174

İş Bankası

Annual Report 2013

Financial Information and Risk Management

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2013

b.

Information on Derivative Financial Liabilities Held for Trading:

Negative differences on derivative financial liabilities held for trading:

Derivative Financial Liabilities Held for Trading

Current Period

Prior Period

TL

FC

TL

FC

Forward Transactions

161,705

12,511

11,797

44,251

Swap Transactions

519,557

161,986

372,702

268,382

Futures

Options

4,237

121,526

6,219

33,236

Other

697

Total

685,499

296,023

390,718

346,566

c.

Information on Funds Borrowed:

c.1. Information on banks and other financial institutions:

Current Period

Prior Period

TL

FC

TL

FC

Funds borrowed from the Central Bank of Turkey

Domestic banks and Institutions

271,666

375,190

220,240

382,843

Foreign banks, institutions and funds

1,379,376 13,895,662

668,068 9,476,403

Total

1,651,042 14,270,852

888,308 9,859,246

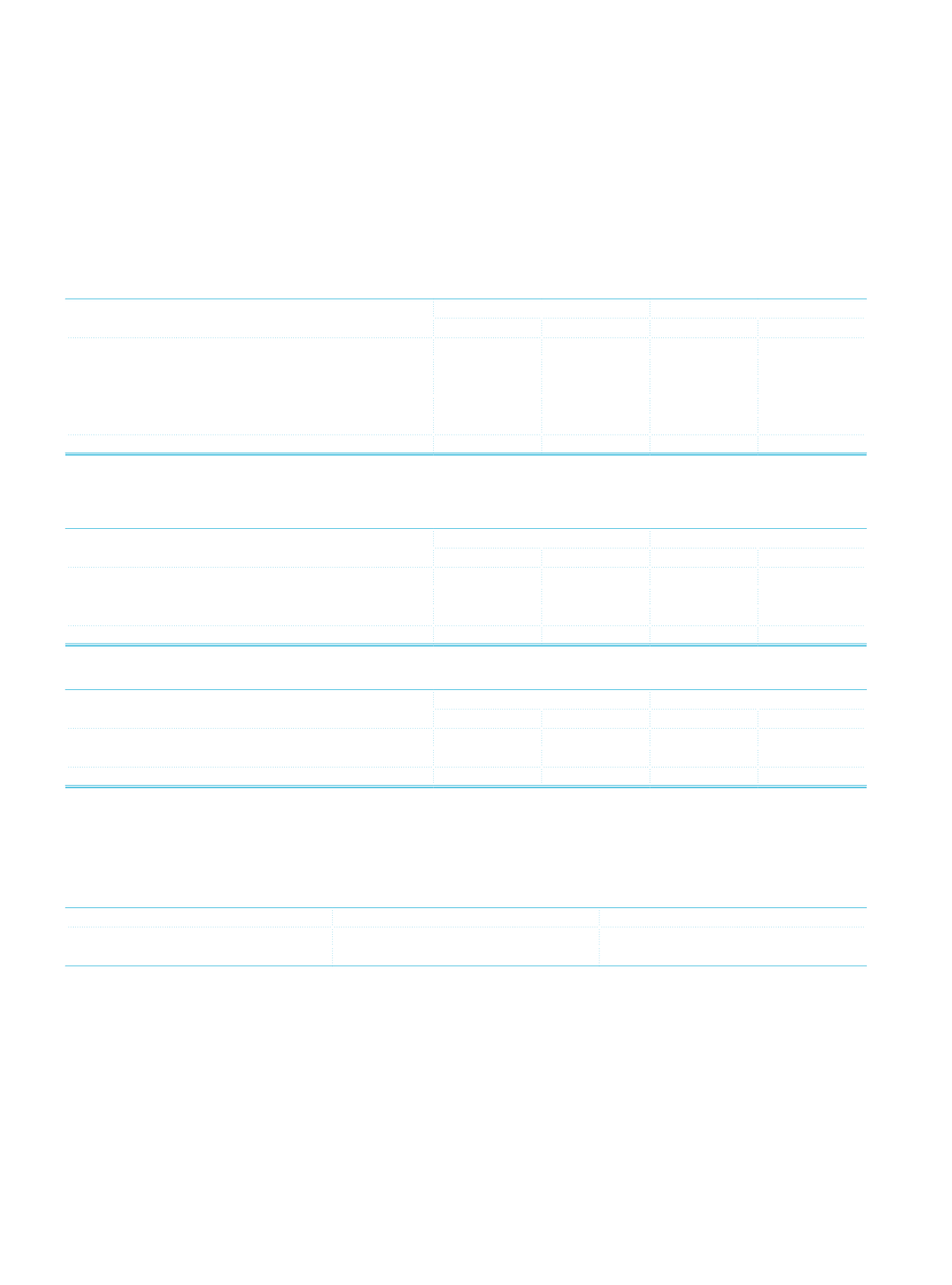

c.2. Maturity analysis of funds borrowed:

Current Period

Prior Period

TL

FC

TL

FC

Short-term

1,462,322

7,862,046

869,719

5,425,214

Medium and Long-term

188,720 6,408,806

18,589 4,434,032

Total

1,651,042 14,270,852

888,308 9,859,246

c.3. Information on funds borrowed:

Information on funds received through syndicated loans and securitization deals, which take a significant place among funds

borrowed, are given below.

Syndicated loans:

Date of Use

Funds Borrowed

Maturity

May 2013

USD 441,000,000 + EUR 631,000,000 1 year (with 1 year extension option)

September 2013

USD 391,000,000 + EUR 651,500,000 1 year (with 1 year extension option)