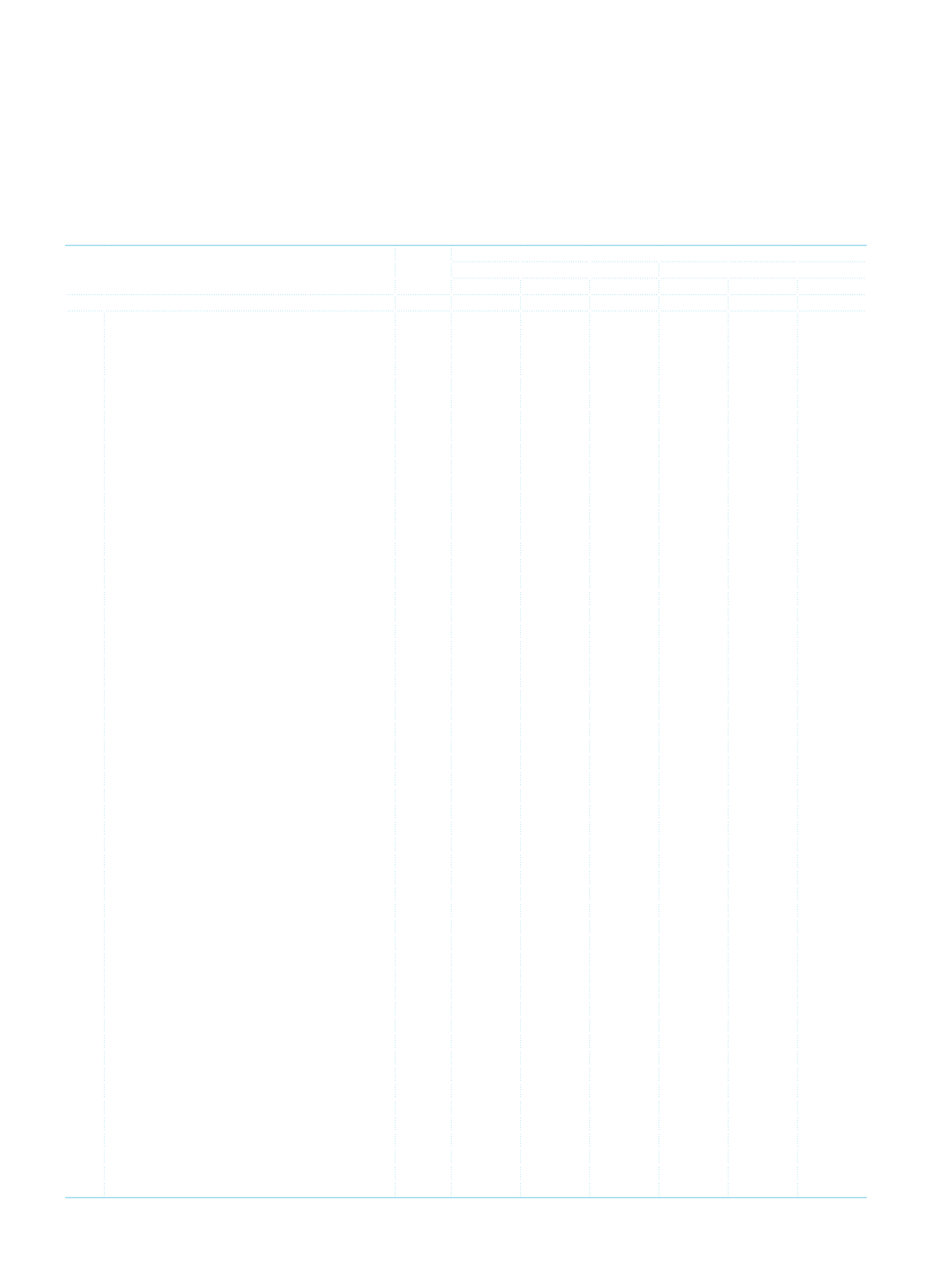

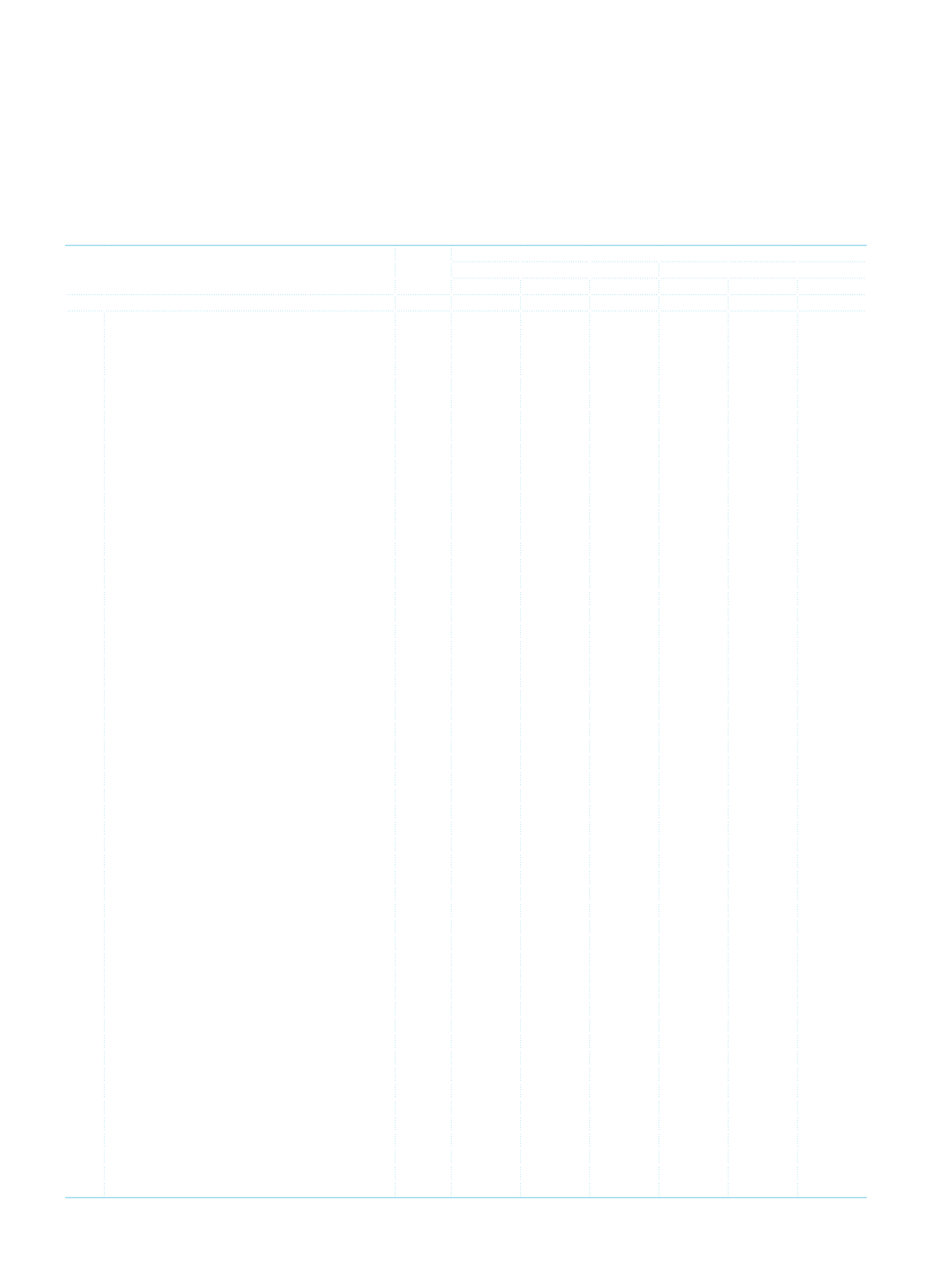

Financial Information and Risk Management

202

İş Bankası

Annual Report 2013

OFF-BALANCE SHEET ITEMS

Footnotes

THOUSAND TL

CURRENT PERIOD (31/12/2013)

PRIOR PERIOD (31/12/2012)

TL

FC

Total

TL

FC

Total

A. OFF-BALANCE SHEET CONTINGENCIES AND COMMITMENTS (I+II+III)

V-III

81,418,598 108,787,611 190,206,209 64,691,713 80,056,402 144,748,115

I.

GUARANTEES AND SURETYSHIPS

16,110,063 23,659,989 39,770,052 12,908,107 17,189,100 30,097,207

1.1.

Letters of Guarantee

15,952,429 14,662,821 30,615,250 12,753,135 10,194,326 22,947,461

1.1.1.

Guarantees Subject to State Tender Law

767,823 3,865,351 4,633,174 788,915 2,923,182 3,712,097

1.1.2.

Guarantees Given for Foreign Trade Operations

2,010,806 5,064,059 7,074,865 1,147,044 2,529,524 3,676,568

1.1.3.

Other Letters of Guarantee

13,173,800 5,733,411 18,907,211 10,817,176 4,741,620 15,558,796

1.2.

Bank Acceptances

4,262 1,490,684 1,494,946

19,739 1,278,511 1,298,250

1.2.1.

Import Letters of Acceptance

-

191,778

191,778

-

113,096

113,096

1.2.2.

Other Bank Acceptances

4,262 1,298,906 1,303,168

19,739 1,165,415 1,185,154

1.3.

Letters of Credit

-

6,903,157 6,903,157

-

5,220,486 5,220,486

1.3.1.

Documentary Letters of Credit

-

4,687,003 4,687,003

-

3,899,886 3,899,886

1.3.2.

Other Letters of Credit

-

2,216,154 2,216,154

-

1,320,600 1,320,600

1.4.

Prefinancing Given as Guarantee

-

-

-

-

-

-

1.5.

