188

İş Bankası

Annual Report 2013

Financial Information and Risk Management

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2013

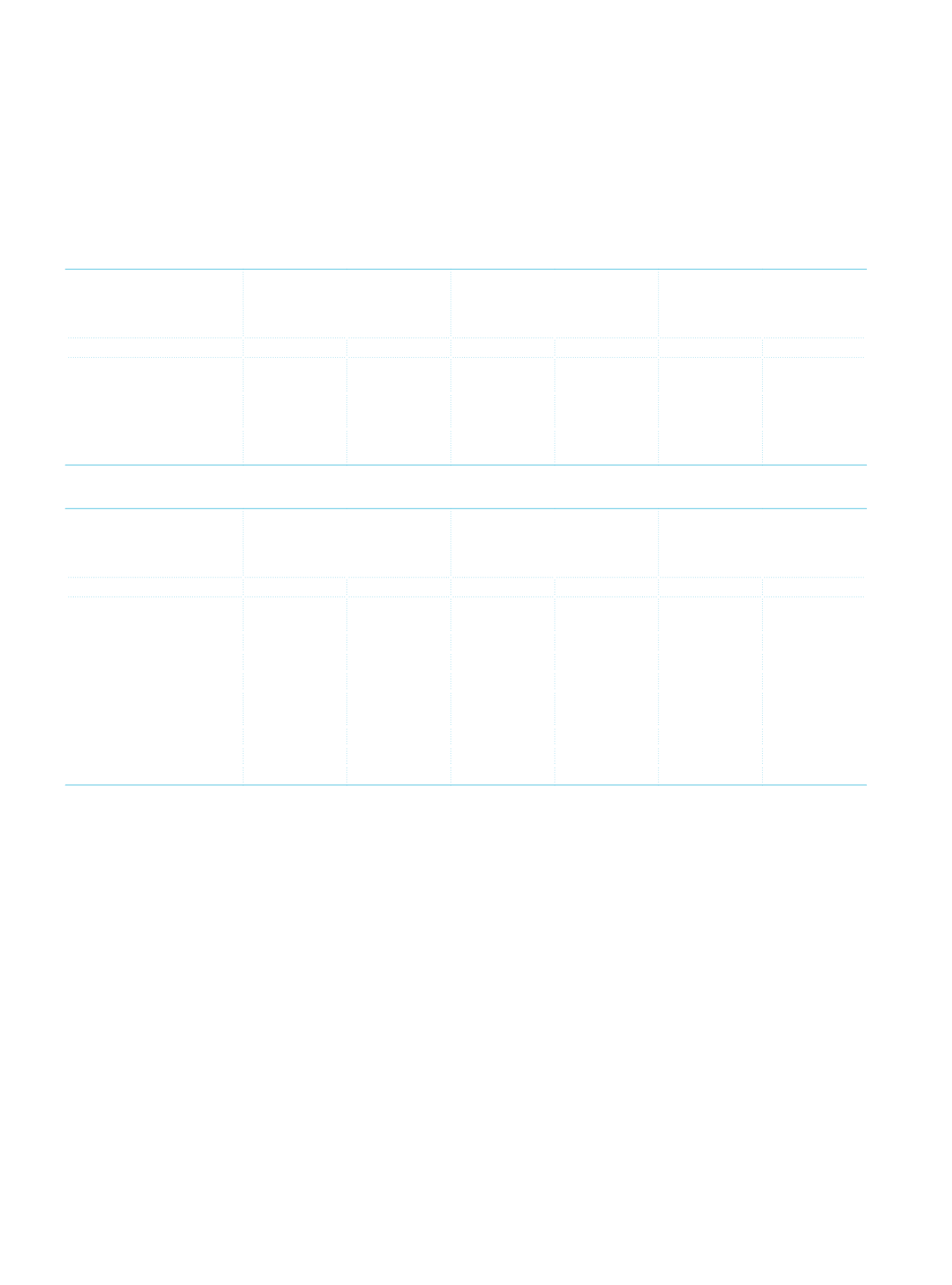

a.2. Information on deposits held by the Bank’s risk group:

Bank’s Risk Group

Investments in Associates,

Subsidiaries and Jointly

Controlled Entities

(Joint Ventures)

Direct and Indirect

Shareholders of the Bank

Other Individuals and

Corporates in Risk Group

Deposits

Current Period Prior Period Current Period Prior Period Current Period Prior Period

