197

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

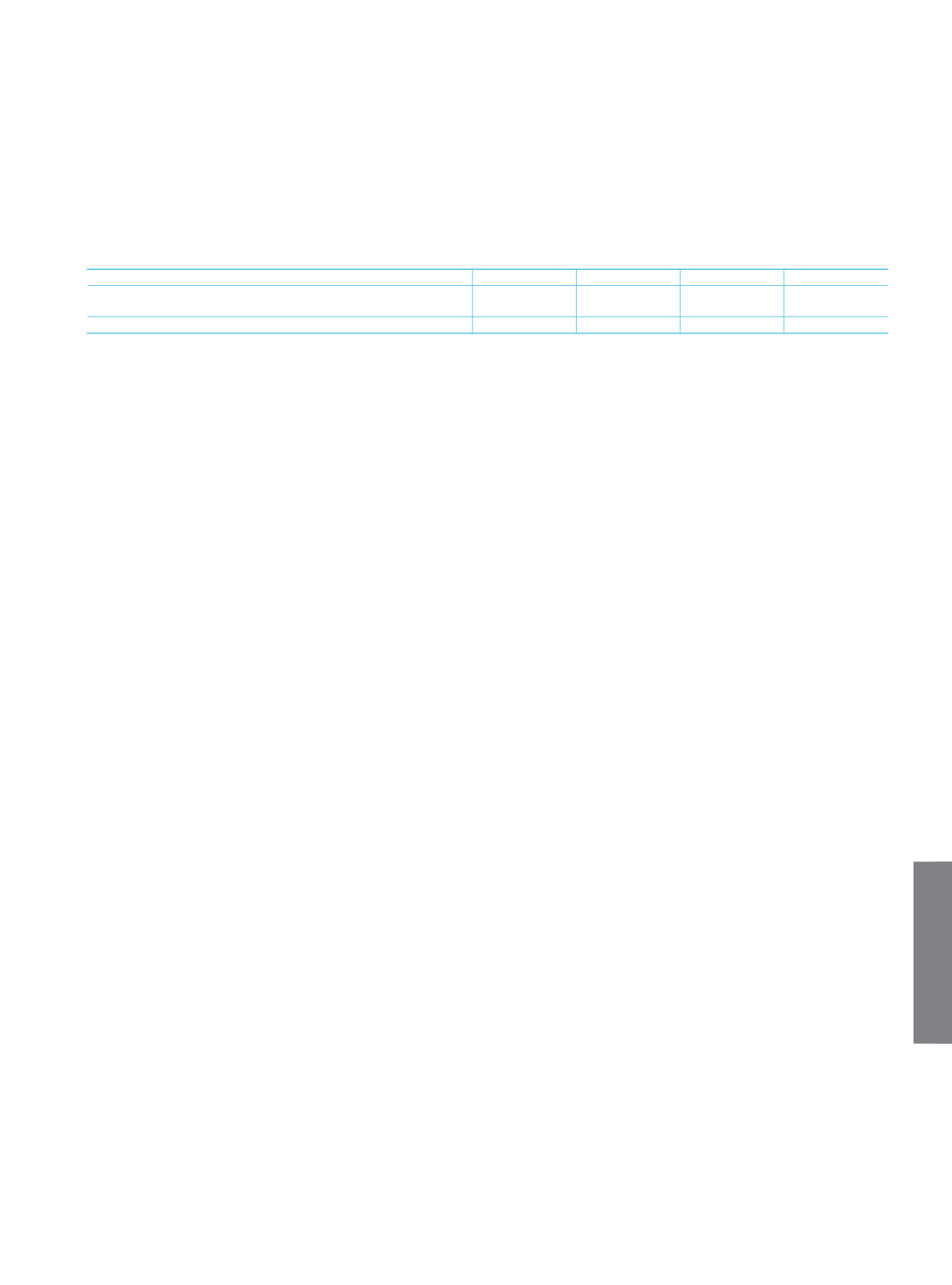

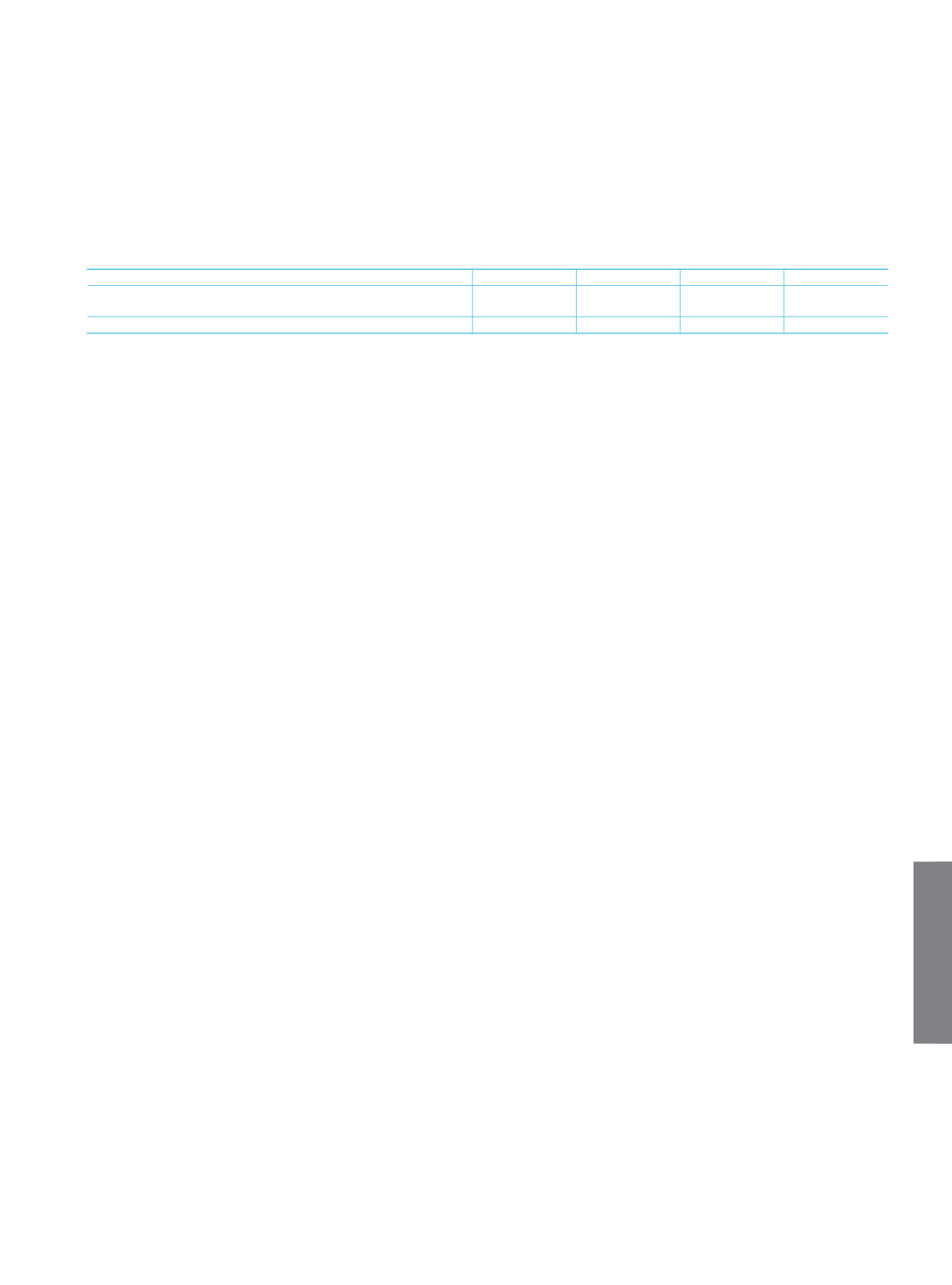

IV. Information on the Parent Bank’s Qualified Shareholders

Name Surname/Company

Shares

Ownership Paid-in Capital

Unpaid Capital

T. İş Bankası A.Ş. Mensupları Munzam Sosyal Güvenlik ve Yardımlaşma

Sandığı Vakfı (İşbank Members’ Supplementary Pension Fund)

1,807,003

40.16% 1,807,003

Cumhuriyet Halk Partisi - Republican People’s Party (Atatürk’s Shares)

1,264,142

28.09% 1,264,142

V. Summary Information on the Parent Bank’s Functions and Business Lines

In line with the relevant legislation and principles stated in the Articles of Incorporation of the Bank, the Parent Bank’s activities

include operating in retail, commercial, corporate and private banking, foreign currency and money market operations, marketable

securities operations, international banking services and other banking operations, as well as initiating or participating in all kinds of

financial and industrial sector corporations as may be required.

VI. Differences between the Communiqué on Preparation of Consolidated Financial Statements of Banks and Turkish

Accounting Standards and Explanation about the Institutions Subject to Line-By-Line Method or Proportional

Consolidation and Institutions which are Deducted from Equity or not Included in These Three Methods

Bank’s are obligated to prepare consolidated financial statements for credit institutions and financial subsidiaries for creating legal