Endorsements

-

-

-

-

-

-

1.5.1.

Endorsements to the Central Bank of Turkey

-

-

-

-

-

-

1.5.2.

Other Endorsements

-

-

-

-

-

-

1.6.

Purchase Guarantees for Securities Issued

-

-

-

-

-

-

1.7.

Factoring Guarantees

59,639

12,808

72,447

69,042

18,083

87,125

1.8.

Other Guarantees

93,733

590,519 684,252

66,191

477,694 543,885

1.9.

Other Suretyships

-

-

-

-

-

-

II.

COMMITMENTS

37,582,606 15,533,980 53,116,586 33,064,869 9,356,149 42,421,018

2.1.

Irrevocable Commitments

37,093,928 8,593,817 45,687,745 32,236,265 5,466,913 37,703,178

2.1.1.

Forward Asset Purchase Commitments

353,660 3,636,836 3,990,496

99,081

796,191

895,272

2.1.2.

Forward Deposit Purchase and Sale Commitments

-

-

-

-

-

-

2.1.3.

Capital Commitment for Associates and Subsidiaries

-

-

-

120

-

120

2.1.4.

Loan Granting Commitments

7,819,183 1,367,072 9,186,255 5,838,616

918,133 6,756,749

2.1.5.

Securities Underwriting Commitments

-

-

-

-

-

-

2.1.6.

Commitments for Reserve Deposit Requirements

-

-

-

-

-

-

2.1.7.

Commitments for Cheque Payments

6,024,383

-

6,024,383 6,124,562

-

6,124,562

2.1.8.

Tax and Fund Liabilities from Export Commitments

16,821

-

16,821

13,899

-

13,899

2.1.9.

Commitments for Credit Card Expenditure Limits

17,679,967

- 17,679,967 15,742,457

- 15,742,457

2.1.10.

Commitments for Credit Cards and Banking Services Promotions

90,239

-

90,239

76,548

-

76,548

2.1.11.

Receivables from Short Sale Commitments

-

-

-

-

-

-

2.1.12.

Payables for Short Sale Commitments

1,695

-

1,695

52,774

-

52,774

2.1.13.

Other Irrevocable Commitments

5,107,980 3,589,909 8,697,889 4,288,208 3,752,589 8,040,797

2.2.

Revocable Commitments

488,678 6,940,163 7,428,841

828,604 3,889,236 4,717,840

2.2.1.

Revocable Loan Granting Commitments

488,678 6,940,163 7,428,841

828,604 3,889,236 4,717,840

2.2.2.

Other Revocable Commitments

-

-

-

-

-

-

III.

DERIVATIVE FINANCIAL INSTRUMENTS

27,725,929 69,593,642 97,319,571 18,718,737 53,511,153 72,229,890

3.1

Derivative Financial Instruments held for risk management

-

-

-

-

-

-

3.1.1 Fair Value Hedges

-

-

-

-

-

-

3.1.2 Cash Flow Hedges

-

-

-

-

-

-

3.1.3 Net Foreign Investment Hedges

-

-

-

-

-

-

3.2 Derivative Financial Instruments Held for Trading

27,725,929 69,593,642 97,319,571 18,718,737 53,511,153 72,229,890

3.2.1 Forward Foreign Currency Buy/Sell Transactions

3,909,499 8,134,835 12,044,334 4,740,295 9,404,096 14,144,391

3.2.1.1 Forward Foreign Currency Buy Transactions

2,700,765 3,303,958 6,004,723 3,386,864 3,699,476 7,086,340

3.2.1.2 Forward Foreign Currency Sell Transactions

1,208,734 4,830,877 6,039,611

1,353,431 5,704,620 7,058,051

3.2.2 Currency and Interest Rate Swaps

20,325,006 50,359,859 70,684,865 11,322,852 35,262,471 46,585,323

3.2.2.1 Currency Swap Buy Transactions

8,276,302 15,023,163 23,299,465 1,260,755 8,659,050 9,919,805

3.2.2.2 Currency Swap Sell Transactions

8,213,744 14,888,196 23,101,940 2,874,097 6,344,991 9,219,088

3.2.2.3 Interest Rate Swap Buy Transactions

1,917,480 10,224,250 12,141,730 3,594,000 10,129,215 13,723,215

3.2.2.4 Interest Rate Swap Sell Transactions

1,917,480 10,224,250 12,141,730 3,594,000 10,129,215 13,723,215

3.2.3 Currency, Interest Rate and Security Options

3,478,120 10,635,424 14,113,544 2,597,625 8,403,163 11,000,788

3.2.3.1 Currency Call Options

1,708,133 4,108,815 5,816,948 1,435,814 2,799,876 4,235,690

3.2.3.2 Currency Put Options

1,647,633 4,151,335 5,798,968 1,009,761 3,207,375 4,217,136

TÜRKİYE İŞ BANKASI A.Ş.

III. Consolidated Off-Balance Sheet Items