176 İşbank

Annual Report 2015

Türkiye İş Bankası A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2015

SECTION THREE: EXPLANATIONS ON ACCOUNTING POLICIES

I. Basis of Presentation

1. Basis of Presentation

The consolidated financial statements, related notes and explanations in this report are prepared in accordance with the “Banking Regulation and Supervision Agency (“BRSA”)

Accounting and Reporting Legislation” which includes the “Regulation on Accounting Applications for Banks and Safeguarding of Documents” published in the Official Gazette

No.26333 dated 1 November 2006, and other regulations on accounting records of Banks published by Banking Regulation and Supervision Board and circulars and interpretations

published by BRSA and requirements of Turkish Accounting Standards for the matters not regulated by the aforementioned legislations.

As indicated in Note XIII and Note XIV of Section Three, changes in the current period on accounting policies from historical cost method to revaluation / fair value method for the real

estates which held for the Group’s own use and investment properties. Accounting policy is applied retrospectively due to the changes in measurement of investment properties and

the financial statements of prior period are restated in accordance with the Turkish Accounting Standard (TAS) – 8 “Accounting Policies, Changes in Accounting Estimates and Errors”.

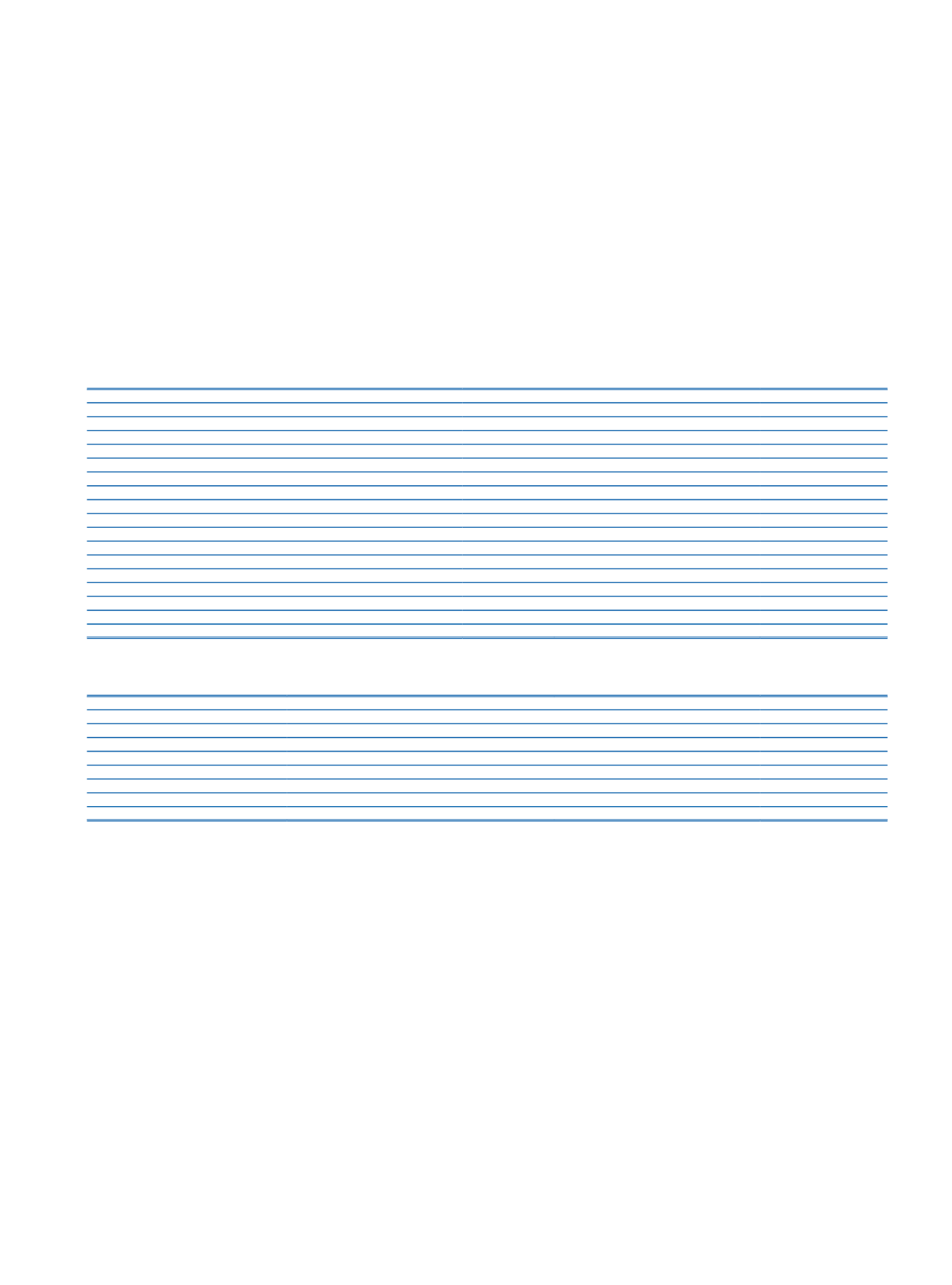

The effects of aforementioned adjustments on financial statements dated 31 December 2014 and 31 December 2013 are summarized below.

31 December 2014

Reported

Adjustments

Restated

Assets

Tangible assets

(1)

2,386,849

(3,161)

2,383,688

Investment Properties

1,387,651

1,310,661

2,698,312

Deferred Tax Asset

637,937

(10,701)

627,236

Liabilities

Deferred Tax Liabilities

1,882

4,694

6,576

Prior Years' Profit/Loss

(648,918)

540,777

(108,141)

Net Period Profit/Loss

3,351,828

171,891

3,523,719

Non-controlling Interest

3,506,147

579,437

4,085,584

Income Statement

Other Operating Income

4,836,167

273,813

5,109,980

Other Operating Expense

9,515,404

(16,026)

9,499,378

Deferred Tax Income

287,857

(1,458)

286,399

Net Period Profit/Loss

3,732,036

288,381

4,020,417

Group’s Profit / Loss

3,351,828

171,891

3,523,719

Non-controlling Interest’s Profit/Loss

380,208

116,490

496,698

Profit per share

(2)

0.029793431

0.001527889

0.031321320

(1)

The effect of the reclassification of costs related to real estates which are held for Group’s own use and classified as tangible assets on consolidated financial statements from investment properties in the financial

statements.

(2)

