171

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2013

p.

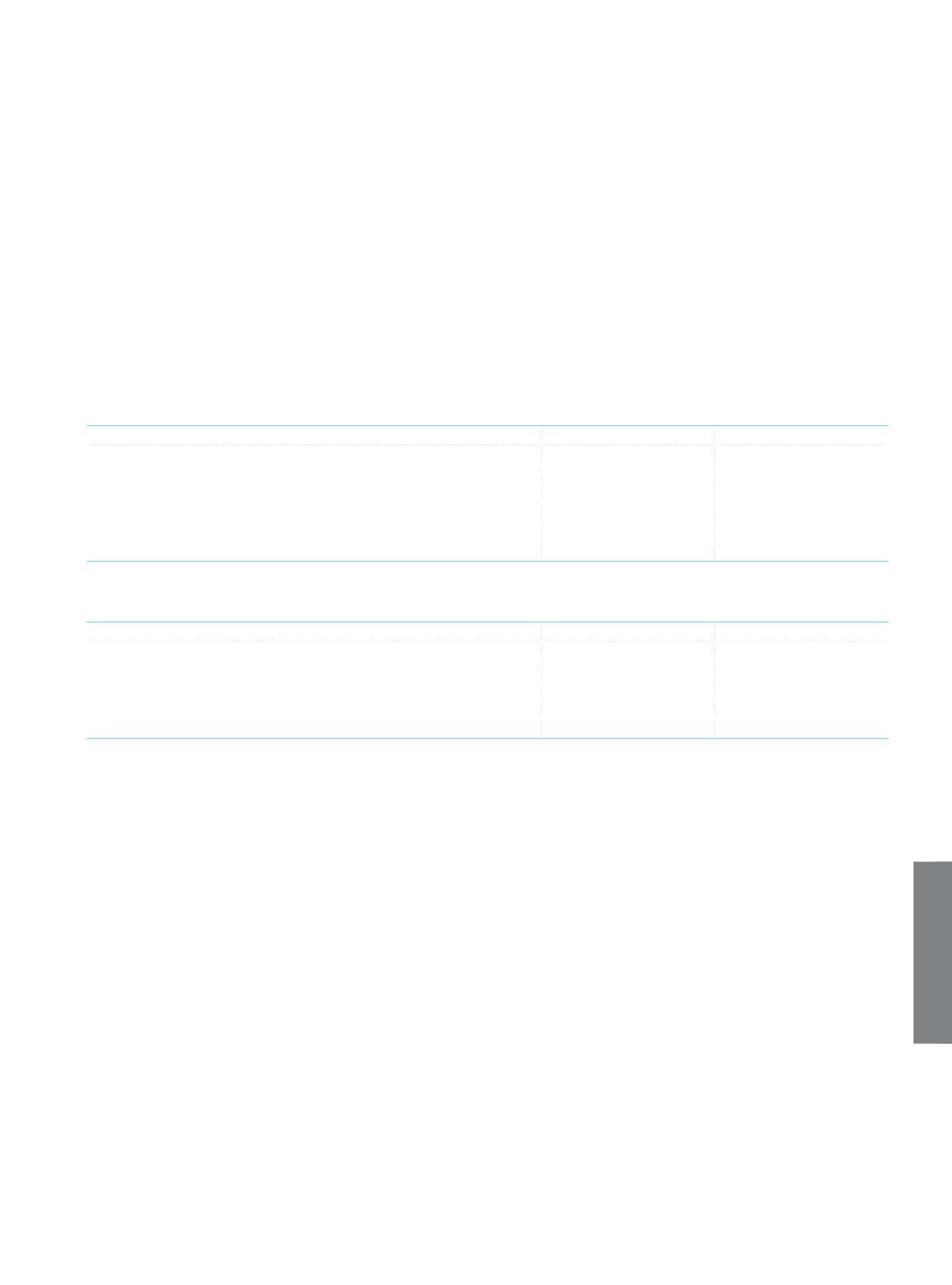

Information on investment property:

The Bank has not any investment properties.

r.

Information on deferred tax asset:

As of 31 December 2013, the Bank has deferred tax asset amounting to TL 538,592. Such deferred tax asset is calculated based

on the temporary differences between the book value of the Bank’s assets and liabilities and their tax basis measured as per the

prevailing tax regulation. When the items comprising the temporary differences are followed under equity, the related tax asset/

liability is directly recognized under equity items. As of 31 December 2013, the Bank has no tax asset measured over the period loss

or tax relief.