restrictions on a consolidated basis based on the “Communiqué on Preparation of Consolidated Financial Statements of Banks”

by applying Turkish Accounting Standards. There is not any difference between the related Communiqué and the consolidation

operations that is based on Turkish Accounting Standards. The consolidated financial statement includes the subsidiaries of the

Bank which are credit institutions or financial institutions accordance with the BRSA regulations. As of current there is no credit

institution or financial institution subsidiaries which are excluded in the scope of the consolidation.

The information about the organizations in the scope of the consolidation:

The Parent Bank and its subsidiaries;

• ANADOLU ANONİM TÜRK SİGORTA ŞİRKETİ

• ANADOLU HAYAT EMEKLİLİK A.Ş.

• CAMİŞ MENKUL DEĞERLER A.Ş.

• CJSC İŞBANK

• EFES VARLIK YÖNETİM A.Ş.

• IS INVESTMENTS GULF LTD.

• İŞ B TİPİ YATIRIM ORTAKLIĞI A.Ş.

• İŞ FAKTORİNG A.Ş.

• İŞ FİNANSAL KİRALAMA A.Ş.

• İŞ GAYİMENKUL YATIRIM ORTAKLIĞI A.Ş.

• İŞ GİRİŞİM SERMAYESİ YATIRIM ORTAKLIĞI A.Ş.

• İŞ PORTFÖY YÖNETİMİ A.Ş.

• İŞ YATIRIM MENKUL DEĞERLER A.Ş.

• İŞBANK AG

• MAXIS INVESTMENTS LTD.

• MİLLİ REASÜRANS T.A.Ş.

• TSKB GAYRİMENKUL YATIRIM ORTAKLIĞI A.Ş.

• TÜRKİYE SINAİ KALKINMA BANKASI A.Ş.

• YATIRIM FİNANSMAN MENKUL DEĞERLER A.Ş.

and Special Purpose Entities,

• TIB Diversified Payment Rights Finance Company

• TIB Card Receivables Funding Company Limited

are fully consolidated,

Its associate;

• ARAP-TÜRK BANKASI A.Ş.

is accounted under equity accounting method.