Financial Information and Risk

Management

205

İş Bankası

Annual Report 2013

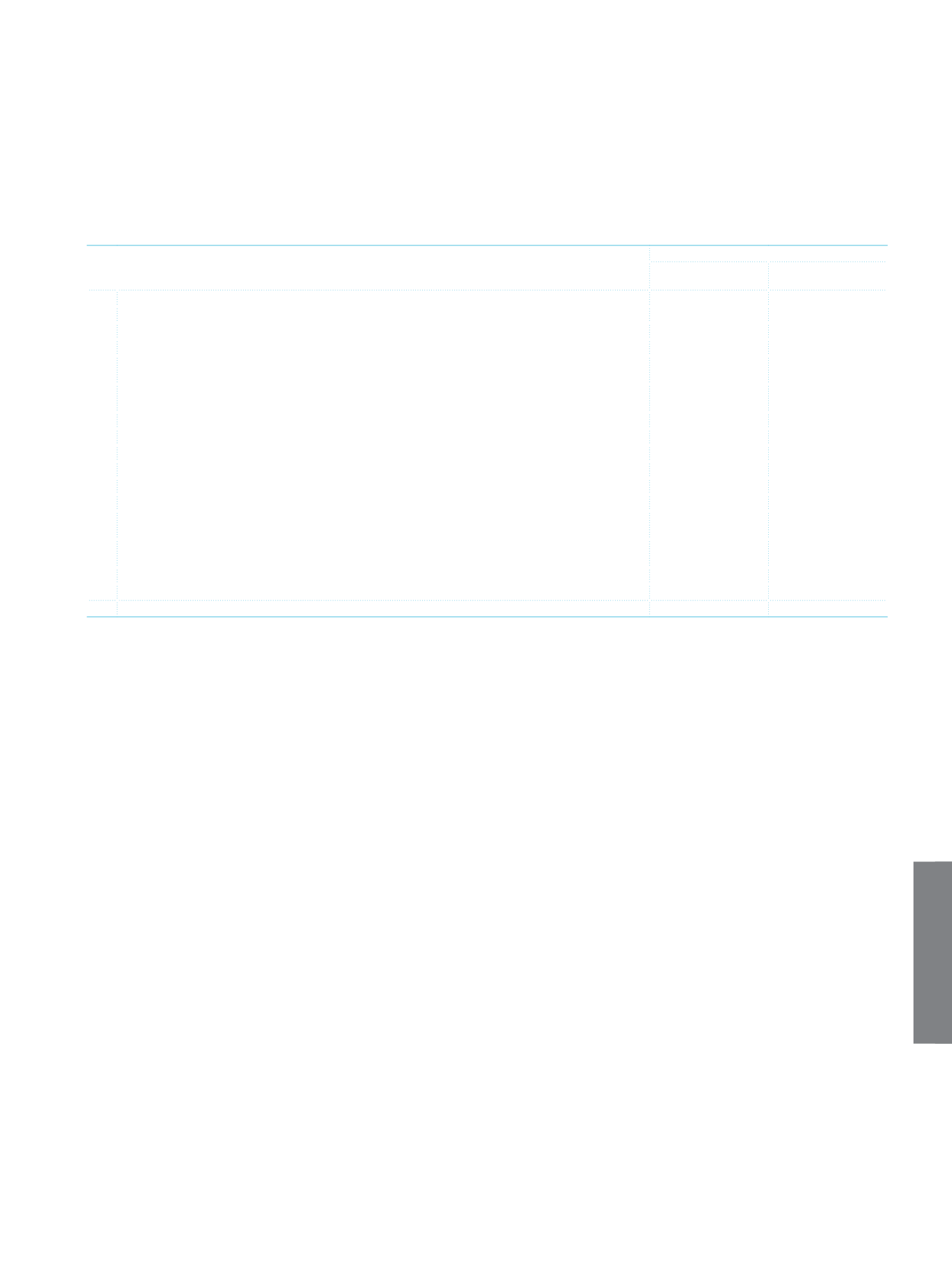

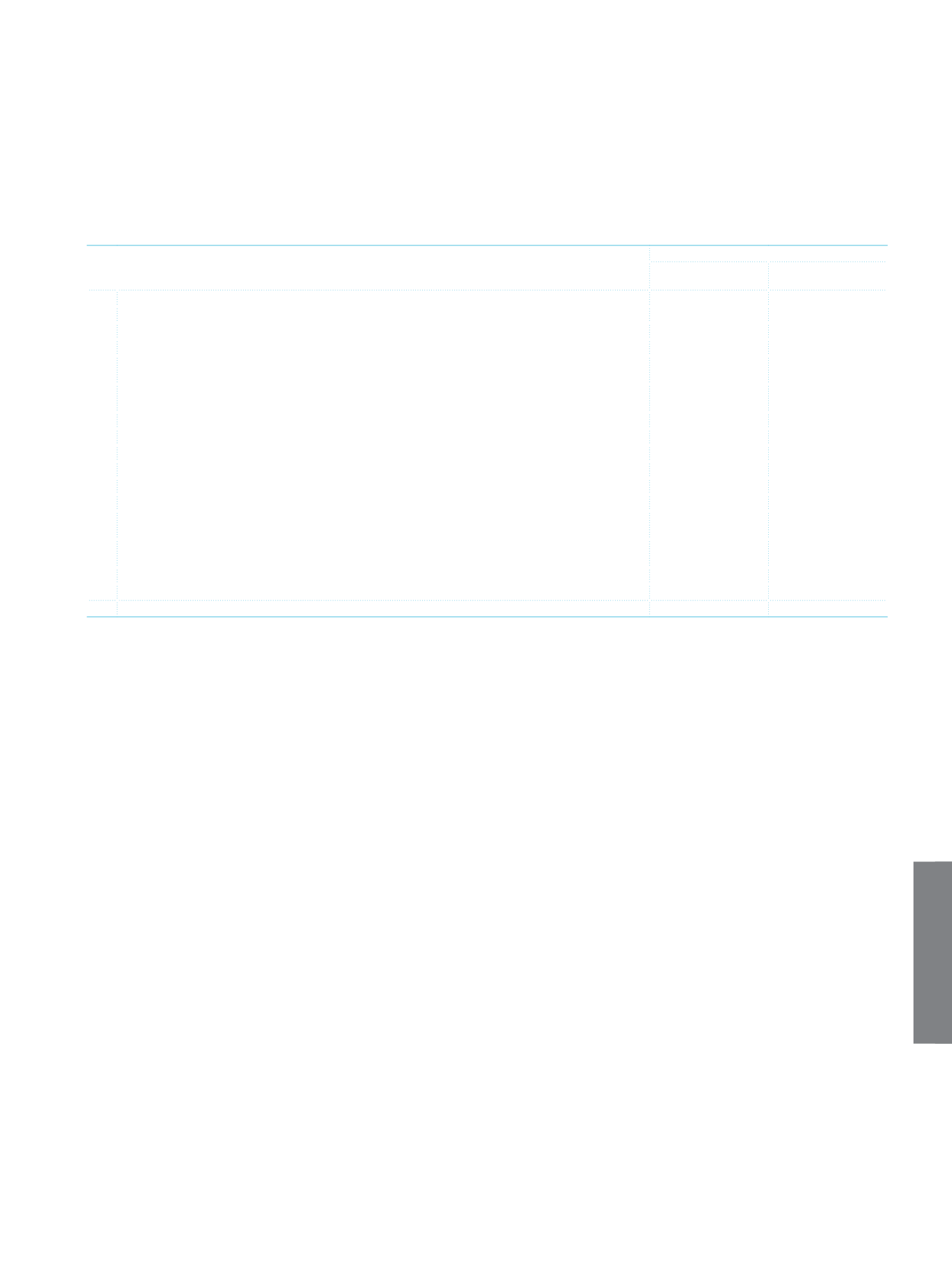

INCOME AND EXPENSE ITEMS ACCOUNTED UNDER SHAREHOLDERS’ EQUITY

THOUSAND TL

CURRENT PERIOD

(01/01-31/12/2013)

PRIOR PERIOD

(01/01-31/12/2012)

I.

ADDITIONS TO MARKETABLE SECURITIES VALUE INCREASE FUND FROM FINANCIAL ASSETS AVAILABLE FOR SALE

(2,003,089)

1,533,550

II.

REVALUATION SURPLUS ON TANGIBLE ASSETS

-

-

III.

REVALUATION SURPLUS ON INTANGIBLE ASSETS

-

-

IV.

TRANSLATION ADJUSTMENT FOR FOREIGN CURRENCY TRANSACTIONS

115,431

(106,500)

V.

PROFIT/LOSS ON DERIVATIVE FINANCIAL ASSETS HELD FOR CASH FLOWHEDGES (Effective Portion of the Changes

in Fair Value)

-

-

VI.

PROFIT/LOSS ON DERIVATIVE FINANCIAL ASSETS HELD FOR NET FOREIGN INVESTMENT HEDGES (Effective Portion

of the Changes in Fair Value)

-

-

VII.

THE EFFECT OF CORRECTIONS OF THE ERRORS AND CHANGES IN THE ACCOUNTING POLICIES

