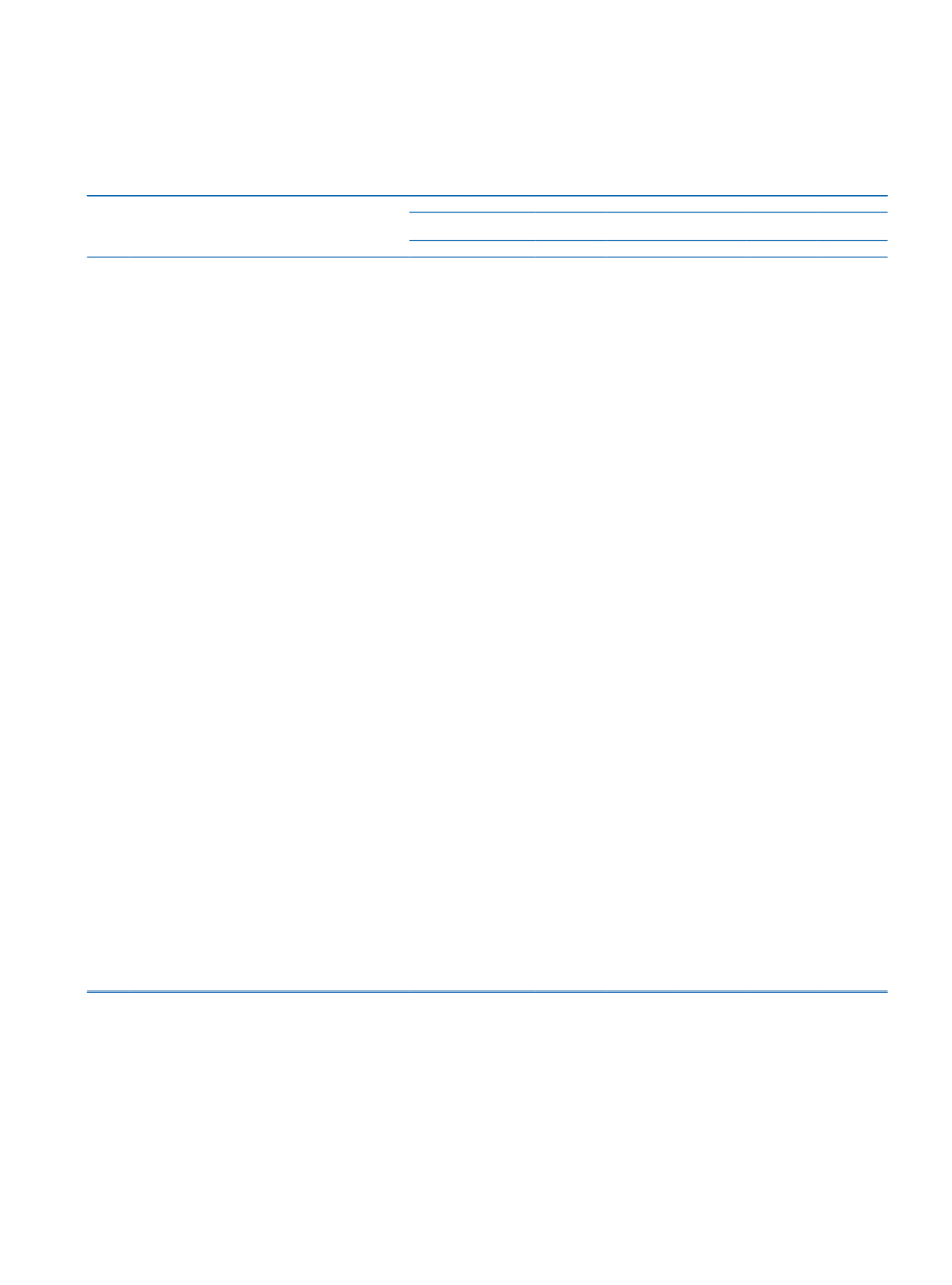

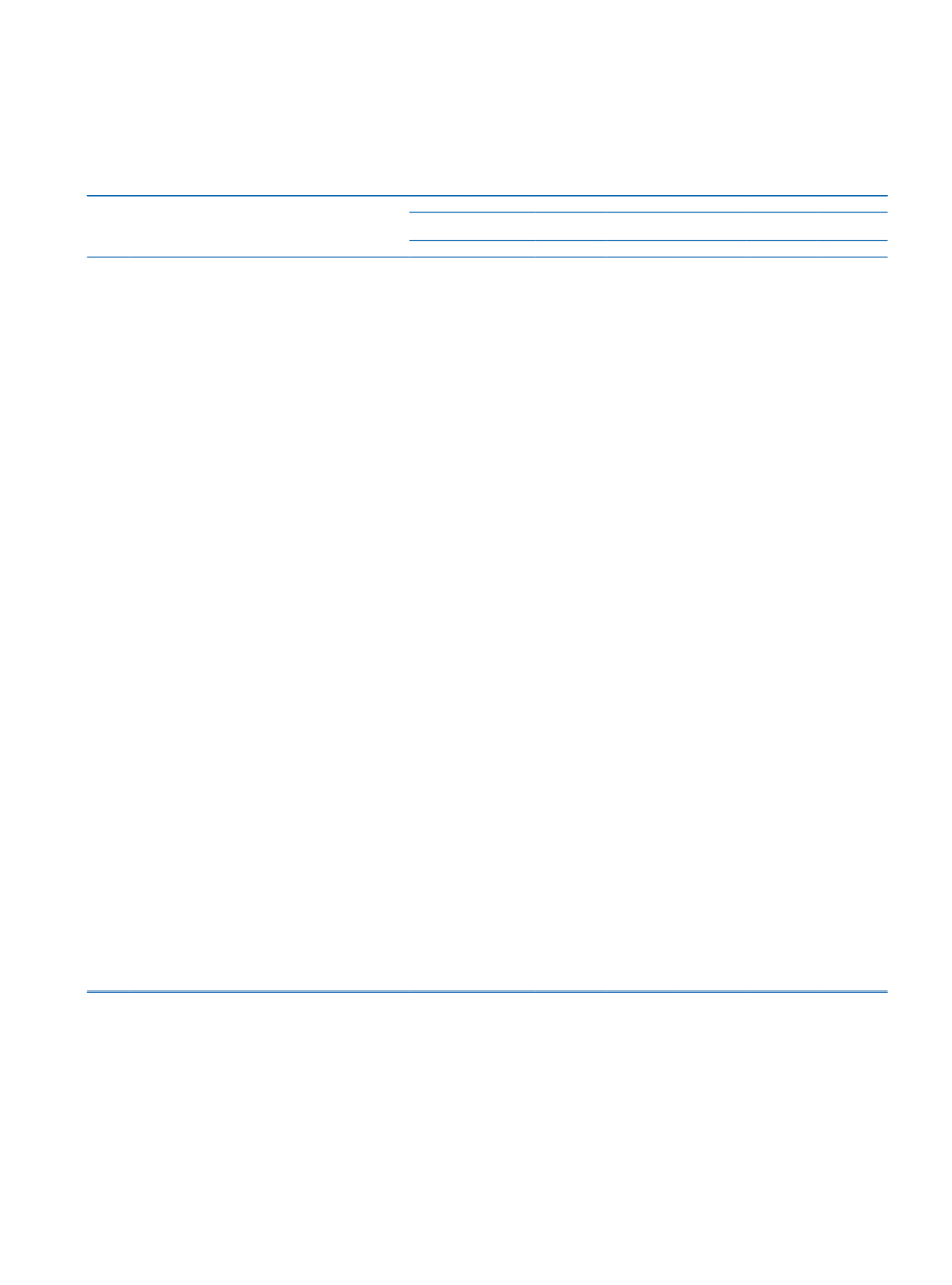

168 İşbank

Annual Report 2015

THOUSAND TL

Footnotes

CURRENT PERIOD

(31/12/2015)

PRIOR PERIOD

(31/12/2014)

OFF-BALANCE SHEET ITEMS

TL

FC

Total

TL

FC

Total

A.

OFF-BALANCE SHEET CONTINGENCIES AND COMMITMENTS

(I+II+III)

101,375,370 157,624,155 258,999,525 85,747,317 109,096,113 194,843,430

I.