Represented in full TL

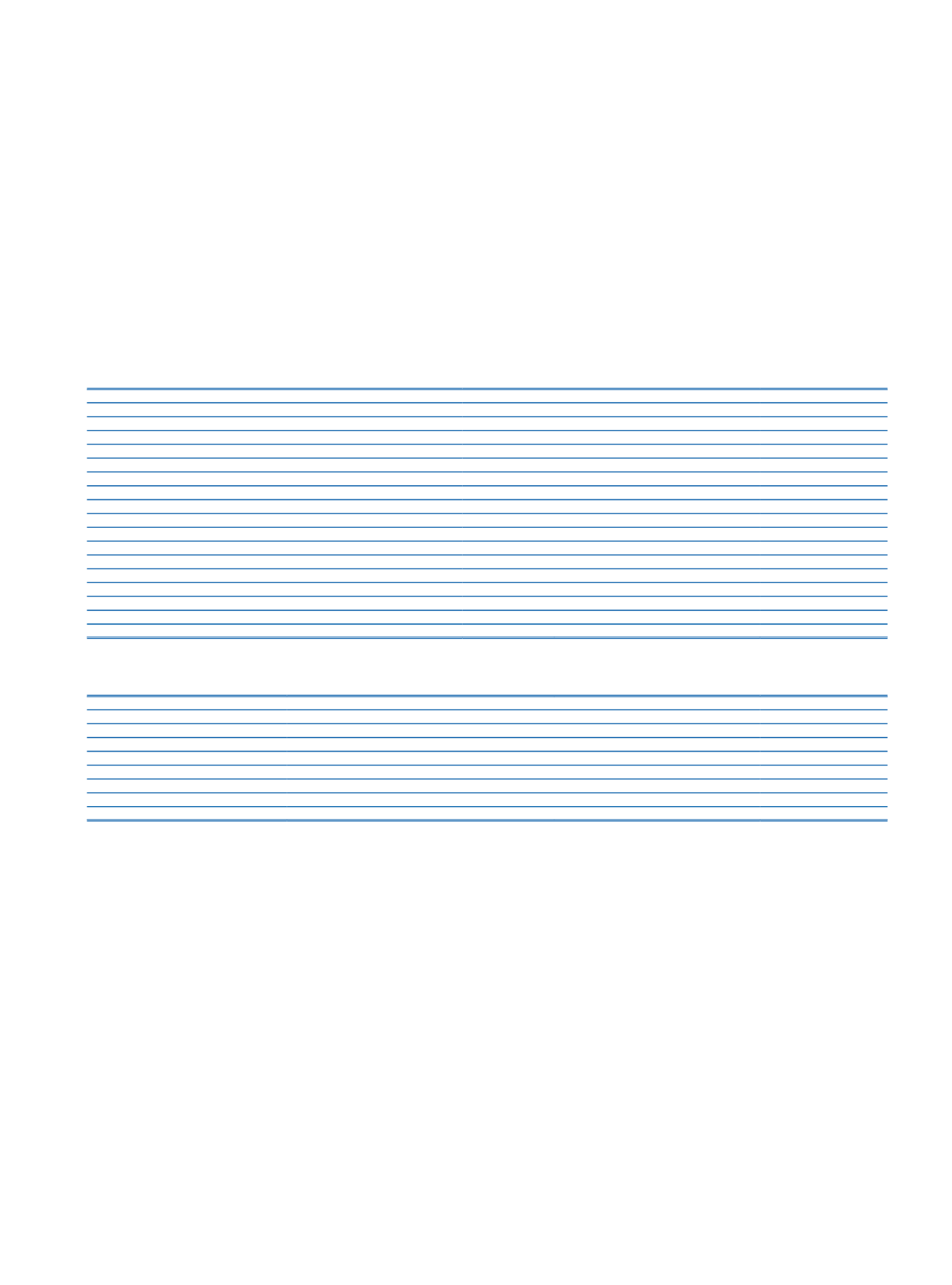

31 December 2013

Reported

Adjustments

Restated

Assets

Tangible assets

(1)

2,234,328

(3,161)

2,231,167

Investment Properties

1,342,182

1,020,822

2,363,004

Deferred Tax Asset

666,543

(10,735)

655,808

Liabilities

Deferred Tax Liabilities

2,599

3,202

5,801

Prior Years' Profit/Loss

2,621,162

540,777

3,161,939

Non-controlling Interest

3,133,450

462,947

3,596,397

(1)

The effect of the reclassification of costs related to real estates which are held for Group’s own use and classified as tangible assets on consolidated financial statements from

investment properties in the financial statements.

The accounting policies are consistent with the financial statements in prior period, except the changes in the current period on accounting policies for real estates. Accounting

policies applied and valuation methods used in the preparation of the consolidated financial statements are expressed in detail below.

2. Additional paragraph for convenience translation to English

The differences between accounting principles, as described in the preceding paragraphs, and the accounting principles generally accepted in countries, in which the accompanying

consolidated financial statements are to be distributed, and International Financial Reporting Standards (“IFRS”), may have significant influence on the accompanying consolidated

financial statements. Accordingly, the accompanying consolidated financial statements are not intended to present the financial position and results of operations in accordance with

the accounting principles generally accepted in such countries and IFRS.

II. Strategy for Use of Financial Instruments and on Foreign Currency Transactions

1. The Group’s Strategy on Financial Instruments

The Group’s main financial activities comprise a wide range of activities such as banking, insurance and reinsurance services, brokerage services, investment consulting, real estate

