163

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2013

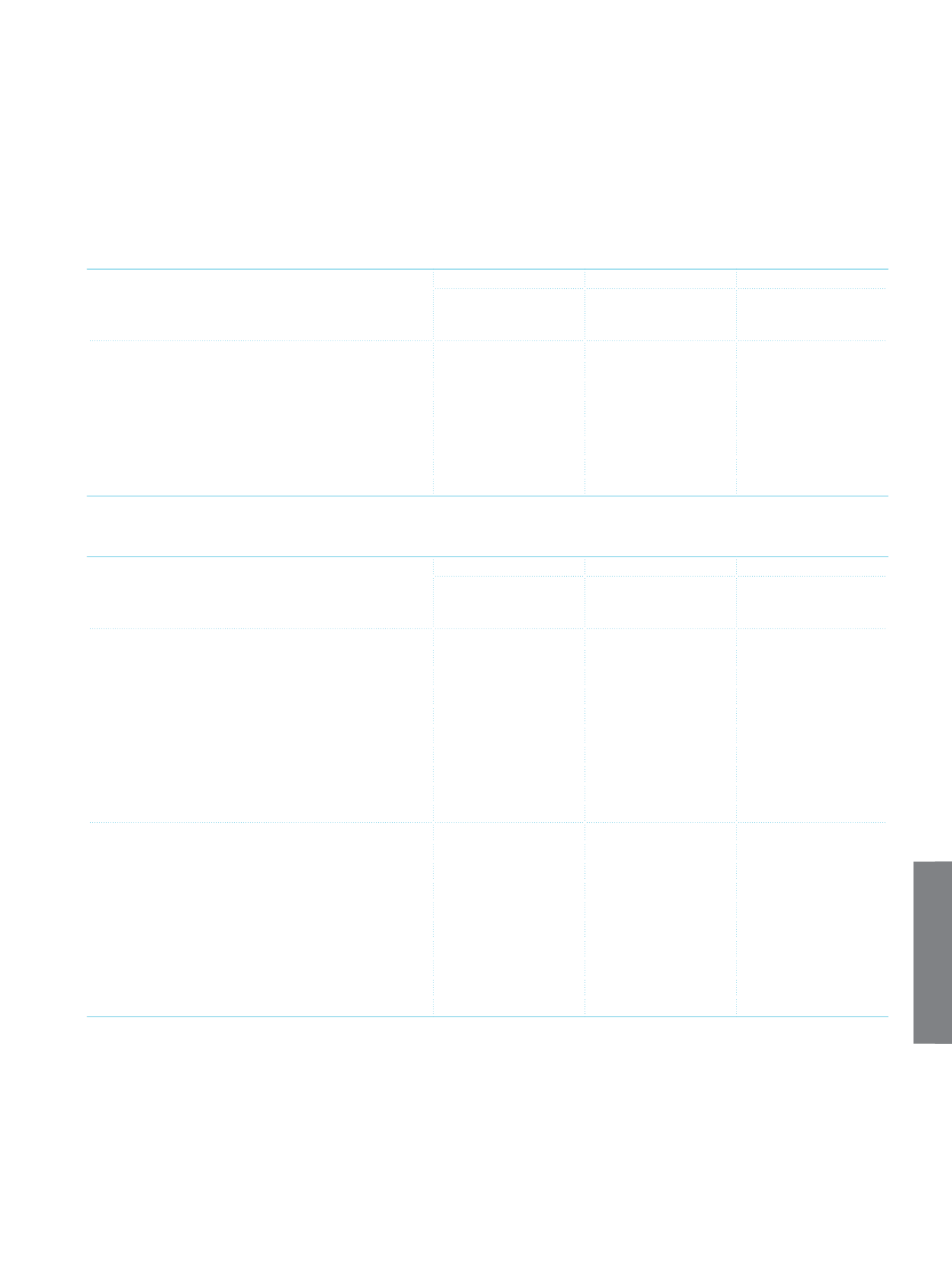

g.10.3. Information on foreign currency non-performing loans and other receivables:

Group III

Group IV

Group V

Loans and

Receivables with

Limited Collectability

Loans and

Receivables with

Doubtful Collectability

Uncollectible

Loans and

Other Receivables

Current Period:

Period Ending Balance

8,759

26,693

291,680

Specific Provisions (-)

2,109

13,727

291,680

Net Balance on Balance Sheet

6,650

12,966

Prior Period:

Period Ending Balance

4,974

15,269

340,069

Specific Provisions (-)

1,226

7,831

340,069

Net Balance on Balance Sheet

(1)

3,748

7,438

(1)

In addition to the loans extended in foreign currency, loans which are monitored in Turkish Lira are included.