Current Period

Prior Period

Deferred Tax (Asset)/Liability:

Tangible Assets Base Differences

28,583

28,419

Provisions

(1)

(559,910)

(462,737)

Valuation of Financial Assets

(1,542)

(162,872)

Other

(5,723)

2,699

Net Deferred Tax (Asset)/Liability:

(538,592)

(594,491)

(1)

Comprised of employee termination benefits, actual and technical deficits of the pension fund, the provisions for credit card bonus points, and other provisions.

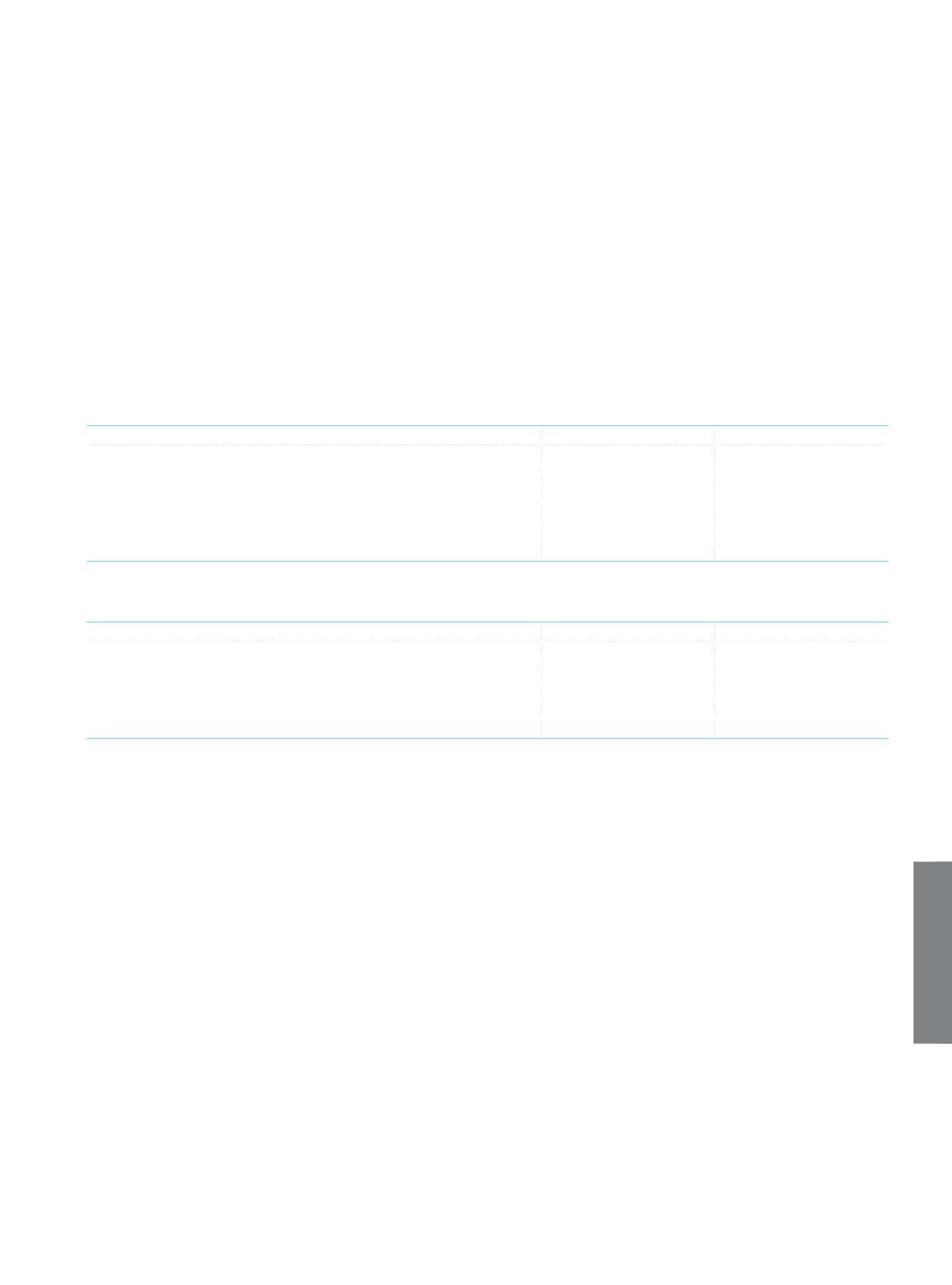

The Movement of deferred tax assets are as follows:

Current Period

Prior Period

Balance at Beginning of Period

594,491

488,613

Deferred Tax Income/(Expense) (Net)

(329,474)

306,871

Deferred tax under Equity Accounting

273,566

(200,993)

Exchange Difference

9

Deferred Tax Asset

538,592

594,491