151

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2013

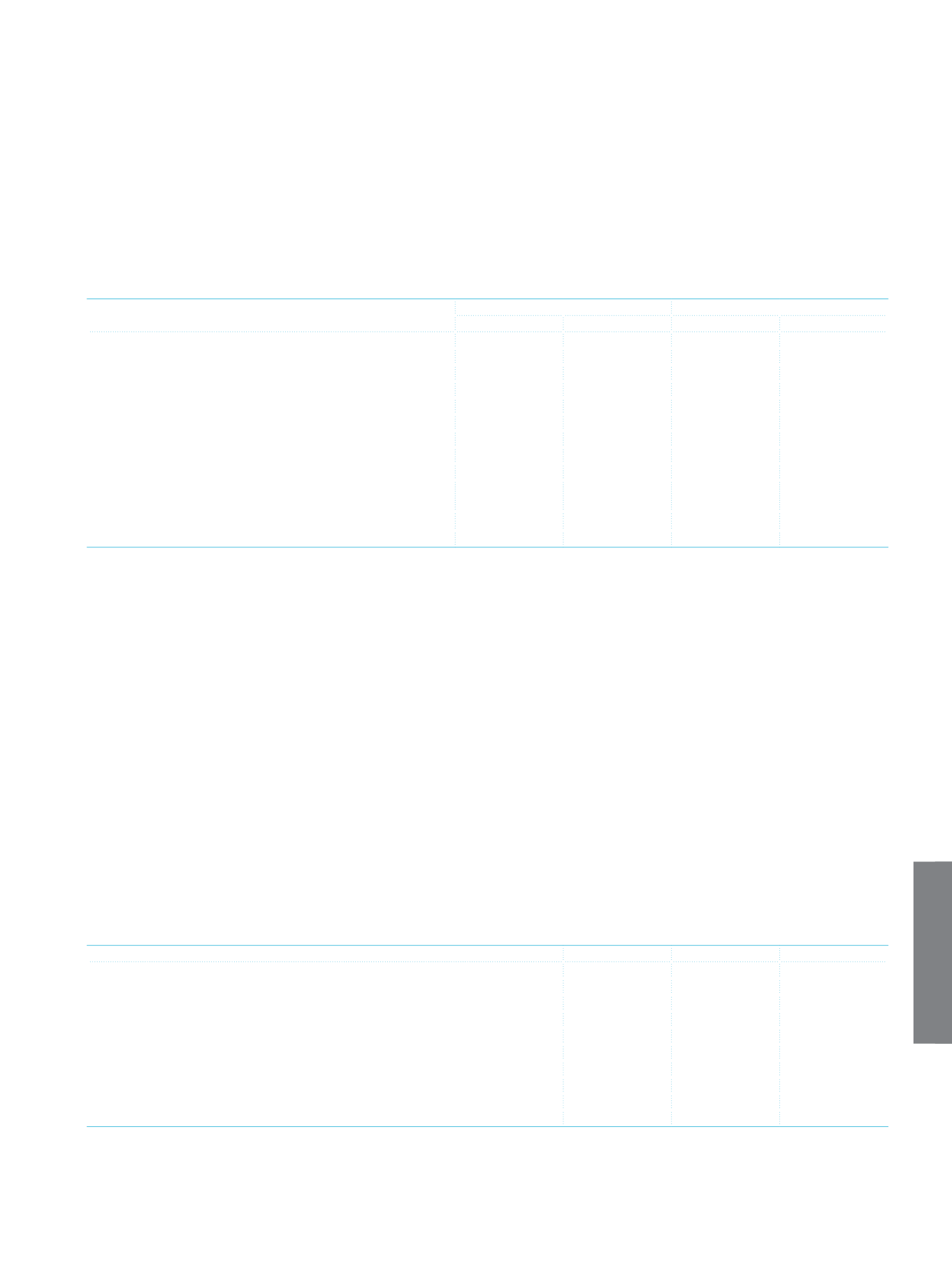

XIII. Explanations on Presentation of Assets and Liabilities at Fair Value

1. Information on fair values of financial assets and liabilities

Book Value

Fair Value

Current Period

Prior Period Current Period

Prior Period

Financial Assets

Money Market Placements

Banks

1,527,610

1,434,846

1,528,476

1,435,488

Financial Assets Available for Sale

28,347,830

26,346,903

28,347,830

26,346,903

Investments Held to Maturity

7,627,448

10,953,158

7,732,705

11,737,347

Loans

135,281,021

107,142,154

135,246,177

109,328,315

Financial Liabilities

Banks Deposits

3,979,410

3,045,951

3,978,557

3,047,971

Other Deposits

116,995,355

102,337,483

116,991,760

102,336,717

Funds Provided from Other Financial

Institutions

15,921,894

10,747,554

15,847,426

10,780,406

Marketable Securities Issued

(1)

13,079,569

8,168,567

12,834,095

8,368,707

Miscellaneous Payables

4,337,257

3,674,259

4,337,257

3,674,259

(1)

Secondary subordinated issued bonds having credit quality, which are classified on the balance sheet under the subordinated loans, are also included

Fair values of investments held to maturity securities issued is determined by using the market prices; in cases where market prices

cannot be measured, quoted market prices of other securities that are subject to amortization having similar interest, maturity and

other conditions are taken as the basis for the fair value determination.

Market prices are taken into account in determining the fair values of the securities available for sale. When the prices cannot be

measured in an active market, fair values are not deemed to be reliably determined and amortized cost, calculated by the internal

rate of return method, are taken into account as the fair values.

