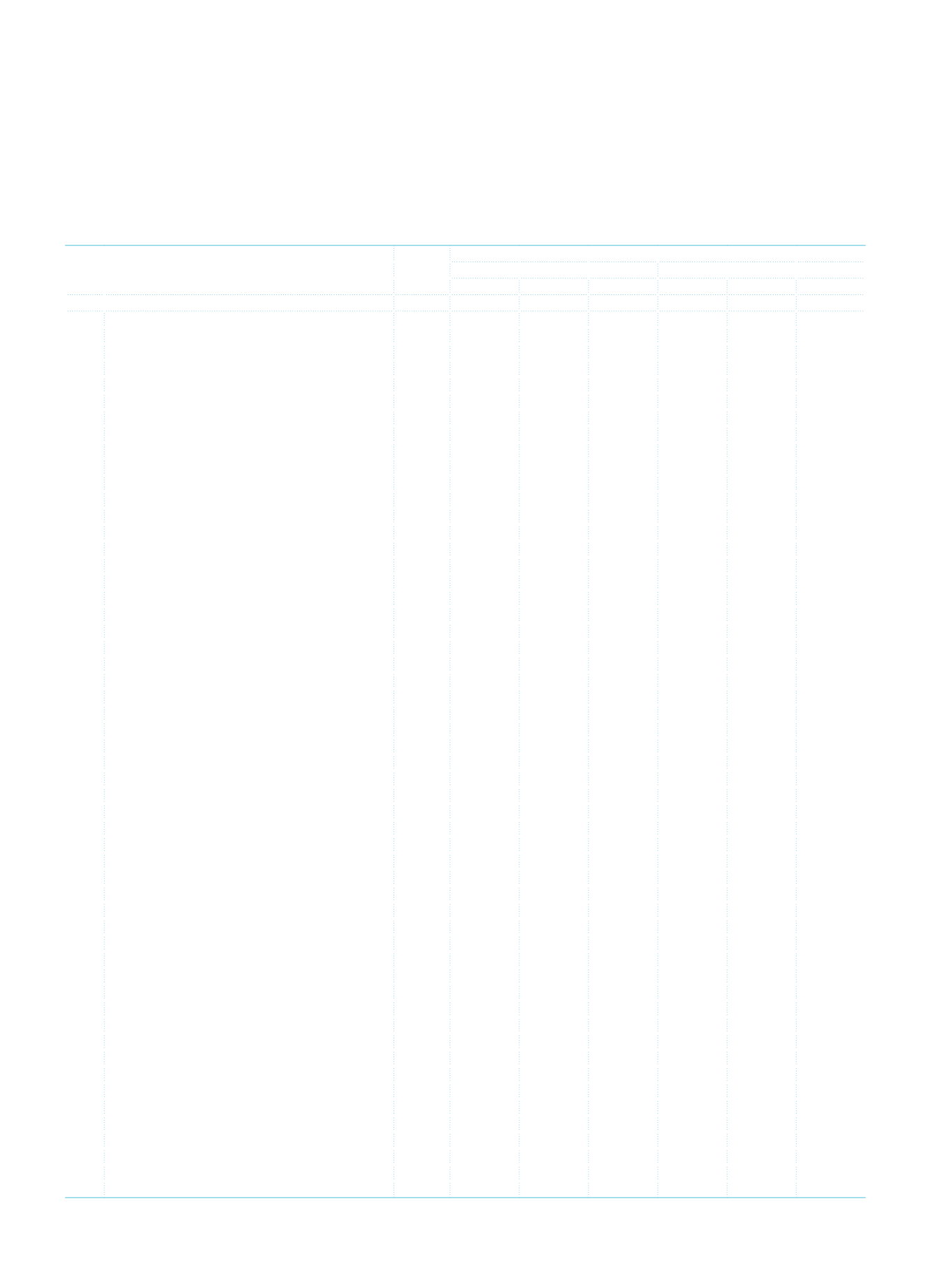

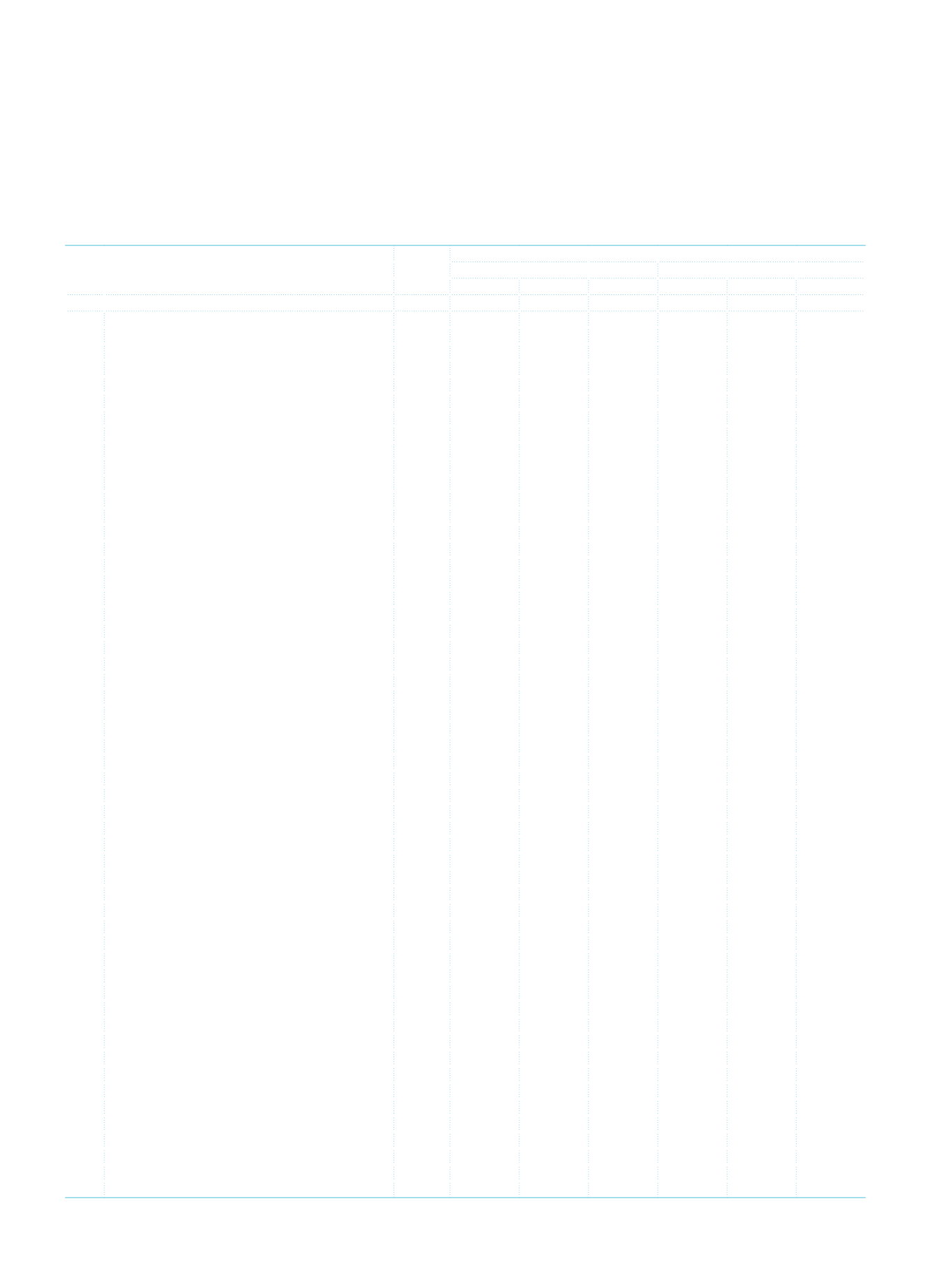

Financial Information and Risk Management

106

İş Bankası

Annual Report 2013

OFF-BALANCE SHEET ITEMS

Footnotes

THOUSAND TL

CURRENT PERIOD (31/12/2013)

PRIOR PERIOD (31/12/2012)

TL

FC

Total

TL

FC

Total

A. OFF-BALANCE SHEET CONTINGENCIES AND COMMITMENTS (I+II+III)

V-III

73,673,427 94,970,887 168,644,314 60,478,549 68,744,213 129,222,762

I.

GUARANTEES AND SURETYSHIPS

15,457,202 22,554,912 38,012,114 12,507,104 16,114,508 28,621,612

1.1.

Letters of Guarantee

15,445,061 14,065,796 29,510,857 12,465,658 9,785,736 22,251,394

1.1.1.

Guarantees Subject to State Tender Law

767,823 3,865,351 4,633,174 788,915 2,923,182 3,712,097

1.1.2.

Guarantees Given for Foreign Trade Operations

2,010,806 5,064,059 7,074,865 1,147,044 2,529,524 3,676,568

1.1.3.

Other Letters of Guarantee

12,666,432 5,136,386 17,802,818 10,529,699 4,333,030 14,862,729

1.2.

Bank Acceptances

4,262 1,490,684 1,494,946

19,739 1,278,511 1,298,250

1.2.1.

Import Letters of Acceptance

-

191,778

191,778

-

113,096

113,096

1.2.2.

Other Bank Acceptances

4,262 1,298,906 1,303,168

19,739 1,165,415 1,185,154

1.3.

Letters of Credit

-

6,421,249 6,421,249

-

4,585,247 4,585,247

1.3.1.

Documentary Letters of Credit

-

4,221,966 4,221,966

-

3,298,568 3,298,568

1.3.2.

Other Letters of Credit

-

2,199,283 2,199,283

-

1,286,679 1,286,679

1.4.

Prefinancing Given as Guarantee

-

-

-

-

-

-

1.5.

