Financial Information and Risk Management

110

İş Bankası

Annual Report 2013

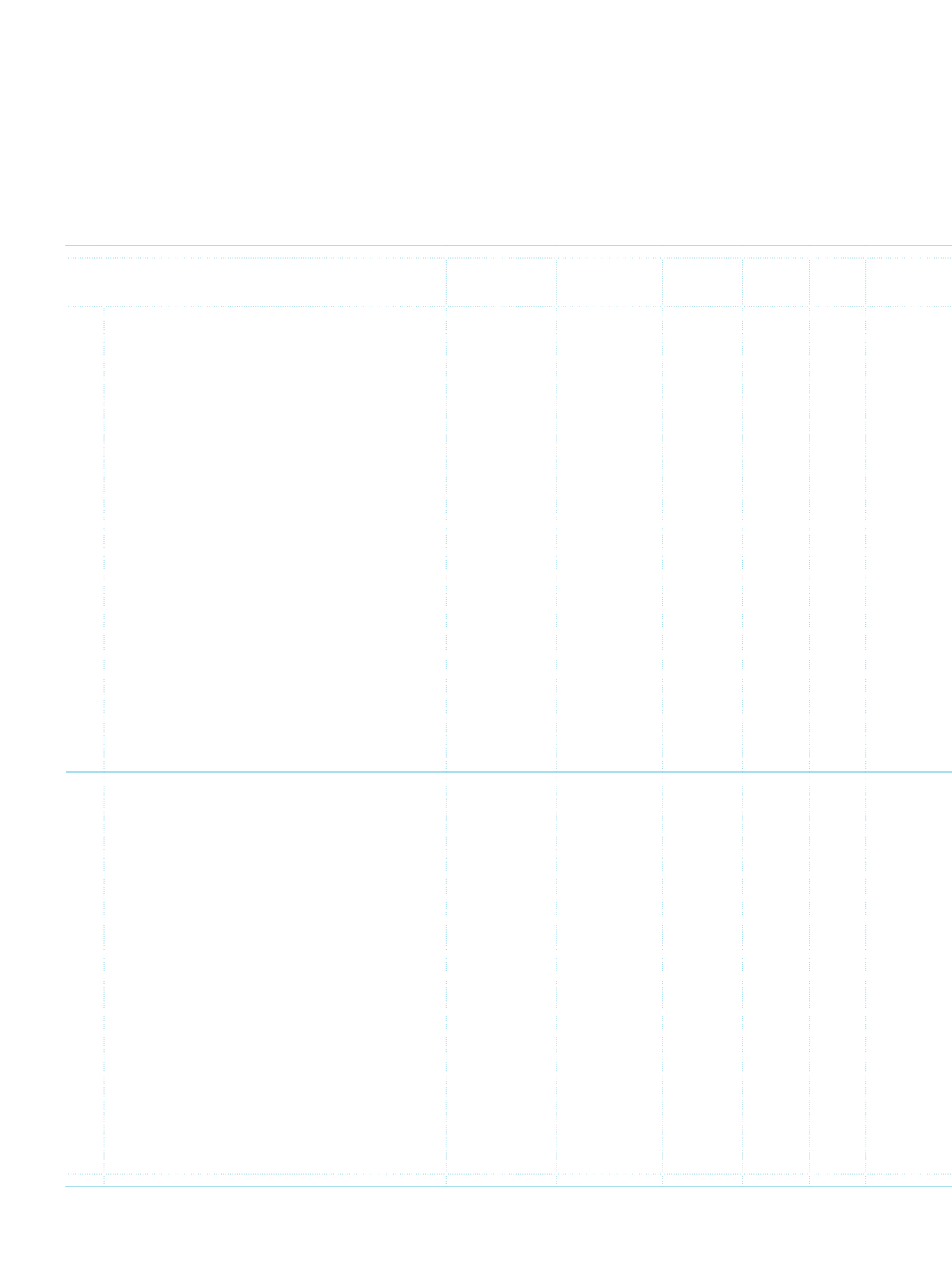

CHANGES IN SHAREHOLDERS’ EQUITY

Footnotes

Paid-in

Capital

Paid-in Capital

Inflation Adjustment

Paid-in Capital

Premium

Share

Cancellation

Profits

Legal

Reserves

V -V

PRIOR PERIOD (31/12/2012)

I.

