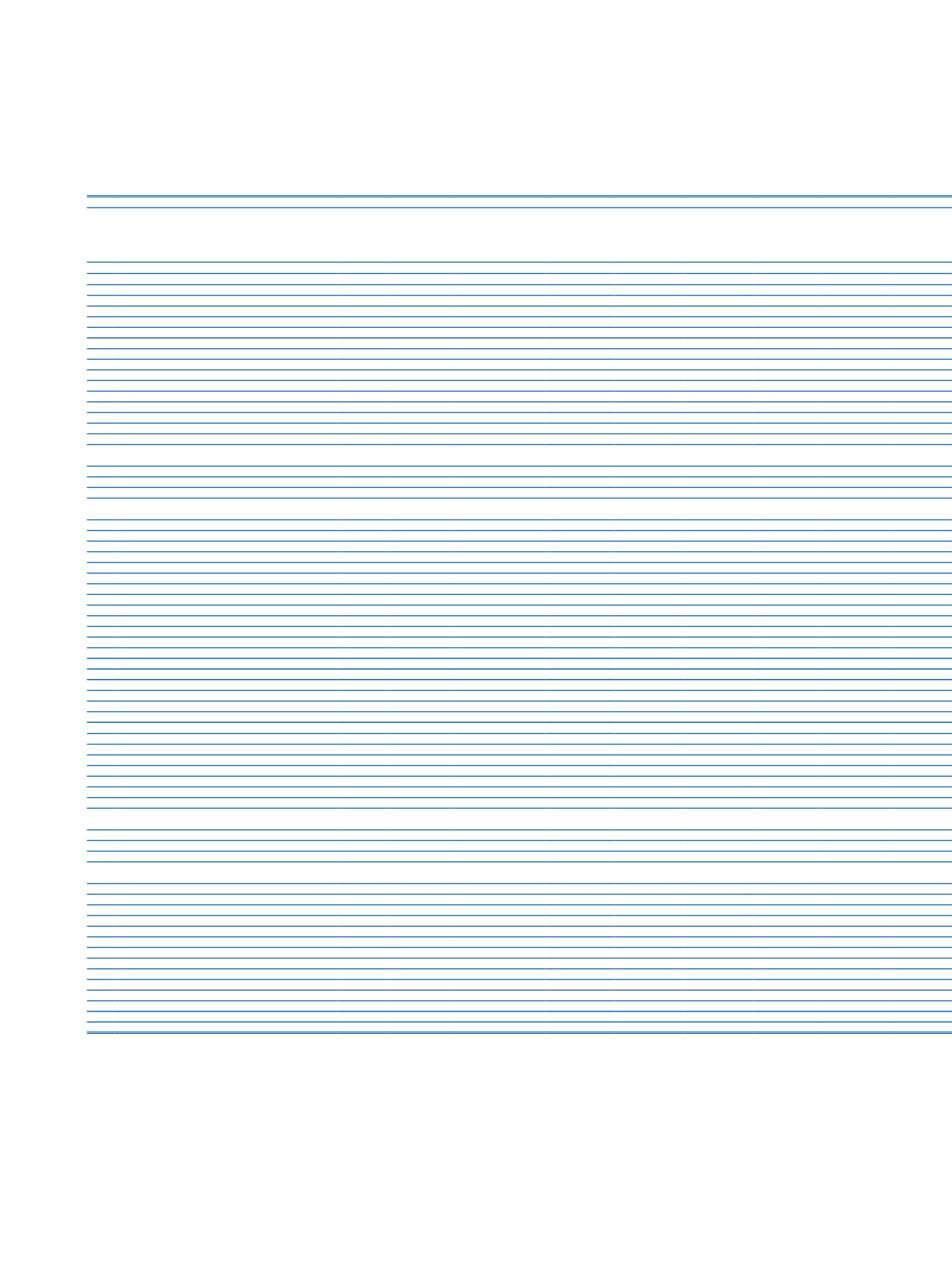

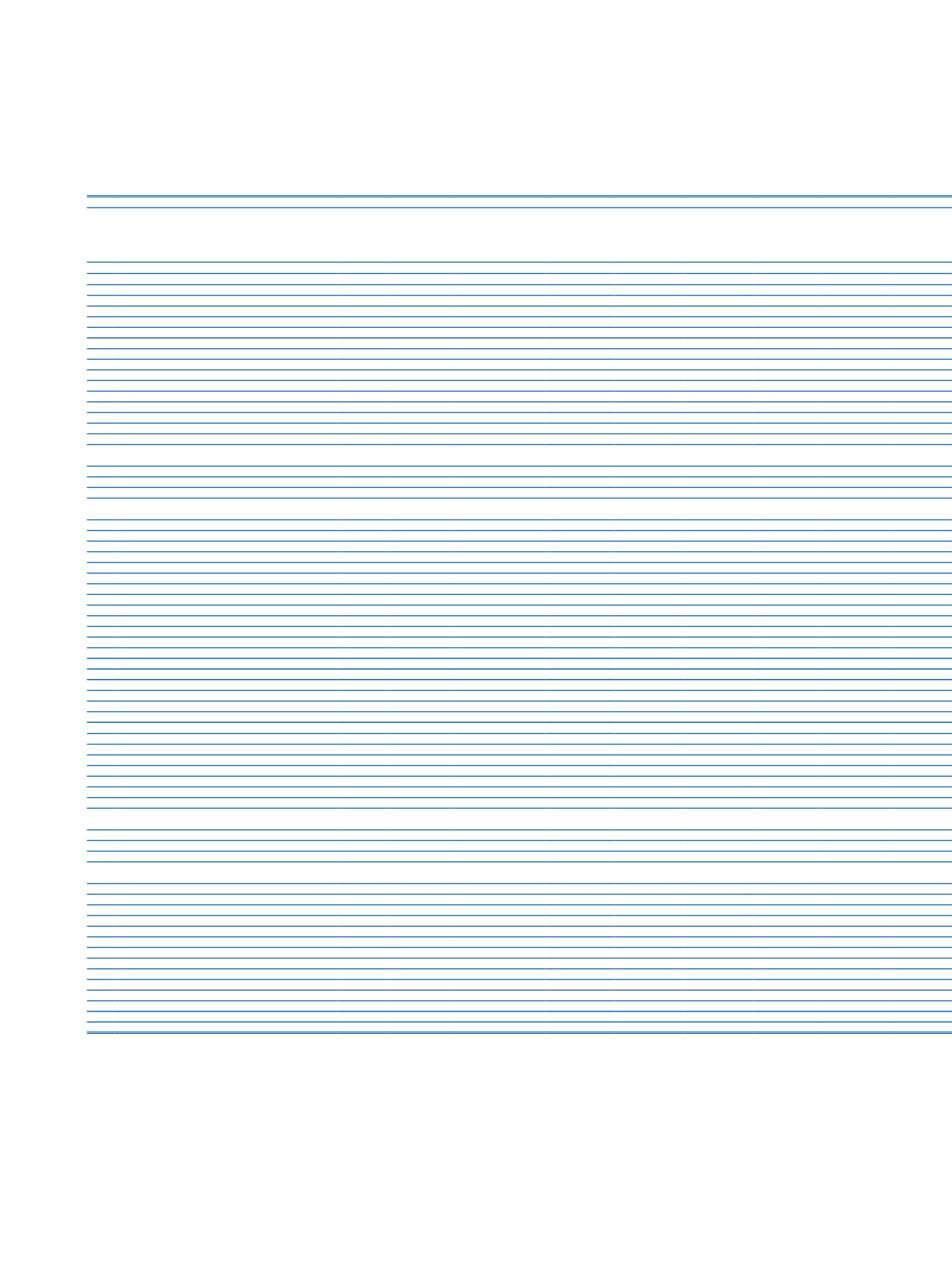

172 İşbank

Annual Report 2015

CHANGES IN SHAREHOLDERS’ EQUITY

Footnotes

Capital

Paid-in Capital

Inflation

Adjustment

Share

Premium

Share

Cancellation

Profits

Legal

Reserves

Statutory

Reserves

Extraordinary

Reserves

V-V

PRIOR PERIOD

(31/12/2014)

I.