Fair values of banks, loans granted, deposits and funds borrowed from other financial institutions and marketable securities are

calculated by discounting the amounts in each maturity bracket formed according to repricing periods, using the rate corresponding

to relevant maturity bracket in the discount curves based on current market conditions.

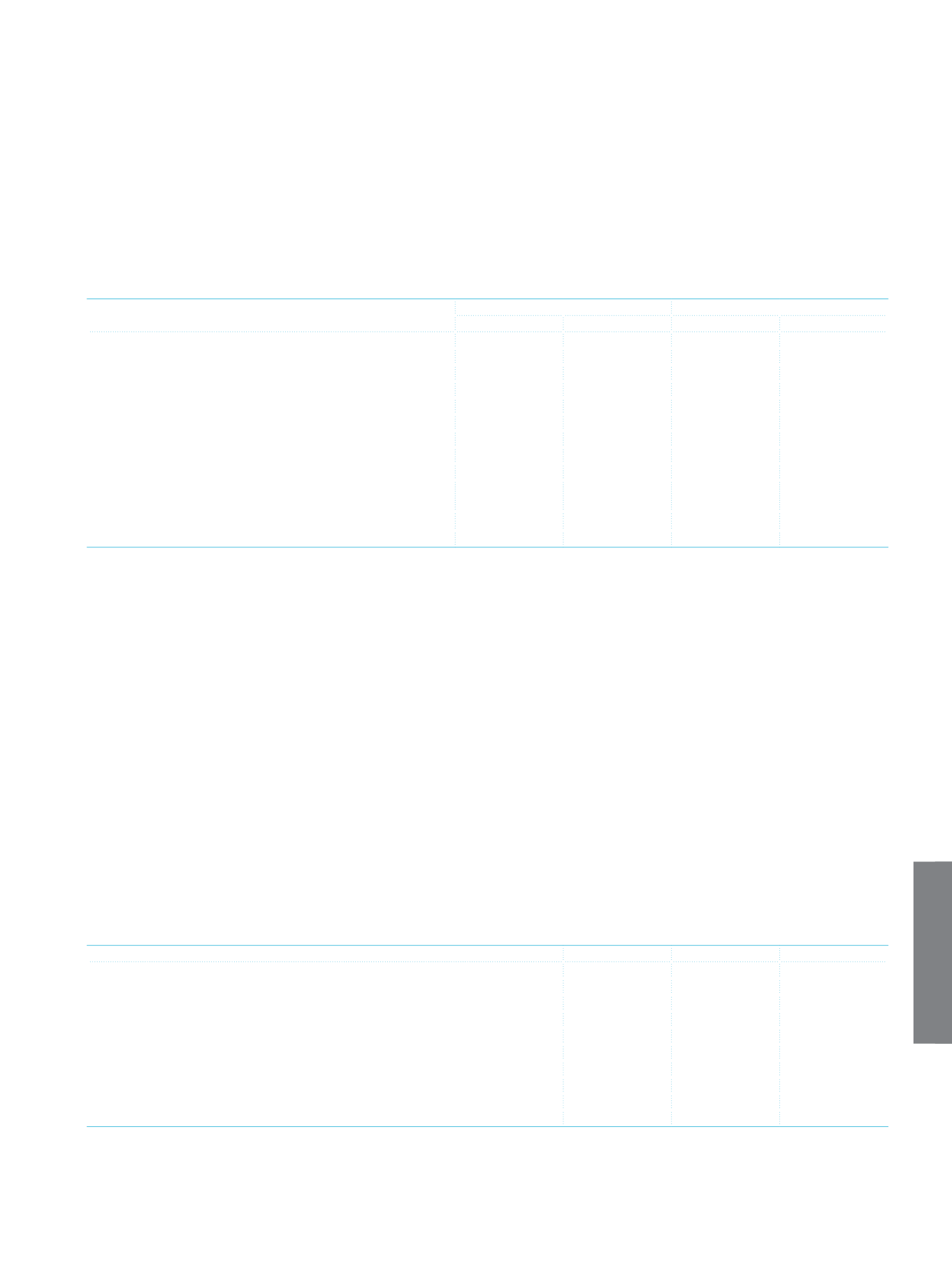

2. Information on fair value measurements recognized in the financial statements

“TFRS 7 - Financial Instruments: Disclosures” standard requires the items, which are recognized in the balance sheet at their fair

values to be shown in the notes by being classified within a range. According to this, the related financial instruments are classified

into three levels in such a way that they will express the significance of the data used in fair value measurements. At the first level,

there are financial instruments, whose fair values are determined according to quoted prices in active markets for identical assets or

liabilities, at the second level, there are financial instruments, whose fair values are determined by directly or indirectly observable

market data, and at the third level, there are financial instruments, whose fair values are determined by the data, which are not

based on observable market data. The financial assets, which are recognized in the balance sheet at their values, are shown below

as classified according to the aforementioned principles of ranking.

Current Period

Level 1

Level 2

Level 3

Financial Assets at Fair Value Through Profit and Loss

Debt Securities

827,854

5,901

57,228

Equity Securities

2

Derivative Financial Assets Held for Trading

1,312,573

Other

Financial Assets Available-for-Sale

(1)

Debt Securities

18,989,827

5,190,812

4,095,104

Other

44,002

Investments in Subsidiaries and Associates

(2)

5,585,702

Derivative Financial Liabilities

981,522

(1)

Since they are not traded in an active market, the equity securities (TL 28,085) under the financial assets available-for-sale are shown in the financial statements at

acquisition cost and the related securities are not shown in this table.

(2)

Since the unlisted investments in associates and subsidiaries are recognized at acquisition cost within the framework of “TAS 39”, these companies are not included in

the table.