148

İş Bankası

Annual Report 2013

Financial Information and Risk Management

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2013

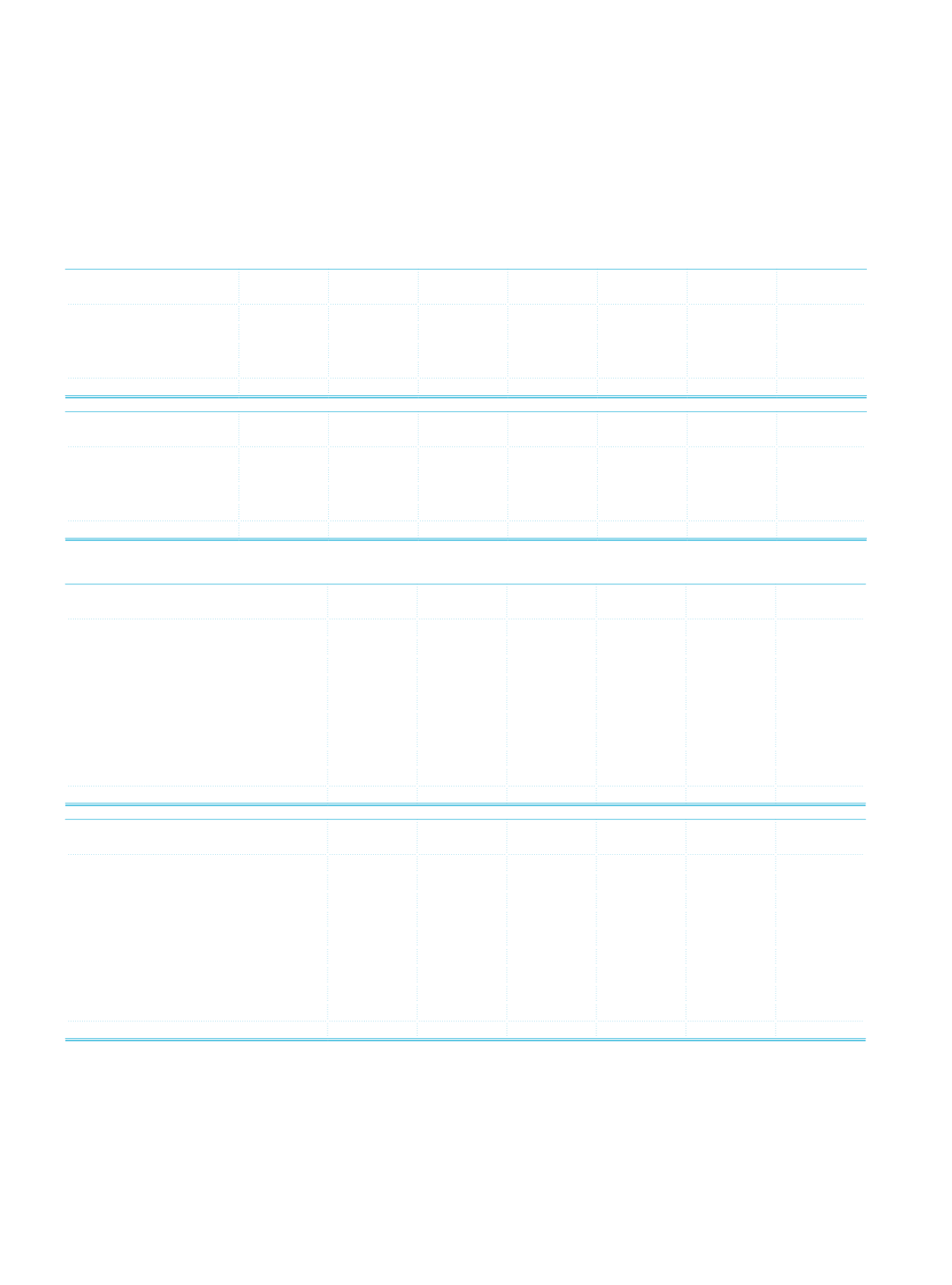

The following table shows the remaining maturities of non-cash loans of the Bank.