Beginning Balance

4,500,000

1,615,938

3,694

- 1,646,564

II.

Corrections Made According to TAS 8

-

-

-

-

-

2.1

The Effect of Corrections of Errors

-

-

-

-

-

2.2 The Effect of Changes in Accounting Policies

-

-

-

-

-

III.

Adjusted Beginning Balance (I+II)

4,500,000

1,615,938

3,694

- 1,646,564

Changes During the Period

IV.

Increase/Decrease Due to Mergers

-

-

-

-

-

V.

Marketable Securities Value Increase Fund

-

-

-

-

-

VI.

Hedge Reserves (Effective Portion)

-

-

-

-

-

6.1

Cash Flow Hedges

-

-

-

-

-

6.2 Net Foreign Investment Hedges

-

-

-

-

-

VII.

Revaluation Surplus on Tangible Assets

-

-

-

-

-

VIII.

Revaluation Surplus on Intangible Assets

-

-

-

-

-

IX.

Bonus Shares from Associates, Subsidiaries and Jointly Controlled Entities

(Joint Ventures)

-

-

-

-

-

X.

Translation Differences

-

-

-

-

-

XI.

The Effect of Disposal of Assets

-

-

-

-

-

XII.

The Effect of Reclassification of Assets

-

-

-

-

-

XIII.

The Effect of Changes in the Equity of Subsidiaries on the Equity of the

Bank

-

-

-

-

-

XIV.

Capital Increase

-

-

-

-

-

14.1 Cash

-

-

-

-

-

14.2 Internal Sources

-

-

-

-

-

XV.

Share Issue

-

-

-

-

-

XVI.

Share Cancellation Profits

-

-

-

-

-

XVII.

Paid-in-Capital Inflation Adjustment

-

-

-

-

-

XVIII.

Other

-

-

-

-

-

XIX.

Net Profit/(Loss)

-

-

-

-

-

XX.

Profit Distribution

-

-

-

- 169,931

20.1 Dividend Paid

-

-

-

-

-

20.2 Transfer to Reserves

-

-

-

-

169,931

20.3 Other

-

-

-

-

-

Ending Balance (III+IV+V...+XVIII+XIX+XX)