Balance at the beginning

of the period

1,868,581

1,430,686

385,728

549,679 1,609,009

1,725,317

Balance at the end of the

period

1,149,202

1,868,581

352,420

385,728 2,360,288 1,609,009

Interest expense on

deposits

74,992

84,790

45,462

46,369

82,792

84,671

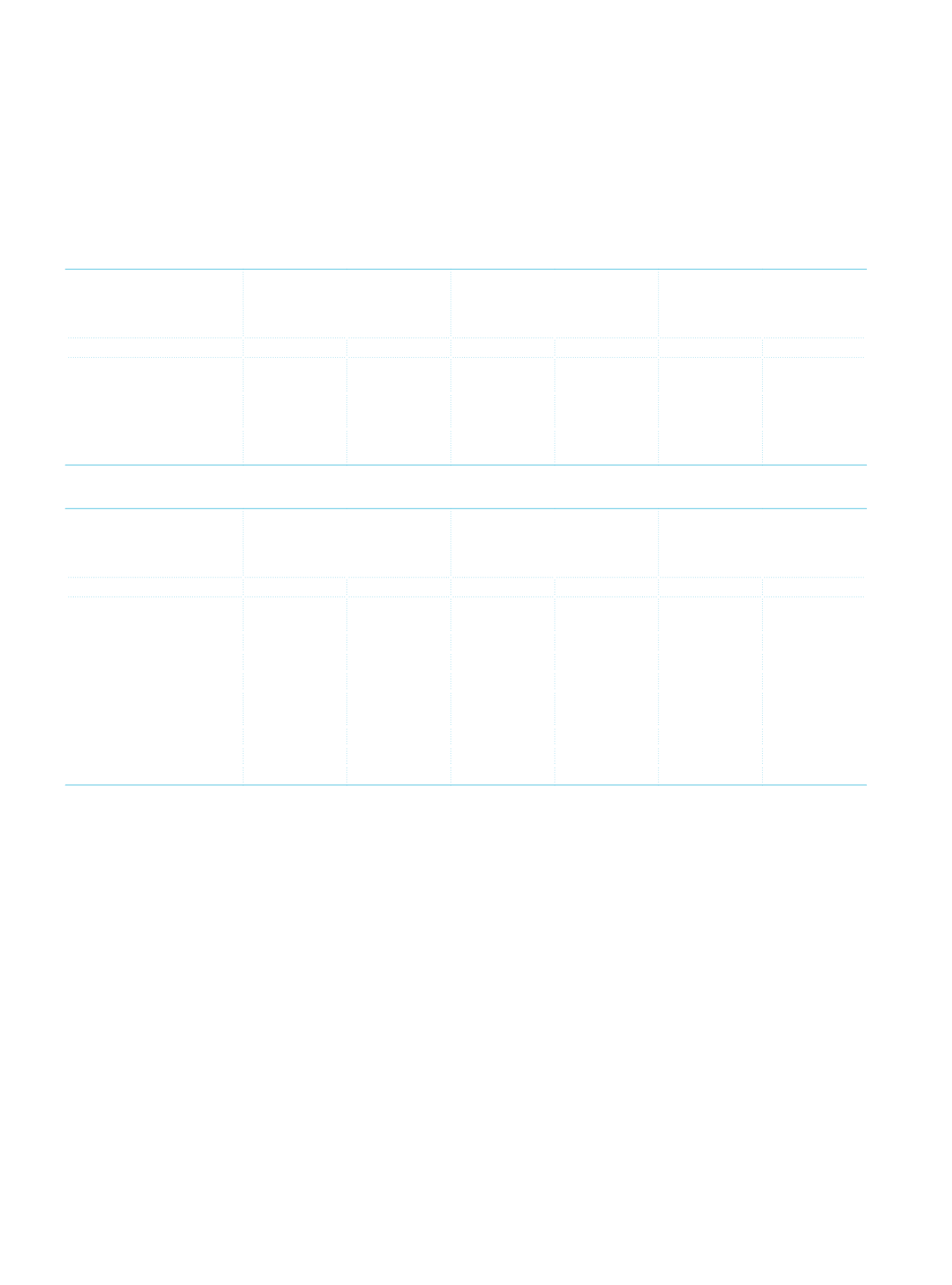

a.3. Information on forward and option agreements and other similar agreements made with the Bank’s risk group:

Bank’s Risk Group

Investments in Associates,

Subsidiaries and Jointly

Controlled Entities

(Joint Ventures)

Direct and Indirect

Shareholders of the Bank

Other Individuals and

Corporates in Risk Group

Current Period Prior Period Current Period Prior Period Current Period Prior Period

Transactions at Fair Value

Through Profit and Loss

Beginning of the period

526,529

557,190

4,708

188,145

End of the period

1,208,134

526,529

4,708

Total Profit/Loss

67,916

(15,547)

308

(2,438)

Transactions for hedging

purposes

Beginning of the period

End of the period

Total Profit/Loss

b.

Disclosures for Bank’s risk group:

b.1. The relations of the Bank with the entities controlled by the Bank and its related parties regardless of whether there are any

transactions between the parties:

All types of corporate and retail banking services are provided to these corporations in line with the articles of Banking Law.

b.2. The type and amount of transaction carried out, and its ratio to the overall transaction volume, values of principal items and

their ratios to overall items, pricing policy and other items in addition to the structure of the relationship:

The transactions carried out are mainly loan and deposit transactions. The ratio of loans extended to the risk group to the overall

loans is 1.13%, while the ratio to the overall assets is 0.72%; the ratio of deposits of the risk group corporations to the overall

deposits is 3.19%, while the ratio to overall liabilities is 1.83%. Comparable price method is used in pricing the transactions.