Endorsements

-

-

-

-

-

-

1.5.1.

Endorsements to the Central Bank of Turkey

-

-

-

-

-

-

1.5.2.

Other Endorsements

-

-

-

-

-

-

1.6.

Purchase Guarantees for Securities Issued

-

-

-

-

-

-

1.7.

Factoring Guarantees

-

-

-

-

-

-

1.8.

Other Guarantees

7,879

577,183

585,062

21,707

465,014 486,721

1.9.

Other Suretyships

-

-

-

-

-

-

II.

COMMITMENTS

33,746,881 13,558,184 47,305,065 29,490,633 7,658,309 37,148,942

2.1.

Irrevocable Commitments

33,621,597 8,171,671 41,793,268 29,404,129 5,417,667 34,821,796

2.1.1.

Forward Asset Purchase Commitments

140,066 3,339,085 3,479,151

96,311

788,786 885,097

2.1.2.

Forward Deposit Purchase and Sale Commitments

-

-

-

-

-

-

2.1.3.

Capital Commitment for Associates and Subsidiaries

-

-

-

-

-

-

2.1.4.

Loan Granting Commitments

7,819,183 1,336,209 9,155,392 5,838,616

914,126 6,752,742

2.1.5.

Securities Underwriting Commitments

-

-

-

-

-

-

2.1.6.

Commitments for Reserve Deposit Requirements

-

-

-

-

-

-

2.1.7.

Commitments for Cheque Payments

6,024,383

-

6,024,383 6,124,562

-

6,124,562

2.1.8.

Tax and Fund Liabilities from Export Commitments

16,821

-

16,821

13,899

-

13,899

2.1.9.

Commitments for Credit Card Expenditure Limits

17,679,967

- 17,679,967 15,742,457

- 15,742,457

2.1.10.

Commitments for Credit Cards and Banking Services Promotions

90,239

-

90,239

76,548

-

76,548

2.1.11.

Receivables from Short Sale Commitments

-

-

-

-

-

-

2.1.12.

Payables for Short Sale Commitments

-

-

-

-

-

-

2.1.13.

Other Irrevocable Commitments

1,850,938 3,496,377 5,347,315 1,511,736 3,714,755 5,226,491

2.2.

Revocable Commitments

125,284 5,386,513 5,511,797

86,504 2,240,642 2,327,146

2.2.1.

Revocable Loan Granting Commitments

125,284 5,386,513 5,511,797

86,504 2,240,642 2,327,146

2.2.2.

Other Revocable Commitments

-

-

-

-

-

-

III.

DERIVATIVE FINANCIAL INSTRUMENTS

24,469,344 58,857,791 83,327,135 18,480,812 44,971,396 63,452,208

3.1

Derivative Financial Instruments held for risk management

-

-

-

-

-

-

3.1.1 Fair Value Hedges

-

-

-

-

-

-

3.1.2 Cash Flow Hedges

-

-

-

-

-

-

3.1.3 Net Foreign Investment Hedges

-

-

-

-

-

-

3.2 Derivative Financial Instruments Held for Trading

24,469,344 58,857,791 83,327,135 18,480,812 44,971,396 63,452,208

3.2.1 Forward Foreign Currency Buy/Sell Transactions

3,631,263 5,518,931 9,150,194 4,587,624 5,472,881 10,060,505

3.2.1.1 Forward Foreign Currency Buy Transactions

2,456,254 2,105,382 4,561,636 3,306,856 1,737,497 5,044,353

3.2.1.2 Forward Foreign Currency Sell Transactions

1,175,009 3,413,549 4,588,558 1,280,768 3,735,384 5,016,152

3.2.2 Currency and Interest Rate Swaps

17,732,945 44,310,130 62,043,075 11,365,854 31,614,867 42,980,721

3.2.2.1 Currency Swap Buy Transactions

5,244,998 15,052,183 20,297,181

1,123,113 7,811,818 8,934,931

3.2.2.2 Currency Swap Sell Transactions

8,702,379 11,270,075 19,972,454 3,054,741 5,190,493 8,245,234

3.2.2.3 Interest Rate Swap Buy Transactions

1,892,784 8,993,936 10,886,720 3,594,000 9,306,278 12,900,278

3.2.2.4 Interest Rate Swap Sell Transactions

1,892,784 8,993,936 10,886,720 3,594,000 9,306,278 12,900,278

3.2.3 Currency, Interest Rate and Security Options

3,104,778 8,590,476 11,695,254 2,525,134 7,463,218 9,988,352

3.2.3.1 Currency Call Options

1,520,789 3,034,751 4,555,540 1,415,580 2,298,340 3,713,920

3.2.3.2 Currency Put Options

1,463,989 3,100,255 4,564,244 989,554 2,708,886 3,698,440

TÜRKİYE İŞ BANKASI A.Ş.

III. Unconsolidated Statement of Off-Balance Sheet Items