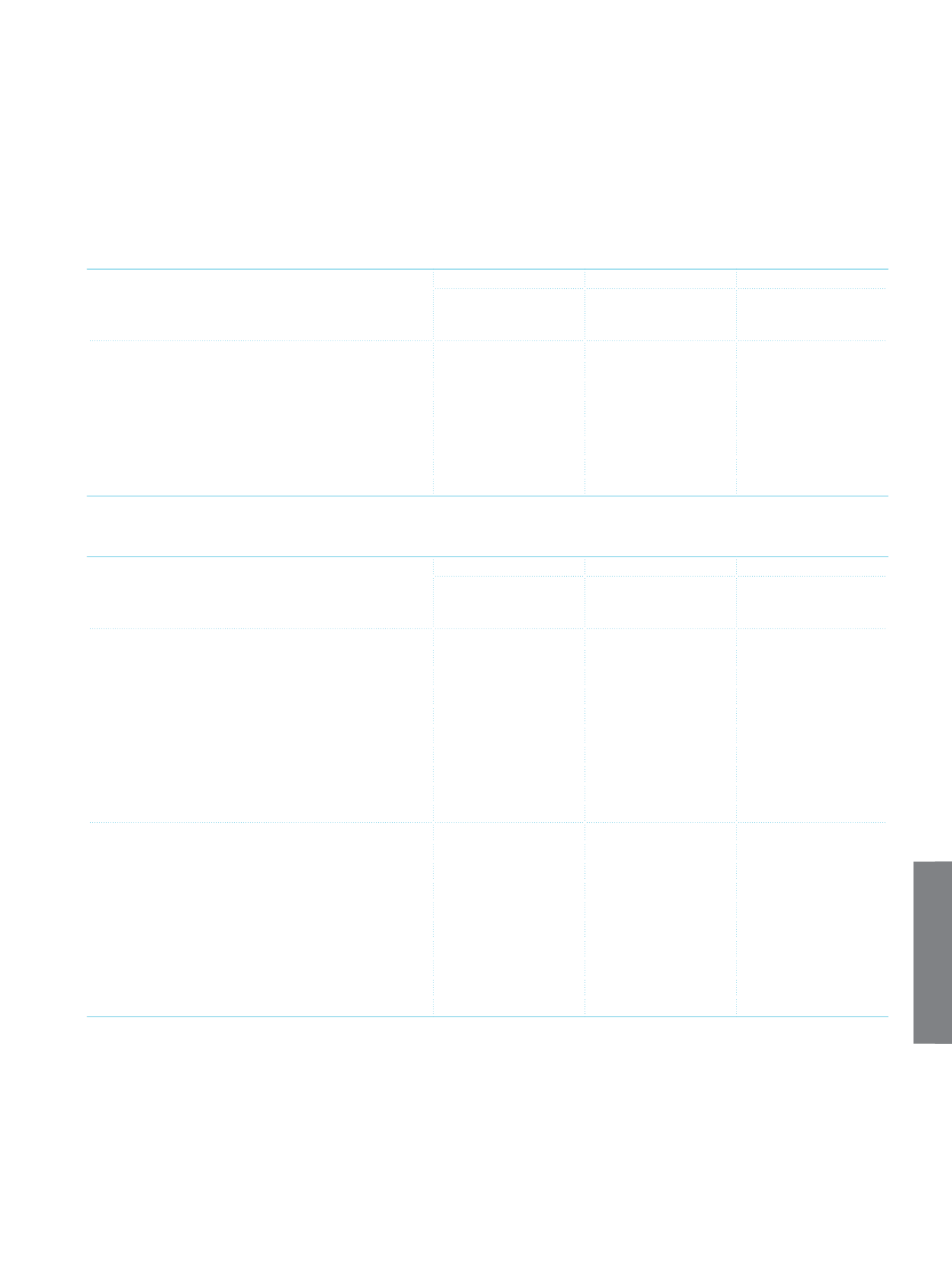

g.10.4. Information on gross and net non-performing loans and receivables as per customer categories:

Group III

Group IV

Group V

Loans and

Receivables with

Limited Collectability

Loans and

Receivables with

Doubtful Collectability

Uncollectible

Loans and Other

Receivables

Current Period (Net)

206,441

231,206

Loans to Individuals and Corporate (Gross)

259,121

465,396

1,462,585

Specific Provisions (-)

52,680

234,190

1,462,585

Loans to Individuals and Corporate (Net)

206,441

231,206

Banks (Gross)

Specific Provisions (-)

Banks (Net)

Other Loans and Receivables (Gross)

50,690

Specific Provisions (-)

50,690

Other Loans and Receivables (Net)

Prior Period (Net)

212,903

213,481

Loans to Individuals and Corporate (Gross)

266,953

428,740

1,282,028

Specific Provisions (-)

54,050

215,259

1,282,028

Loans to Individuals and Corporate (Net)

212,903

213,481

Banks (Gross)

Specific Provisions (-)

Banks (Net)

Other Loans and Receivables (Gross)

47,546

Specific Provisions (-)

47,546

Other Loans and Receivables (Net)

g.10.5. Main principles of liquidating for uncollectible loans and other receivables

In order to ensure the liquidation of non-performing loans, all possibilities evaluated to ensure maximum collection according to the

legislation. First of all, administrative initiatives are taken to deal with the borrower. Collection through legal proceedings used if

there is no possibility of collection and configuration with the interviews for other receivables.