4,500,000

1,615,938

3,694

- 1,816,495

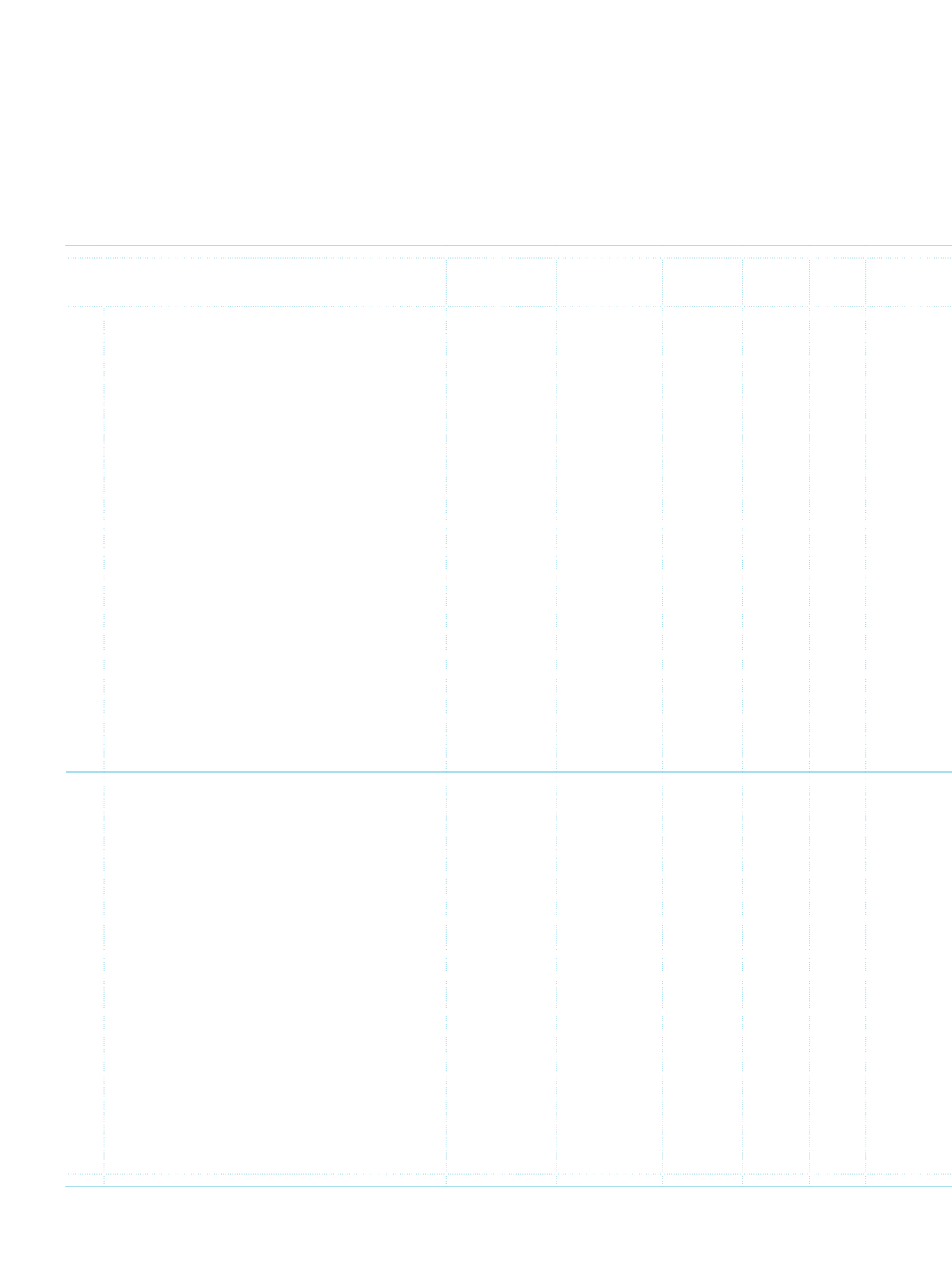

CURRENT PERIOD (31/12/2013)

I.

Beginning Balance

4,500,000

1,615,938

3,694

- 1,816,495

Changes During the Period

II.

Increase/Decrease Due to Mergers

-

-

-

-

-

III.

Marketable Securities Value Increase Fund

-

-

-

-

-

IV.

Hedge Reserves (Effective Portion)

-

-

-

-

-

4.1

Cash Flow Hedges

-

-

-

-

-

4.2 Net Foreign Investment Hedges

-

-

-

-

-

V.

Revaluation Surplus on Tangible Assets

-

-

-

-

-

VI.

Revaluation Surplus on Intangible Assets

-

-

-

-

-

VII.

Bonus Shares from Associates, Subsidiaries and Jointly Controlled Entities

(Joint Ventures)

-

-

-

-

-

VIII.

Translation Differences

-

-

-

-

-

IX.

The Effect of Disposal of Assets

-

-

-

-

-

X.

The Effect of Reclassification of Assets

-

-

-

-

-

XI.

The Effect of Changes in the Equity of Subsidiaries on the Equity of the

Bank

-

-

-

-

-

XII.

Capital Increase

-

-

-

-

-

12.1 Cash

-

-

-

-

-

12.2 Internal Sources

-

-

-

-

-

XIII.

Share Issue

-

-

-

-

-

XIV.

Share Cancellation Profits

-

-

-

-

-

XV.

Paid-in-Capital Inflation Adjustment

-

-

-

-

-

XVI.

Other

-

-

-

-

-

XVII.

Net Profit/Loss for the Period

-

-

-

-

-

XVIII.

Profit Distribution

-

-

-

- 228,335

18.1 Dividend Paid

-

-

-

-

-

18.2 Transfer to Reserves

-

-

-

- 228,335

18.3 Other

(*)

-

-

-

-

-

Ending Balance (I+II+III...+XVI+XVII+XVIII)

4,500,000

1,615,938

3,694

- 2,044,830

(*)

According to the Articles of Incorporation of the Bank, since a portion of the net profit for the period is distributed to the employees as a dividend, the provision provided

for employee dividend distribution in 2012 within the scope of “TAS 19-Employee Benefits”, has been added to distributable profit.

TÜRKİYE İŞ BANKASI A.Ş.

VI. Unconsolidated Statement of Changes in Shareholders’ Equity