Budget discipline was maintained.

The strong performance of the central government budget

continued in 2013, as well. Domestic demand was reflected

positively on tax revenues. At the end of 2013, budget revenues

increased by 17.1%, while budget expenditures increased by

12.7%. Accordingly, the budget recorded a deficit of TL 18.4

billion in 2013 whereas it recorded TL 29.4 billion in 2012.

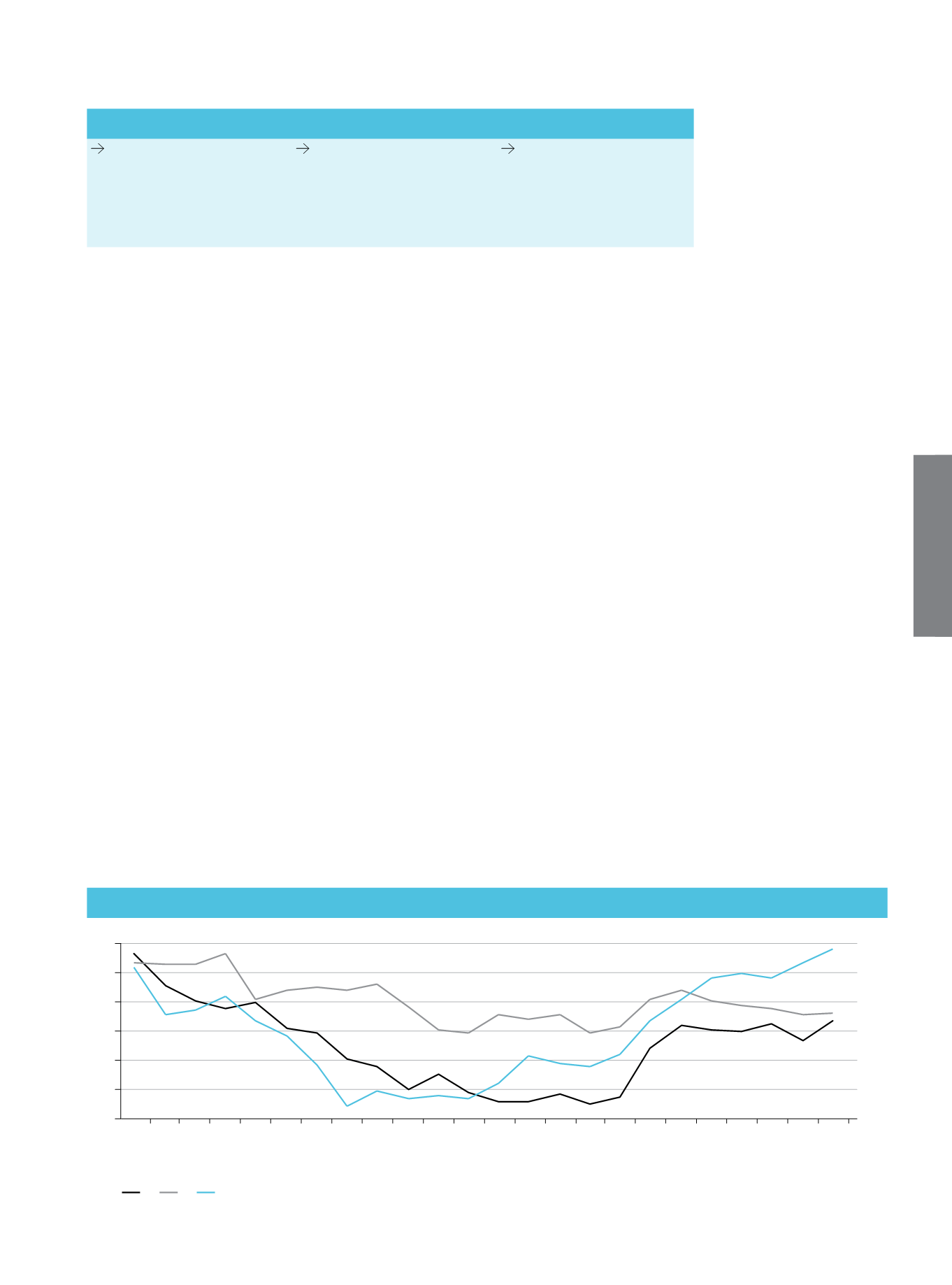

Inflation remained above the year-end target.

Due to the increase in unprocessed food prices and the

depreciation of the TL, annual increase in CPI reached 8.88%

in July, the highest level of 2013. Annual CPI started to decline

again thanks to the base effect and was realized as 7.4% at the

end of the year. The acceleration of the depreciation of the TL

in the second half of the year limited a further decline in the CPI.

The CBRT’s decision: Monetary tightening

In the first months of 2013, CBRT gave more weight to

monetary policies supporting economic activity by cutting the

interest rates while implementing macro-prudential measures.

In the second half of the year, on the other hand, capital

outflows from developing markets, including Turkey, were

observed over the concerns on Fed’s tapering of asset

purchases. This led to a depreciation of the TL and increased

upward pressures on inflation. In order to maintain price

stability and support financial stability, the CBRT decided to

raise the upper band of the interest rate corridor and took

tightening measures through “extraordinary” and “ordinary”

day implementations. In this period, the CBRT mainly focused

on liquidity management and declared that it would continue

to keep monetary policy tight until inflation aligns with the

targets.

Investment grade awarded from a second credit rating

agency

The international credit rating agency Moody’s upgraded

Turkey’s credit rating by one notch from “Ba1” to “Baa3” in 2013.

Accordingly, Moody’s was the second credit rating agency after

Fitch to raise Turkey’s credit rating to investment grade.

The motivation behind Moody’s decision to upgrade the rating

was declared as the improvement in economic and public

finance indicators. Moody’s also foresaw that the implemented

structural reforms would reduce the vulnerability to capital

flows.

PPI

CPI

FC Basket (right axis)

J 12

J 13

F 12

F 13

M 12

M 13

A 12

A 13

M 12

M 13

J 12

J 13

J 12

J 13

A 12

A 13

S 12

S 13

O 12

O 13

N 12

N 13

D 12

D 13

0

2

4

6

10

12

8

-10

-5

0

5

15

20

10

*Currency basket (0.5*EUR + 0.5*USD) is calculated by using monthly average currency rates of CBRT.

Inflation and FC Basket (Monthly Annualized Changes) (%)

In brief

Budget discipline was

maintained, but inflation

exceeded the year-end target.

The CBRT started to take

tightening measures.

Moody’s upgraded Turkey’s

credit rating to investment

grade.

Activities

25

İşbank

Annual Report 2013