portfolio and asset management, financial lease, factoring services, portfolio and asset management. The liabilities on the Group’s balance sheet are mainly composed of relatively

short-term deposits, parallel to general liability structure of the banking system, which is its main field of other activity. As for the non-deposit liabilities, funds are collected through

medium and short-term instruments. The liquidity risk that may arise from this liability structure can be easily controlled through deposit continuity, as well as widespread network of

the correspondent banks, market maker status (The Parent Bank is one of the market maker banks) and by the use of liquidity facilities of the Central Bank of the Republic of Turkey

(CBRT). The liquidity of the Group and the banking system can be easily monitored. On the other hand, foreign currency liquidity requirements are met by the money market operations

and currency swaps.

Most of the funds collected bear fixed-interest, and by monitoring the developments in the sector fixed and floating rate placements are made according to the yields of alternative

investment instruments.

The fixed rate Eurobond issued and a portion of fixed rate funds borrowed are subject to fair value hedge accounting. The Group enter into interest rate swap agreements in order

to hedge the change in fair values of its fixed rate financial liabilities. The changes in the fair value of the hedged fixed rate financial liabilities and hedging interest rate swaps are

recognized under the statement of profit/loss. At the beginning and later period of the hedging transaction, the aforementioned hedging transactions are expected to offset changes

occurred in the relevant period of the hedging transaction and hedged risk (attributable to hedging risk) and effectiveness tests are performed in this regard.