Current Period

Demand

Up to 1

Month 1-3 Months 3-12 Months 1-5 Years

5 Years and

Over

Total

Letters of Credit

3,049,754 226,328 751,540 2,300,112

93,515

6,421,249

Letters of Guarantee

17,552,272 594,791 1,642,000 5,588,081 3,404,725 728,988 29,510,857

Acceptances

26,160 282,825 191,936 964,702

29,323

1,494,946

Other

8,494

696

9,193

23,639

50,312 492,728 585,062

Total

20,636,680 1,104,640 2,594,669 8,876,534 3,577,875 1,221,716 38,012,114

Prior Period

Demand

Up to 1

Month 1-3 Months 3-12 Months 1-5 Years

5 Years and

Over

Total

Letters of Credit

2,043,693 372,527 631,597 1,495,739

41,691

4,585,247

Letters of Guarantee

13,464,796 642,626 1,343,974 3,973,423 2,488,947 337,628 22,251,394

Acceptances

45,351

168,374 343,971

698,964

41,590

1,298,250

Other

22,057

5,276

6,996

32,888

42,769 376,735 486,721

Total

15,575,897 1,188,803 2,326,538 6,201,014 2,614,997 714,363 28,621,612

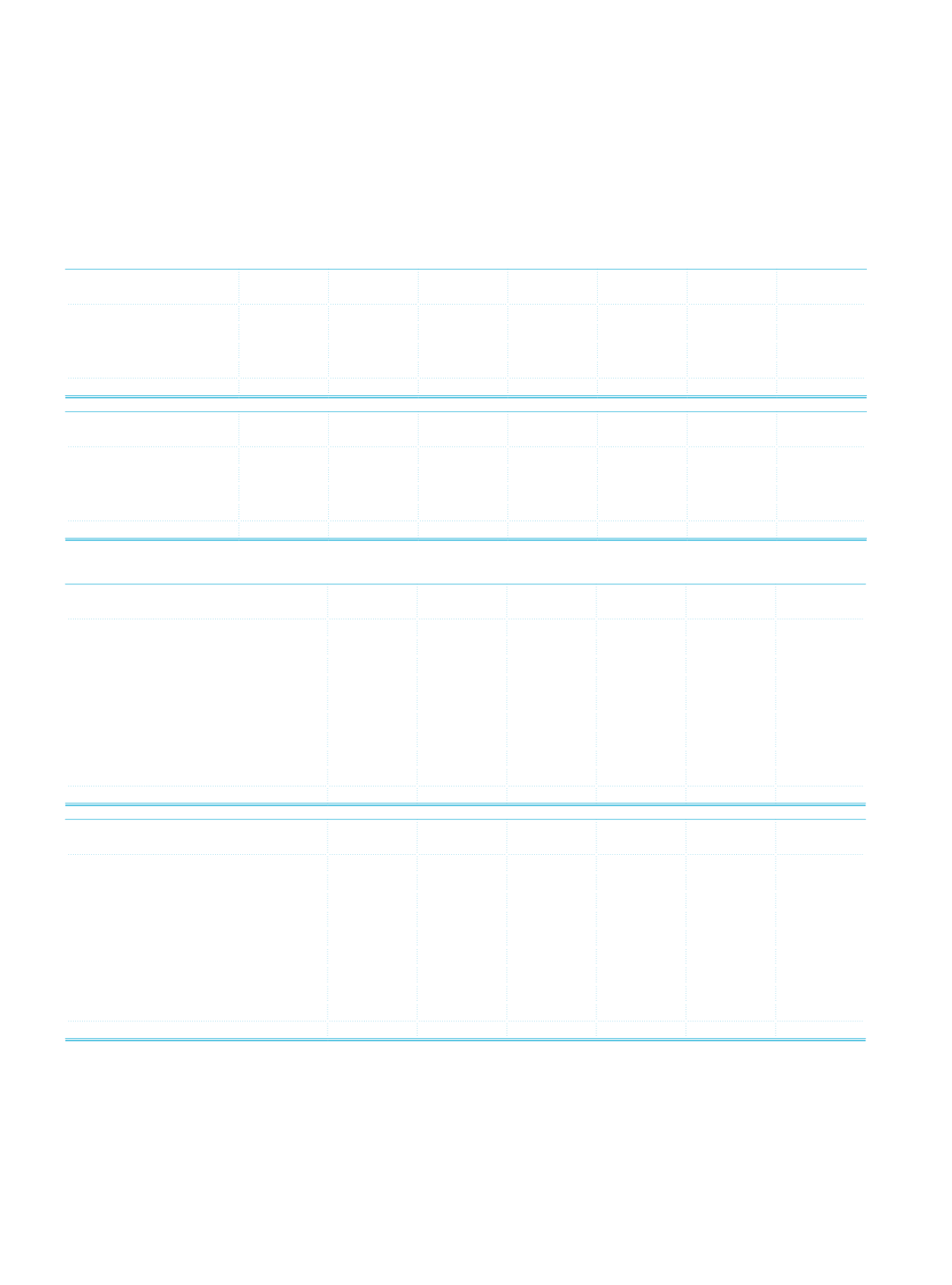

The following table shows the remaining maturities of derivative financial assets and liabilities of the Bank.

Current Period

Up to 1

Month 1-3 Months 3-12 Months 1-5 Years

5 Years and

Over

Total

Forwards Contracts-Buy

1,931,447 929,102 1,563,470 137,617

4,561,636

Forwards Contracts-Sell

1,938,462 945,983 1,566,678 137,435

4,588,558

Swaps Contracts-Buy

9,363,548 4,703,135 3,701,449 11,075,371 2,340,398 31,183,901

Swaps Contracts-Sell

9,279,628 4,670,697 3,682,428 10,886,023 2,340,398 30,859,174

Futures Transactions-Buy

Futures Transactions-Sell

358

358

Options-Call

919,955 835,986 3,164,858 352,305

570,171 5,843,275

Options-Put

924,307 840,338 3,164,858 352,305

570,171 5,851,979

Other

52,397 240,338 145,519

438,254

Total

24,409,744 13,165,937 16,989,260 22,941,056 5,821,138 83,327,135

Prior Period

Up to 1

Month 1-3 Months 3-12 Months 1-5 Years

5 Years and

Over

Total

Forwards Contracts- Buy

2,181,845 1,109,347 1,585,745 167,416

5,044,353

Forwards Contracts- Sell

2,159,549 1,104,851 1,584,790 166,962

5,016,152

Swaps Contracts-Buy

5,192,537 1,501,917 5,690,904 7,806,874 1,642,977 21,835,209

Swaps Contracts-Sell

4,781,645 1,501,805 5,464,629 7,754,456 1,642,977 21,145,512

Futures Transactions-Buy

Futures Transactions-Sell

Options-Call

712,426 583,651 2,142,104 1,074,063 489,672 5,001,916

Options-Put

711,100 580,993 2,130,608 1,074,063 489,672 4,986,436

Other

380,080

2,212

40,338

422,630

Total

16,119,182 6,384,776 18,639,118 18,043,834 4,265,298 63,452,208

IX. Explanations on securitization positions

None.

X. Explanations on credit risk mitigation techniques:

Activities carried out by the bank that give rise to credit risk and collaterals are in accordance with the provisions of the relevant

legislation. However, effect of credit risk mitigation techniques is not taken into account in the determination of the capital

adequacy ratio.