Beginning Balance

4,500,000

1,615,938

33,940

2,286,486

59,539 10,812,744

II.

Corrections Made According to TAS 8

2.1 The Effect of Corrections of Errors

2.2 The Effect of Changes in Accounting Policies

III.

Adjusted Beginning Balance (I+II)

4,500,000

1,615,938

33,940

2,286,486

59,539 10,812,744

Changes During the Period

IV.

Increase/Decrease Due to Mergers

V.

Marketable Securities Value Increase Fund

VI.

Hedge Reserves (Effective Portion)

6.1 Cash Flow Hedges

6.2 Net Foreign Investment Hedges

VII.

Revaluation Surplus on Tangible Assets

VIII. Revaluation Surplus on Intangible Assets

IX.

Bonus Shares fromAssociates, Subsidiaries and

Jointly Controlled Entities(Joint Ventures)

X.

Translation Differences

XI.

The Effect of Disposal of Assets

XII.

The Effect of Reclassification of Assets

XIII. The Effect of Changes in the Equity of

Subsidiaries on the Equity of the Bank

XIV. Capital Increase

14.1 Cash

14.2 Internal Sources

XV.

Share Issue

XVI. Share Cancellation Profits

XVII. Paid-in-Capital Inflation Adjustment

XVIII. Other

(*)

1

354

1,010

XIX. Net Profit / Loss for the Period

XX. Profit Distribution

224,787

4,695 2,486,592

20.1 Dividend Paid

20.2 Transfer to Reserves

224,787

4,695

2,390,161

20.3 Other

(**)

96,431

Ending Balance (III+IV+V...+XVIII+XIX+XX)

4,500,000

1,615,938

33,941

-

2,511,627

64,234 13,300,346

CURRENT PERIOD

(31/12/2015)

I.

Beginning Balance

4,500,000

1,615,938

33,941

2,511,627

64,234 13,300,346

Changes During the Period

II.

Increase/Decrease Due to Mergers

III.

Marketable Securities Value Increase Fund

IV.

Hedge Reserves (Effective Portion)

4.1 Cash Flow Hedges

4.2 Net Foreign Investment Hedges

V.

Revaluation Surplus on Tangible Assets

VI.

Revaluation Surplus on Intangible Assets

VII.

Bonus Shares fromAssociates, Subsidiaries and

Jointly Controlled Entities(Joint Ventures)

VIII. Translation Differences

IX.

The Effect of Disposal of Assets

X.

The Effect of Reclassification of Assets

XI.

The Effect of Changes in the Equity of

Subsidiaries on the Equity of the Bank

XII.

Capital Increase

12.1 Cash

12.2 Internal Sources

XIII. Share Issue

XIV. Share Cancellation Profits

XV.

Paid-in-Capital Inflation Adjustment

XVI. Other

(*)

XVII. Net Profit / Loss for the Period

XVIII. Profit Distribution

263,262

6,967 2,496,960

18.1 Dividend Paid

18.2 Transfer to Reserves

263,262

6,967 2,366,336

18.3 Other

(**)

130,624

Ending Balance (I+II+III...+XVI+XVII+XVIII)

4,500,000

1,615,938

33,941

-

2,774,889

71,201 15,797,306

(*)

Includes changes in Group’s shares.

(**)

According to the Articles of Incorporation of the Bank, since a portion of the net profit for the period is distributed to the employees as a dividend, the provision provided for employee dividend distribution within

the scope of “TAS 19-Employee Benefits”, has been added to distributable profit.

Türkiye İş Bankası A.Ş.

Consolidated Statement of Changes in Shareholders’ Equity