign Investment Hedges

V.

Revaluation Surplus on Tangible Assets

VI. Revaluation Surplus on Intangible Assets

VII. Bonus Shares fromAssociates, Subsidiaries and

Jointly Controlled Entities (Joint Ventures)

VIII. Translation Differences

IX. The Effect of Disposal of Assets

X.

The Effect of Reclassification of Assets

XI. The Effect of Changes in the Equity of Subsidiaries

on the Equity of the Bank

XII. Capital Increase

12.1 Cash

12.2 Internal Sources

XIII. Share Issue

XIV. Share Cancellation Profits

XV. Paid-in-Capital Inflation Adjustment

XVI. Other

XVII. Net Profit / Loss for the Period

XVIII.Profit Distribution

237,052

2,433,379

18.1 Dividend Paid

18.2 Transfer to Reserves

237,052

2,304,379

18.3 Other

(*)

129,000

Ending Balance (I+II+III...+XVI+XVII+XVIII)

4,500,000 1,615,938

3,694

2,483,718

15,018,038

(*)

According to the Articles of Incorporation of the Bank, since a portion of the net profit for the period is distributed to the employees as a dividend, the provision provided for employee dividend distribution within the scope of “TAS 19-Employee Benefits”, h