-

-

VIII.

OTHER INCOME AND EXPENSES RECOGNISED UNDER SHAREHOLDERS’ EQUITY ACCORDANCE WITH TAS

(191,984)

140,022

IX.

DEFERRED TAX EFFECT OF REVALUATION AND VALUE INCREASES

295,313

(220,425)

X.

NET INCOME/EXPENSE DIRECTLY RECOGNISED UNDER SHAREHOLDERS’ EQUITY (I+II+…+IX)

(1,784,329)

1,346,647

XI.

PROFIT/LOSS FOR THE PERIOD

3,235,921

3,412,022

11.1 Net Changes in the Fair Values of Marketable Securities (Transfer to Profit/Loss)

(45,083)

(28,343)

11.2 The Portion of Derivative Financial Assets Held for Cash Flow Hedges Reclassified in and Transferred to Income

Statement

-

-

11.3 The Portion of Derivative Financial Assets Held for Net Foreign Investment Hedges Reclassified in and Transferred to

Income Statement

-

-

11.4 Other

3,281,004

3,440,365

XII.

TOTAL PROFIT/LOSS RECOGNISED FOR THE PERIOD (X±XI)

1,451,592

4,758,669

TÜRKİYE İŞ BANKASI A.Ş.

V. Consolidated Statement of Income and Expense Items Accounted

Under Shareholders’ Equity