GUARANTEES AND SURETYSHIPS

V-III 20,849,553 32,062,712 52,912,265 18,327,481 26,335,832 44,663,313

1.1

Letters of Guarantee

20,561,735 19,279,873 39,841,608 18,080,951 16,568,615 34,649,566

1.1.1 Guarantees Subject to State Tender Law

804,216 2,524,859 3,329,075

741,815 2,975,340 3,717,155

1.1.2 Guarantees Given for Foreign Trade Operations

3,540,122 6,843,585 10,383,707 3,205,517 5,001,864 8,207,381

1.1.3 Other Letters of Guarantee

16,217,397 9,911,429 26,128,826 14,133,619 8,591,411 22,725,030

1.2

Bank Acceptances

4,821

950,759 955,580

9,813 1,219,918 1,229,731

1.2.1 Import Letters of Acceptance

-

135,844 135,844

-

413,697

413,697

1.2.2 Other Bank Acceptances

4,821

814,915

819,736

9,813

806,221

816,034

1.3

Letters of Credit

5,655 10,900,839 10,906,494

-

7,763,406 7,763,406

1.3.1 Documentary Letters of Credit

5,067 8,404,696 8,409,763

-

5,580,303 5,580,303

1.3.2 Other Letters of Credit

588 2,496,143 2,496,731

-

2,183,103 2,183,103

1.4 Prefinancing Given as Guarantee

-

-

-

-

-

-

1.5

Endorsements

-

-

-

-

-

-

1.5.1 Endorsements to the Central Bank of Turkey

-

-

-

-

-

-

1.5.2 Other Endorsements

-

-

-

-

-

-

1.6 Purchase Guarantees for Securities Issued

-

-

-

-

-

-

1.7

Factoring Guarantees

50,022

14,269

64,291

88,602

11,941

100,543

1.8 Other Guarantees

227,320

916,972 1,144,292

148,115

771,952

920,067

1.9 Other Suretyships

-

-

-

-

-

-

II.

COMMITMENTS

43,118,249 15,796,161 58,914,410 41,486,251 10,949,790 52,436,041

2.1

Irrevocable Commitments

42,559,743 5,229,275 47,789,018 40,998,494 2,863,091 43,861,585

2.1.1 Forward Asset Purchase Commitments

208,436 3,063,854 3,272,290

67,689 977,497 1,045,186

2.1.2 Forward Deposit Purchase and Sale Commitments

-

-

-

-

-

-

2.1.3 Capital Commitment for Associates and Subsidiaries

-

-

-

-

121,296

121,296

2.1.4 Loan Granting Commitments

10,355,068 427,173 10,782,241 9,429,052

527,744 9,956,796

2.1.5 Securities Underwriting Commitments

-

-

-

-

-

-

2.1.6 Commitments for Reserve Deposit Requirements

-

-

-

-

-

-

2.1.7 Commitments for Cheque Payments

5,654,056

-

5,654,056 5,875,007

-

5,875,007

2.1.8 Tax and Fund Liabilities from Export Commitments

11,630

-

11,630

17,932

-

17,932

2.1.9 Commitments for Credit Card Expenditure Limits

21,219,999

- 21,219,999 20,489,527

- 20,489,527

2.1.10 Commitments for Credit Cards and Banking Services Promotions

100,470

-

100,470

93,072

-

93,072

2.1.11 Receivables from Short Sale Commitments

-

-

-

-

-

-

2.1.12 Payables for Short Sale Commitments

12,960

-

12,960

9,784

-

9,784

2.1.13 Other Irrevocable Commitments

4,997,124 1,738,248 6,735,372 5,016,431 1,236,554 6,252,985

2.2 Revocable Commitments

558,506 10,566,886 11,125,392

487,757 8,086,699 8,574,456

2.2.1 Revocable Loan Granting Commitments

558,506 10,566,886 11,125,392

487,757 8,086,699 8,574,456

2.2.2 Other Revocable Commitments

-

-

-

-

-

-

III.

DERIVATIVE FINANCIAL INSTRUMENTS

37,407,568 109,765,282 147,172,850 25,933,585 71,810,491 97,744,076

3.1

Derivative Financial Instruments held for risk management

-

4,689,900 4,689,900

-

-

-

3.1.1 Fair Value Hedges

-

4,689,900 4,689,900

-

-

-

3.1.2 Cash Flow Hedges

-

-

-

-

-

-

3.1.3 Net Foreign Investment Hedges

-

-

-

-

-

-

3.2 Derivative Financial Instruments Held for Trading

37,407,568 105,075,382 142,482,950 25,933,585 71,810,491 97,744,076

Türkiye İş Bankası A.Ş.

Consolidated Statement of Off-Balance Sheet Items